1098t Form 2014

What is the 1098-T Form

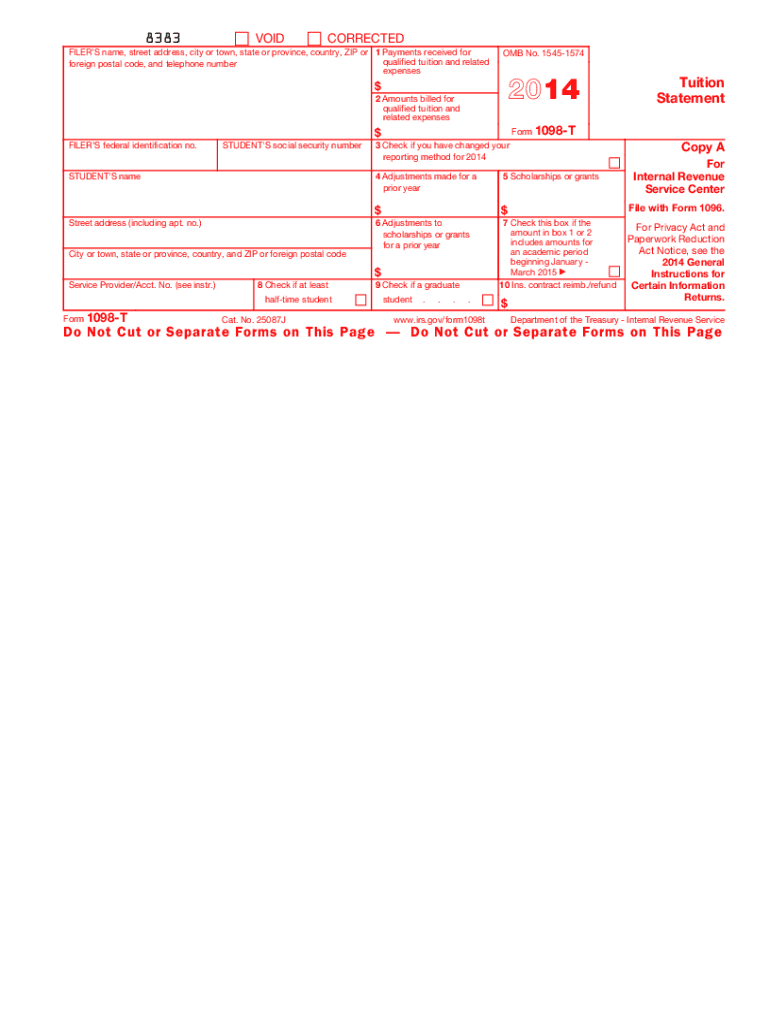

The 1098-T Form, officially known as the Tuition Statement, is a tax document used in the United States. It is issued by eligible educational institutions to report information about qualified tuition and related expenses paid by students. The form is essential for students and their families as it helps in claiming education-related tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit. The 1098-T provides details on the amounts billed for tuition and fees, scholarships or grants received, and adjustments made to prior year amounts.

How to Obtain the 1098-T Form

Students can obtain the 1098-T Form from their educational institution. Most colleges and universities provide this form electronically through their student portals. In some cases, institutions may also mail a paper copy to students’ registered addresses. If a student does not receive the form, they should contact the financial aid or registrar's office of their institution to request a copy. It is important to ensure that the institution has the correct address and email on file to facilitate timely delivery.

Steps to Complete the 1098-T Form

Completing the 1098-T Form involves several key steps:

- Gather all relevant information, including your Social Security number, the institution’s Employer Identification Number (EIN), and details about tuition payments and scholarships.

- Review the form for accuracy, ensuring that all amounts reported reflect your actual payments and any financial aid received.

- Use the information from the 1098-T to complete your federal tax return, specifically when claiming education tax credits.

- Keep a copy of the completed form for your records, as it may be needed for future reference or audits.

Legal Use of the 1098-T Form

The 1098-T Form is legally recognized as a document that supports claims for educational tax credits. To ensure its legal validity, it must be filled out accurately and submitted in accordance with IRS guidelines. The information provided on the form must be truthful and reflect actual financial transactions. Misrepresenting information on the form can lead to penalties and disqualification from tax credits. Therefore, it is crucial to maintain accurate records of tuition payments and related expenses.

Filing Deadlines / Important Dates

For the 1098-T Form, educational institutions are required to send the form to students by January 31 of the year following the tax year. Students should keep in mind that the deadline for filing their federal tax returns is typically April 15. It is advisable to complete tax returns as soon as possible after receiving the 1098-T to ensure that any potential tax credits are claimed promptly. Additionally, extensions may be available, but they do not extend the time to pay any taxes owed.

Who Issues the Form

The 1098-T Form is issued by eligible educational institutions, which include colleges, universities, and certain vocational schools that participate in federal student aid programs. These institutions are responsible for reporting the necessary information to the IRS and providing copies to students. It is important for students to verify that their institution is eligible to issue the 1098-T, as not all educational entities qualify.

Quick guide on how to complete 1098t 2014 form

Complete 1098t Form seamlessly on any device

Online document administration has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 1098t Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign 1098t Form effortlessly

- Find 1098t Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign 1098t Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1098t 2014 form

Create this form in 5 minutes!

How to create an eSignature for the 1098t 2014 form

The best way to create an electronic signature for your PDF in the online mode

The best way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is a 1098t Form and why is it important?

The 1098t Form is a tax document used by educational institutions to report amounts billed for qualified tuition and related expenses. It is important for students and their families as it helps them claim educational tax credits on their federal tax returns. Understanding how to use the 1098t Form can lead to signNow tax savings.

-

How can airSlate SignNow help with the 1098t Form signing process?

airSlate SignNow simplifies the signing process of the 1098t Form by allowing users to electronically sign and send documents securely. With its user-friendly interface, you can easily manage and track the status of your 1098t Form, ensuring that all parties receive their copies promptly. This enhances efficiency and saves time compared to traditional paper signing.

-

Is there a cost associated with using airSlate SignNow for the 1098t Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including plans suitable for handling the 1098t Form. The pricing is competitive and provides features that ensure effective document management and e-signing. You can choose a plan that best fits your budget while still accessing robust functionalities.

-

What features does airSlate SignNow offer for managing the 1098t Form?

airSlate SignNow includes features like customizable templates, secure storage, and real-time tracking for documents like the 1098t Form. These features enhance your document workflow, making it easier to manage, sign, and share important tax-related documents efficiently. Additionally, users can automate reminders for signing, further streamlining the process.

-

Can I integrate airSlate SignNow with other software for handling the 1098t Form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to manage the 1098t Form. You can connect it with platforms like Salesforce, Google Workspace, and Microsoft Office, allowing for a smooth workflow between different tools and ensuring easy access to your documents.

-

How secure is airSlate SignNow when handling sensitive documents like the 1098t Form?

Security is a top priority at airSlate SignNow. When dealing with sensitive documents like the 1098t Form, your information is protected with advanced encryption and secure data storage. This ensures that your documents remain confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for the 1098t Form compared to traditional methods?

Using airSlate SignNow for the 1098t Form offers numerous benefits over traditional paper methods. It reduces processing time, minimizes errors, and enhances collaboration among parties involved. The electronic signing process is faster and more convenient, allowing you to focus on important tax matters rather than paperwork.

Get more for 1098t Form

- Gray less than 1 in us mark memorial day creative form

- Valdosta state university purchasing card pcard application form

- Secondary or home school student admission form

- Contracts agreements for services foothill de anza form

- Committee service guidelines the university of new mexico form

- On campus proctor sheet form

- Experimental technical services agreement form

- Central piedmont community college steps to complete form

Find out other 1098t Form

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online