941 Form 2014

What is the 941 Form

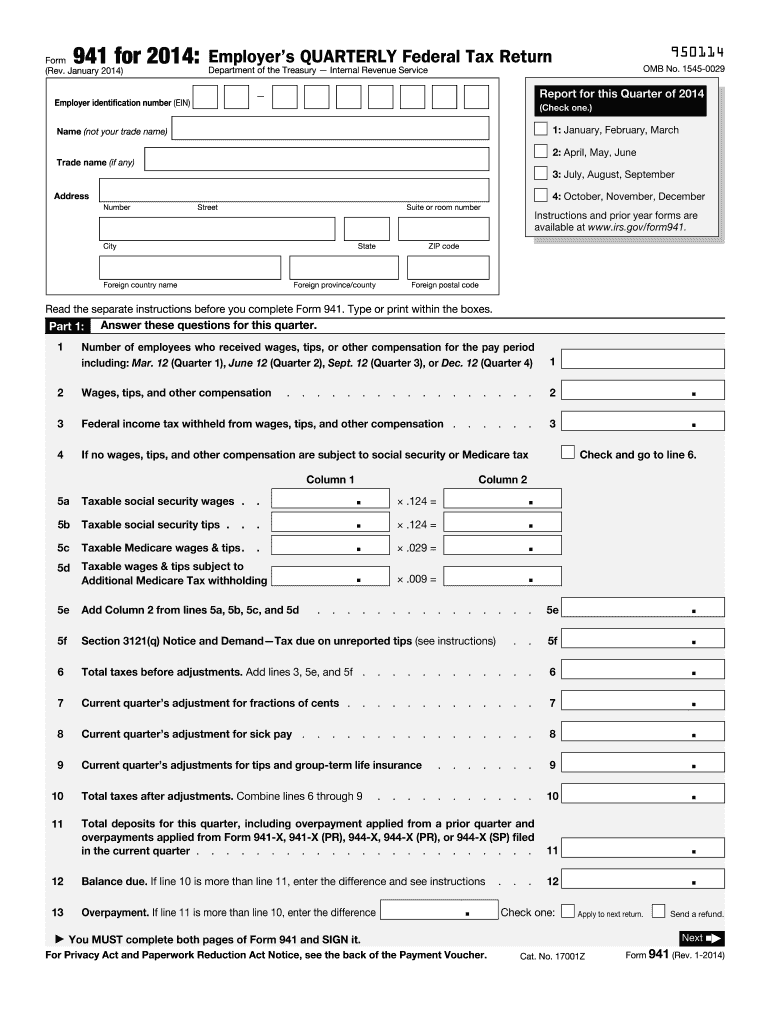

The 941 Form, officially known as the Employer's Quarterly Federal Tax Return, is a crucial document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is filed quarterly and provides the Internal Revenue Service (IRS) with essential information regarding an employer's payroll tax obligations. Employers must accurately complete and submit this form to ensure compliance with federal tax laws.

How to use the 941 Form

To use the 941 Form effectively, employers need to gather necessary payroll information for the quarter, including total wages paid, tips reported, and the amount of federal income tax withheld. The form requires employers to report the number of employees, the total taxable wages, and the taxes owed. Employers can fill out the form manually or use electronic filing options available through IRS-approved software, which can simplify the process and reduce errors.

Steps to complete the 941 Form

Completing the 941 Form involves several steps:

- Gather payroll records for the quarter, including wages, tips, and taxes withheld.

- Fill in the employer identification information at the top of the form.

- Report the total number of employees and taxable wages in the designated sections.

- Calculate the total taxes owed, including Social Security and Medicare taxes.

- Sign and date the form, certifying that the information provided is accurate.

Employers should ensure that all calculations are accurate to avoid penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the 941 Form are critical for compliance. Employers must submit the form by the last day of the month following the end of each quarter. The deadlines are as follows:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

Timely filing helps avoid penalties and ensures that employers remain compliant with IRS regulations.

Legal use of the 941 Form

The 941 Form is legally required for all employers who withhold federal income tax, Social Security tax, or Medicare tax from employee wages. Failure to file this form can result in significant penalties, including fines and interest on unpaid taxes. Employers must ensure that the information reported is accurate and complete to maintain compliance with federal tax laws. The form serves as an official record of tax obligations and payments made to the IRS.

Form Submission Methods

Employers have several options for submitting the 941 Form. The form can be filed electronically through IRS-approved software, which is often the preferred method due to its efficiency and accuracy. Alternatively, employers can submit a paper version of the form by mailing it to the appropriate IRS address based on their location. In-person submission is not typically available for this form. Employers should choose the method that best suits their needs while ensuring compliance with filing deadlines.

Quick guide on how to complete 2014 941 form

Effortlessly Prepare 941 Form on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute to traditional printed and signed documents, as it allows you to access the appropriate form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents rapidly without delays. Manage 941 Form on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The Easiest Way to Modify and eSign 941 Form Without Effort

- Locate 941 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or redact sensitive information with the tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from your chosen device. Alter and eSign 941 Form while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 941 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 941 form

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is a 941 Form and why is it important?

The 941 Form, also known as the Employer's Quarterly Federal Tax Return, is a crucial document for employers in the United States. It reports income taxes, Social Security tax, and Medicare tax withheld from employee wages. Understanding the 941 Form is essential for compliance with federal tax regulations.

-

How can airSlate SignNow help with completing the 941 Form?

airSlate SignNow streamlines the process of preparing and eSigning the 941 Form by providing a user-friendly platform for document management. With our solution, you can easily fill out the form, securely share it with your team, and get it signed electronically. This efficiency helps reduce errors and save time.

-

Is airSlate SignNow a cost-effective solution for submitting the 941 Form?

Yes, airSlate SignNow offers competitive pricing plans designed to suit various business needs. Our cost-effective solution ensures you can manage the 941 Form and other essential documents without breaking the bank. Investing in airSlate SignNow can ultimately lead to signNow savings in time and resources.

-

What features does airSlate SignNow offer to enhance my 941 Form submissions?

airSlate SignNow includes features such as eSignature, automated workflows, and document templates to simplify your 941 Form submissions. These tools enhance collaboration and ensure that all necessary steps are taken before sending out the form. Our platform is designed to make the entire process seamless and efficient.

-

Can I integrate airSlate SignNow with other software for 941 Form management?

Absolutely! airSlate SignNow seamlessly integrates with a variety of third-party applications to optimize your 941 Form management. Whether using accounting software or HR management tools, our integrations allow for a streamlined workflow. This ensures that you can easily access and manage all your document needs in one place.

-

What benefits can I expect when using airSlate SignNow for the 941 Form?

Using airSlate SignNow for the 941 Form streamlines the document preparation process, enhances compliance, and allows for real-time tracking of submissions. The eSigning feature ensures that you receive signed documents quickly, boosting overall productivity. These benefits contribute to a more organized and efficient business operation.

-

Is my data secure when using airSlate SignNow for the 941 Form?

Yes, data security is a top priority at airSlate SignNow. We implement advanced security protocols, including encryption and secure access controls, to protect sensitive information related to your 941 Form. You can eSign and manage your documents with confidence, knowing that your data is safe.

Get more for 941 Form

- Maharashtra veterinary council form

- Wegmans application pdf form

- Chargeback form

- Dr d y patil vidyapeeth dpu edu form

- Request letter to bank manager for home loan disbursement form

- Application format for canteen contract

- Hdfc credit card expired renewal online form

- Annexure i letter of acceptance to be furnished on the form

Find out other 941 Form

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online