1120s Fill and Sign Printable Template OnlineUS Legal 2021

Understanding the 1120S Form

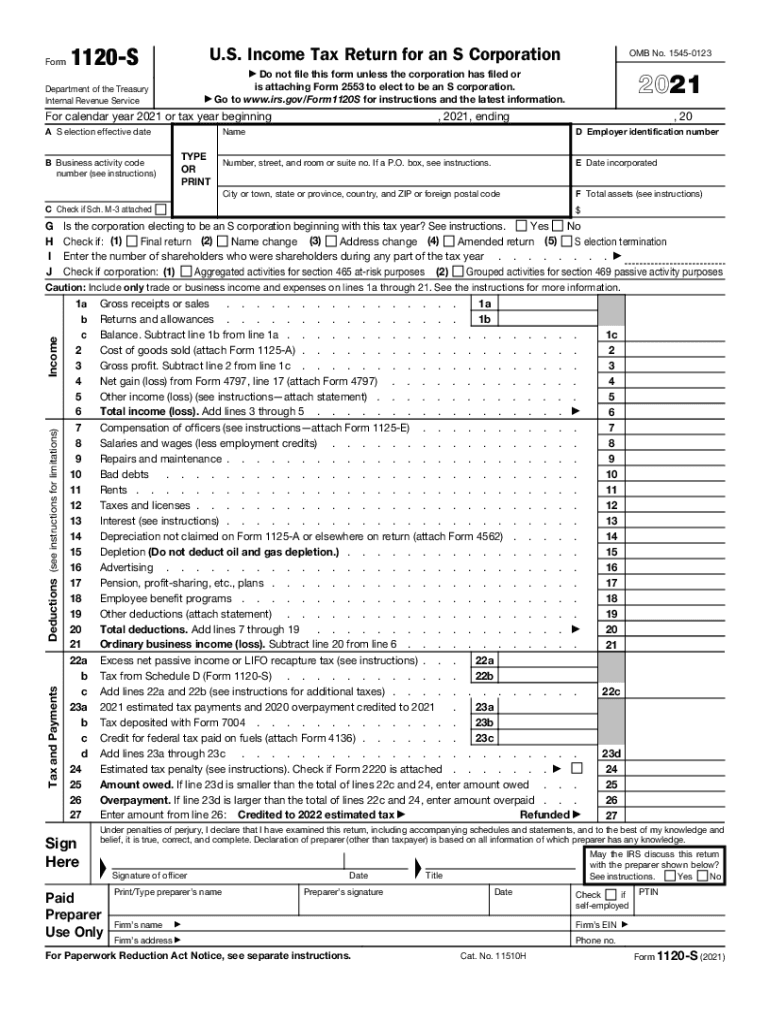

The 1120S form is a crucial document used by S corporations in the United States to report income, deductions, and credits to the Internal Revenue Service (IRS). This form allows S corporations to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. The 1120S form is essential for ensuring compliance with tax regulations while providing a clear picture of the company's financial status.

Steps to Complete the 1120S Form

Filling out the 1120S form involves several key steps:

- Gather Financial Information: Collect all necessary financial documents, including income statements, balance sheets, and any other relevant records.

- Complete the Form: Fill out the form accurately, ensuring that all sections are completed according to IRS guidelines. This includes reporting income, deductions, and credits.

- Review and Verify: Double-check all entries for accuracy and completeness. Mistakes can lead to delays or penalties.

- Sign and Date: Ensure that the form is signed by an authorized officer of the corporation before submission.

IRS Guidelines for the 1120S Form

The IRS provides specific guidelines for completing and submitting the 1120S form. It is essential to follow these guidelines to avoid issues with your tax return. Key points include:

- Ensure that the form is submitted by the due date, which is typically March 15 for calendar year S corporations.

- Include all necessary schedules and attachments, such as Schedule K-1, which reports each shareholder's share of income, deductions, and credits.

- Utilize the most current version of the form, as outdated forms may not be accepted.

Filing Deadlines for the 1120S Form

Timely submission of the 1120S form is critical to avoid penalties. The standard deadline for filing is March 15 for S corporations operating on a calendar year. If additional time is needed, corporations can file for an extension, which typically allows for an additional six months. However, it is important to note that any taxes owed must still be paid by the original due date to avoid interest and penalties.

Required Documents for the 1120S Form

When preparing to file the 1120S form, certain documents are necessary to ensure accurate reporting. These include:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income received and expenses incurred during the tax year.

- Previous year’s tax return for reference.

- Any supporting documentation for deductions and credits claimed.

Penalties for Non-Compliance with the 1120S Form

Failure to file the 1120S form on time or inaccuracies in reporting can result in significant penalties. The IRS may impose fines for late filings, which can accumulate over time. Additionally, incorrect information may lead to audits or further scrutiny, resulting in additional tax liabilities. It is essential for S corporations to adhere to all filing requirements to avoid these potential consequences.

Quick guide on how to complete 1120s fill and sign printable template onlineus legal

Complete 1120s Fill And Sign Printable Template OnlineUS Legal effortlessly on any gadget

Online document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the proper format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 1120s Fill And Sign Printable Template OnlineUS Legal on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to modify and eSign 1120s Fill And Sign Printable Template OnlineUS Legal without hassle

- Find 1120s Fill And Sign Printable Template OnlineUS Legal and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or conceal sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to store your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Modify and eSign 1120s Fill And Sign Printable Template OnlineUS Legal and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1120s fill and sign printable template onlineus legal

Create this form in 5 minutes!

How to create an eSignature for the 1120s fill and sign printable template onlineus legal

How to create an e-signature for a PDF in the online mode

How to create an e-signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an e-signature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is form 1120s and why is it important?

Form 1120s is the U.S. federal tax form used by S corporations to report income, deductions, and other tax-related information. It's important because it allows S corporations to pass their income, losses, and deductions directly to shareholders, avoiding double taxation. Understanding how to properly complete form 1120s is crucial for compliance with IRS regulations.

-

How does airSlate SignNow help with form 1120s?

airSlate SignNow streamlines the process of gathering electronic signatures on documents like form 1120s. Our platform allows users to create, send, and sign the form 1120s quickly and securely, ensuring that all necessary signatures are obtained efficiently. With airSlate SignNow, you can easily manage your form 1120s without the hassle of paperwork.

-

What features does airSlate SignNow offer for managing form 1120s?

airSlate SignNow offers features such as customizable templates, automated reminders, and real-time tracking for form 1120s. These tools facilitate a smooth signing process, allowing users to stay on top of their filings. Additionally, our intuitive interface makes it easy to navigate through the necessary steps in completing form 1120s.

-

Is airSlate SignNow cost-effective for businesses needing to file form 1120s?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to file form 1120s. Our pricing plans are designed to cater to various business sizes and budgets, making it accessible for all. By choosing airSlate SignNow, you can save on physical paperwork and expedite your filing process, ultimately reducing costs.

-

Can I integrate airSlate SignNow with other software for filing form 1120s?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, which can enhance the process of filing form 1120s. These integrations facilitate smooth data transfers and improve workflow efficiency, ensuring that all necessary information is readily available for your filing process. Our platform is designed to cater to diverse business needs.

-

What are the security measures in place for submitting form 1120s digitally?

Security is a top priority at airSlate SignNow, particularly when it comes to sensitive documents like form 1120s. We utilize advanced encryption protocols and secure servers to protect your data during transmission and storage. Moreover, our platform complies with industry regulations to ensure that your form 1120s and associated information are kept confidential and secure.

-

How can I track the status of my form 1120s submission through airSlate SignNow?

With airSlate SignNow, tracking the status of your form 1120s submission is easy. Our platform provides real-time updates and notifications, allowing you to monitor whether your document has been viewed, signed, or completed. This transparency ensures that you stay informed throughout the entire process of filing your form 1120s.

Get more for 1120s Fill And Sign Printable Template OnlineUS Legal

- Hawaii notice form

- Quitclaim deed from individual to corporation hawaii form

- Warranty deed from individual to corporation hawaii form

- Demand for payment hawaii form

- Quitclaim deed from individual to llc hawaii form

- Warranty deed from individual to llc hawaii form

- Notice hearing template form

- Hawaii quitclaim deed 497304362 form

Find out other 1120s Fill And Sign Printable Template OnlineUS Legal

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free