1098 T Form 2015

What is the 1098 T Form

The 1098 T Form, officially known as the Tuition Statement, is a tax document used in the United States to report qualified tuition and related expenses paid by students enrolled in eligible educational institutions. This form is essential for students and their families as it provides information necessary for claiming education tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit. Educational institutions are required to issue this form to students who have paid tuition during the tax year, making it a vital part of the tax filing process for many individuals.

How to obtain the 1098 T Form

Students can obtain the 1098 T Form directly from their educational institution. Most colleges and universities provide this form electronically through their student portals, allowing easy access to the document. If a student does not receive their 1098 T Form by the end of January, it is advisable to contact the school's financial aid office or registrar for assistance. Institutions may also send paper copies to students' mailing addresses, so it is important to ensure that contact information is up to date.

Steps to complete the 1098 T Form

Completing the 1098 T Form involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary information, including your Social Security number, the institution's Employer Identification Number (EIN), and details of qualified expenses. Next, accurately fill out the form with the required data, ensuring that amounts reported reflect what was actually paid during the tax year. After completing the form, review it for any errors before submitting it with your tax return. It is important to keep a copy for your records.

Legal use of the 1098 T Form

The 1098 T Form is legally recognized as a valid document for reporting educational expenses to the IRS. To ensure its legal use, it must be completed accurately and submitted in accordance with IRS guidelines. The form serves as proof of tuition payments, which can be crucial for claiming education-related tax credits. Inaccuracies or omissions on the form may lead to complications during tax filing, including potential audits or penalties. Therefore, it is essential to adhere to all legal requirements when using this form.

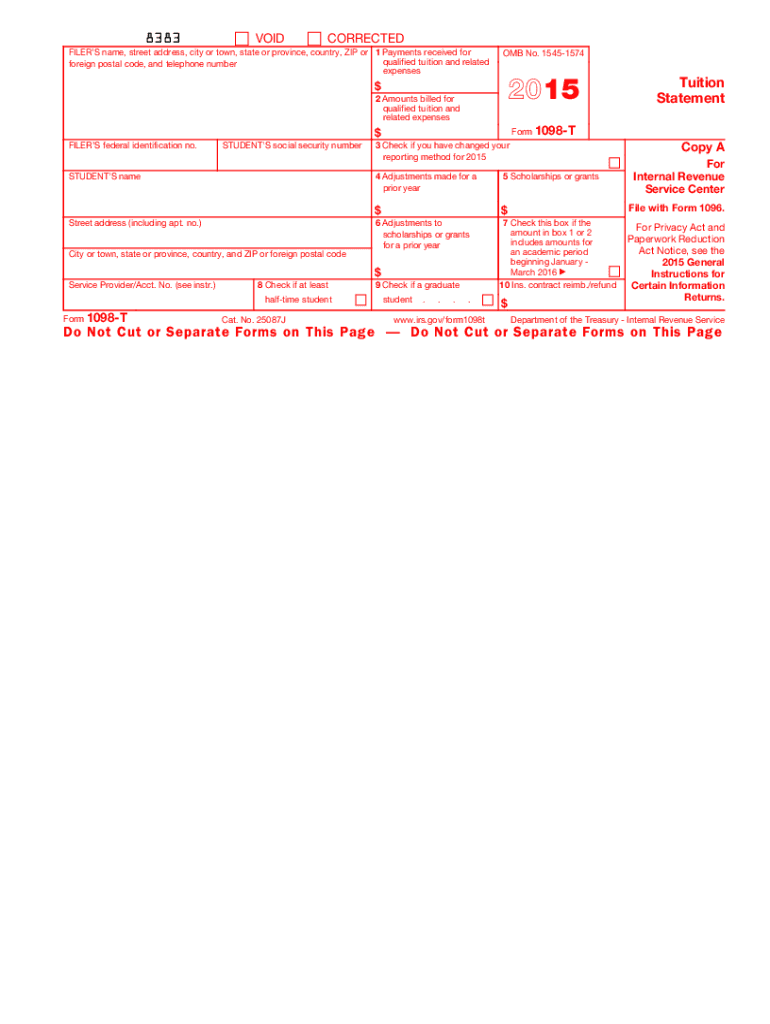

Key elements of the 1098 T Form

The 1098 T Form includes several key elements that are important for both students and the IRS. These elements typically include the student's name, address, and Social Security number, as well as the institution's name, address, and EIN. The form also details the amount of qualified tuition and related expenses paid during the tax year, any scholarships or grants received, and the amount billed for qualified expenses. Understanding these elements is crucial for accurately filing taxes and maximizing potential education tax credits.

Filing Deadlines / Important Dates

Filing deadlines for the 1098 T Form are crucial for students and educational institutions alike. Educational institutions must provide the form to students by January thirty-first of the year following the tax year in which tuition was paid. Students should ensure that they have received their 1098 T Form in time to include it with their tax returns, which are typically due on April fifteenth. Being aware of these deadlines helps prevent delays in tax filing and ensures compliance with IRS regulations.

Examples of using the 1098 T Form

The 1098 T Form can be utilized in various scenarios to claim education tax credits. For instance, a student who paid qualified tuition of five thousand dollars and received a scholarship of one thousand dollars can report the net amount of four thousand dollars on their tax return. This form can also be beneficial for parents claiming their dependent students' education expenses. By accurately reporting the information from the 1098 T Form, taxpayers can potentially reduce their tax liability through available credits.

Quick guide on how to complete 1098 t 2015 form

Prepare 1098 T Form effortlessly on any device

Web-based document management has gained traction among companies and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can obtain the appropriate form and securely preserve it online. airSlate SignNow equips you with all the resources necessary to create, amend, and eSign your documents quickly and without hindrance. Manage 1098 T Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

Steps to modify and eSign 1098 T Form effortlessly

- Find 1098 T Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign function, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form retrieval, or errors necessitating new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign 1098 T Form and guarantee outstanding communication at any point in the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1098 t 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 1098 t 2015 form

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the 1098 T Form and why do I need it?

The 1098 T Form is a tax document used to report payments received for qualified tuition and related expenses. If you are a student or a parent paying for education, you will need the 1098 T Form to claim education tax credits when filing your taxes. Using airSlate SignNow simplifies the process of obtaining and signing the 1098 T Form electronically.

-

How can airSlate SignNow help me manage my 1098 T Form?

airSlate SignNow provides an easy-to-use platform to create, send, and eSign your 1098 T Form securely. With our digital solution, you can streamline the entire process, ensuring you have all necessary signatures and documents organized for tax season. This helps save time and reduces the stress of handling paperwork.

-

Is there a cost associated with using airSlate SignNow for the 1098 T Form?

Yes, airSlate SignNow offers various pricing plans tailored to different needs, including features specifically for managing documents like the 1098 T Form. Our cost-effective solution ensures you only pay for the features you need, making it a great choice for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other software for handling the 1098 T Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to manage your 1098 T Form alongside your favorite tools. This integration helps streamline your workflow, making it easier to access and process your documents in one place.

-

What features does airSlate SignNow offer for handling the 1098 T Form?

airSlate SignNow offers features such as customizable templates, electronic signatures, and document tracking, specifically designed to simplify the management of your 1098 T Form. These features ensure that you can easily create, send, and receive signed documents without hassle.

-

How secure is my information when using airSlate SignNow for the 1098 T Form?

Security is a top priority at airSlate SignNow. When handling sensitive documents like the 1098 T Form, we utilize industry-leading encryption and compliance measures to protect your data. You can confidently manage your documents knowing they are secure and accessible only to authorized users.

-

Can I access my 1098 T Form from anywhere with airSlate SignNow?

Yes! airSlate SignNow is cloud-based, allowing you to access your 1098 T Form from anywhere, at any time. Whether you're in the office or on the go, you can manage your documents and signatures with ease.

Get more for 1098 T Form

Find out other 1098 T Form

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application