Form Withholding 2020

What is the Form Withholding

The Form Withholding is a crucial document used primarily for tax purposes in the United States. It allows employers to report the amount of income tax withheld from employees' paychecks. This form ensures that the correct amount of tax is withheld based on the employee's earnings and tax status. Understanding this form is essential for both employers and employees to ensure compliance with federal tax regulations.

How to use the Form Withholding

Using the Form Withholding involves several steps. Employers must accurately fill out the form with the necessary information, including employee details and withholding amounts. Employees should review their withholding status regularly, especially when there are changes in their personal or financial situations. This form can also be used to adjust withholding amounts if necessary, ensuring that employees do not owe a significant amount at tax time.

Steps to complete the Form Withholding

Completing the Form Withholding involves a systematic approach:

- Gather necessary information, such as the employee's Social Security number and filing status.

- Determine the appropriate withholding amount based on the employee's earnings and any allowances claimed.

- Fill out the form accurately, ensuring all details are correct.

- Submit the completed form to the appropriate tax authority, typically the IRS.

Legal use of the Form Withholding

The legal use of the Form Withholding is governed by IRS regulations. Employers are required to withhold a certain percentage of an employee's wages for federal taxes. Failure to comply with these regulations can result in penalties for both the employer and the employee. It is essential to ensure that the form is filled out correctly and submitted on time to avoid any legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Form Withholding are critical for compliance. Employers must submit this form by specific dates, typically aligned with payroll schedules. It is important to stay informed about these deadlines to avoid late fees and penalties. Additionally, employees should be aware of any changes in tax laws that may affect their withholding status.

Examples of using the Form Withholding

There are various scenarios in which the Form Withholding is utilized. For instance, a new employee may need to complete the form to establish their withholding status. Similarly, an employee who experiences a change in marital status may need to update their withholding information. These examples highlight the form's importance in maintaining accurate tax records and ensuring proper tax withholding throughout the year.

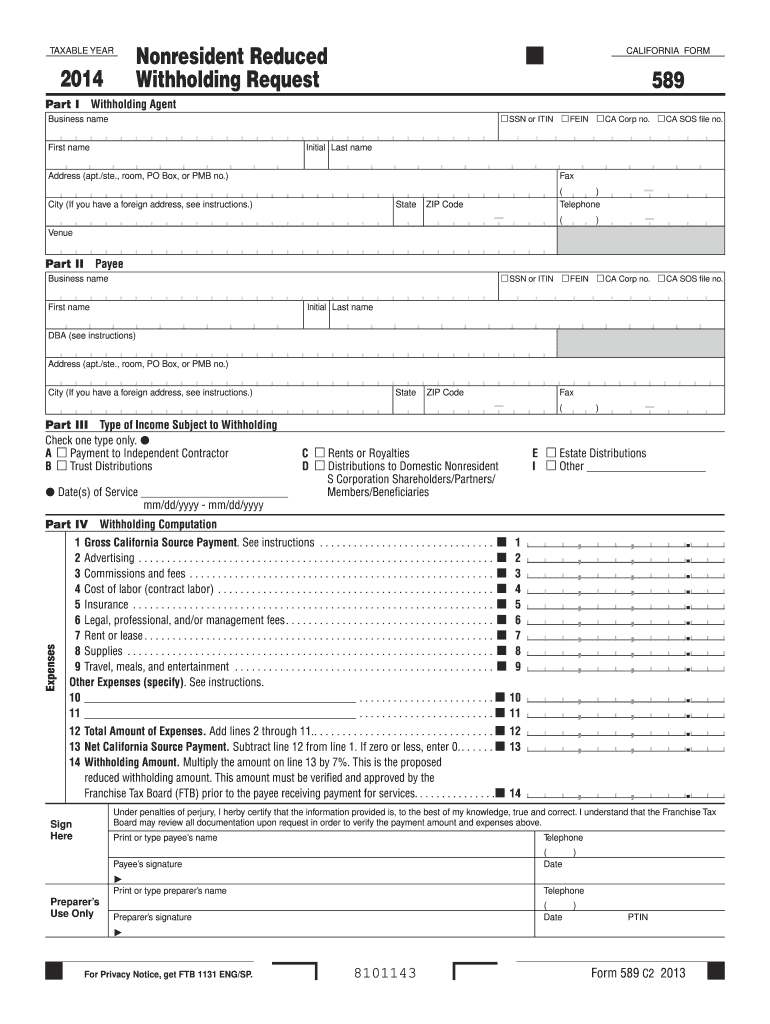

Quick guide on how to complete 2014 form withholding

Effortlessly prepare Form Withholding on any device

Digital document administration has become widely embraced by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Manage Form Withholding on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The easiest way to edit and electronically sign Form Withholding seamlessly

- Obtain Form Withholding and click Get Form to begin.

- Use the tools at your disposal to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the exact legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Form Withholding to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form withholding

Create this form in 5 minutes!

How to create an eSignature for the 2014 form withholding

The best way to generate an eSignature for your PDF file in the online mode

The best way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is Form Withholding and how does airSlate SignNow facilitate it?

Form Withholding refers to the process of collecting and managing withholding tax forms electronically. airSlate SignNow simplifies this process by allowing users to create, send, and eSign Form Withholding documents seamlessly, ensuring compliance and accuracy in tax reporting.

-

How does airSlate SignNow ensure the security of Form Withholding documents?

Security is paramount when dealing with Form Withholding documents. airSlate SignNow uses advanced encryption protocols and robust authentication methods to protect sensitive information, ensuring that your Form Withholding processes are secure and confidential.

-

What pricing plans does airSlate SignNow offer for managing Form Withholding needs?

airSlate SignNow offers flexible pricing plans tailored to various business sizes and needs. Whether you require basic features for Form Withholding or advanced capabilities, you can choose a plan that fits your budget and operational requirements.

-

Can I integrate airSlate SignNow with other tools for managing Form Withholding?

Yes, airSlate SignNow seamlessly integrates with popular business tools and platforms, enhancing your Form Withholding management. This integration allows you to streamline your workflows and access all necessary data in one place.

-

What are the benefits of using airSlate SignNow for Form Withholding?

Using airSlate SignNow for Form Withholding offers numerous benefits, including increased efficiency, reduced processing time, and enhanced accuracy. This solution simplifies the entire process, allowing businesses to focus on what matters most.

-

Is it easy to create Form Withholding documents with airSlate SignNow?

Absolutely! airSlate SignNow provides user-friendly templates for creating Form Withholding documents that can be customized to meet your specific needs. The intuitive interface makes it easy for anyone to design and send these forms quickly.

-

What support does airSlate SignNow provide for Form Withholding inquiries?

airSlate SignNow offers comprehensive support for all Form Withholding-related inquiries. Our dedicated customer support team is available to assist you with any questions or challenges you may encounter while using our platform.

Get more for Form Withholding

- Beaver medical group medical records form

- Request form for tenders administration account 100360631

- Nccer registration and release form

- Energy efficiency certificate sticker form

- Employer data record philhealth form

- City of welland amps 60 east main street welland form

- Canada pony card form

- Ontario student assistance program 584395092 form

Find out other Form Withholding

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template