Fillable Online Form 1120S U S Income Tax Return 2020

What is the Fillable Online Form 1120S U S Income Tax Return

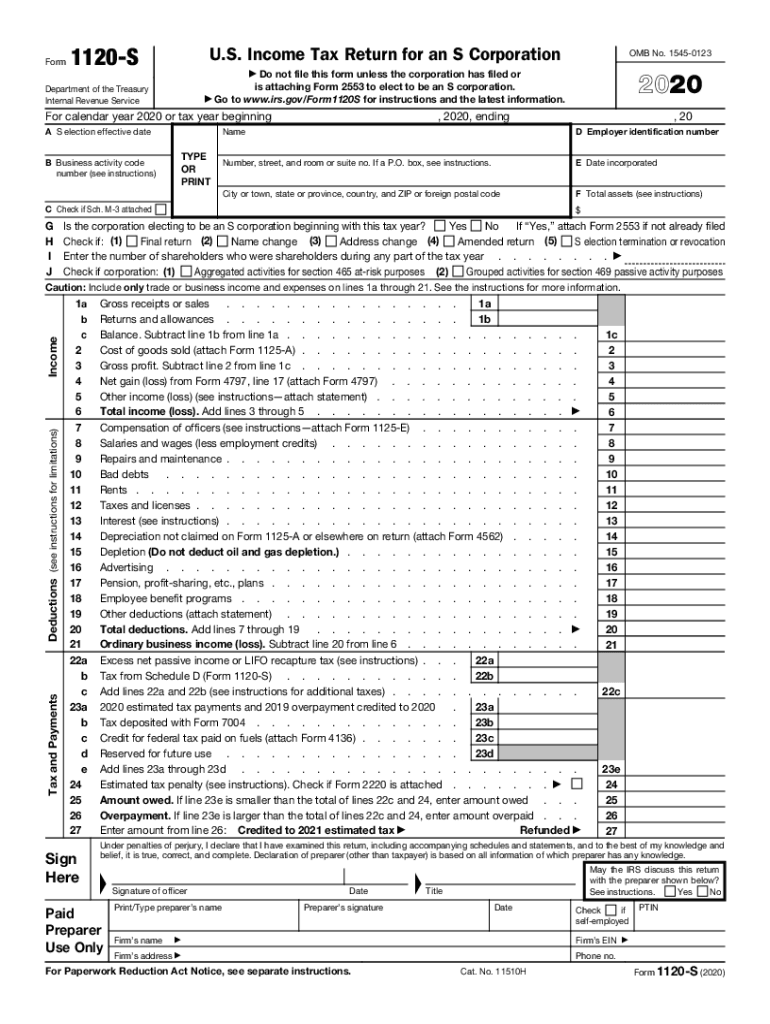

The Fillable Online Form 1120S is used by S corporations to report income, deductions, and credits. This form is essential for S corporations, which are unique tax entities that allow income to pass through to shareholders, avoiding double taxation. The form captures vital financial information and ensures compliance with IRS regulations. It is specifically designed for electronic completion, making it accessible and convenient for users to fill out their tax returns online.

Steps to Complete the Fillable Online Form 1120S U S Income Tax Return

Completing the Fillable Online Form 1120S involves several key steps:

- Gather necessary documents: Collect all financial statements, including income statements, balance sheets, and any relevant tax documents.

- Access the form: Navigate to the official IRS website or a trusted platform that offers the Fillable Online Form 1120S.

- Fill in your information: Enter your corporation's details, including name, address, and Employer Identification Number (EIN).

- Report income and deductions: Input all income sources and applicable deductions accurately to ensure compliance.

- Review and validate: Double-check all entries for accuracy and completeness before submission.

- Submit the form: Follow the instructions for electronic submission or print and mail the form if required.

Legal Use of the Fillable Online Form 1120S U S Income Tax Return

The Fillable Online Form 1120S is legally binding when completed and submitted in accordance with IRS regulations. To ensure its legal validity, the form must be filled out accurately, reflecting the corporation's financial activities for the tax year. It is crucial to maintain compliance with all IRS guidelines and deadlines to avoid penalties. Using a trusted eSignature solution can further enhance the legal standing of the submitted form, providing an electronic certificate that verifies the authenticity of the signature.

Filing Deadlines / Important Dates

Filing deadlines for the Fillable Online Form 1120S are critical to avoid penalties. Generally, the form must be filed by the fifteenth day of the third month following the end of the corporation's tax year. For S corporations operating on a calendar year, this means the due date is March 15. If additional time is needed, an extension can be requested, but it is essential to file for the extension before the original due date to avoid late fees.

Required Documents

To complete the Fillable Online Form 1120S, certain documents are necessary:

- Financial statements: Income statements and balance sheets for the tax year.

- Previous tax returns: Prior year Form 1120S can provide a reference for current filings.

- Shareholder information: Details about shareholders, including their ownership percentages and any distributions made.

- Supporting documentation: Any receipts or records that support deductions and credits claimed on the form.

Form Submission Methods (Online / Mail / In-Person)

The Fillable Online Form 1120S can be submitted through various methods:

- Online submission: The preferred method, allowing for quick processing and confirmation of receipt.

- Mail: If submitting by mail, ensure the form is sent to the appropriate IRS address based on the corporation's location.

- In-person: Some taxpayers may choose to deliver the form directly to an IRS office, though this is less common.

Quick guide on how to complete fillable online 2017 form 1120s us income tax return

Effortlessly Prepare Fillable Online Form 1120S U S Income Tax Return on Any Device

The management of online documents has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to acquire the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Fillable Online Form 1120S U S Income Tax Return on any platform using the airSlate SignNow applications available for Android or iOS and enhance your document-oriented tasks today.

How to Alter and Electronically Sign Fillable Online Form 1120S U S Income Tax Return with Ease

- Obtain Fillable Online Form 1120S U S Income Tax Return and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Identify key sections of the documents or obscure confidential information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature with the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify your information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether through email, text message (SMS), invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, exhausting searches for forms, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Fillable Online Form 1120S U S Income Tax Return to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online 2017 form 1120s us income tax return

Create this form in 5 minutes!

How to create an eSignature for the fillable online 2017 form 1120s us income tax return

How to make an eSignature for your PDF file online

How to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the 1120s form 2017?

The 1120s form 2017 is a tax document used by S corporations to report their income, deductions, and credits for the tax year. It helps in calculating the income tax owed by shareholders based on the corporation's earnings. Understanding the 1120s form 2017 is essential for accurate tax reporting and compliance.

-

How can airSlate SignNow help me with the 1120s form 2017?

airSlate SignNow offers a seamless platform for electronically signing and sending the 1120s form 2017. With its user-friendly interface, creating and managing documents becomes efficient, ensuring timely submissions. This not only simplifies the eSigning process but also improves overall workflow for businesses.

-

Is airSlate SignNow cost-effective for managing the 1120s form 2017?

Yes, airSlate SignNow provides a cost-effective solution for managing the 1120s form 2017. Our pricing plans cater to businesses of all sizes, allowing you to choose a package that fits your needs and budget. By streamlining the document signing process, you can save both time and money.

-

Can I integrate airSlate SignNow with other tools for the 1120s form 2017?

Absolutely! airSlate SignNow integrates seamlessly with a wide range of applications to simplify the handling of the 1120s form 2017. Whether you need to connect with accounting software, cloud storage, or CRM systems, our integrations ensure you can manage your documents effectively.

-

What features does airSlate SignNow offer for managing the 1120s form 2017?

airSlate SignNow provides several features designed to enhance the management of the 1120s form 2017. Key features include customizable templates, real-time tracking, and secure cloud storage. These functionalities facilitate a smooth process from document creation to completion.

-

Are there templates available for the 1120s form 2017 in airSlate SignNow?

Yes, airSlate SignNow offers customizable templates specifically for the 1120s form 2017. This allows users to quickly fill in their business information, ensuring that all required fields are addressed. Templates help streamline the process and minimize errors.

-

How secure is the airSlate SignNow platform for sending the 1120s form 2017?

The airSlate SignNow platform prioritizes security, employing advanced encryption protocols to protect your 1120s form 2017 and other sensitive documents. Our compliance with regulatory standards ensures that your data is safe during transmission and storage. You can trust us to keep your information secure.

Get more for Fillable Online Form 1120S U S Income Tax Return

- Gems chronic forms 15811810

- College acceptance letter generator form

- Icao flight plan form pdf download

- Basketball registration form

- Truck dispatcher paperwork form

- Ea 800 receipt for firearms and firearm parts form

- Ornl 703 direct deposit of flexible spending account reimbursements ornl 703 direct deposit of flexible spending account form

- National register eligibility questionnaire resour form

Find out other Fillable Online Form 1120S U S Income Tax Return

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document