Form 1040 - U.S. Individual Tax Return 2022-2026

What is the Form 1040 - U.S. Individual Tax Return

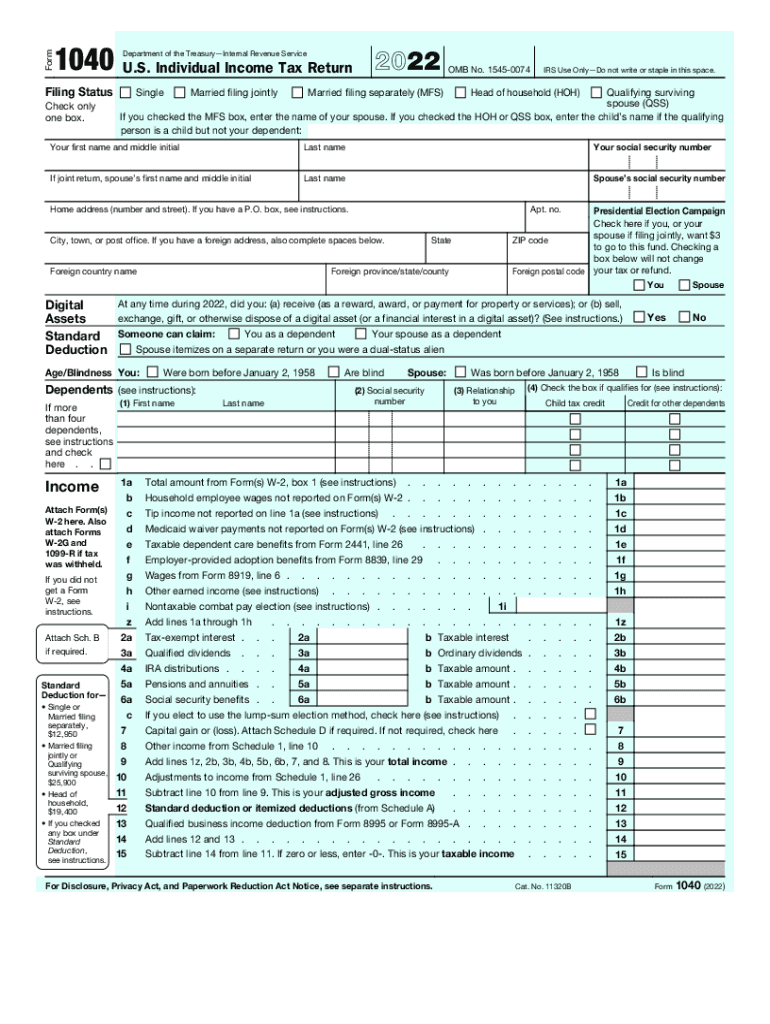

The Form 1040 is the standard U.S. Individual Income Tax Return used by taxpayers to report their annual income and calculate their tax liability. This form is essential for individuals who earn income from various sources, including wages, dividends, and self-employment. The 1040 form provides a comprehensive overview of a taxpayer's financial situation, allowing them to claim deductions, credits, and report any taxes owed or refunds due. It is a critical document in the tax filing process, ensuring compliance with federal tax laws.

Steps to complete the Form 1040 - U.S. Individual Tax Return

Completing the Form 1040 involves several key steps to ensure accuracy and compliance. Start by gathering all necessary documents, such as W-2s, 1099s, and records of other income. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your income on the appropriate lines, adding any adjustments to income as needed. After calculating your adjusted gross income (AGI), apply any deductions you qualify for, which may include the standard deduction or itemized deductions. Finally, calculate your tax liability, apply any tax credits, and determine whether you owe additional taxes or are due a refund.

Legal use of the Form 1040 - U.S. Individual Tax Return

The Form 1040 serves as a legally binding document that must be completed accurately to comply with U.S. tax laws. Filing this form signifies that the information provided is true and complete to the best of the taxpayer's knowledge. Misrepresentation or failure to file can lead to penalties, including fines or legal action by the Internal Revenue Service (IRS). It is crucial for taxpayers to retain copies of their completed forms and any supporting documentation for future reference and potential audits.

Filing Deadlines / Important Dates

Taxpayers must be aware of the critical deadlines associated with the Form 1040. Typically, the filing deadline for individual tax returns is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can request an extension to file, usually extending the deadline to October 15, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040 can be submitted through various methods, providing flexibility for taxpayers. Many individuals choose to file electronically using tax software, which can streamline the process and reduce errors. Alternatively, taxpayers can complete a paper version of the form and mail it to the appropriate IRS address. In some cases, individuals may opt to file in person at designated IRS offices, although this method is less common. Each submission method has its own advantages, including faster processing times for electronic filings.

Required Documents

To accurately complete the Form 1040, taxpayers need to gather specific documents that detail their financial situation. Essential documents include W-2 forms from employers, 1099 forms for freelance or contract work, and records of any other income sources. Additionally, individuals should have documentation for deductions and credits, such as mortgage interest statements, medical expenses, and charitable contributions. Having all necessary documents on hand can simplify the filing process and help ensure accuracy.

Eligibility Criteria

Eligibility to file the Form 1040 generally includes individuals who earn income above a certain threshold, which can vary based on filing status and age. Most U.S. citizens and resident aliens are required to file if their gross income exceeds the minimum filing requirement set by the IRS. Special considerations apply to self-employed individuals, dependents, and those claiming certain credits or deductions. Understanding these criteria is essential for determining whether filing is necessary and which form variant may be appropriate.

Quick guide on how to complete f1040pdf form 1040 us individual income tax return 2022 filing

Complete Form 1040 - U.S. Individual Tax Return effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without any delays. Manage Form 1040 - U.S. Individual Tax Return on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

How to modify and eSign Form 1040 - U.S. Individual Tax Return effortlessly

- Obtain Form 1040 - U.S. Individual Tax Return and click Get Form to commence.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 1040 - U.S. Individual Tax Return and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f1040pdf form 1040 us individual income tax return 2022 filing

Create this form in 5 minutes!

People also ask

-

What is a 1040 form?

The 1040 form is a U.S. Individual Income Tax Return used by taxpayers to report their annual income and calculate their tax liability. airSlate SignNow can help you securely send and eSign your 1040 form, making the filing process smoother and more efficient.

-

How does airSlate SignNow help with the 1040 form?

airSlate SignNow empowers users to easily eSign and send their 1040 form, ensuring documents are handled securely and efficiently. With our platform, you can streamline the signature process, reducing the time spent on paperwork.

-

What are the pricing options for using airSlate SignNow for my 1040 form?

airSlate SignNow offers flexible pricing plans that are cost-effective for handling your 1040 form and other documents. You can choose a plan that best fits your business needs, ensuring you pay only for the features you use.

-

Is airSlate SignNow compliant with tax regulations when handling a 1040 form?

Yes, airSlate SignNow is fully compliant with tax regulations and standards when it comes to handling sensitive documents like the 1040 form. We prioritize security to keep your personal information safe while you eSign and send tax documents.

-

Can I integrate airSlate SignNow with other software to manage my 1040 form?

Absolutely! airSlate SignNow offers seamless integrations with a variety of software platforms that can help you manage your 1040 form and other business documents. This flexibility allows for a more efficient workflow and better document management overall.

-

What features does airSlate SignNow offer for signing a 1040 form?

airSlate SignNow includes several features designed specifically for document signing, including customizable workflows, real-time tracking, and automated reminders for your 1040 form. These features help keep you organized and ensure timely submissions.

-

How can airSlate SignNow improve the efficiency of submitting my 1040 form?

With airSlate SignNow, you can eliminate manual errors and reduce the time it takes to submit your 1040 form. The eSignature feature allows for quick document turnaround, enabling faster interactions with clients or tax professionals.

Get more for Form 1040 - U.S. Individual Tax Return

Find out other Form 1040 - U.S. Individual Tax Return

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe