1120s Form 2008

What is the 1120S Form

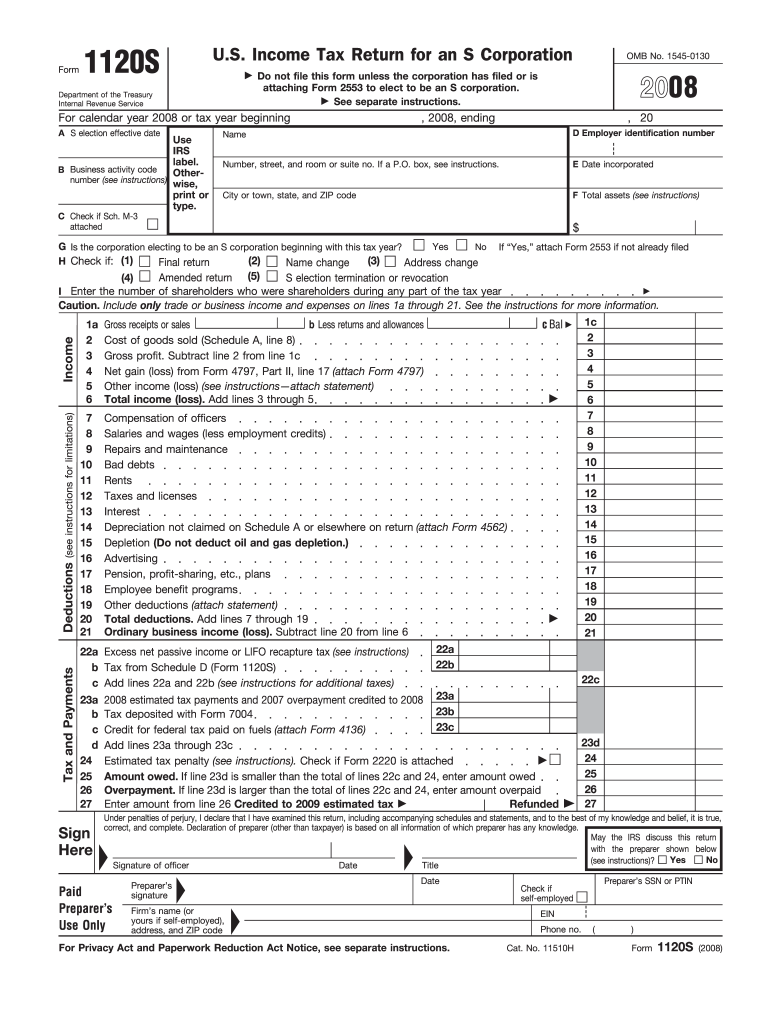

The 1120S Form is a U.S. tax return form used by S corporations to report income, deductions, and credits. This form allows S corporations to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Shareholders then report this information on their personal tax returns, avoiding double taxation on corporate income. Understanding the 1120S Form is essential for S corporations to ensure compliance with IRS regulations and to accurately report their financial activities.

How to use the 1120S Form

Using the 1120S Form involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, accurately complete each section of the form, ensuring that all income and expenses are reported correctly. It's important to include any applicable credits and deductions to minimize tax liability. Once completed, the form must be signed by an authorized officer of the corporation before submission to the IRS.

Steps to complete the 1120S Form

Completing the 1120S Form requires careful attention to detail. Follow these steps for accurate completion:

- Gather all financial records, including profit and loss statements and balance sheets.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report income in the appropriate sections, including gross receipts and other income sources.

- Detail deductions, such as salaries, rent, and other business expenses.

- Calculate the taxable income and any applicable credits.

- Review the form for accuracy and completeness.

- Sign the form and prepare it for submission.

Filing Deadlines / Important Dates

Filing deadlines for the 1120S Form are crucial for compliance. Generally, the form is due on the fifteenth day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is typically due by March 15. If additional time is needed, corporations can file for an extension, which allows for an additional six months to submit the form. However, any taxes owed must still be paid by the original deadline to avoid penalties.

Legal use of the 1120S Form

The 1120S Form is legally binding when completed and submitted in accordance with IRS guidelines. It is essential for S corporations to ensure that all information is accurate and complete to avoid potential legal issues. The form must be signed by an authorized officer, affirming that the information provided is true and correct to the best of their knowledge. Compliance with tax laws and regulations is crucial to maintain the corporation's status and avoid penalties.

Required Documents

To complete the 1120S Form, several documents are necessary. These include:

- Financial statements, including income statements and balance sheets.

- Records of all income sources, such as sales and investments.

- Documentation of all deductions, including receipts and invoices.

- Shareholder information, including ownership percentages and distributions.

Having these documents ready can streamline the process of completing the form and ensure accuracy in reporting.

Quick guide on how to complete 2008 1120s form

Complete 1120s Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides you with all the resources needed to generate, edit, and electronically sign your documents swiftly without delays. Manage 1120s Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign 1120s Form effortlessly

- Obtain 1120s Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or conceal sensitive information using features that airSlate SignNow specifically provides for that purpose.

- Craft your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether it be via email, text message (SMS), or an invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that mandate the printing of new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Alter and eSign 1120s Form and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2008 1120s form

Create this form in 5 minutes!

How to create an eSignature for the 2008 1120s form

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is the 1120s Form and why is it important?

The 1120s Form is a tax return filed by S corporations to report income, deductions, and other financial information. It is important because it helps determine the corporation’s income tax liability and ensures compliance with IRS regulations. Properly completing the 1120s Form is essential for avoiding potential penalties.

-

How can airSlate SignNow assist with the 1120s Form process?

AirSlate SignNow provides a seamless platform for eSigning and sending the 1120s Form electronically. This simplifies the filing process, reducing paperwork and speeding up the submission. With an easy-to-use interface, users can quickly manage and sign their tax forms.

-

What features does airSlate SignNow offer for handling the 1120s Form?

AirSlate SignNow offers features such as document templates, real-time tracking, and secure storage to effectively manage the 1120s Form. Users can create, edit, and send the form with confidence, knowing their documents are secure. The platform also allows for easy collaboration among team members.

-

Is airSlate SignNow cost-effective for managing the 1120s Form?

Yes, airSlate SignNow is a cost-effective solution for managing documents like the 1120s Form. Pricing is competitive, and the platform offers various plans to fit different business sizes and needs. Investing in this tool can save time and enhance your tax filing efficiency.

-

Can I integrate airSlate SignNow with other tools for filing the 1120s Form?

Absolutely, airSlate SignNow integrates with various business tools, including accounting software, to streamline the 1120s Form filing process. This allows for easy data transfer and ensures that all necessary documents are accessible in one place. Integrations enhance workflow efficiency signNowly.

-

How secure is my data when using airSlate SignNow for the 1120s Form?

AirSlate SignNow prioritizes data security, providing advanced encryption and compliance with industry standards. Your information related to the 1120s Form is protected at all times, ensuring that sensitive business data is safe. You can confidently eSign and send documents knowing your data is secure.

-

Can I access my 1120s Form documents from multiple devices?

Yes, airSlate SignNow is designed to be accessible from multiple devices, enabling you to manage your 1120s Form documents on-the-go. Whether you’re using a computer, tablet, or smartphone, you can easily access, sign, and send your forms. This flexibility supports productivity and convenience.

Get more for 1120s Form

- Form loa loan out affidavit allocation 2020

- Instructions for tax return of certain form

- Statutory declaration of acknowledgement of parentage form

- Form for notification of practices and sources instructions one

- Unladen wt form

- Arkansas tax amendment instructions and forms prepare

- 2019 tax tables form

- Form et 30120application for releases of estate tax lienet30

Find out other 1120s Form

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document