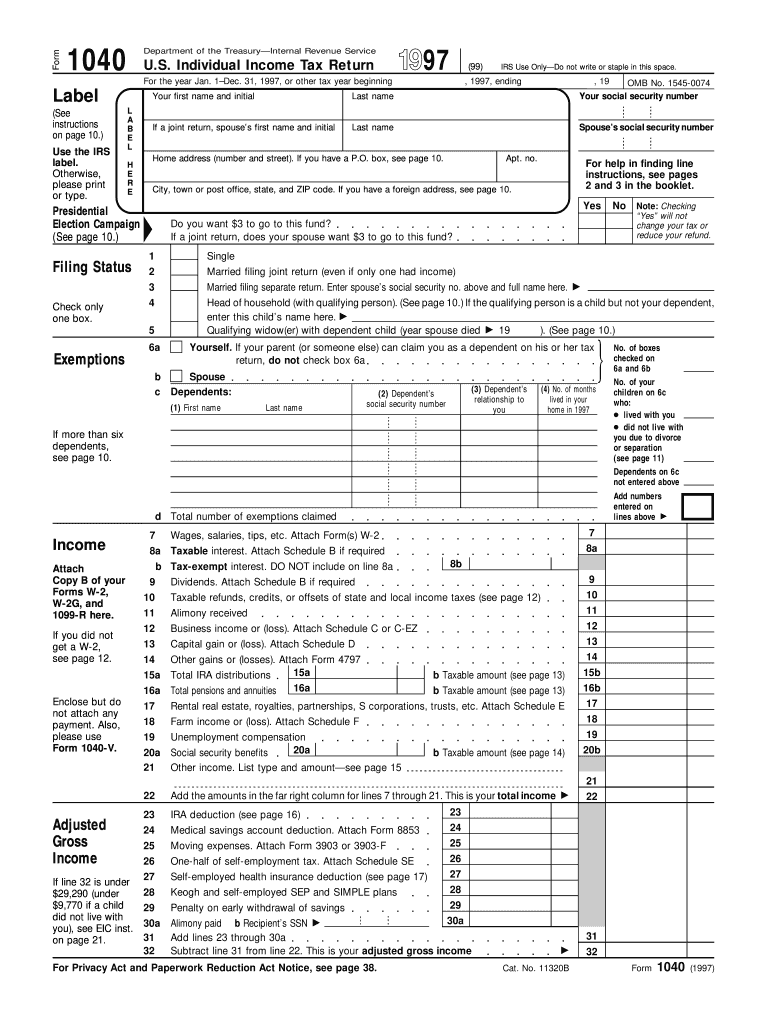

Irs Form 1997

What is the IRS Form

The IRS Form refers to various forms used by the Internal Revenue Service for tax-related purposes in the United States. Each form serves a specific function, such as reporting income, claiming deductions, or applying for tax credits. Understanding the purpose of these forms is essential for compliance with U.S. tax laws. For example, the W-2 form reports wages and is issued by employers, while the 1040 form is used by individuals to file their annual income tax returns. Knowing which form to use is crucial for accurate tax reporting.

How to Use the IRS Form

Using the IRS Form correctly involves several steps. First, identify the specific form required for your tax situation. Next, gather all necessary information, such as income statements and deduction records. Complete the form by filling in the required fields accurately. It is important to review the form for any errors before submission. Depending on the form, you may need to attach additional documentation. Finally, submit the form by the designated deadline, either electronically or by mail, to ensure compliance with IRS regulations.

Steps to Complete the IRS Form

Completing an IRS Form involves a systematic approach to ensure accuracy. Start by downloading the correct form from the IRS website or obtaining a physical copy. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Fill out the form, ensuring that all information is accurate and complete.

- Double-check calculations and verify that all necessary fields are filled.

- Sign and date the form where required.

- Submit the form by the deadline, either electronically or by mailing it to the appropriate address.

Legal Use of the IRS Form

The legal use of IRS Forms is governed by federal tax laws. Each form must be completed accurately and submitted within the specified deadlines to avoid penalties. Misuse of forms, such as falsifying information or failing to file, can lead to serious legal consequences, including fines and audits. It is essential to keep copies of all submitted forms and related documents for at least three years, as the IRS may request them during audits or reviews.

Filing Deadlines / Important Dates

Filing deadlines for IRS Forms vary depending on the type of form and the taxpayer's situation. For individual income tax returns, the typical deadline is April 15th of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to be aware of specific deadlines for other forms, such as extensions or estimated tax payments, to avoid late fees and penalties. Marking these dates on your calendar can help ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

IRS Forms can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online: Many forms can be filed electronically using tax software or through the IRS e-file system, which is often faster and more secure.

- Mail: Taxpayers can print completed forms and send them to the IRS via postal mail. It is advisable to use certified mail for tracking.

- In-Person: Some taxpayers may choose to file forms in person at designated IRS offices or during tax preparation appointments.

Quick guide on how to complete 1997 irs form

Effortlessly prepare Irs Form on any device

The management of online documents has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to find the right template and securely save it online. airSlate SignNow provides you with all the necessary tools to swiftly create, edit, and eSign your documents without delays. Handle Irs Form on any platform using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to edit and eSign Irs Form effortlessly

- Obtain Irs Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Put an end to missing or lost files, tedious form searching, and mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Irs Form and ensure exceptional communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1997 irs form

Create this form in 5 minutes!

How to create an eSignature for the 1997 irs form

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What types of IRS Forms can I sign with airSlate SignNow?

With airSlate SignNow, you can easily sign a variety of IRS Forms such as Form W-2, Form 1040, and Form 1099. Our platform allows you to upload and eSign these documents securely and efficiently, streamlining the process for both senders and recipients.

-

How does airSlate SignNow ensure the security of my IRS Forms?

airSlate SignNow prioritizes the security of your documents, including IRS Forms, by implementing industry-leading encryption and authentication measures. Your data is securely stored and transmitted, ensuring that your sensitive information remains confidential and protected.

-

Can I customize my IRS Forms using airSlate SignNow?

Absolutely! airSlate SignNow provides tools for you to customize IRS Forms before sending them out for signature. You can add fields, notes, and specific instructions to tailor each document to your needs, ensuring clarity and compliance.

-

Is there a monthly subscription fee for using airSlate SignNow to manage IRS Forms?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs, including those who need to manage IRS Forms. Our cost-effective subscription model allows you to choose a plan that best fits your volume of document handling and signature requirements.

-

What features does airSlate SignNow offer for IRS Form management?

airSlate SignNow offers a robust set of features for managing IRS Forms, including eSignature capabilities, document tracking, and cloud storage. These features ensure that you can send, sign, and receive your IRS Forms seamlessly, improving overall efficiency.

-

How do I integrate airSlate SignNow with other applications for IRS Form processing?

Integrating airSlate SignNow with other applications for IRS Form processing is simple and straightforward. Our platform supports numerous integrations with popular software like Google Drive, Salesforce, and Dropbox, facilitating a streamlined workflow and document management system.

-

Can I use airSlate SignNow to send IRS Forms for multiple signers?

Yes, airSlate SignNow allows you to send IRS Forms for multiple signers efficiently. You can easily add multiple recipients to any document, ensuring all necessary parties can eSign the form without delays, making the process quick and collaborative.

Get more for Irs Form

- Reducing justice involvement for people with mental illness form

- Camp code of conduct and camp information girl scouts western gswpa

- Homestead northampton county form

- Crp online application form

- Form seh 195 expense reimbursement

- Bank account information bank account information form gsep

- 1609 pr editable form

- The bucks county childrens museum field trip registration form

Find out other Irs Form

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement