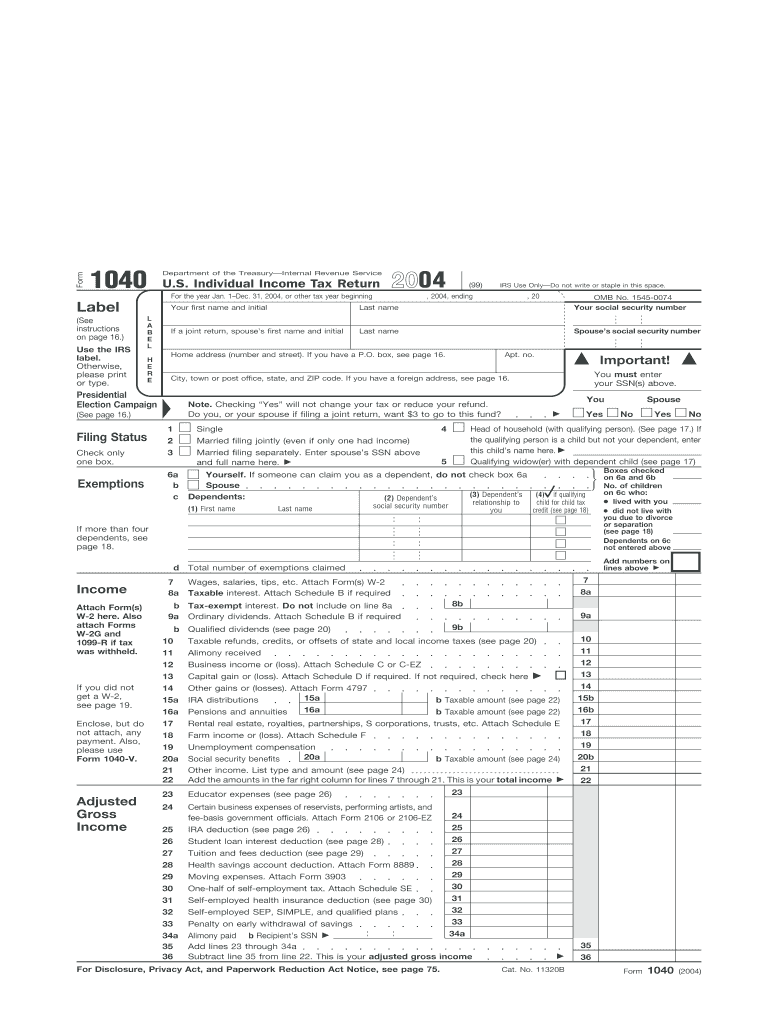

Irs Form 2004

What is the IRS Form

The IRS Form is an official document used by individuals and businesses to report financial information to the Internal Revenue Service (IRS). These forms are crucial for tax compliance, allowing the IRS to assess tax obligations accurately. Different types of IRS Forms serve various purposes, including income reporting, deductions, credits, and other tax-related activities. Each form has specific instructions and requirements that must be followed to ensure proper submission.

How to Use the IRS Form

Using the IRS Form involves several steps to ensure accurate completion and submission. First, identify the correct form for your tax situation, such as the 1040 for individual income tax or the W-2 for wage reporting. Next, gather all necessary financial documents, including W-2s, 1099s, and receipts for deductions. Carefully follow the instructions provided with the form, filling in all required fields accurately. Once completed, review the form for any errors before submitting it to the IRS.

Steps to Complete the IRS Form

Completing the IRS Form requires a systematic approach:

- Gather all necessary documents, including income statements and deduction records.

- Select the appropriate form based on your filing status and financial situation.

- Carefully read the instructions that accompany the form to understand what information is required.

- Fill out the form, ensuring that all information is accurate and complete.

- Review the completed form for any mistakes or omissions.

- Submit the form by the deadline, either online or by mail, as specified by the IRS.

Legal Use of the IRS Form

The IRS Form must be used in compliance with federal tax laws. It is essential to ensure that all information provided is truthful and accurate, as submitting false information can lead to penalties. The form serves as a legal declaration of income and deductions, and it is subject to review by the IRS. Understanding the legal implications of completing the form correctly is crucial for avoiding potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for IRS Forms vary depending on the type of form and the taxpayer's situation. Generally, individual tax returns are due on April fifteenth of each year. However, if that date falls on a weekend or holiday, the deadline may be extended. It is important to keep track of these deadlines to avoid late fees and penalties. Additionally, certain forms may have different deadlines, such as those related to business taxes or estimated tax payments.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the IRS Form, including:

- Online Submission: Many forms can be filed electronically using IRS-approved software or through the IRS website.

- Mail Submission: Completed forms can be printed and sent via postal mail to the appropriate IRS address.

- In-Person Submission: Some taxpayers may choose to submit their forms in person at designated IRS offices, although this option may be limited.

Quick guide on how to complete 2004 irs form

Complete Irs Form effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as it allows you to find the necessary form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly and without interruptions. Manage Irs Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Irs Form with ease

- Find Irs Form and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Irs Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2004 irs form

Create this form in 5 minutes!

How to create an eSignature for the 2004 irs form

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is an IRS Form and how can airSlate SignNow help with it?

An IRS Form is a document used by individuals or businesses to report financial information to the Internal Revenue Service. airSlate SignNow simplifies the process of electronically signing and sending these forms, ensuring you can complete and submit your IRS Form quickly and securely.

-

Is airSlate SignNow compliant with IRS regulations for electronic signatures?

Yes, airSlate SignNow is compliant with IRS regulations, allowing you to electronically sign IRS Forms with confidence. Our platform meets the security and authenticity requirements outlined by the IRS, making it a reliable choice for your document signing needs.

-

What features does airSlate SignNow offer for handling IRS Forms?

airSlate SignNow provides a range of features tailored for IRS Forms, including customizable templates, an easy-to-use interface, and tracking capabilities. You can create, send, and sign documents efficiently, helping you streamline your tax reporting process.

-

Can I integrate airSlate SignNow with other accounting software for IRS Forms?

Absolutely! airSlate SignNow can integrate with various accounting software programs, facilitating seamless document management for your IRS Forms. This integration allows you to streamline your workflow, making it easy to access and sign your forms directly from your accounting tools.

-

What are the pricing options for using airSlate SignNow for IRS Forms?

airSlate SignNow offers flexible pricing plans designed to suit different business needs. Whether you're a freelancer or a larger organization, you can choose a plan that meets your requirements for managing and signing IRS Forms efficiently.

-

How does airSlate SignNow enhance the security of IRS Forms?

Security is a top priority for airSlate SignNow when handling IRS Forms. Our platform employs advanced encryption and compliance measures to ensure your documents are protected during transmission and storage, giving you peace of mind when signing sensitive tax documents.

-

Can I access airSlate SignNow from my mobile device to manage IRS Forms?

Yes, airSlate SignNow is fully compatible with mobile devices, allowing you to manage and sign your IRS Forms on the go. Our mobile app ensures you can send documents and get them signed anywhere, anytime, enhancing your efficiency and convenience.

Get more for Irs Form

Find out other Irs Form

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online