Form 1040 2018

What is the Form 1040

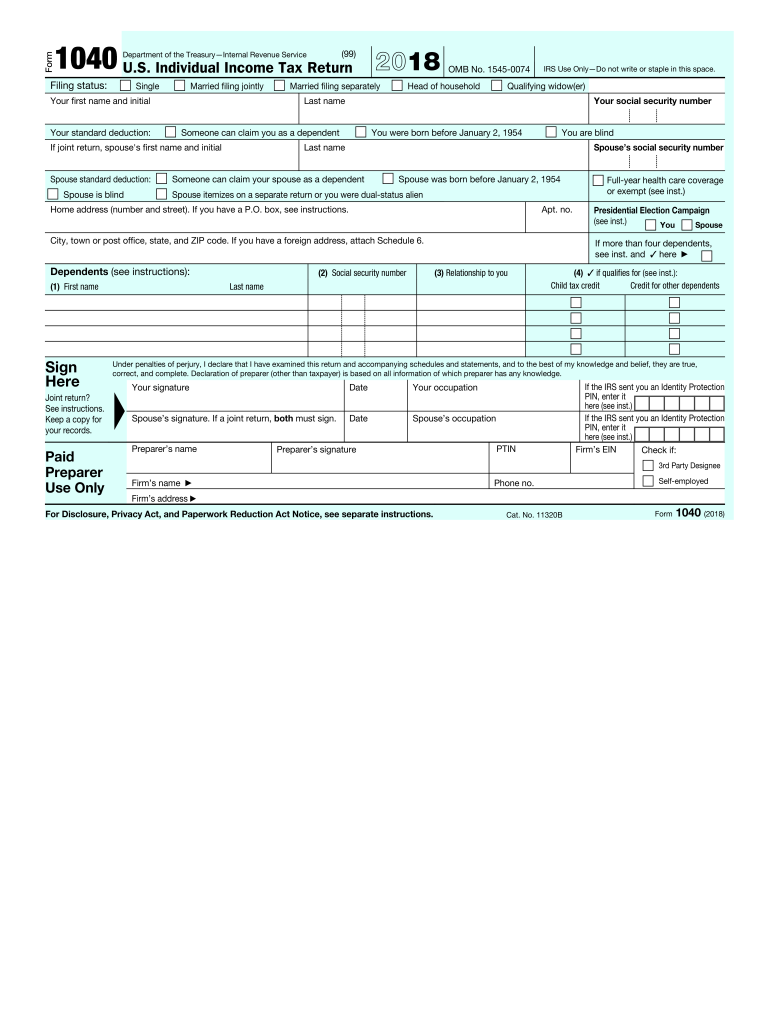

The Form 1040 is the standard individual income tax return form used in the United States. It is issued by the Internal Revenue Service (IRS) and allows taxpayers to report their income, claim deductions, and calculate their tax liability. The 2017 version of the form includes various sections for personal information, income sources, and tax credits. Understanding this form is crucial for compliance with federal tax laws and for ensuring that you accurately report your financial situation.

Steps to complete the Form 1040

Completing the 2017 Form 1040 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your income in the appropriate sections, ensuring you include all sources of income.

- Claim deductions and credits you are eligible for, which can help reduce your taxable income.

- Calculate your total tax liability and determine if you owe money or are due a refund.

- Sign and date the form before submitting it to the IRS.

How to obtain the Form 1040

The 2017 Form 1040 can be obtained directly from the IRS website or through various tax preparation services. It is available in both printable and digital formats. If you prefer a physical copy, you can also request it by mail from the IRS. Ensure you are using the correct version for the tax year you are filing to avoid any issues with your submission.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the 2017 Form 1040:

- Online: Many taxpayers choose to file electronically using IRS-approved software. This method can expedite processing and reduce errors.

- Mail: If you prefer to file by mail, print your completed form and send it to the appropriate IRS address based on your state of residence.

- In-Person: Some taxpayers may opt to file in person at designated IRS offices or through authorized tax professionals.

Legal use of the Form 1040

The 2017 Form 1040 must be completed accurately and submitted by the tax filing deadline to ensure compliance with U.S. tax laws. Filing a false or incomplete form can result in penalties, including fines or legal action. It is essential to keep copies of your submitted forms and any supporting documents for your records, as the IRS may request them for verification.

Key elements of the Form 1040

The 2017 Form 1040 consists of several key elements that taxpayers should be aware of:

- Filing Status: This section determines your tax rate and eligibility for certain deductions.

- Income: Report all sources of income, including wages, dividends, and interest.

- Deductions: Taxpayers can choose between standard and itemized deductions, which can significantly affect their taxable income.

- Tax Credits: Various credits can reduce your tax liability, including education credits and earned income credits.

Quick guide on how to complete 1040 2018 form

Uncover the easiest method to complete and endorse your Form 1040

Are you still spending time preparing your official paperwork on paper instead of doing it digitally? airSlate SignNow offers an improved approach to complete and endorse your Form 1040 and associated forms for public services. Our intelligent eSignature solution provides everything necessary to handle documents swiftly and in accordance with formal specifications - robust PDF editing, managing, safeguarding, signing, and sharing features all readily available within an intuitive interface.

Only a few steps are needed to complete the process of filling out and signing your Form 1040:

- Upload the editable template to the editor by clicking the Get Form button.

- Review what details you need to input in your Form 1040.

- Move between the fields using the Next option to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to complete the blanks with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Blur out fields that are no longer relevant.

- Click on Sign to create a legally valid eSignature using any method you prefer.

- Add the Date next to your signature and conclude your work with the Done button.

Store your finalized Form 1040 in the Documents folder of your profile, download it, or send it to your preferred cloud storage. Our service also provides versatile file sharing. There's no need to print your templates when you need to submit them to the right public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 1040 2018 form

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out FAFSA without my kid seeing all my financial information?

You will have a FSA ID. Keep it somewhere secure and where you can find it when it is needed again over the time your kid is in college. Use this ID to “sign” the parent’s part of the FAFSA.Your student will have their own FSA ID. They need to keep it somewhere secure and where they can find it when it is needed again over the time they are in college. They will use the ID to “sign” their part of the FAFSA.There is no need to show your student your part of the FAFSA. I do suggest you just casually offer to help your student fill out their part of the form.The Parent’s Guide to Filling Out the FAFSA® Form - ED.gov BlogThe FAFSA for school year 2018–19 has been available since October 1. Some financial aid is first come-first served. I suggest you get on with this.How to Fill Out the FAFSA, Step by StepNotes:Reading the other answers brings up some other points:The student pin was replaced by the parent’s FSA ID and the student’s FSA ID in May, 2015. Never the twain need meet.Families each need to deal with three issues in their own way:AffordabilityIf you read my stuff you know I am a devotee of Frank Palmasani’s, Right College, Right Price. His book describes an “affordability” exercise with the parents and the student. The purpose is to determine what the family can afford to spend on post-secondary education and to SET EXPECTATIONS. He’s not talking about putting your 1040 on the dining room table, but sharing some of the basics of family finances.I get the impression that many families ignore this issue. I have a study that shows five out of eight students assume their families are going to pay for college regardless of cost. Most of these students are in for a big surprise.PrivacySome parents may want to hold their “financial cards” closer to their chest than others. In my opinion that’s OK. I suppose an 18 year old kid, theoretically, has the right to keeping his finances private. My approach to this would not be to make a big deal out of it but to offer to help them fill out their part of the FAFSA. The main objective should be to get the FAFSA filled out properly, in a timely fashion.FraudThis is absolutely not acceptable, and, hopefully, those who try it get caught and suffer the consequences. (I had a conversation with a father recently who was filling out the CSS Profile. He wasn’t intent on committing fraud. He thought he was being clever in defining assets. After our conversation he had to file a signNow revision. This revision was a good thing because two or three years from now his mistake was going to come to light. I’m not sure what the consequences of all that would have been, but, at a minimum, it would have been a big mess to unwind.)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

Create this form in 5 minutes!

How to create an eSignature for the 1040 2018 form

How to create an electronic signature for the 1040 2018 Form in the online mode

How to create an electronic signature for your 1040 2018 Form in Chrome

How to generate an electronic signature for putting it on the 1040 2018 Form in Gmail

How to make an eSignature for the 1040 2018 Form right from your smartphone

How to create an electronic signature for the 1040 2018 Form on iOS

How to generate an electronic signature for the 1040 2018 Form on Android

People also ask

-

What is Form 1040 and why is it important?

Form 1040 is the standard IRS form used by individuals to file their annual income tax returns in the United States. It is important because it helps taxpayers report their income, claim deductions and credits, and ultimately determine their tax liability. Using airSlate SignNow, you can easily eSign and send Form 1040 electronically, streamlining your tax filing process.

-

How can airSlate SignNow help with completing Form 1040?

airSlate SignNow simplifies the process of completing Form 1040 by allowing users to easily fill out, eSign, and send the document from any device. With its user-friendly interface, you can ensure that all necessary fields are completed accurately and securely. This signNowly reduces the time spent on tax preparation.

-

Is there a cost associated with using airSlate SignNow for Form 1040?

Yes, airSlate SignNow offers various pricing plans to accommodate different user needs, including options for individuals and businesses. The cost of using airSlate SignNow to manage Form 1040 is typically lower than traditional methods, providing a cost-effective solution for eSigning and document management.

-

What features does airSlate SignNow offer for Form 1040?

airSlate SignNow offers several features for managing Form 1040, including customizable templates, secure eSigning, and cloud storage for easy access. Additionally, the platform allows for real-time collaboration, enabling multiple users to work on the form simultaneously, enhancing efficiency in tax preparation.

-

Can I integrate airSlate SignNow with other software for Form 1040?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage Form 1040 alongside your financial records. This integration simplifies the workflow, allowing you to pull in information directly from your accounting software, reducing manual entry and potential errors.

-

How secure is the eSigning process for Form 1040 with airSlate SignNow?

The eSigning process for Form 1040 with airSlate SignNow is highly secure, utilizing advanced encryption and authentication measures to protect your sensitive information. Users can sign documents with confidence, knowing that their data is safeguarded throughout the entire process.

-

What are the benefits of using airSlate SignNow for tax documents like Form 1040?

Using airSlate SignNow for tax documents like Form 1040 offers numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. The platform allows for quick eSigning and submission, which can help you meet tax deadlines while keeping your documents organized and easily accessible.

Get more for Form 1040

- Principal key employee form pa supplement

- Rhode island reducible load permit form

- Rhode island school physical form 2010

- Ri tx 13 form

- Dwc 11 ic form

- Rhode island certified payroll forms

- Ri dem law enforcement boating accident form dem ri

- Fixing 1040sr ampamp mi state tax return step by step guide form

Find out other Form 1040

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself

- Sign Illinois Deposit Receipt Template Free

- Sign Missouri Joint Venture Agreement Template Free

- Sign Tennessee Joint Venture Agreement Template Free