Form 1040 - U.S. Individual Tax Return 2021

What is the Form 1040 - U.S. Individual Tax Return

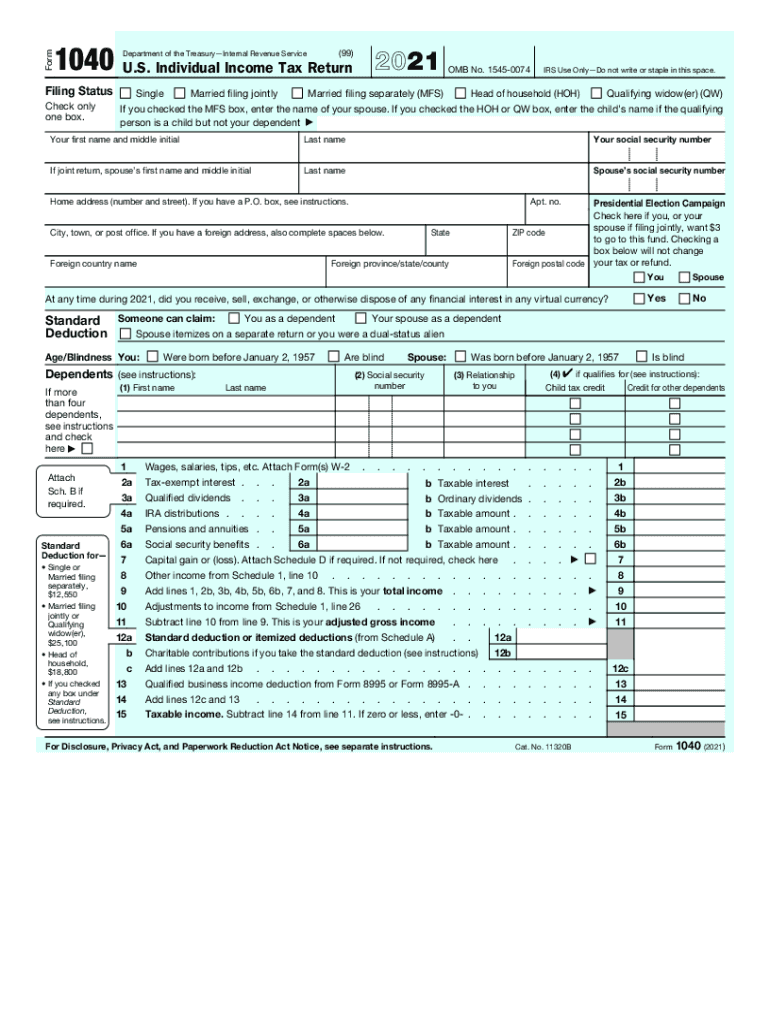

The Form 1040 is the standard federal income tax form used by individuals in the United States to report their income, claim tax deductions and credits, and calculate their tax liability. This form is essential for filing annual income taxes with the Internal Revenue Service (IRS). It is designed for a wide range of taxpayers, including those who are self-employed, retired, or have various income sources. Understanding the purpose and structure of the Form 1040 is crucial for accurate tax reporting.

Steps to complete the Form 1040 - U.S. Individual Tax Return

Completing the Form 1040 involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out personal information, such as your name, address, and Social Security number. After that, report your income, including wages, dividends, and interest. Then, claim any deductions and credits you qualify for, which can reduce your taxable income. Finally, calculate your total tax liability and determine if you owe taxes or are due a refund. Ensure to review the form for accuracy before submission.

How to obtain the Form 1040 - U.S. Individual Tax Return

The Form 1040 can be obtained through various methods. It is available for download directly from the IRS website, where taxpayers can find the most current version of the form. Additionally, physical copies can be requested from the IRS by mail or picked up at local IRS offices. Many tax preparation software programs also include the Form 1040, allowing users to complete their taxes electronically. Knowing how to access the form is the first step in the tax preparation process.

Legal use of the Form 1040 - U.S. Individual Tax Return

The Form 1040 is legally binding when completed accurately and submitted to the IRS. It must be signed and dated by the taxpayer to validate the information provided. The IRS requires all taxpayers to comply with tax laws, and any discrepancies or inaccuracies can lead to penalties or audits. Using electronic signatures through secure platforms can enhance the legal validity of the form, ensuring compliance with eSignature regulations. Understanding the legal implications of the Form 1040 is essential for all taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 are critical for taxpayers to remember. Typically, the deadline to file your federal income tax return is April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also file for an extension, allowing an additional six months to submit the form, but any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these dates is vital for timely compliance.

Required Documents

To complete the Form 1040 accurately, several documents are required. Taxpayers should gather income statements such as W-2 forms from employers, 1099 forms for freelance or contract work, and any other relevant income documentation. Additionally, receipts for deductible expenses, such as medical bills or mortgage interest, should be collected. Having these documents on hand will facilitate a smoother and more efficient filing process.

Quick guide on how to complete f1040 fill online printable fillable blankpdffiller

Effortlessly Prepare Form 1040 - U.S. Individual Tax Return on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed papers, allowing you to locate the appropriate form and securely save it on the web. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without holdups. Manage Form 1040 - U.S. Individual Tax Return on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Edit and eSign Form 1040 - U.S. Individual Tax Return with Ease

- Obtain Form 1040 - U.S. Individual Tax Return and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management demands in a few clicks from any preferred device. Edit and eSign Form 1040 - U.S. Individual Tax Return and guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f1040 fill online printable fillable blankpdffiller

Create this form in 5 minutes!

How to create an eSignature for the f1040 fill online printable fillable blankpdffiller

The way to create an e-signature for a PDF document online

The way to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The best way to generate an e-signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the 1040 form, and why is it important?

The 1040 form is the primary document used for individual income tax filing in the United States. It provides the IRS with essential information about your income and deductions, allowing you to calculate your tax liability. Understanding how to properly fill out and submit your 1040 form is crucial for compliance and to ensure you receive any refunds you might be eligible for.

-

How can airSlate SignNow help with the 1040 form?

AirSlate SignNow simplifies the process of eSigning and managing your 1040 form by allowing you to send and receive documents electronically. With our user-friendly platform, you can easily collaborate with tax professionals and ensure that your 1040 form is signed and filed efficiently. This streamlines the entire process, reducing the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for the 1040 form?

AirSlate SignNow offers various pricing plans that are cost-effective, making it affordable for individuals and businesses alike. Our plans provide a range of features tailored to efficiently manage documents, including the 1040 form, without breaking the bank. Visit our website to explore the pricing options that best fit your needs.

-

Can I integrate airSlate SignNow with other tax software for the 1040 form?

Yes, airSlate SignNow seamlessly integrates with popular tax software, making it easy to manage your 1040 form and related documents. This integration allows you to streamline your workflow by importing and exporting documents, ensuring consistency and accuracy in your tax filing process. Check our integration options to see what works best for you.

-

What are the benefits of using airSlate SignNow for my 1040 form?

Using airSlate SignNow for your 1040 form provides numerous benefits, including time savings and enhanced security. Our platform offers advanced features like document tracking, notifications, and secure cloud storage, making the management of your 1040 form both easy and secure. This ensures your sensitive information is protected throughout the signing process.

-

Is it easy to eSign my 1040 form with airSlate SignNow?

Absolutely! ESigning your 1040 form with airSlate SignNow is a straightforward process that anyone can navigate. Users can simply upload their document, add required fields, and send it for signature, all in a few clicks, eliminating the need for printing or mailing paper forms.

-

Do I need technical skills to use airSlate SignNow for the 1040 form?

No special technical skills are required to use airSlate SignNow. Our platform is designed for users of all technical backgrounds, allowing you to manage and eSign your 1040 form easily. With our intuitive interface and comprehensive tutorials, you'll be completing documents effortlessly in no time.

Get more for Form 1040 - U.S. Individual Tax Return

- Residential lease renewal agreement idaho form

- Idaho option form

- Assignment of lease and rent from borrower to lender idaho form

- Assignment of lease from lessor with notice of assignment idaho form

- Idaho notice 497305611 form

- Guaranty or guarantee of payment of rent idaho form

- Letter from landlord to tenant as notice of default on commercial lease idaho form

- Residential or rental lease extension agreement idaho form

Find out other Form 1040 - U.S. Individual Tax Return

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template