Federal Form 8840 Closer Connection Exception Statement for Aliens2020 Form 8840 IRS Tax FormsForm 8840 IRS Closer Connection Ex 2021

Understanding the Federal Form 8840 Closer Connection Exception Statement

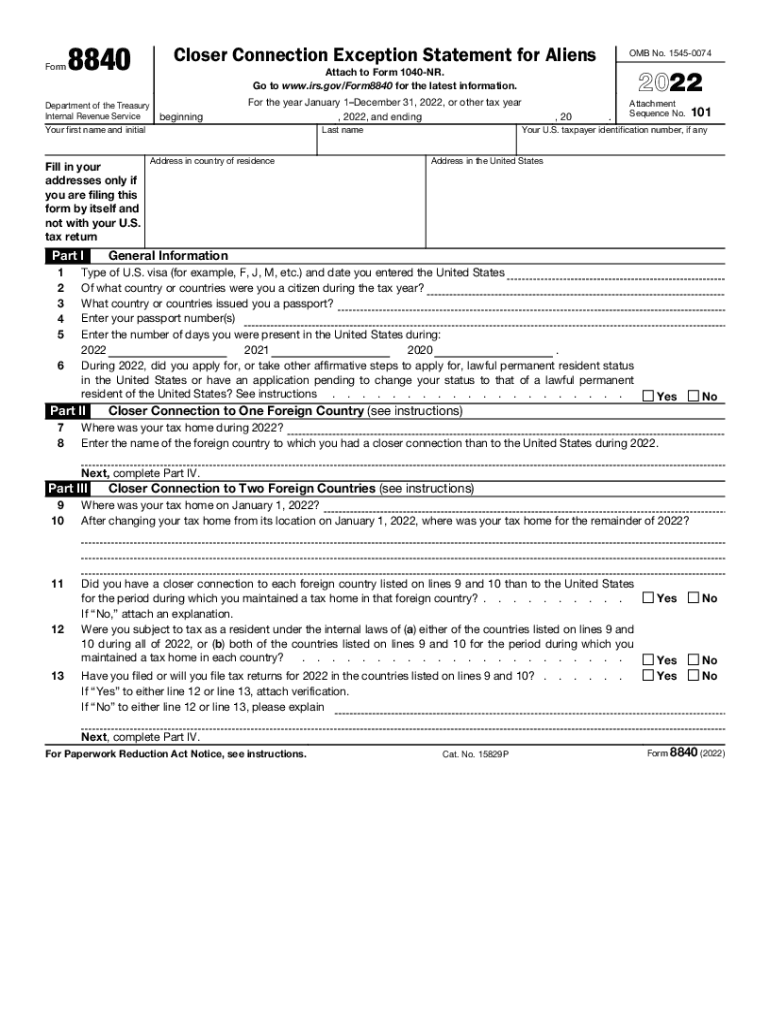

The Federal Form 8840, also known as the Closer Connection Exception Statement for Aliens, is a crucial document for non-resident aliens who wish to claim a closer connection to a foreign country than to the United States. This form is particularly relevant for individuals who spend significant time in the U.S. but maintain their primary residence elsewhere. By filing this form, individuals can avoid being classified as U.S. residents for tax purposes under the substantial presence test.

Form 8840 is essential for snowbirds—those who live part-time in the U.S. and part-time in another country. It helps establish that their primary ties are to their home country, which can have significant tax implications. Understanding the criteria for filing this form is vital for compliance with U.S. tax laws.

Steps to Complete the Federal Form 8840

Completing the Federal Form 8840 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including details about your residency and physical presence in the U.S. for the current and prior two years. The form requires you to provide:

- Your name and address.

- The number of days you were present in the U.S. during the relevant tax years.

- Information about your closer connection to a foreign country, including details about your home and family ties.

Once you have filled out the form, review it carefully for any errors. It's important to ensure that all information is accurate, as mistakes can lead to complications with the IRS. After verifying the details, submit the form to the IRS by the specified deadline to avoid penalties.

Legal Use of the Federal Form 8840

The legal use of the Federal Form 8840 is grounded in U.S. tax law, specifically for non-resident aliens who meet certain criteria. By filing this form, you assert your claim of a closer connection to a foreign country, which can exempt you from being taxed as a U.S. resident. This is particularly important for individuals who may otherwise meet the substantial presence test due to their time spent in the U.S.

It is essential to understand that filing Form 8840 does not exempt you from all U.S. tax obligations. Instead, it clarifies your tax status and helps ensure compliance with IRS regulations. Proper use of this form can prevent misunderstandings and potential audits by the IRS.

Eligibility Criteria for Filing Form 8840

To be eligible to file the Federal Form 8840, you must meet specific criteria set by the IRS. Primarily, you need to be a non-resident alien who has been physically present in the U.S. for a limited number of days during the current year and the two preceding years. The substantial presence test is a key factor in determining your eligibility.

Additionally, you must demonstrate that you have a closer connection to a foreign country. This may include maintaining a permanent home, having family ties, and conducting business or other significant activities outside the U.S. Understanding these criteria is essential for ensuring that you can successfully file Form 8840 and maintain your desired tax status.

Filing Deadlines for Form 8840

Filing deadlines for the Federal Form 8840 are critical to avoid penalties and ensure compliance with IRS regulations. Generally, the form must be submitted by the due date of your tax return, which is typically April 15 for most taxpayers. However, if you are living outside the U.S., you may qualify for an automatic extension until June 15.

It is important to note that while the deadline for filing Form 8840 aligns with your tax return, you should not delay submitting the form if you meet the criteria for a closer connection. Early submission can help clarify your tax status and prevent potential issues with the IRS.

Quick guide on how to complete federal form 8840 closer connection exception statement for aliens2020 form 8840 irs tax formsform 8840 irs closer connection

Complete Federal Form 8840 Closer Connection Exception Statement For Aliens2020 Form 8840 IRS Tax FormsForm 8840 IRS Closer Connection Ex effortlessly on any gadget

Web-based document management has become widely adopted by companies and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly and without holdups. Manage Federal Form 8840 Closer Connection Exception Statement For Aliens2020 Form 8840 IRS Tax FormsForm 8840 IRS Closer Connection Ex on any device with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to edit and eSign Federal Form 8840 Closer Connection Exception Statement For Aliens2020 Form 8840 IRS Tax FormsForm 8840 IRS Closer Connection Ex with ease

- Obtain Federal Form 8840 Closer Connection Exception Statement For Aliens2020 Form 8840 IRS Tax FormsForm 8840 IRS Closer Connection Ex and click on Get Form to initiate the process.

- Utilize the features we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools designed by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Federal Form 8840 Closer Connection Exception Statement For Aliens2020 Form 8840 IRS Tax FormsForm 8840 IRS Closer Connection Ex and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal form 8840 closer connection exception statement for aliens2020 form 8840 irs tax formsform 8840 irs closer connection

Create this form in 5 minutes!

People also ask

-

What is the form 8840 form and who needs to file it?

The form 8840 form, also known as the 'Closer Connection Exception Statement for Aliens,' is required by certain individuals who wish to claim that they are not U.S. residents for tax purposes. Typically, this form is filed by non-resident aliens who spend time in the U.S. and meet specific criteria to demonstrate their closer connection to another country.

-

How does airSlate SignNow help with the form 8840 form?

AirSlate SignNow simplifies the process of preparing and signing the form 8840 form by providing an intuitive platform for document management. Users can easily input information, send the form for electronic signatures, and track its status all in one place. This streamlines compliance and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow when filing the form 8840 form?

AirSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, allowing you to choose the best fit for your needs when handling forms like the form 8840 form. Plans include features ranging from basic signing capabilities to comprehensive document management solutions, ensuring cost-effectiveness and efficiency.

-

Can I integrate airSlate SignNow with other software while handling the form 8840 form?

Yes, airSlate SignNow provides seamless integrations with a variety of popular software applications that can assist in managing the form 8840 form. This includes tools like Google Drive, Dropbox, and CRM systems, enhancing your workflow by connecting your most-used platforms with advanced eSigning capabilities.

-

What are the key benefits of using airSlate SignNow for the form 8840 form?

Using airSlate SignNow for the form 8840 form offers numerous benefits, such as faster document processing, improved compliance, and reduced paper usage. The platform ensures that all signatures are legally binding and provides a secure environment for sensitive tax information, making it a robust choice for businesses and individuals.

-

Is it easy to track the status of the form 8840 form with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of the form 8840 form in real-time. The platform provides notifications and updates when the form is viewed, signed, or completed, allowing you to stay informed throughout the entire process.

-

What types of documents can I send for eSigning alongside the form 8840 form?

In addition to the form 8840 form, airSlate SignNow supports eSigning for a wide range of documents, including contracts, agreements, and consent forms. This versatility makes it an ideal solution for various business needs, allowing you to manage all your document signing tasks in one user-friendly platform.

Get more for Federal Form 8840 Closer Connection Exception Statement For Aliens2020 Form 8840 IRS Tax FormsForm 8840 IRS Closer Connection Ex

Find out other Federal Form 8840 Closer Connection Exception Statement For Aliens2020 Form 8840 IRS Tax FormsForm 8840 IRS Closer Connection Ex

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later