1120 Corp Return Form 2023

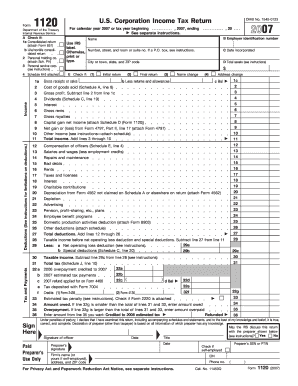

What is the 1120 Corp Return Form

The 1120 Corp Return Form is a tax document used by corporations in the United States to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for C corporations, which are separate legal entities from their owners. It provides a comprehensive overview of a corporation's financial activities over the tax year and is used to calculate the corporation's tax liability.

How to use the 1120 Corp Return Form

To effectively use the 1120 Corp Return Form, corporations must gather all necessary financial data for the reporting period. This includes income statements, balance sheets, and records of expenses. The form requires detailed information on revenue, cost of goods sold, operating expenses, and other financial metrics. After completing the form, it should be reviewed for accuracy before submission to ensure compliance with IRS regulations.

Steps to complete the 1120 Corp Return Form

Completing the 1120 Corp Return Form involves several key steps:

- Gather financial records, including income statements and balance sheets.

- Fill out the form with accurate figures, ensuring all required sections are completed.

- Calculate the total income, deductions, and tax liability based on the provided data.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the designated deadline.

Filing Deadlines / Important Dates

The filing deadline for the 1120 Corp Return Form is typically the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations can request an automatic six-month extension, but this does not extend the time to pay any taxes owed.

Required Documents

When preparing to file the 1120 Corp Return Form, corporations should have the following documents ready:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets, liabilities, and equity.

- Records of any deductions and credits claimed.

- Prior year tax returns for reference.

Form Submission Methods

The 1120 Corp Return Form can be submitted to the IRS through various methods. Corporations have the option to file electronically using IRS-approved e-filing software, which is often more efficient and secure. Alternatively, the form can be mailed to the appropriate IRS address based on the corporation's location and whether payment is included. In-person submissions are generally not accepted for this form.

Quick guide on how to complete 1120 corp return form

Complete 1120 Corp Return Form effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and efficiently. Handle 1120 Corp Return Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to alter and eSign 1120 Corp Return Form with ease

- Obtain 1120 Corp Return Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize essential sections of your documents or redact sensitive details with tools that airSlate SignNow specifically offers for this function.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, lengthy form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Adjust and eSign 1120 Corp Return Form to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1120 corp return form

Create this form in 5 minutes!

How to create an eSignature for the 1120 corp return form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1120 Corp Return Form?

The 1120 Corp Return Form is a tax form used by corporations to report their income, gains, losses, deductions, and credits to the IRS. It is essential for corporations to file this form annually to comply with federal tax regulations. Understanding how to properly complete the 1120 Corp Return Form can help businesses avoid penalties and ensure accurate reporting.

-

How can airSlate SignNow help with the 1120 Corp Return Form?

airSlate SignNow provides a streamlined solution for sending and eSigning the 1120 Corp Return Form. With its user-friendly interface, businesses can easily manage their documents and ensure timely submissions. This not only saves time but also enhances the accuracy of the filing process.

-

What are the pricing options for using airSlate SignNow for the 1120 Corp Return Form?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for handling the 1120 Corp Return Form. You can choose from monthly or annual subscriptions, with options that scale based on the number of users and features required. This ensures that businesses of all sizes can find a suitable plan.

-

Are there any features specifically designed for the 1120 Corp Return Form?

Yes, airSlate SignNow includes features that simplify the process of completing the 1120 Corp Return Form. These features include customizable templates, automated workflows, and secure eSigning capabilities. This ensures that your documents are not only compliant but also efficiently processed.

-

Can I integrate airSlate SignNow with other software for the 1120 Corp Return Form?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage the 1120 Corp Return Form alongside your other financial documents. This seamless integration helps streamline your workflow and reduces the chances of errors during the filing process.

-

What are the benefits of using airSlate SignNow for the 1120 Corp Return Form?

Using airSlate SignNow for the 1120 Corp Return Form provides numerous benefits, including enhanced security, faster processing times, and improved collaboration among team members. The platform's ease of use allows businesses to focus on their core operations while ensuring compliance with tax regulations. Additionally, the ability to track document status in real-time adds to the overall efficiency.

-

Is airSlate SignNow secure for handling the 1120 Corp Return Form?

Yes, airSlate SignNow prioritizes security, ensuring that your 1120 Corp Return Form and other sensitive documents are protected. The platform employs advanced encryption and complies with industry standards to safeguard your data. This gives businesses peace of mind when managing their tax documents online.

Get more for 1120 Corp Return Form

- New state resident package massachusetts form

- Revocation of health care proxy massachusetts form

- Commercial property sales package massachusetts form

- General partnership package massachusetts form

- Contract for deed package massachusetts form

- Power of attorney forms package massachusetts

- Massachusetts anatomical gift form

- Massachusetts process form

Find out other 1120 Corp Return Form

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement