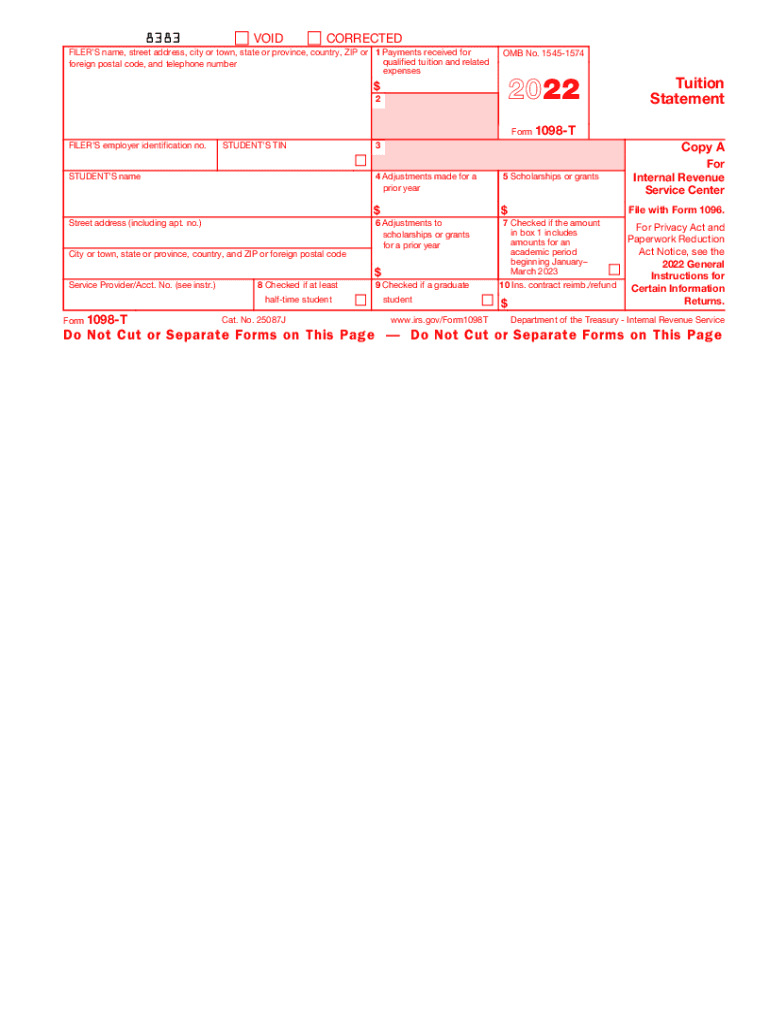

Form 1098 T Tuition Statement 2022

What is the Form 1099-G for 2017?

The Form 1099-G is a tax document used in the United States to report certain government payments. For the year 2017, this form primarily includes unemployment compensation, state or local income tax refunds, and other government payments. It is essential for taxpayers to accurately report this income on their federal tax returns, as it may affect their overall tax liability.

Key Elements of the Form 1099-G for 2017

Understanding the key elements of the 1099-G form is crucial for proper tax reporting. The form typically includes:

- Payer Information: This section contains the name, address, and taxpayer identification number of the government agency issuing the payment.

- Recipient Information: This includes the name, address, and Social Security number of the taxpayer receiving the payment.

- Payment Amounts: The form details the total amount of unemployment compensation or other payments received during the tax year.

- State Tax Refunds: If applicable, the amount of any state tax refunds is also reported.

Steps to Complete the Form 1099-G for 2017

Filling out the Form 1099-G involves several steps to ensure accuracy and compliance. Follow these steps:

- Gather necessary information, including your Social Security number and details of the payments received.

- Fill in the payer information accurately, ensuring the government agency's details are correct.

- Complete the recipient information with your personal details.

- Report the total payment amounts in the designated boxes on the form.

- Review the form for any errors before submission.

How to Obtain the Form 1099-G for 2017

Taxpayers can obtain the Form 1099-G through various means. Many government agencies provide this form electronically through their websites. Alternatively, taxpayers can request a paper copy by contacting the agency that issued the payment. It's important to ensure that you receive this form by the time you prepare your tax return, as it is necessary for accurate reporting.

Filing Deadlines for the Form 1099-G

Filing deadlines for the Form 1099-G are crucial for compliance. Typically, the form must be issued to recipients by January thirty-first of the year following the tax year. Additionally, the form must be filed with the IRS by the end of February if submitted on paper, or by the end of March if filed electronically. Adhering to these deadlines helps avoid potential penalties.

IRS Guidelines for Reporting Income on the Form 1099-G

The IRS provides specific guidelines for reporting income received on the Form 1099-G. Taxpayers must include the amounts reported on this form as part of their gross income on their federal tax returns. It's essential to refer to the IRS instructions for the 1099-G for any updates or additional information regarding reporting requirements and tax implications.

Quick guide on how to complete 2022 form 1098 t tuition statement

Manage Form 1098 T Tuition Statement effortlessly on any device

Digital document management has become favored among companies and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to draft, edit, and eSign your documents swiftly without interruptions. Handle Form 1098 T Tuition Statement on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Steps to modify and eSign Form 1098 T Tuition Statement with ease

- Locate Form 1098 T Tuition Statement and then select Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your edits.

- Select your preferred method for sharing your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign Form 1098 T Tuition Statement and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 1098 t tuition statement

Create this form in 5 minutes!

People also ask

-

What is a 1099g 2017 form and why is it important?

The 1099g 2017 form is used to report certain government payments and is crucial for individuals and businesses to accurately report income during tax season. Understanding this form helps ensure compliance with tax regulations and prevents potential penalties.

-

How can airSlate SignNow help with signing 1099g 2017 forms?

airSlate SignNow offers a user-friendly platform that allows businesses to easily eSign and send 1099g 2017 forms securely. This streamlines the signing process, reduces paperwork, and saves time for both senders and recipients.

-

Are there any costs associated with using airSlate SignNow for 1099g 2017 forms?

airSlate SignNow provides cost-effective solutions with various pricing plans suitable for different business needs. You can efficiently manage and send 1099g 2017 forms without incurring excessive expenses, making it a budget-friendly option.

-

What features does airSlate SignNow offer for 1099g 2017 document management?

With airSlate SignNow, you can automate workflows, create templates for 1099g 2017 forms, and securely store documents in the cloud. These features enhance productivity and ensure that your important tax documents are always accessible.

-

Can airSlate SignNow integrate with other software for handling 1099g 2017 forms?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to manage 1099g 2017 forms alongside your existing software. This capability enhances your workflow efficiency and helps ensure all your documents are organized in one place.

-

Is eSigning a 1099g 2017 form legally binding?

Yes, eSigning a 1099g 2017 form through airSlate SignNow is legally binding and compliant with electronic signature laws. This ensures that your signed documents hold the same weight as traditional handwritten signatures.

-

What benefits do businesses gain by using airSlate SignNow for 1099g 2017 forms?

Using airSlate SignNow for 1099g 2017 forms allows businesses to reduce paper usage, speed up the signing process, and improve overall efficiency. Additionally, it helps maintain accurate records, which is essential for tax filing and audits.

Get more for Form 1098 T Tuition Statement

- Examination debtor form

- Ohio transfer form

- Transfer death affidavit form

- Release of garnishee ohio form

- Notice of furnishing corporation or llc ohio form

- Quitclaim deed from individual to two individuals in joint tenancy ohio form

- Quitclaim from individual to husband and wife as joint tenants with right of survivorship ohio form

- Renunciation and disclaimer of property from will by testate ohio form

Find out other Form 1098 T Tuition Statement

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself