941 Form 2013

What is the 941 Form

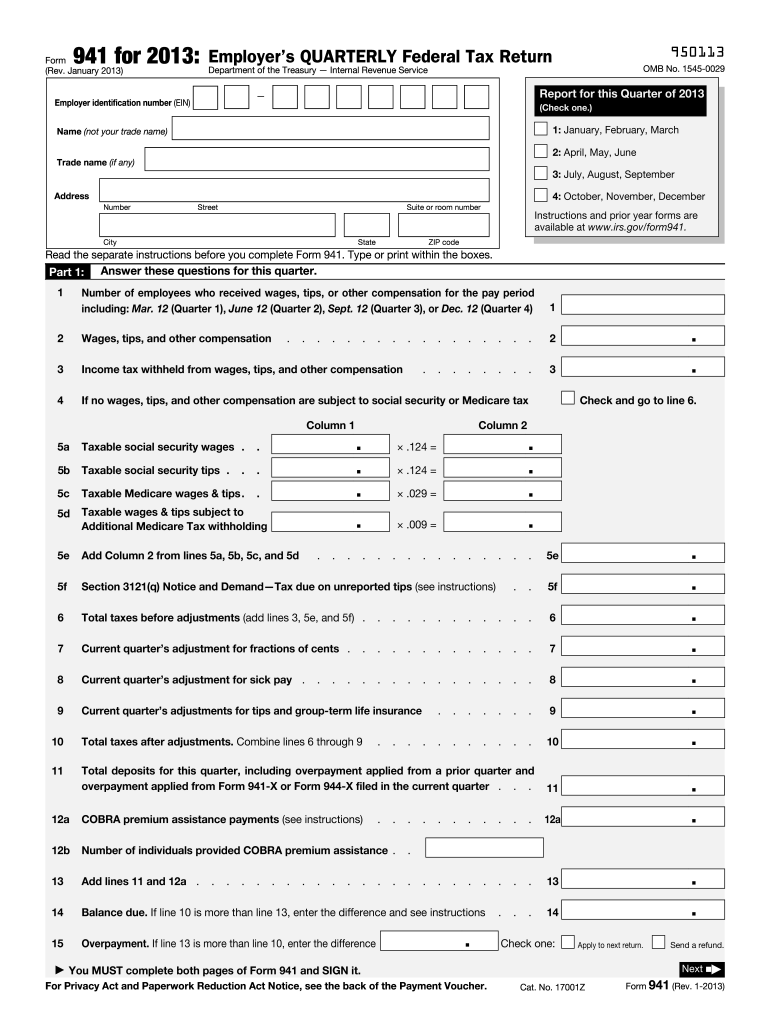

The 941 Form, officially known as the Employer's Quarterly Federal Tax Return, is a crucial document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. This form is filed quarterly, allowing the IRS to track the amount of taxes owed and collected from employers. It is essential for maintaining compliance with federal tax regulations and ensuring accurate reporting of employee wages and tax withholdings.

Steps to complete the 941 Form

Completing the 941 Form involves several key steps to ensure accuracy and compliance. Here is a straightforward guide:

- Gather necessary information: Collect details about your business, including the Employer Identification Number (EIN), total wages paid, and taxes withheld for the quarter.

- Fill out the form: Enter the required information in the designated sections, such as the number of employees, total wages, and tax amounts.

- Calculate tax liability: Determine the total taxes owed by adding the amounts for Social Security and Medicare taxes, and account for any adjustments.

- Review and verify: Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the form: File the completed 941 Form with the IRS by the specified deadline, either electronically or via mail.

How to obtain the 941 Form

The 941 Form can be easily obtained through various channels. Employers can download the form directly from the IRS website, where it is available in PDF format. Additionally, many tax preparation software programs include the 941 Form, allowing for seamless integration into the filing process. It is important to ensure you are using the most current version of the form to comply with any updates or changes in tax regulations.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 941 Form is essential for compliance. The form is due four times a year, with specific deadlines for each quarter:

- First quarter (January - March): Due by April 30

- Second quarter (April - June): Due by July 31

- Third quarter (July - September): Due by October 31

- Fourth quarter (October - December): Due by January 31 of the following year

Filing late can result in penalties, so it is crucial to adhere to these deadlines.

Legal use of the 941 Form

The 941 Form serves as a legally binding document when completed accurately and submitted on time. It is essential for employers to understand that this form not only reports tax information but also fulfills legal obligations under federal employment tax laws. Proper completion and timely submission help avoid penalties and ensure compliance with IRS regulations, protecting both the employer and employees.

Penalties for Non-Compliance

Failure to file the 941 Form on time or inaccuracies in the information reported can lead to significant penalties. The IRS imposes fines based on the length of the delay in filing and the amount of tax owed. Employers may face a penalty of five percent of the unpaid tax for each month the form is late, up to a maximum of 25 percent. Additionally, inaccuracies can result in further penalties, making it crucial for employers to ensure the form is filled out correctly and submitted promptly.

Quick guide on how to complete 2013 941 form

Prepare 941 Form effortlessly on any device

The management of online documents has gained increased popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and safely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Manage 941 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and electronically sign 941 Form with ease

- Search for 941 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your edits.

- Choose your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign 941 Form to guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 941 form

Create this form in 5 minutes!

How to create an eSignature for the 2013 941 form

How to create an eSignature for your PDF file online

How to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What is a 941 Form and why do I need it?

The 941 Form is a crucial document used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Understanding how to properly fill out and submit the 941 Form is essential for compliance with IRS regulations. With airSlate SignNow, you can easily eSign your 941 Form and ensure timely submission.

-

How does airSlate SignNow simplify the 941 Form signing process?

airSlate SignNow streamlines the signing process for the 941 Form by allowing you to send, sign, and manage documents electronically. Our user-friendly platform enables you to easily fill out and eSign your 941 Form, reducing paperwork and saving time. Plus, the secure cloud storage ensures your documents are safe and accessible.

-

Is airSlate SignNow cost-effective for businesses needing to manage the 941 Form?

Yes, airSlate SignNow offers a cost-effective solution for businesses that need to manage the 941 Form and other documents. Our pricing plans are designed to fit various business sizes, ensuring you can efficiently eSign your forms without breaking the bank. Enjoy the benefits of electronic signatures and document management at an affordable rate.

-

Can I integrate airSlate SignNow with my accounting software for 941 Form processing?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easier to manage your 941 Form and other tax documents. This integration allows for automatic data transfer and ensures that your financial records are always up-to-date, enhancing efficiency in your business operations.

-

What features does airSlate SignNow offer for eSigning the 941 Form?

airSlate SignNow provides a variety of features specifically designed for eSigning the 941 Form, including customizable templates, in-person signing options, and advanced security measures. These features help ensure that your signing process is not only quick but also compliant with legal standards. Plus, you can track the status of your forms in real-time.

-

How can airSlate SignNow help me stay compliant with 941 Form regulations?

Using airSlate SignNow for your 941 Form assists in maintaining compliance with IRS regulations through secure eSigning and accurate document management. Our platform includes features that remind you of deadlines and allow for easy updates to your forms, ensuring that you meet all necessary filing requirements. Compliance has never been easier!

-

What devices can I use to access the 941 Form on airSlate SignNow?

You can access the 941 Form on airSlate SignNow from any device, including desktops, laptops, tablets, and smartphones. This flexibility allows you to eSign your forms wherever you are, ensuring that you can manage your documents on the go. Our platform is designed to be user-friendly across all devices.

Get more for 941 Form

- Iowa withholding annual vsp report iowa department of form

- Registration forms south carolina department of revenue

- Iowa department of revenue ia 706 iowa inheritanceestate form

- Form 5208d ampquotamended tax ampampamp wage reportampquot washington

- Abl 946 1350 44221026 sc department of revenue scgov form

- Form 89 350 20 3 1 000 rev

- State of south carolina department of revenue l 2087 form

- Form 72 010 20 3 1 000 rev

Find out other 941 Form

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe