1040 Form 2016

What is the 1040 Form

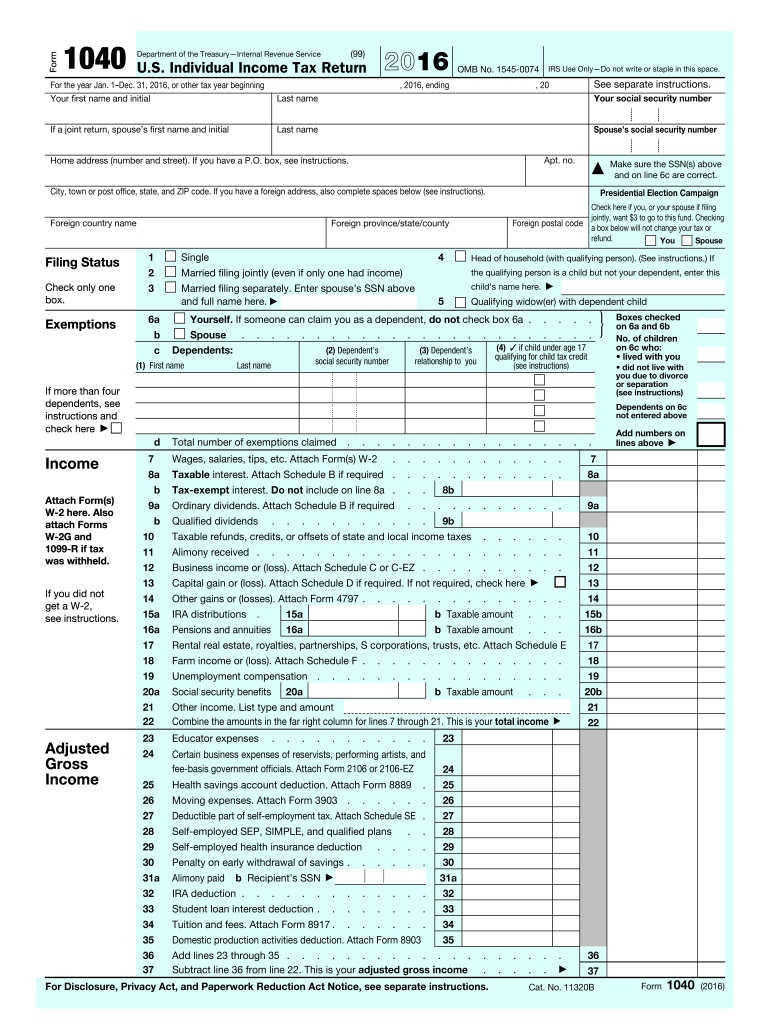

The 1040 Form is a standard federal income tax form used by individuals in the United States to report their annual income. This form is essential for calculating the amount of tax owed or the refund due to the taxpayer. The 1040 Form allows taxpayers to detail their income, claim deductions and credits, and report other tax-related information. It is a crucial document for ensuring compliance with U.S. tax laws.

How to use the 1040 Form

Using the 1040 Form involves several steps. First, gather all necessary financial documents, such as W-2s, 1099s, and records of other income. Next, fill out the form by entering personal information, income details, and applicable deductions. After completing the form, review it for accuracy and ensure all required fields are filled. Finally, submit the form to the IRS either electronically or via mail, depending on your preference.

Steps to complete the 1040 Form

Completing the 1040 Form requires careful attention to detail. Follow these steps:

- Gather all income documents, including W-2s and 1099s.

- Enter your personal information, including your name, address, and Social Security number.

- Report all sources of income on the form.

- Claim deductions and credits applicable to your situation.

- Calculate your total tax liability or refund.

- Review the completed form for accuracy.

- Submit the form electronically or by mail.

Key elements of the 1040 Form

The 1040 Form consists of several key elements that are critical for accurate reporting. These include:

- Filing Status: Indicates whether you are single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Income Section: Where you report wages, dividends, interest, and other income sources.

- Deductions: Standard or itemized deductions that reduce your taxable income.

- Tax Credits: Direct reductions of tax liability that can lower the amount owed.

- Signature Section: Where you sign and date the form to certify its accuracy.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 Form are crucial for avoiding penalties. Typically, the deadline for submitting your tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an extension, which usually allows an additional six months to file, but any taxes owed must still be paid by the original deadline.

Form Submission Methods (Online / Mail / In-Person)

The 1040 Form can be submitted in several ways, providing flexibility for taxpayers. Common submission methods include:

- Online Filing: Many taxpayers choose to file electronically using tax preparation software, which often simplifies the process.

- Mail: Taxpayers can print the completed form and mail it to the appropriate IRS address based on their location.

- In-Person: While less common, some individuals may choose to file in person at IRS offices or through authorized tax professionals.

Quick guide on how to complete 1040 form 2016

Uncover the easiest method to complete and endorse your 1040 Form

Are you still spending valuable time preparing your official paperwork on physical copies instead of doing it digitally? airSlate SignNow provides a superior way to complete and endorse your 1040 Form and associated forms for public services. Our intelligent electronic signature solution equips you with everything necessary to handle documents swiftly and in compliance with official standards - robust PDF editing, management, protection, signing, and sharing tools conveniently located within an intuitive interface.

Only a few steps are required to complete and endorse your 1040 Form:

- Upload the editable template to the editor using the Get Form button.

- Verify which details you must provide in your 1040 Form.

- Move between the fields using the Next button to avoid missing anything.

- Utilize Text, Check, and Cross tools to populate the fields with your information.

- Update the content using Text boxes or Images from the upper toolbar.

- Emphasize what is truly essential or Obscure areas that are no longer relevant.

- Click on Sign to create a legally binding electronic signature using your preferred method.

- Include the Date next to your signature and conclude your tasks with the Done button.

Store your finished 1040 Form in the Documents folder in your profile, download it, or export it to your chosen cloud storage. Our solution also provides versatile file sharing options. There’s no need to print your forms when they need to be submitted to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 1040 form 2016

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

Can I file a claim with TurboTax for filing the wrong form for me? Instead of filling the 1040NR form in 2015 and 2016, TurboTax filled 1040 for me instead. Now I need to file for an amendment, which will cost $1200.

Sure you can. Pretty much any one can sue for anything. You have a snowballs chance in hell of winning though. Go back and read the disclaimer-terms of use that you just accepted without reading on installing it.You’ll notice that they bear NO responsibility for incorrect taxes.Besides it was your failure to pick the correct product. Turbo tax does not and has NEVER produced a 1040NR product.As my old Computer Science professors used to say. GIGO - Garbage In Garbage Out.

Create this form in 5 minutes!

How to create an eSignature for the 1040 form 2016

How to generate an electronic signature for the 1040 Form 2016 in the online mode

How to create an electronic signature for your 1040 Form 2016 in Google Chrome

How to generate an eSignature for signing the 1040 Form 2016 in Gmail

How to create an electronic signature for the 1040 Form 2016 from your mobile device

How to generate an eSignature for the 1040 Form 2016 on iOS devices

How to create an eSignature for the 1040 Form 2016 on Android devices

People also ask

-

What is the 1040 Form and why do I need it?

The 1040 Form is a U.S. tax return form used by individuals to report their annual income and calculate tax liability. It's essential for ensuring compliance with IRS regulations and for claiming any potential refunds. Using airSlate SignNow can streamline the eSigning process for your 1040 Form, making tax season easier.

-

How can airSlate SignNow help me with my 1040 Form?

airSlate SignNow provides a user-friendly platform for sending and eSigning your 1040 Form quickly and securely. With features like document storage and real-time notifications, you can manage your tax documents efficiently. Our solution simplifies the process, allowing you to focus on other important aspects of your taxes.

-

Is airSlate SignNow cost-effective for managing my 1040 Form?

Yes, airSlate SignNow offers competitive pricing plans that cater to individuals and businesses alike, making it a cost-effective solution for managing your 1040 Form. With various subscription options, you can choose a plan that fits your needs while benefiting from unlimited eSignatures and document management capabilities.

-

Can I integrate airSlate SignNow with other tax software for my 1040 Form?

Absolutely! airSlate SignNow seamlessly integrates with popular tax software, allowing you to easily import and manage your 1040 Form. This integration enhances your workflow by enabling you to eSign documents without leaving your preferred tax software, simplifying the entire tax preparation process.

-

What are the security measures in place for my 1040 Form on airSlate SignNow?

Security is a priority for airSlate SignNow. We utilize advanced encryption methods and secure servers to protect your 1040 Form and other sensitive documents. Additionally, our platform complies with industry standards, ensuring that your information remains safe throughout the eSigning process.

-

Can I track the status of my 1040 Form once I send it with airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking for your sent documents, including your 1040 Form. You will receive notifications when the document is viewed and signed, ensuring that you're always updated on its status. This feature enhances accountability and keeps your tax filing process organized.

-

Are there templates available for the 1040 Form in airSlate SignNow?

Yes, airSlate SignNow provides customizable templates for the 1040 Form, making it easier for you to get started. You can quickly fill in your information and send it out for eSignature, saving you time during tax season. Our templates are designed to meet IRS requirements while streamlining your workflow.

Get more for 1040 Form

- Form 1223

- Letterhead template boston ashburton mass gov mass form

- Letter from vmrc form

- Request for patient admission form spendelove private hospital

- Uib 0105b eligibility questionnaire for unemployment insurance benefits ui benefits form

- Physician assistant pa healthcare practitioner licensing form

- Spanish pdf child support form

- Solicitors fee sharing agreement template form

Find out other 1040 Form

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe