1120 S Form 2013

What is the 1120 S Form

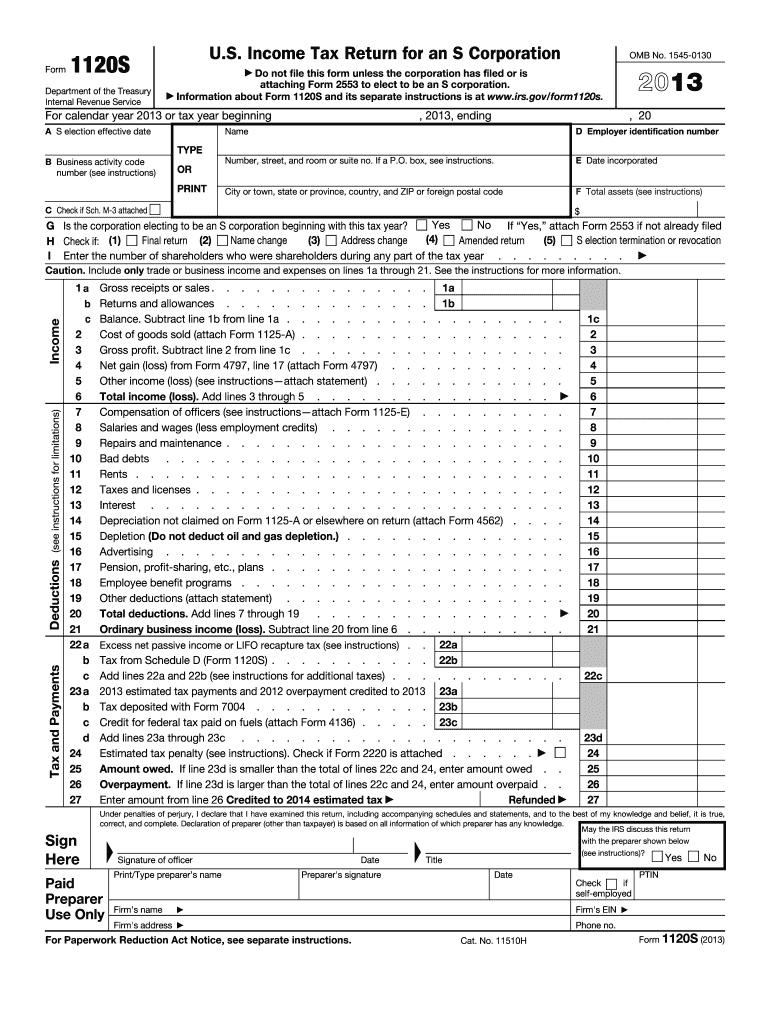

The 1120 S Form is a tax document used by S corporations in the United States to report income, deductions, and credits to the Internal Revenue Service (IRS). This form allows S corporations to pass their income directly to shareholders, who then report it on their individual tax returns. By doing so, S corporations avoid double taxation, which is a significant advantage compared to traditional C corporations. The form is essential for ensuring compliance with federal tax regulations while providing a clear overview of the corporation's financial activities.

How to use the 1120 S Form

Using the 1120 S Form involves several steps that ensure accurate reporting of the corporation's financial activities. First, gather all necessary financial records, including income statements, balance sheets, and expense reports. Next, complete the form by entering the corporation's income, deductions, and credits in the appropriate sections. It is crucial to ensure that all figures are accurate and supported by documentation. After completing the form, it must be signed by an authorized officer of the corporation before submission to the IRS.

Steps to complete the 1120 S Form

Completing the 1120 S Form requires careful attention to detail. Follow these steps for successful completion:

- Gather financial records, including revenue, expenses, and prior year tax returns.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report the corporation's income on the appropriate lines, including gross receipts and other income sources.

- Deduct eligible expenses, such as salaries, rent, and utilities, in the designated sections.

- Calculate the corporation's taxable income and any applicable credits.

- Review the form for accuracy, ensuring all calculations are correct.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Filing deadlines for the 1120 S Form are critical for compliance. Typically, S corporations must file their return by the 15th day of the third month following the end of their tax year. For corporations operating on a calendar year, this means the deadline is March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Additionally, S corporations may file for an automatic six-month extension, but they must pay any taxes owed by the original due date to avoid penalties.

Legal use of the 1120 S Form

The legal use of the 1120 S Form is governed by IRS regulations, which outline the requirements for S corporations. To use this form, a corporation must meet specific eligibility criteria, including having no more than one hundred shareholders and only one class of stock. Additionally, all shareholders must be U.S. citizens or residents. Proper completion and timely filing of the form are essential to maintain the S corporation status and avoid penalties or loss of tax benefits.

Key elements of the 1120 S Form

Several key elements make up the 1120 S Form, each serving a specific purpose in the tax reporting process. These include:

- Income Section: Reports total income, including gross receipts and other income sources.

- Deductions Section: Lists eligible expenses that reduce taxable income.

- Shareholder Information: Details about each shareholder, including their share of income, deductions, and credits.

- Tax Computation: Calculates the tax owed, if any, based on the corporation's income and deductions.

Quick guide on how to complete 1120 s 2013 form

Effortlessly Prepare 1120 S Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documentation, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage 1120 S Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and eSign 1120 S Form with Ease

- Find 1120 S Form and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your method of sharing your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign 1120 S Form to ensure outstanding communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1120 s 2013 form

Create this form in 5 minutes!

How to create an eSignature for the 1120 s 2013 form

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is the 1120 S Form and why is it important?

The 1120 S Form is a tax return specifically for S corporations in the United States. It reports the income, deductions, and credits of the corporation, allowing shareholders to report their share of income on their personal tax returns. Properly filing the 1120 S Form is crucial for compliance with IRS regulations and to ensure accurate tax reporting.

-

How can airSlate SignNow help me with the 1120 S Form?

airSlate SignNow simplifies the process of preparing and signing the 1120 S Form by providing an easy-to-use platform for eSignature and document management. You can securely send the form for signature, track its status, and store it electronically, ensuring that your important tax documents are organized and accessible.

-

Is there a cost associated with using airSlate SignNow for the 1120 S Form?

Yes, there is a cost associated with using airSlate SignNow, but it offers various pricing plans to fit different business needs. These plans provide access to features that facilitate the signing and management of the 1120 S Form, making it a cost-effective solution for businesses looking to streamline their document processes.

-

What features does airSlate SignNow offer for managing the 1120 S Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, document tracking, and cloud storage, all tailored to streamline the management of the 1120 S Form. These tools enhance efficiency and ensure that all parties can sign the document from anywhere, at any time.

-

Can I integrate airSlate SignNow with accounting software for the 1120 S Form?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing for seamless data transfer and management of the 1120 S Form. This feature helps ensure that your financial documentation remains consistent and up-to-date across different platforms.

-

Is airSlate SignNow secure for handling the 1120 S Form?

Yes, airSlate SignNow prioritizes security and employs advanced encryption and authentication measures to protect sensitive information, including the 1120 S Form. This ensures that your documents are secure during the signing process and stored safely in the cloud.

-

How does airSlate SignNow improve the efficiency of filing the 1120 S Form?

By using airSlate SignNow, you can eliminate the need for physical paperwork and manual signatures, allowing for faster preparation and submission of the 1120 S Form. This streamlined process reduces the chances of errors and enhances overall productivity, saving you time and effort.

Get more for 1120 S Form

- Nc e 585 faq 2015 fill out tax template onlineus form

- Pdf request for taxpayer identification number and umass amherst form

- Electronic filing specifications handbook form

- 355 7004 instr with coupon form

- Form st mab 4 rev 315 instructions for sales tax on

- 2019 form 1 massachusetts resident income tax return

- Massachusetts form m 1310 statement of claimant to

- Images for who is httpswwwmassgovfilesdocuments20190109for 2018 inc sch ecpdf form

Find out other 1120 S Form

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement