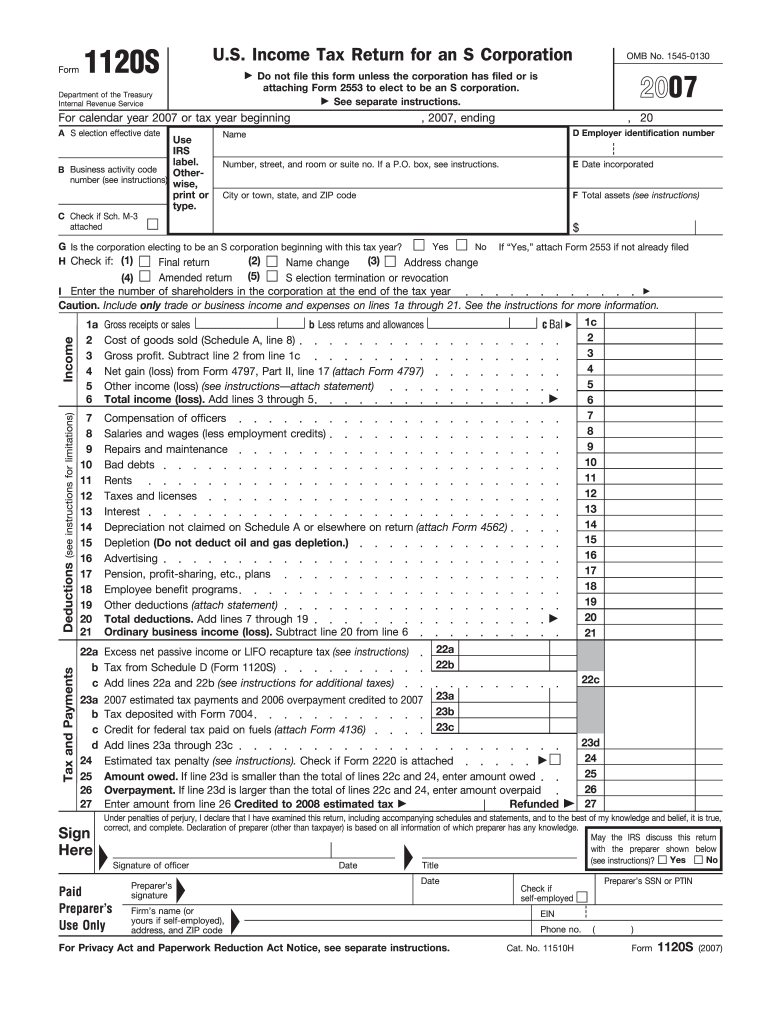

Form 1120s 2007

What is the Form 1120S

The Form 1120S is a tax document used by S corporations in the United States to report income, deductions, and credits. This form allows S corporations to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. By using Form 1120S, S corporations can avoid double taxation, as the income is only taxed at the shareholder level. Understanding the purpose and function of this form is crucial for compliance with IRS regulations.

Steps to complete the Form 1120S

Completing Form 1120S involves several key steps that ensure accurate reporting of an S corporation's financial activities. The process typically includes:

- Gathering financial records, including income statements and balance sheets.

- Filling out the form with accurate information regarding income, deductions, and credits.

- Calculating the total income and tax liability based on the information provided.

- Reviewing the completed form for accuracy and completeness.

- Submitting the form to the IRS by the designated deadline.

Each step is essential to ensure compliance and avoid potential penalties.

How to obtain the Form 1120S

The Form 1120S can be obtained directly from the IRS website or through tax preparation software. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, many tax professionals and accounting firms provide access to this form as part of their services. Ensuring you have the correct version of the form for the tax year is important for accurate filing.

Legal use of the Form 1120S

Form 1120S is legally binding when completed and submitted according to IRS guidelines. It is important to ensure that all information is accurate and truthful, as providing false information can lead to penalties. The form must be signed by an authorized officer of the S corporation, which adds a layer of accountability. Compliance with relevant tax laws and regulations is essential for the legal use of this form.

Filing Deadlines / Important Dates

Filing deadlines for Form 1120S are crucial for S corporations to adhere to in order to avoid penalties. Typically, the form must be filed by the 15th day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. Extensions may be available, but they must be filed properly to ensure compliance.

Examples of using the Form 1120S

Form 1120S is used by various types of businesses that qualify as S corporations. For instance, a small business that has elected S corporation status will use this form to report its annual income and expenses. Similarly, a family-owned business that meets the eligibility criteria may also utilize Form 1120S to pass through income to its shareholders. These examples illustrate the form's importance in facilitating tax reporting for diverse business structures.

Quick guide on how to complete form 1120s 2007

Complete Form 1120s effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Form 1120s on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form 1120s with ease

- Locate Form 1120s and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a standard wet ink signature.

- Review all details and then click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, monotonous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 1120s while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120s 2007

Create this form in 5 minutes!

How to create an eSignature for the form 1120s 2007

The best way to create an electronic signature for your PDF in the online mode

The best way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is Form 1120s and who needs to file it?

Form 1120s is the U.S. Income Tax Return for an S Corporation. It is used by S corporations to report income, deductions, and other tax-related information to the IRS. If your business is structured as an S corporation, you are required to file Form 1120s annually.

-

How can airSlate SignNow help with filing Form 1120s?

airSlate SignNow offers a streamlined process for electronically signing and sending Form 1120s, making it easier for S corporations to manage their tax filings. With its user-friendly interface, you can quickly prepare and eSign the document, ensuring compliance and timely submission.

-

What features does airSlate SignNow offer for managing Form 1120s?

airSlate SignNow provides features such as customizable templates for Form 1120s, secure cloud storage, and real-time tracking of document status. These tools help ensure that your tax documents are completed accurately and efficiently, reducing the risk of errors.

-

Is airSlate SignNow a cost-effective solution for filing Form 1120s?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses needing to file Form 1120s. With flexible pricing plans and no hidden fees, you can access powerful eSigning and document management features without breaking your budget.

-

Can I integrate airSlate SignNow with my accounting software for Form 1120s?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software platforms, allowing you to streamline the process of filing Form 1120s. This integration helps keep your financial data synchronized and simplifies your tax preparation workflow.

-

What are the benefits of using airSlate SignNow for Form 1120s?

Using airSlate SignNow for Form 1120s offers numerous benefits, including enhanced security for sensitive tax information, faster document turnaround times, and improved collaboration among stakeholders. The platform ensures that your tax documents are handled efficiently and securely.

-

Is it easy to get started with airSlate SignNow for Form 1120s?

Getting started with airSlate SignNow for Form 1120s is quick and easy. Simply sign up for an account, choose your desired pricing plan, and start creating or uploading your Form 1120s documents. Our intuitive interface guides you through the process, making it accessible for all users.

Get more for Form 1120s

- Form 1094 b

- 2019 instructions for form 1042 s internal revenue service

- Schedule e schools omb no 1545 0047 form 990 or 990 ez

- 592 f franchise tax board cagov form

- 2019 form 8453 s internal revenue service

- Form 1099 h rev 12 2020 health coverage tax credit hctc advance payments

- Form 990 schedule h

- 2019 form 1067a nonresident group return schedule 2019 form 1067a nonresident group return schedule

Find out other Form 1120s

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document