Instructions for Schedule M 3 Form 1120 Treasury 2020

What is the Instructions For Schedule M-3 Form 1120 Treasury

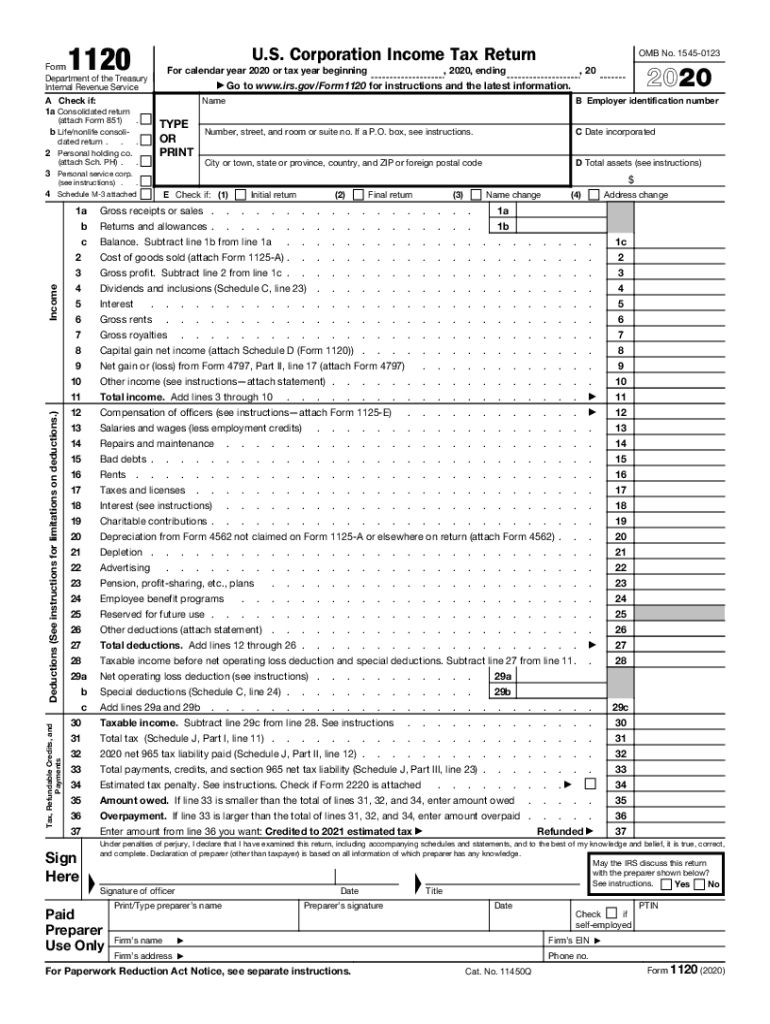

The Instructions for Schedule M-3 Form 1120 provide detailed guidelines for corporations filing their federal income tax returns. This schedule is specifically designed for corporations with total assets of ten million dollars or more. It helps in reconciling financial accounting income with taxable income, ensuring compliance with IRS regulations. The instructions outline the necessary steps to complete the form accurately, including definitions of terms used and the information required for each section.

Steps to Complete the Instructions For Schedule M-3 Form 1120 Treasury

Completing the Instructions for Schedule M-3 Form 1120 involves several key steps:

- Gather all necessary financial records, including balance sheets and income statements.

- Review the definitions provided in the instructions to understand the terms used throughout the form.

- Fill out the required sections of the schedule, ensuring that all figures are accurate and correspond to your financial statements.

- Double-check calculations to avoid errors that could lead to penalties or delays.

- Submit the completed schedule along with your Form 1120 by the specified deadline.

Legal Use of the Instructions For Schedule M-3 Form 1120 Treasury

The legal use of the Instructions for Schedule M-3 Form 1120 is crucial for corporations to ensure compliance with federal tax laws. Properly completing this schedule is necessary for accurately reporting income and expenses, which can affect tax liability. Failure to adhere to the guidelines may result in penalties, audits, or other legal repercussions. It is important to maintain accurate records and follow the instructions closely to uphold legal standards.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines for the Schedule M-3 Form 1120. Typically, the deadline for filing is the fifteenth day of the fourth month following the end of the corporation's tax year. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations may also request an extension, but it is essential to file the extension request before the original due date to avoid penalties.

Required Documents

When completing the Instructions for Schedule M-3 Form 1120, several documents are required to ensure accuracy and compliance:

- Financial statements, including balance sheets and income statements.

- Previous year’s tax returns for reference.

- Documentation supporting any adjustments made to income or deductions.

- Records of any transactions that may affect taxable income.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule M-3 Form 1120, which must be followed closely. These guidelines include detailed instructions on how to report income, expenses, and adjustments. It is essential to refer to the most current IRS publications and updates to ensure compliance with any changes in tax laws or procedures. Adhering to IRS guidelines helps prevent errors and potential audits.

Quick guide on how to complete instructions for schedule m 3 form 1120 treasury

Complete Instructions For Schedule M 3 Form 1120 Treasury seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents promptly without any holdups. Manage Instructions For Schedule M 3 Form 1120 Treasury on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Instructions For Schedule M 3 Form 1120 Treasury with ease

- Obtain Instructions For Schedule M 3 Form 1120 Treasury and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal authority as a standard wet ink signature.

- Review all the details and press the Done button to save your changes.

- Choose how you would prefer to send your form, via email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misfiled documents, tedious form searches, or mistakes requiring printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Instructions For Schedule M 3 Form 1120 Treasury to ensure effective communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for schedule m 3 form 1120 treasury

Create this form in 5 minutes!

How to create an eSignature for the instructions for schedule m 3 form 1120 treasury

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the 2018 1120 S form and why is it important?

The 2018 1120 S form is the U.S. income tax return used for S corporations. It is important because it allows S corporations to report their income and taxes to the IRS, ensuring compliance with tax regulations. Proper completion of the 2018 1120 S ensures that the business can avoid penalties.

-

How can airSlate SignNow help with the 2018 1120 S filing process?

airSlate SignNow streamlines the document signing process, making it easier for businesses to collect signatures on the 2018 1120 S form. With our easy-to-use platform, you can upload your form, send it for eSignature, and save time while maintaining compliance. Our solution simplifies filing by ensuring all necessary signatures are obtained promptly.

-

What features does airSlate SignNow offer for managing the 2018 1120 S documents?

With airSlate SignNow, you can expertly manage the 2018 1120 S documents through features like template creation, automated workflows, and secure cloud storage. These features enable users to efficiently customize and reuse forms, track document status, and enhance collaboration among team members and clients. All these streamline the filing process.

-

Is airSlate SignNow cost-effective for businesses preparing the 2018 1120 S?

Yes, airSlate SignNow is a cost-effective solution for businesses preparing the 2018 1120 S. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that you get the best value for your eSignature needs. Plus, by reducing the time spent on document management, you can save on overall operational costs.

-

What are the benefits of using airSlate SignNow for tax-related documents like the 2018 1120 S?

Using airSlate SignNow for tax-related documents like the 2018 1120 S provides numerous benefits, including faster turnaround times and reduced paperwork. The platform offers enhanced security features to protect sensitive information while ensuring that signatures are legally binding. Overall, it simplifies the tax filing process considerably.

-

Does airSlate SignNow integrate with accounting software for filing the 2018 1120 S?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your 2018 1120 S filings. This integration allows you to pull in relevant data directly into the form, reducing the chance of errors. You can ensure a smoother workflow for your tax preparation needs.

-

Can I access my signed 2018 1120 S documents from anywhere?

Yes, with airSlate SignNow, you can access your signed 2018 1120 S documents from anywhere, at any time. Our cloud-based solution ensures your documents are secure yet easily accessible, allowing you to stay organized and efficient, whether you’re in the office or on the go.

Get more for Instructions For Schedule M 3 Form 1120 Treasury

Find out other Instructions For Schedule M 3 Form 1120 Treasury

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement