Form 1040 1993

What is the Form 1040

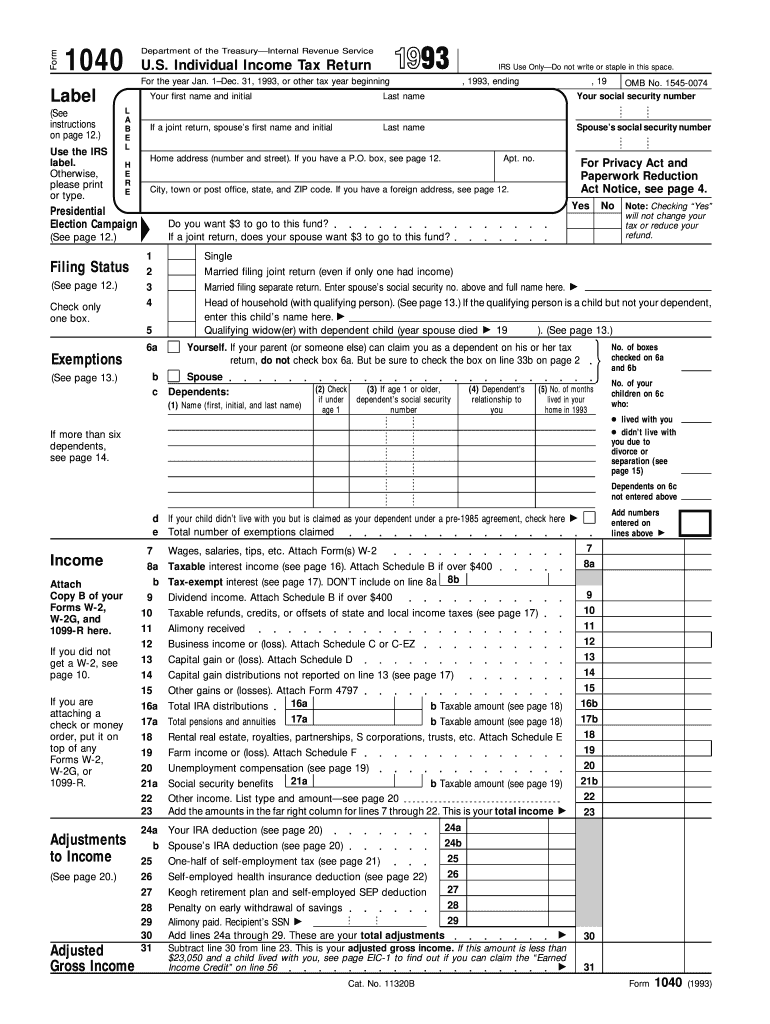

The Form 1040 is the standard individual income tax return form used by U.S. taxpayers to report their annual income to the Internal Revenue Service (IRS). This form is essential for calculating the amount of tax owed or the refund due. It includes various sections for reporting wages, salaries, dividends, capital gains, and other income sources. The Form 1040 also allows taxpayers to claim deductions and credits to reduce their taxable income, making it a crucial document for personal financial management.

Steps to complete the Form 1040

Completing the Form 1040 involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2 forms, 1099 forms, and receipts for deductions.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Include all sources of income in the appropriate sections, ensuring accuracy to avoid issues with the IRS.

- Claim deductions and credits: Identify eligible deductions and tax credits that can lower your taxable income.

- Calculate tax liability: Use the tax tables provided by the IRS to determine your tax owed based on your taxable income.

- Sign and date the form: Ensure that you sign the form, as an unsigned return may be considered invalid.

How to obtain the Form 1040

The Form 1040 can be obtained through various methods:

- IRS website: Download the form directly from the IRS website in PDF format.

- Tax preparation software: Many software programs offer electronic versions of the Form 1040 that can be filled out and submitted online.

- Local IRS offices: Visit a local IRS office to request a physical copy of the form.

- Libraries and post offices: Some public libraries and post offices may have copies available for distribution.

Legal use of the Form 1040

The Form 1040 is legally binding when completed and submitted according to IRS guidelines. To ensure compliance:

- Use accurate information: Provide truthful and complete information to avoid penalties.

- File by the deadline: Submit the form by the IRS deadline to avoid late fees and interest charges.

- Maintain records: Keep copies of your filed Form 1040 and supporting documents for at least three years.

Filing Deadlines / Important Dates

Understanding key deadlines is essential for timely filing:

- April 15: The standard deadline for filing the Form 1040 for the previous tax year.

- October 15: The deadline for taxpayers who filed for an extension to submit their Form 1040.

- Quarterly estimated tax payments: Self-employed individuals must pay estimated taxes quarterly, typically due in April, June, September, and January.

Required Documents

To complete the Form 1040 accurately, gather the following documents:

- W-2 forms: From employers to report wages and withheld taxes.

- 1099 forms: For reporting income from freelance work, interest, dividends, and other sources.

- Receipts: For deductible expenses, such as medical costs, mortgage interest, and charitable contributions.

- Social Security numbers: For yourself, your spouse, and any dependents.

Quick guide on how to complete 1993 form 1040

Prepare Form 1040 seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage Form 1040 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Form 1040 effortlessly

- Find Form 1040 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive details using features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 1040 while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1993 form 1040

Create this form in 5 minutes!

How to create an eSignature for the 1993 form 1040

The best way to generate an eSignature for your PDF file online

The best way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is Form 1040, and why is it important?

Form 1040 is the standard tax form used by individuals in the United States to file their annual income tax returns. It is important because it allows taxpayers to report their income, claim deductions and credits, and calculate their tax liability. Properly filing Form 1040 ensures compliance with IRS regulations and can help maximize potential refunds.

-

How can airSlate SignNow help with signing Form 1040?

airSlate SignNow streamlines the process of signing Form 1040 by providing an easy-to-use electronic signature solution. With SignNow, you can securely send, receive, and sign your tax forms from anywhere, ensuring that your Form 1040 is completed efficiently and on time. This eliminates the hassle of printing and scanning documents, making tax season much simpler.

-

What features does airSlate SignNow offer for managing Form 1040 documents?

airSlate SignNow offers a range of features for managing Form 1040 documents, including customizable templates, secure cloud storage, and real-time tracking of document status. Users can easily create, edit, and share their Form 1040, ensuring a smooth workflow. Additionally, the platform supports bulk sending, which is great for tax professionals handling multiple clients.

-

Is airSlate SignNow a cost-effective solution for handling Form 1040?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses and individuals managing Form 1040. With flexible pricing plans and no hidden fees, users can choose the option that best fits their needs. This affordability, combined with its comprehensive features, makes airSlate SignNow a smart choice for efficient document management.

-

Can I integrate airSlate SignNow with other software for Form 1040 management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including popular accounting and tax software used for Form 1040 management. This integration allows users to streamline their workflows by connecting different tools, reducing manual data entry, and ensuring that all information is up-to-date.

-

What security measures does airSlate SignNow have for Form 1040 documents?

airSlate SignNow prioritizes the security of your Form 1040 documents with advanced encryption and compliance with industry standards. The platform employs SSL encryption for data transmission and offers secure cloud storage to protect sensitive information. With these measures in place, you can confidently manage your tax documents without worrying about unauthorized access.

-

How can I get support if I have questions about Form 1040 in airSlate SignNow?

If you have questions about managing Form 1040 in airSlate SignNow, you can access a wealth of resources including FAQs, video tutorials, and live chat support. The dedicated support team is ready to assist you with any inquiries, ensuring that you have all the help you need for a smooth experience with your tax documents.

Get more for Form 1040

Find out other Form 1040

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word