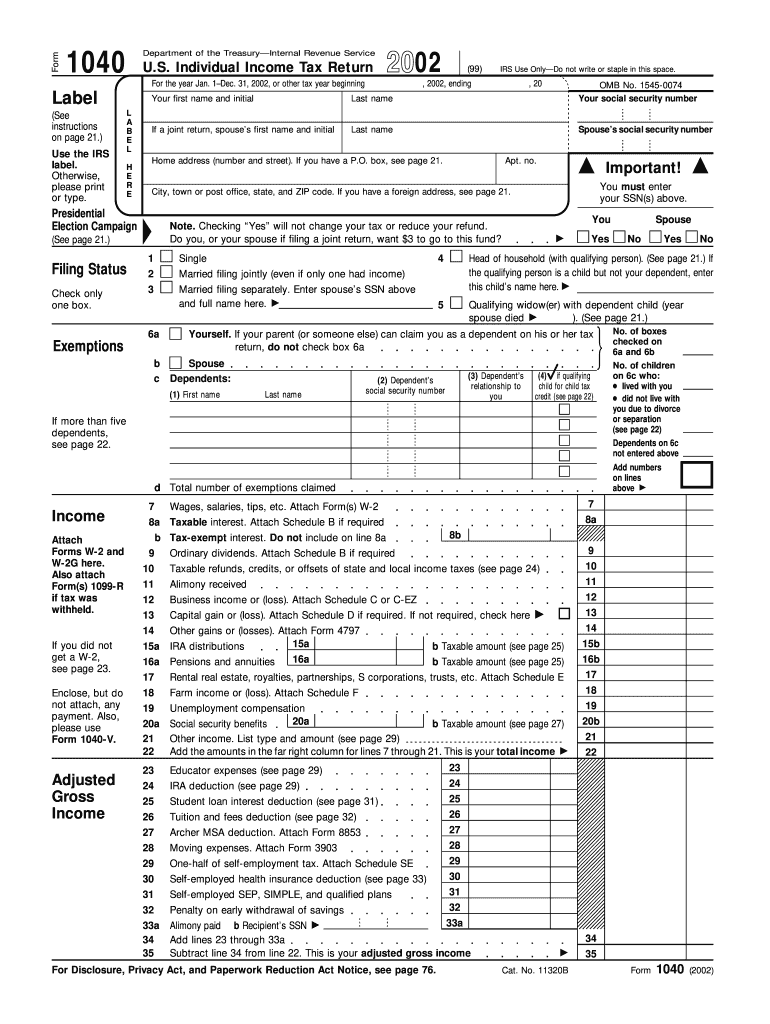

Irs Form 2002

What is the IRS Form

The IRS Form refers to various forms issued by the Internal Revenue Service (IRS) for tax-related purposes. These forms are essential for individuals and businesses to report income, claim deductions, and fulfill tax obligations. Each form serves a specific purpose, such as the W-2 for wage and tax statements or the 1040 for individual income tax returns. Understanding the purpose of each IRS Form is crucial for accurate tax filing and compliance with federal regulations.

How to Use the IRS Form

Using an IRS Form involves several steps to ensure accurate completion and submission. First, identify the specific form required for your tax situation. Next, gather all necessary information, such as income statements, deductions, and credits. Fill out the form carefully, ensuring that all entries are accurate and complete. Once completed, review the form for any errors before submitting it either electronically or by mail. Proper use of the IRS Form helps avoid delays in processing and potential penalties.

Steps to Complete the IRS Form

Completing an IRS Form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Determine the correct form based on your tax situation.

- Collect all required documents, including income statements and receipts.

- Fill out the form, paying close attention to each section.

- Double-check all entries for accuracy.

- Sign and date the form where required.

- Submit the form by the designated deadline, either electronically or by mail.

Legal Use of the IRS Form

The legal use of the IRS Form is governed by federal tax laws. When filled out correctly, these forms serve as official documents for reporting income and claiming tax benefits. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to audits or penalties. Utilizing a reliable e-signature platform, such as signNow, can enhance the legal standing of submitted forms by ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for IRS Forms vary depending on the type of form and the taxpayer's situation. Generally, individual tax returns are due on April 15 each year, while businesses may have different deadlines based on their fiscal year. It is crucial to be aware of these dates to avoid late fees and penalties. Marking your calendar with important dates can help ensure timely submissions and compliance with tax regulations.

Form Submission Methods

IRS Forms can be submitted through various methods, including:

- Online: Many forms can be filed electronically through the IRS website or authorized e-filing services.

- Mail: Completed forms can be sent via postal mail to the appropriate IRS address based on the form type.

- In-Person: Some forms may be submitted in person at local IRS offices, although appointments may be required.

Penalties for Non-Compliance

Failure to comply with IRS Form requirements can result in various penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action for fraudulent submissions. Understanding the consequences of non-compliance emphasizes the importance of accurate and timely filing. To avoid penalties, it is advisable to stay informed about tax obligations and deadlines.

Quick guide on how to complete 2002 irs form

Prepare Irs Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Irs Form from any device using airSlate SignNow apps for Android or iOS, and streamline any document-related task today.

How to modify and eSign Irs Form with ease

- Find Irs Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or conceal sensitive information with the tools that airSlate SignNow provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to share your form: via email, SMS, or invitation link, or download it to your computer.

No more worries about lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2002 irs form

Create this form in 5 minutes!

How to create an eSignature for the 2002 irs form

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is an IRS Form, and why is it important for businesses?

An IRS Form is a document required by the Internal Revenue Service for various tax-related purposes. Businesses must accurately complete and submit the correct IRS Forms to ensure compliance with tax regulations. Utilizing airSlate SignNow simplifies the process of signing and managing these forms efficiently.

-

How can airSlate SignNow help me manage my IRS Forms more effectively?

airSlate SignNow provides a user-friendly platform that enables businesses to eSign and send IRS Forms effortlessly. With its intuitive interface, users can quickly prepare and distribute these forms, saving valuable time and reducing errors associated with manual signatures.

-

Is there a cost associated with using airSlate SignNow for IRS Forms?

Yes, while airSlate SignNow offers various pricing plans, it is designed to be a cost-effective solution for managing IRS Forms and document workflows. Evaluate the pricing options to find a plan that best meets your business needs while ensuring efficient handling of IRS documentation.

-

What features does airSlate SignNow offer for managing IRS Forms?

airSlate SignNow is equipped with features such as customizable templates, in-app eSigning, and secure document storage, making it ideal for managing IRS Forms. These features enhance the ease of use and ensure that your documents are always compliant with IRS standards.

-

Can I integrate airSlate SignNow with other applications for handling IRS Forms?

Absolutely! airSlate SignNow offers integrations with a variety of apps and services, allowing you to streamline your workflow for managing IRS Forms. This ensures that you can easily combine tools and enhance productivity, all while maintaining compliance.

-

What benefits can I expect from using airSlate SignNow for my IRS Forms?

By using airSlate SignNow, businesses can expect improved efficiency and reduced turnaround times when handling IRS Forms. The platform's automated workflows and secure eSigning capabilities simplify the process, making it easier to stay organized and compliant.

-

What types of IRS Forms can I manage with airSlate SignNow?

With airSlate SignNow, you can manage various types of IRS Forms, such as W-2s, 1099s, and more. The platform accommodates multiple form types to meet the needs of your business, ensuring that you can handle all IRS documentation seamlessly.

Get more for Irs Form

- Direct disbursements of 50000 and above will require a notary seal or signature guarantee form

- Prior authorization benefit form

- Laboratory suppy request bformb rochestergeneral

- Physical examination form oregongov

- Medical abstract form

- Nys form sny9457

- History formpreparticipation physical evaluation infohub

- Ut forms dearborn life benefits

Find out other Irs Form

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple