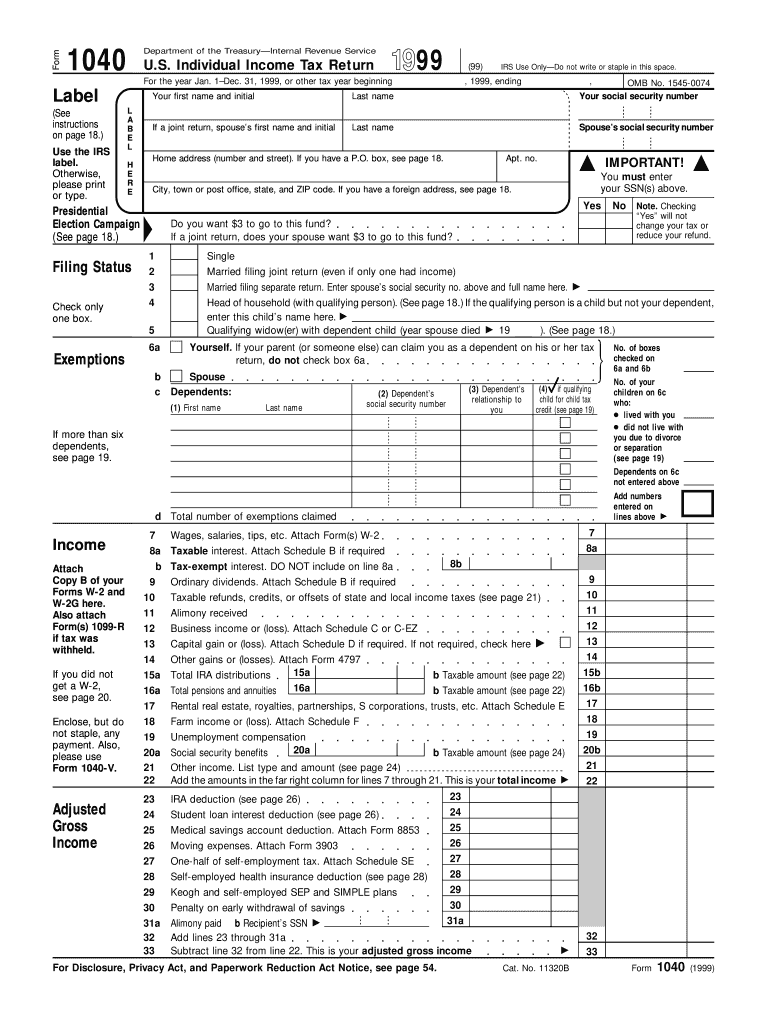

Irs Form 1999

What is the IRS Form?

The IRS Form refers to various forms issued by the Internal Revenue Service (IRS) that taxpayers in the United States use for reporting income, expenses, and other tax-related information. Each form serves a specific purpose, such as filing income tax returns, claiming deductions, or reporting specific financial transactions. Understanding the purpose of each form is crucial for compliance with U.S. tax laws and ensuring accurate reporting of financial information.

How to use the IRS Form

Using the IRS Form involves several steps. First, determine which form is appropriate for your tax situation. For example, Form 1040 is commonly used for individual income tax returns, while Form W-2 is used by employers to report wages paid to employees. Once you have identified the correct form, gather the necessary documentation, such as income statements and deduction records. Complete the form accurately, ensuring all information is correct and up-to-date. Finally, submit the form to the IRS through the appropriate channel, whether online, by mail, or in person.

Steps to complete the IRS Form

Completing the IRS Form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Identify the correct form based on your filing requirements.

- Gather necessary documents, including income statements and receipts for deductions.

- Fill out the form carefully, ensuring all fields are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form by the filing deadline, choosing the appropriate submission method.

Legal use of the IRS Form

The legal use of the IRS Form is paramount for compliance with federal tax laws. Each form is designed to collect specific information required by the IRS. Submitting these forms accurately ensures that taxpayers meet their legal obligations and avoid potential penalties. It is essential to maintain records of submitted forms and any supporting documentation in case of an audit or inquiry from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for IRS Forms are crucial for taxpayers to avoid penalties. Generally, individual tax returns are due on April 15 each year, unless that date falls on a weekend or holiday, in which case the deadline may be extended. Other forms, such as those for businesses or specific tax situations, may have different deadlines. It is important to stay informed about these dates to ensure timely submission and compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting IRS Forms. The most common methods include:

- Online Submission: Many forms can be filed electronically through the IRS website or authorized e-filing services.

- Mail: Forms can be printed and mailed to the appropriate IRS address based on the taxpayer's location and the type of form being submitted.

- In-Person: Some taxpayers may choose to file forms in person at local IRS offices, although this option may require an appointment.

Quick guide on how to complete 1999 irs form

Complete Irs Form effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed documentation, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Irs Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Irs Form with ease

- Obtain Irs Form and select Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method of delivery for your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Form and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1999 irs form

Create this form in 5 minutes!

How to create an eSignature for the 1999 irs form

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is an IRS Form and how can airSlate SignNow help with it?

An IRS Form is a document required by the Internal Revenue Service for tax-related purposes. airSlate SignNow streamlines the process of completing and submitting IRS Forms by allowing users to easily eSign and send documents securely. This ensures that your forms are filled out accurately and submitted on time, minimizing the risk of errors.

-

Are there any costs associated with using airSlate SignNow for IRS Forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that can simplify the preparation and signing of IRS Forms. By investing in airSlate SignNow, you get a cost-effective solution that saves time and enhances compliance for your IRS-related tasks.

-

What features does airSlate SignNow offer for managing IRS Forms?

airSlate SignNow includes a range of features tailored for managing IRS Forms, such as customizable templates, automated workflows, and advanced eSignature capabilities. This ensures that you can easily create, send, and sign IRS Forms without hassle. The platform also provides robust tracking and notification systems to keep you updated on your document statuses.

-

Can I integrate airSlate SignNow with other financial software for IRS Forms?

Yes, airSlate SignNow integrates seamlessly with various financial and accounting software solutions, enhancing your ability to manage IRS Forms. By connecting your existing tools, you can streamline data entry and reduce the time spent on preparing and filing IRS Forms. This capability makes airSlate SignNow a versatile choice for businesses looking to improve their financial processes.

-

Is it safe to use airSlate SignNow for IRS Forms?

Absolutely, airSlate SignNow prioritizes security, employing industry-leading encryption and compliance measures to protect your documents, including IRS Forms. Each eSigned document is securely stored and can only be accessed by authorized users. This ensures that your sensitive tax information remains confidential and secure throughout the signing process.

-

How does airSlate SignNow enhance collaboration on IRS Forms?

airSlate SignNow enhances collaboration by allowing multiple users to review, sign, and comment on IRS Forms in real time. This feature makes it easier for teams to work together, regardless of their locations, ensuring that the IRS Forms are completed accurately and efficiently. You can invite stakeholders to contribute directly, simplifying the entire process.

-

What kind of customer support is available for airSlate SignNow users dealing with IRS Forms?

airSlate SignNow offers comprehensive customer support to assist users with any queries related to IRS Forms. Support options include live chat, email assistance, and a detailed support center with articles and FAQs. Whether you have questions about eSigning or document management, reliable help is readily available.

Get more for Irs Form

- Sa103s form

- Sd502 form nhs pension

- Download self certification form sc1

- Uk immigration and migration form

- Waste shipments waste referred to in article 32 and 4 govuk form

- Phv vehicle related exemption form dec 2015 phv vehicle related exemption form dec 2015

- Find cd formsoffice of the chief information officer

- Civil penalty accreditation scheme application form

Find out other Irs Form

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template