Form 1041 Schedule K 1 Beneficiarys Share of Income Deductions Credits Etc 2024

Understanding Form 1041 Schedule K-1: Beneficiary's Share of Income, Deductions, Credits, Etc.

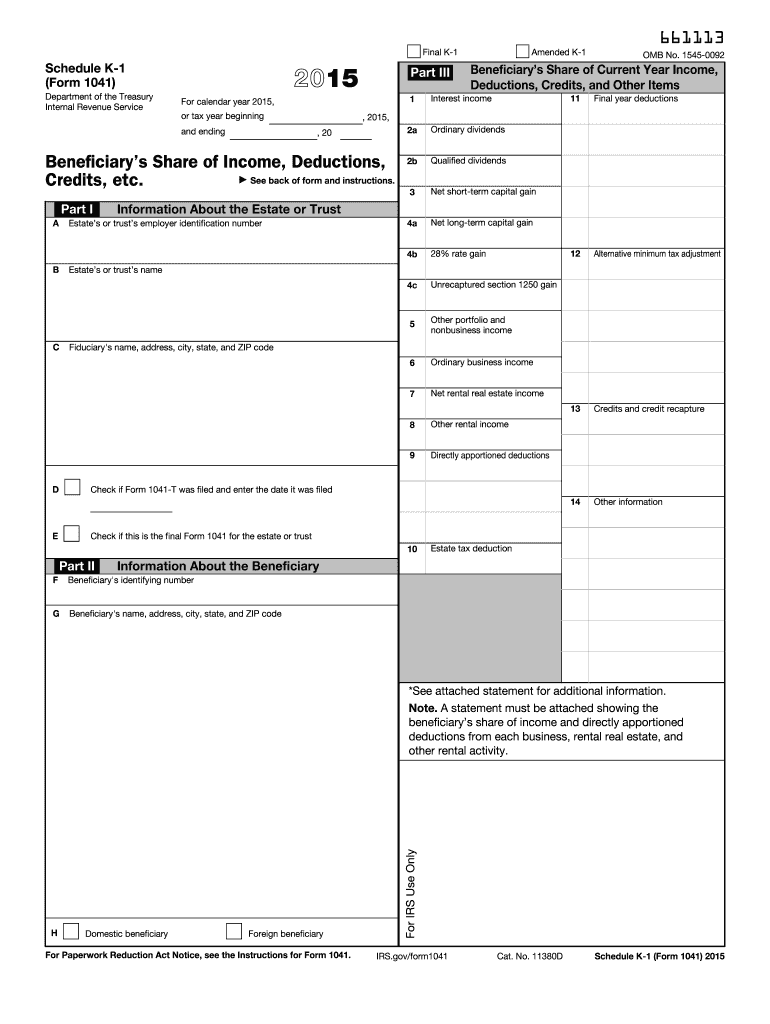

Form 1041 Schedule K-1 is a crucial document used in the United States for reporting the income, deductions, and credits that beneficiaries receive from estates or trusts. This form is essential for beneficiaries to accurately report their share of the estate's or trust's income on their individual tax returns. The information provided on the K-1 helps beneficiaries understand their tax obligations and ensures compliance with IRS regulations.

Steps to Complete Form 1041 Schedule K-1

Completing Form 1041 Schedule K-1 involves several key steps:

- Gather necessary information about the estate or trust, including its income and deductions.

- Fill out the beneficiary's information, including name, address, and taxpayer identification number.

- Report the beneficiary's share of income, deductions, and credits as provided by the estate or trust.

- Ensure all information is accurate and complete before submission.

Each beneficiary should receive a copy of the K-1 from the fiduciary, which they will use for their personal tax filings.

Obtaining Form 1041 Schedule K-1

Form 1041 Schedule K-1 can be obtained from the IRS website or through tax preparation software. It is typically provided by the fiduciary of the estate or trust, who prepares the form based on the estate's or trust's financial activities. Beneficiaries should ensure they receive their K-1 by the tax filing deadline to accurately report their income.

Legal Use of Form 1041 Schedule K-1

The legal use of Form 1041 Schedule K-1 is to report income, deductions, and credits received by beneficiaries from estates or trusts. This form must be filed with the IRS and is also used by beneficiaries when filing their individual tax returns. Proper use of the K-1 is essential to avoid penalties and ensure compliance with tax laws.

Key Elements of Form 1041 Schedule K-1

Key elements of Form 1041 Schedule K-1 include:

- Beneficiary's name and identification number.

- Details of the estate or trust, including its name and identification number.

- Income distributions, including ordinary income, capital gains, and other types of income.

- Deductions and credits allocated to the beneficiary.

Each of these elements is vital for the accurate reporting of income and tax obligations.

IRS Guidelines for Form 1041 Schedule K-1

The IRS provides specific guidelines for completing and filing Form 1041 Schedule K-1. These guidelines outline the information required, deadlines for filing, and the responsibilities of both fiduciaries and beneficiaries. It is important for both parties to understand these guidelines to ensure compliance and avoid potential issues with the IRS.

Filing Deadlines for Form 1041 Schedule K-1

Filing deadlines for Form 1041 Schedule K-1 align with the deadlines for Form 1041, which is typically due on the fifteenth day of the fourth month following the end of the estate's or trust's tax year. Beneficiaries should receive their K-1 in a timely manner to meet their own tax filing obligations. It is essential to keep track of these deadlines to avoid penalties.

Create this form in 5 minutes or less

Find and fill out the correct form 1041 schedule k 1 beneficiarys share of income deductions credits etc 100666604

Create this form in 5 minutes!

How to create an eSignature for the form 1041 schedule k 1 beneficiarys share of income deductions credits etc 100666604

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1041 Schedule K 1 Beneficiarys Share Of Income Deductions Credits Etc.?

The Form 1041 Schedule K 1 Beneficiarys Share Of Income Deductions Credits Etc. is a tax document used to report a beneficiary's share of income, deductions, and credits from an estate or trust. This form is essential for beneficiaries to accurately report their income on their personal tax returns. Understanding this form can help ensure compliance with tax regulations.

-

How can airSlate SignNow help with Form 1041 Schedule K 1 Beneficiarys Share Of Income Deductions Credits Etc.?

airSlate SignNow provides a streamlined solution for sending and eSigning the Form 1041 Schedule K 1 Beneficiarys Share Of Income Deductions Credits Etc. Our platform simplifies the document management process, allowing users to easily create, send, and track important tax documents securely and efficiently.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you need basic eSigning capabilities or advanced features for managing documents like the Form 1041 Schedule K 1 Beneficiarys Share Of Income Deductions Credits Etc., we have a plan that fits your budget. Visit our pricing page for detailed information.

-

Is airSlate SignNow compliant with tax regulations for Form 1041 Schedule K 1?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, ensuring that your Form 1041 Schedule K 1 Beneficiarys Share Of Income Deductions Credits Etc. is handled securely and legally. Our platform uses advanced encryption and security measures to protect sensitive information, giving you peace of mind when managing tax documents.

-

Can I integrate airSlate SignNow with other accounting software for tax purposes?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easy to manage your Form 1041 Schedule K 1 Beneficiarys Share Of Income Deductions Credits Etc. alongside your other financial documents. This integration helps streamline your workflow and ensures that all your data is synchronized across platforms.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow includes a variety of features designed to enhance the management of tax documents, including customizable templates, automated workflows, and real-time tracking. These features make it easier to prepare and send the Form 1041 Schedule K 1 Beneficiarys Share Of Income Deductions Credits Etc., ensuring that you stay organized and efficient throughout the tax season.

-

How does airSlate SignNow ensure the security of my tax documents?

Security is a top priority at airSlate SignNow. We utilize industry-leading encryption protocols and secure cloud storage to protect your Form 1041 Schedule K 1 Beneficiarys Share Of Income Deductions Credits Etc. and other sensitive documents. Additionally, our platform includes user authentication and access controls to further safeguard your information.

Get more for Form 1041 Schedule K 1 Beneficiarys Share Of Income Deductions Credits Etc

- Tradoc form 2009

- Final attach explanation form

- Hawaii form hw 14 2017 2019

- Form g 26 rev 2016 use tax return forms 2016 fillable

- Form g 27 rev 2013 motor vehicle use tax hawaiigov

- General excise and use tax department of taxation hawaiigov form

- 2011 schedule icr form 2017

- Substitute online 2017 2019 form

Find out other Form 1041 Schedule K 1 Beneficiarys Share Of Income Deductions Credits Etc

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement