Form 1120s 2012

What is the Form 1120S

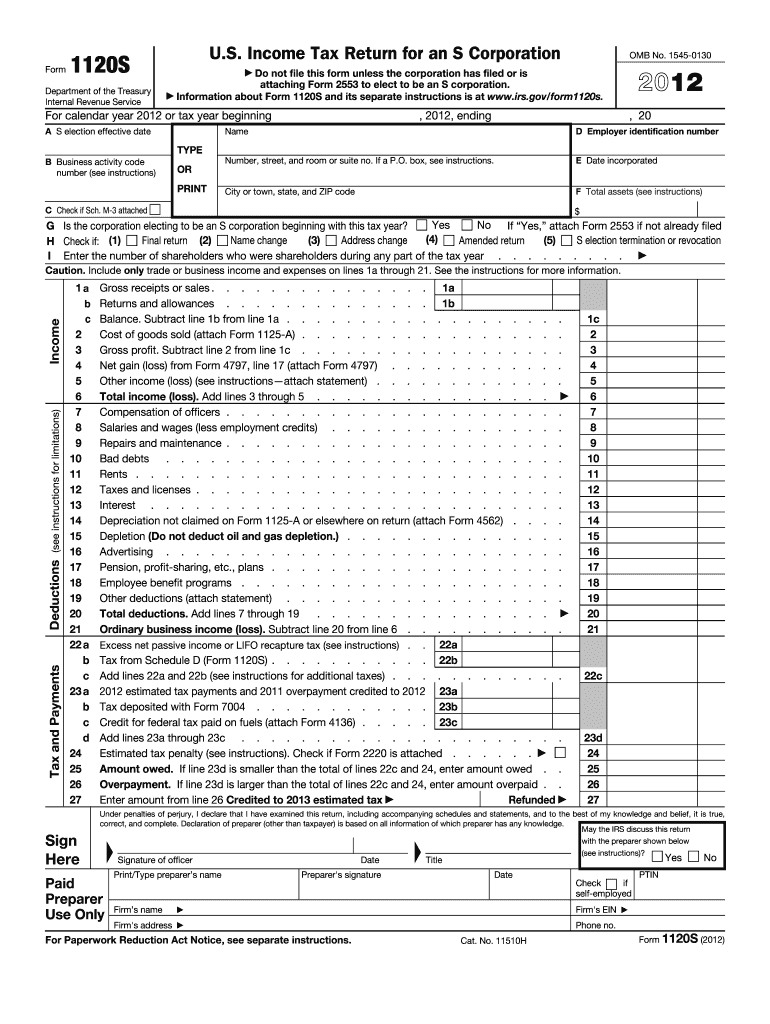

The Form 1120S is an essential tax document used by S corporations in the United States to report income, deductions, and credits. This form is specifically designed for S corporations, which are unique business entities that allow income to pass through to shareholders, avoiding double taxation. By filing Form 1120S, S corporations can provide the Internal Revenue Service (IRS) with a comprehensive overview of their financial activities for the tax year.

Steps to complete the Form 1120S

Completing the Form 1120S involves several key steps to ensure accuracy and compliance with IRS regulations. Here are the primary steps:

- Gather financial records: Collect all relevant financial documents, including income statements, balance sheets, and receipts for expenses.

- Fill out the form: Begin by entering basic information about the corporation, such as the name, address, and Employer Identification Number (EIN).

- Report income: Detail all sources of income, including sales revenue and other income streams, on the appropriate lines of the form.

- Deduct expenses: List all allowable deductions, such as salaries, rent, and utilities, to determine the corporation's taxable income.

- Calculate tax liability: Use the information provided to compute any tax owed or credits available.

- Sign and date: Ensure that the form is signed by an authorized officer of the corporation before submission.

How to obtain the Form 1120S

The Form 1120S can be easily obtained from the IRS website or through various tax preparation software. To access the form online, visit the IRS forms page, where you can download the latest version in PDF format. Additionally, many tax professionals and accountants can provide the form as part of their services, ensuring that it is filled out correctly and in compliance with current tax laws.

Legal use of the Form 1120S

The legal use of Form 1120S is crucial for S corporations to maintain their tax status and comply with federal regulations. Filing this form accurately and on time helps avoid penalties and ensures that shareholders receive the correct tax information. The form must be submitted annually, and failure to file can result in the loss of S corporation status, leading to potential double taxation on corporate income.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Form 1120S is essential for S corporations. The form is typically due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also request a six-month extension to file, but this does not extend the time to pay any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

Form 1120S can be submitted in several ways, providing flexibility for S corporations. The primary submission methods include:

- Online filing: Many tax preparation software programs allow for electronic filing, which is often faster and more efficient.

- Mail: Corporations can print the completed form and send it to the appropriate IRS address based on their location.

- In-person: While less common, some corporations may choose to deliver the form directly to an IRS office.

Quick guide on how to complete form 1120s 2012

Easily Prepare Form 1120s on Any Device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1120s on any device using airSlate SignNow's Android or iOS applications and simplify your document operations today.

Effortlessly Modify and Electronically Sign Form 1120s

- Obtain Form 1120s and click on Get Form to start.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 1120s and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120s 2012

Create this form in 5 minutes!

How to create an eSignature for the form 1120s 2012

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 1120s and why is it important?

Form 1120s is a tax form that S corporations in the United States use to report income, deductions, and credits to the IRS. It is crucial for compliance and helps ensure that S corporations accurately report their financial activities, thereby avoiding potential penalties.

-

How does airSlate SignNow simplify the signing process for Form 1120s?

airSlate SignNow streamlines the signing process for Form 1120s by providing an intuitive eSignature platform. Users can easily send, sign, and manage documents online, reducing the time spent on paperwork and ensuring that every step of the process is secure and compliant.

-

What features does airSlate SignNow offer for managing Form 1120s?

airSlate SignNow offers features such as customizable templates, automated reminders, and secure cloud storage, all designed to facilitate the management of Form 1120s. These tools help users efficiently organize their tax documents and ensure timely submissions.

-

Is airSlate SignNow a cost-effective solution for handling Form 1120s?

Yes, airSlate SignNow provides a cost-effective solution for businesses managing Form 1120s. With flexible pricing plans and a range of features tailored for efficiency, companies can reduce their overall administrative costs while ensuring compliance with tax regulations.

-

Can I integrate airSlate SignNow with other accounting software for Form 1120s?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software platforms, allowing for a smooth workflow when preparing and filing Form 1120s. This integration minimizes data entry errors and ensures that all necessary documents are readily accessible.

-

What are the benefits of using airSlate SignNow for Form 1120s?

Using airSlate SignNow for Form 1120s offers numerous benefits, including increased efficiency, enhanced security, and improved collaboration. Users can track their document status in real-time, making it easier to handle tax submissions and other business documents.

-

How secure is my data when using airSlate SignNow for Form 1120s?

Data security is a priority for airSlate SignNow. All documents, including Form 1120s, are encrypted during transmission and storage, ensuring your sensitive information is protected from unauthorized access.

Get more for Form 1120s

- Nonfriable asbestos removal form asbestos

- Dmv 002 drivers license or identification card application english form

- Vision specialist report fill online printable fillable blank form

- Form guide for termination of scc743scc750 scc751 existence

- Vehicle number and equipment inspection tr 54 vehicle number and equipment inspection tr 54 form

- Tceq change of nameownership texas commission on form

- Storage facility information

- If you answered yes to questions 1 3 on ownership information form lf601 you must submit this form

Find out other Form 1120s

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors