1040 Form 2006

What is the 1040 Form

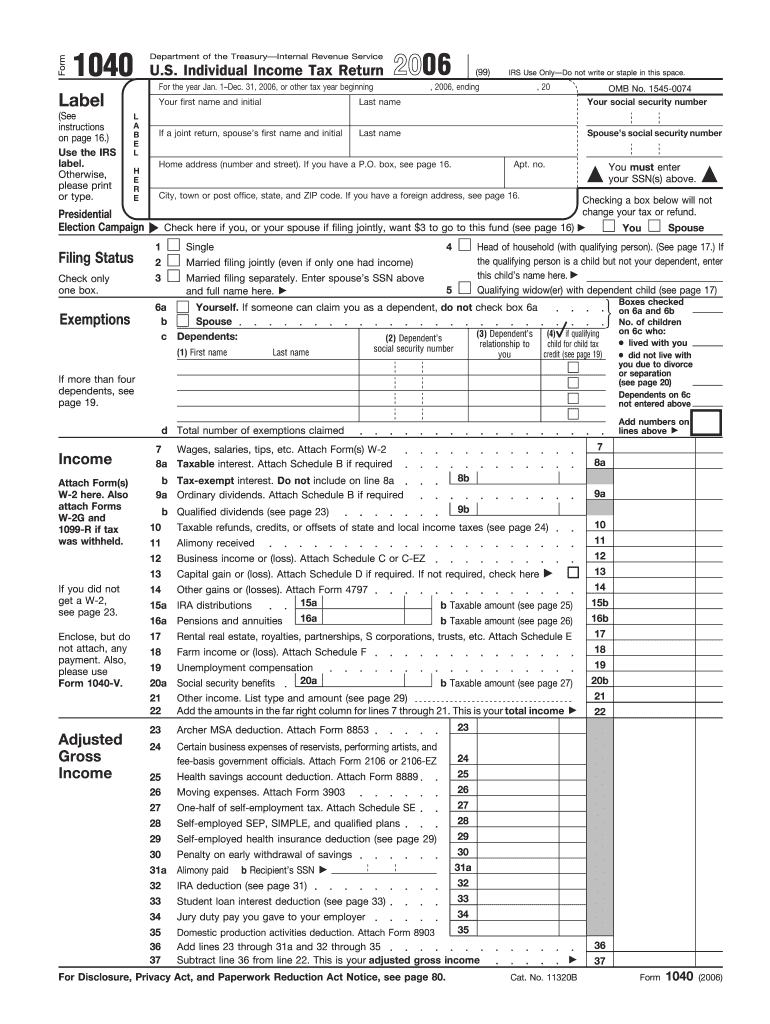

The 1040 Form is the standard individual income tax return form used by taxpayers in the United States to report their annual income to the Internal Revenue Service (IRS). This form allows individuals to calculate their taxable income, claim deductions, and determine their tax liability. The 1040 Form is essential for ensuring compliance with federal tax laws and is typically filed annually by April 15, unless an extension is granted. It comes in various versions, including the 1040-SR for seniors and the 1040-NR for non-resident aliens.

Steps to complete the 1040 Form

Completing the 1040 Form involves several key steps to ensure accurate reporting of income and deductions:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and records of other income.

- Determine filing status: Identify your filing status (e.g., single, married filing jointly) as it affects tax rates and deductions.

- Report income: Enter all sources of income on the form, including wages, interest, dividends, and self-employment income.

- Claim deductions and credits: Identify and claim applicable deductions, such as standard or itemized deductions, and any tax credits.

- Calculate tax liability: Use the IRS tax tables to determine your tax owed based on your taxable income.

- Review and sign: Carefully review all entries for accuracy, then sign and date the form.

How to obtain the 1040 Form

The 1040 Form can be obtained through several convenient methods:

- IRS website: Download a printable version directly from the IRS website.

- Tax preparation software: Many software programs provide the 1040 Form as part of their tax filing services.

- Local IRS office: Visit a local IRS office to pick up a physical copy of the form.

- Libraries and post offices: Some public libraries and post offices may carry copies of the 1040 Form during tax season.

Legal use of the 1040 Form

The 1040 Form must be completed and submitted in compliance with IRS regulations to be considered legally valid. Accurate reporting of income and deductions is crucial, as discrepancies can lead to audits or penalties. Additionally, electronic filing of the 1040 Form is legally recognized, provided it meets the standards set by the IRS, including secure transmission and proper authentication of the taxpayer's identity.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing the 1040 Form to avoid penalties:

- April 15: The standard deadline for filing the 1040 Form for the previous tax year.

- October 15: The extended deadline for those who filed for an extension.

- Quarterly estimated tax payments: Due dates for estimated tax payments are typically April 15, June 15, September 15, and January 15 of the following year.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the 1040 Form:

- Online filing: Submit electronically using IRS-approved software or services, which often provide faster processing and confirmation.

- Mail: Send a paper copy of the completed form to the appropriate IRS address based on your location and whether you are enclosing a payment.

- In-person: Deliver the form directly to a local IRS office, although this option is less common.

Quick guide on how to complete 1040 form 2006

Complete 1040 Form effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage 1040 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign 1040 Form with ease

- Obtain 1040 Form and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign 1040 Form to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040 form 2006

Create this form in 5 minutes!

How to create an eSignature for the 1040 form 2006

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the 1040 Form, and why do I need it?

The 1040 Form is a standard IRS tax form used by individual taxpayers to file their annual income tax returns. Completing your 1040 Form accurately is crucial for ensuring you report your income correctly and receive any applicable tax refunds. Using airSlate SignNow, you can easily eSign your 1040 Form, streamlining the filing process.

-

How can airSlate SignNow help me with my 1040 Form?

airSlate SignNow simplifies the process of completing and eSigning your 1040 Form. Our intuitive platform allows you to upload your form, fill it out, and securely eSign it, ensuring that your tax documents are processed quickly and efficiently. This means less hassle and more time for you during tax season.

-

Is airSlate SignNow cost-effective for managing my 1040 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing your 1040 Form and other documents. With various pricing plans available, you can choose one that fits your budget while still benefiting from our robust features, including unlimited eSigning and document storage.

-

Can I integrate airSlate SignNow with other tools for my 1040 Form needs?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, such as Google Drive and Dropbox, to help you manage your 1040 Form and other documents more efficiently. This integration allows you to access your files easily and collaborate with others when preparing your tax documents.

-

What features does airSlate SignNow offer for eSigning my 1040 Form?

airSlate SignNow provides several features to enhance your experience when eSigning your 1040 Form. You can quickly add signatures, initials, and other required information, all while keeping your data secure. Additionally, our mobile-friendly interface allows you to sign documents on the go.

-

Is my data safe when using airSlate SignNow for my 1040 Form?

Yes, when you use airSlate SignNow for your 1040 Form and other documents, your data is protected with top-notch security protocols. We utilize encryption and secure cloud storage to ensure that your sensitive information remains confidential and safe from unauthorized access.

-

Can I send my 1040 Form to others for signing through airSlate SignNow?

Yes, airSlate SignNow allows you to send your 1040 Form to others for eSigning easily. You can invite multiple signers, track the signing process, and receive notifications when the document is signed, making it simple to collect all necessary signatures promptly.

Get more for 1040 Form

- Rei wbc intake form

- Sample volunteer application for nonprofit organizations volunteer recruitment form

- Global adverse event and special situation reporting roche pro form

- Ielts certificate pdf 22286303 form

- To be read and signed by parentguardian of a minor form

- G 31uasl 20200304 applicationglobal aerospace aviation form

- Mta bsc work procedure c2fo form

- Printclearnot for electronic filing contact 60981 form

Find out other 1040 Form

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later

- Can I Sign Texas Life-Insurance Quote Form

- Sign Texas Life-Insurance Quote Form Fast

- How To Sign Washington Life-Insurance Quote Form

- Can I Sign Wisconsin Life-Insurance Quote Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title