Form 1120 S U S Income Tax Return for an S Corporation 2024

What is the Form 1120-S U.S. Income Tax Return for an S Corporation

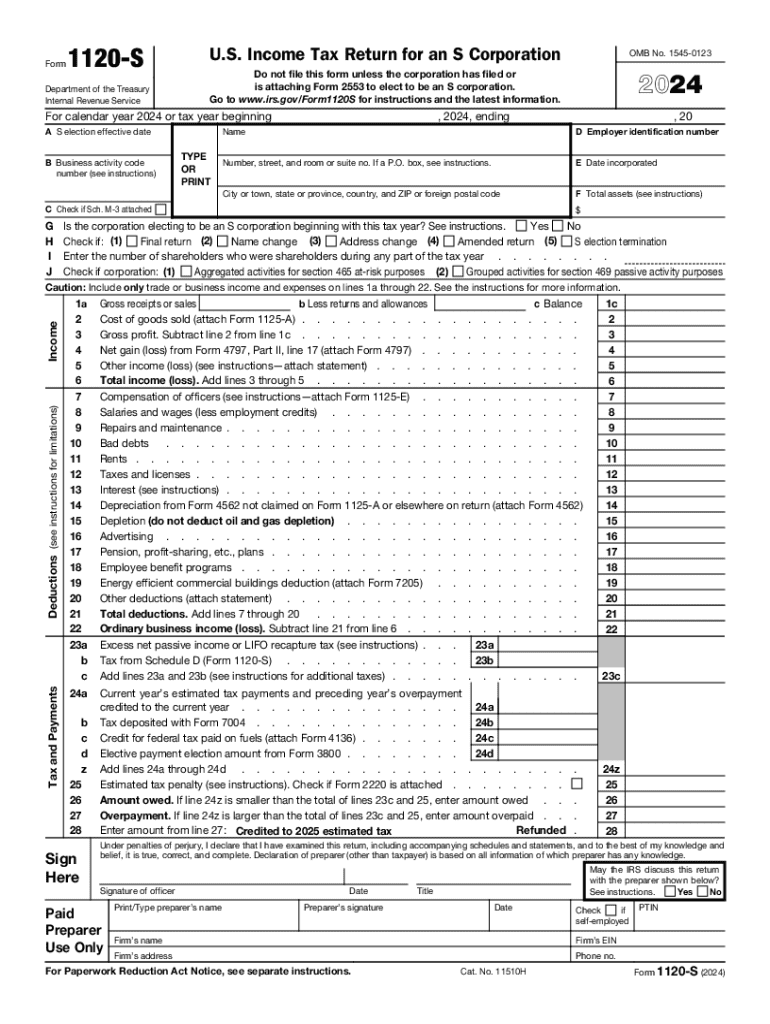

The Form 1120-S is the U.S. Income Tax Return specifically designed for S corporations. An S corporation is a special type of corporation that meets specific Internal Revenue Service (IRS) requirements, allowing income, deductions, and credits to pass through to shareholders for federal tax purposes. This means that the corporation itself generally does not pay federal income tax, avoiding double taxation. Instead, shareholders report the income and losses on their personal tax returns. Understanding the purpose and structure of Form 1120-S is crucial for compliance and accurate tax reporting.

Steps to Complete the Form 1120-S U.S. Income Tax Return

Completing the Form 1120-S involves several key steps:

- Gather Necessary Information: Collect financial statements, shareholder information, and records of income and expenses.

- Fill Out Basic Information: Include the corporation's name, address, and Employer Identification Number (EIN).

- Report Income: Document all sources of income, including sales and interest income, on the appropriate lines.

- Detail Deductions: List all business expenses, such as salaries, rent, and utilities, which can reduce taxable income.

- Complete Schedule K: This section summarizes the income, deductions, and credits that will be passed through to shareholders.

- Review and Sign: Ensure all information is accurate, and have an authorized person sign the form before submission.

Filing Deadlines / Important Dates

For S corporations, the Form 1120-S is typically due on the fifteenth day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is essential to be aware of these dates to avoid penalties and ensure timely filing.

IRS Guidelines for Form 1120-S

The IRS provides specific guidelines for completing and filing Form 1120-S. These guidelines include detailed instructions on eligibility requirements for S corporations, the types of income and deductions that can be reported, and how to handle distributions to shareholders. It is important to refer to the IRS instructions for the most current information and requirements, as tax laws and regulations can change.

Required Documents for Filing Form 1120-S

When preparing to file Form 1120-S, certain documents are essential:

- Financial Statements: Balance sheets and income statements for the tax year.

- Shareholder Information: Names, addresses, and ownership percentages of all shareholders.

- Income Records: Documentation of all income sources, including sales records and interest statements.

- Expense Documentation: Receipts and invoices for all business-related expenses.

How to Obtain the Form 1120-S U.S. Income Tax Return

The Form 1120-S can be obtained directly from the IRS website or through various tax software programs. Many tax software options offer fillable versions of the form, making it easier to complete electronically. Additionally, tax professionals can assist in obtaining and filing the form, ensuring compliance with all IRS requirements.

Handy tips for filling out Form 1120 S U S Income Tax Return For An S Corporation online

Quick steps to complete and e-sign Form 1120 S U S Income Tax Return For An S Corporation online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant platform for optimum straightforwardness. Use signNow to electronically sign and send Form 1120 S U S Income Tax Return For An S Corporation for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 s u s income tax return for an s corporation

Create this form in 5 minutes!

How to create an eSignature for the form 1120 s u s income tax return for an s corporation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an S Corp tax return?

An S Corp tax return is a tax form filed by S corporations to report income, deductions, and credits to the IRS. This return is essential for ensuring compliance with federal tax regulations. Understanding how to properly file an S Corp tax return can help businesses avoid penalties and maximize their tax benefits.

-

How does airSlate SignNow assist with S Corp tax returns?

airSlate SignNow streamlines the process of preparing and signing documents related to your S Corp tax return. With our easy-to-use platform, you can quickly gather necessary signatures and ensure all forms are completed accurately. This efficiency can save you time and reduce the stress associated with tax season.

-

What features does airSlate SignNow offer for S Corp tax return management?

Our platform offers features such as document templates, eSignature capabilities, and secure storage to help manage your S Corp tax return documents. These tools simplify the workflow, allowing you to focus on your business rather than paperwork. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Is airSlate SignNow cost-effective for managing S Corp tax returns?

Yes, airSlate SignNow provides a cost-effective solution for managing S Corp tax returns. Our pricing plans are designed to fit various business sizes and needs, ensuring you get the best value for your investment. By reducing the time spent on document management, you can allocate resources more effectively.

-

Can I integrate airSlate SignNow with my accounting software for S Corp tax returns?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your S Corp tax return data. This integration allows for smooth data transfer and ensures that all your financial documents are in one place, enhancing your overall efficiency.

-

What are the benefits of using airSlate SignNow for S Corp tax returns?

Using airSlate SignNow for your S Corp tax return offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform allows for quick document turnaround and ensures that all signatures are legally binding. This can lead to a smoother tax filing process and peace of mind.

-

How secure is airSlate SignNow for handling S Corp tax return documents?

Security is a top priority at airSlate SignNow. We employ advanced encryption and security protocols to protect your S Corp tax return documents. You can trust that your sensitive information is safe while using our platform, allowing you to focus on your business.

Get more for Form 1120 S U S Income Tax Return For An S Corporation

Find out other Form 1120 S U S Income Tax Return For An S Corporation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online