Net Operating Loss Deduction See Instructions 2024

What is the Net Operating Loss Deduction?

The Net Operating Loss Deduction allows businesses to offset taxable income with losses incurred in previous years. This deduction can be crucial for companies facing financial difficulties, enabling them to reduce their tax burden. A net operating loss (NOL) occurs when a business's allowable tax deductions exceed its taxable income. The NOL can be carried back to previous tax years or carried forward to future years, depending on the specific circumstances and regulations in place.

How to use the Net Operating Loss Deduction

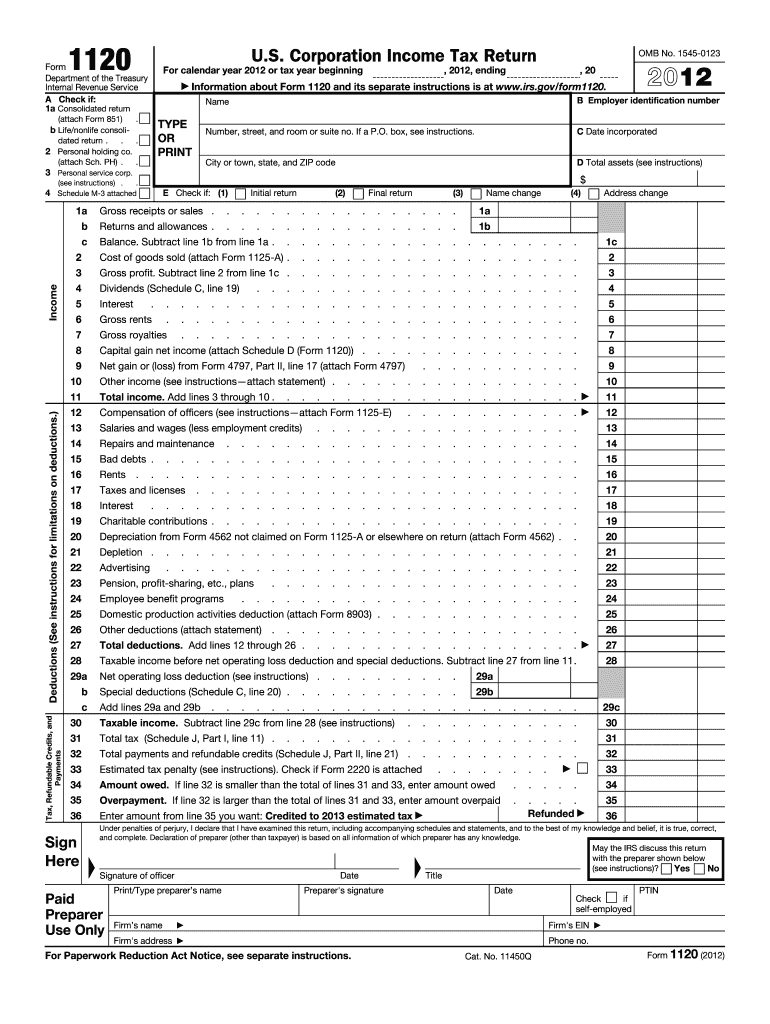

To utilize the Net Operating Loss Deduction, taxpayers must first calculate their net operating loss. This involves determining total income and allowable deductions to find the loss amount. Once calculated, the NOL can be applied to prior year tax returns or future returns. Taxpayers must complete the appropriate forms, such as IRS Form 1045 or Form 1139, to claim the deduction. It is essential to follow IRS guidelines carefully to ensure compliance and maximize the benefits of the deduction.

Steps to complete the Net Operating Loss Deduction

Completing the Net Operating Loss Deduction involves several steps:

- Calculate the net operating loss by subtracting total income from allowable deductions.

- Determine if you will carry the NOL back to previous years or forward to future years.

- Fill out the required forms, such as Form 1045 for individuals or Form 1139 for corporations.

- Attach the completed forms to your tax return for the applicable year.

- Submit your tax return by the required deadline to ensure the deduction is applied.

IRS Guidelines

The IRS provides specific guidelines for claiming the Net Operating Loss Deduction. Taxpayers must adhere to these guidelines to ensure compliance and avoid penalties. Key points include understanding the carryback and carryforward rules, maintaining accurate records of income and deductions, and filing the necessary forms within the specified timeframes. The IRS also outlines the types of losses that qualify for the deduction, emphasizing the importance of following the latest tax laws and regulations.

Eligibility Criteria

To qualify for the Net Operating Loss Deduction, taxpayers must meet certain eligibility criteria. Generally, the deduction is available to businesses that experience a loss in a given tax year. This includes sole proprietorships, partnerships, corporations, and certain estates and trusts. It is important to note that not all losses qualify; for instance, losses from the sale of capital assets or personal losses typically do not qualify. Taxpayers should review IRS guidelines to confirm their eligibility.

Required Documents

Claiming the Net Operating Loss Deduction requires specific documentation. Taxpayers should prepare the following documents:

- Detailed records of income and deductions for the loss year.

- Completed IRS forms, such as Form 1045 or Form 1139.

- Prior year tax returns if carrying back the NOL.

- Any supporting documentation that substantiates the loss, such as financial statements.

Filing Deadlines / Important Dates

Filing deadlines for the Net Operating Loss Deduction vary depending on whether the NOL is carried back or carried forward. Generally, if carrying back the loss, taxpayers must file the claim within one year of the original return due date. For carryforwards, the NOL must be applied in the tax year it is claimed. It is essential to keep track of these deadlines to maximize the benefits of the deduction and avoid potential penalties.

Create this form in 5 minutes or less

Find and fill out the correct net operating loss deduction see instructions

Create this form in 5 minutes!

How to create an eSignature for the net operating loss deduction see instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Net Operating Loss Deduction and how can I find the instructions?

The Net Operating Loss Deduction allows businesses to offset taxable income with losses incurred in previous years. To find the instructions for claiming this deduction, you can refer to the IRS guidelines or consult a tax professional. Understanding the Net Operating Loss Deduction see Instructions is crucial for maximizing your tax benefits.

-

How does airSlate SignNow help with tax document management?

airSlate SignNow provides a streamlined solution for managing tax documents, including those related to the Net Operating Loss Deduction see Instructions. With our platform, you can easily send, sign, and store important tax documents securely. This ensures that you have all necessary paperwork organized and accessible when needed.

-

What features does airSlate SignNow offer for eSigning tax documents?

Our platform offers a variety of features for eSigning tax documents, including customizable templates and secure storage. You can easily integrate the Net Operating Loss Deduction see Instructions into your workflow by creating templates that streamline the signing process. This saves time and reduces the risk of errors in your tax documentation.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Our pricing plans are flexible and cater to different needs, ensuring that you can manage your documents efficiently without breaking the bank. This is especially beneficial when dealing with complex tax matters like the Net Operating Loss Deduction see Instructions.

-

Can I integrate airSlate SignNow with my accounting software?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, making it easy to manage your financial documents. This integration is particularly useful when handling the Net Operating Loss Deduction see Instructions, as it allows for efficient document flow between your accounting and eSigning processes.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including enhanced security, ease of use, and time savings. By utilizing our platform, you can ensure that your documents related to the Net Operating Loss Deduction see Instructions are handled efficiently and securely. This helps you focus on your business while we take care of your document management needs.

-

How can I ensure compliance when using airSlate SignNow for tax documents?

airSlate SignNow is designed with compliance in mind, providing features that help you adhere to legal standards. When dealing with the Net Operating Loss Deduction see Instructions, you can rest assured that our platform maintains the necessary security and compliance protocols. Regular updates and audits ensure that your documents remain compliant with current regulations.

Get more for Net Operating Loss Deduction see Instructions

Find out other Net Operating Loss Deduction see Instructions

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT