941 Form 2016

What is the 941 Form

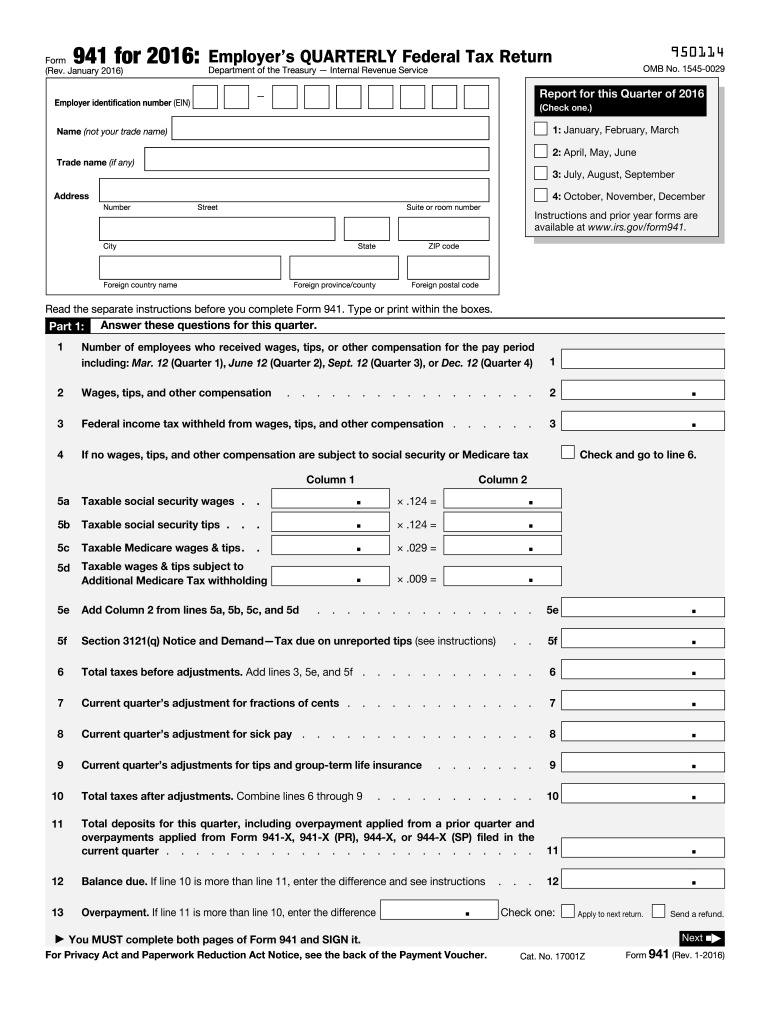

The 941 Form, officially known as the Employer's Quarterly Federal Tax Return, is a crucial document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is filed quarterly and provides the Internal Revenue Service (IRS) with essential information regarding an employer's payroll tax obligations. The 941 Form is vital for maintaining compliance with federal tax laws and ensuring that the correct amounts are being reported and paid.

How to use the 941 Form

Employers use the 941 Form to report the total amount of wages paid to employees, the taxes withheld, and the employer's share of Social Security and Medicare taxes. To use the form effectively, employers must accurately fill out each section, including the number of employees, total wages, and tax amounts. This information helps the IRS track tax liabilities and ensures that employers are meeting their tax responsibilities. Proper usage of the form also aids in avoiding penalties associated with incorrect reporting.

Steps to complete the 941 Form

Completing the 941 Form involves several key steps:

- Gather necessary information, including total wages paid, taxes withheld, and the number of employees.

- Fill out the form by entering the required details in each section, ensuring accuracy in calculations.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the IRS by the designated filing deadline.

Following these steps helps ensure that the form is completed correctly and submitted on time, minimizing the risk of penalties.

Filing Deadlines / Important Dates

The 941 Form must be filed quarterly, with specific deadlines for each quarter. The deadlines are as follows:

- First quarter (January to March): Due by April 30.

- Second quarter (April to June): Due by July 31.

- Third quarter (July to September): Due by October 31.

- Fourth quarter (October to December): Due by January 31 of the following year.

It is essential for employers to adhere to these deadlines to avoid late filing penalties and interest on unpaid taxes.

Legal use of the 941 Form

The 941 Form is legally binding when filed correctly and on time. Employers must ensure that all reported information is accurate and complete, as discrepancies can lead to audits or penalties. The form must be signed by an authorized individual within the organization, affirming the truthfulness of the information provided. Compliance with IRS regulations regarding the 941 Form is crucial for maintaining good standing with federal tax authorities.

Key elements of the 941 Form

Several key elements are essential to the 941 Form, including:

- Employer identification number (EIN): A unique number assigned to the business for tax purposes.

- Total wages paid: The gross amount of wages paid to employees during the reporting period.

- Taxes withheld: The total amount of federal income tax, Social Security tax, and Medicare tax withheld from employee wages.

- Employer's share of taxes: The employer's contribution to Social Security and Medicare taxes.

Understanding these elements helps employers complete the form accurately and fulfill their tax obligations.

Quick guide on how to complete 2016 941 form

Prepare 941 Form effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly and without issues. Handle 941 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign 941 Form with ease

- Locate 941 Form and click on Get Form to begin.

- Make use of the features we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information carefully and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign 941 Form while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 941 form

Create this form in 5 minutes!

How to create an eSignature for the 2016 941 form

How to make an eSignature for your 2016 941 Form online

How to make an eSignature for the 2016 941 Form in Chrome

How to create an eSignature for signing the 2016 941 Form in Gmail

How to generate an eSignature for the 2016 941 Form right from your smartphone

How to generate an electronic signature for the 2016 941 Form on iOS devices

How to create an electronic signature for the 2016 941 Form on Android devices

People also ask

-

What is the 941 Form and why is it important?

The 941 Form is a quarterly tax form used by employers to report income taxes withheld from employee paychecks, Social Security, and Medicare taxes. It's important because accurate submission of the 941 Form ensures compliance with IRS regulations and helps avoid penalties. Understanding the 941 Form is essential for businesses to maintain proper tax records.

-

How can airSlate SignNow help with completing the 941 Form?

airSlate SignNow streamlines the process of completing and submitting the 941 Form by allowing you to create, edit, and eSign documents easily. Our user-friendly platform ensures that all necessary information is accurately captured, which minimizes the risk of errors. Additionally, SignNow securely stores your documents for future reference.

-

Is airSlate SignNow a cost-effective solution for managing 941 Forms?

Yes, airSlate SignNow is a cost-effective solution designed to save your business time and money. By streamlining the process of completing the 941 Form, you reduce administrative overhead and improve efficiency. Our pricing plans are tailored to fit various budgets, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for handling the 941 Form?

airSlate SignNow offers features like customizable templates, electronic signatures, document sharing, and secure storage, all tailored for efficiently managing the 941 Form. Our platform also includes tracking and notifications that help you stay on top of important deadlines. These features enhance your ability to process tax documents smoothly.

-

Can I integrate airSlate SignNow with other software to manage the 941 Form?

Yes, airSlate SignNow easily integrates with a variety of third-party applications, including accounting and payroll software. This integration allows for seamless data transfer and helps automate the process of preparing the 941 Form. By centralizing your operations, you can enhance workflow efficiency and improve accuracy.

-

How secure is my information when using airSlate SignNow for the 941 Form?

The security of your information is a top priority at airSlate SignNow. Our platform uses robust encryption protocols and follows industry best practices to ensure that your 941 Form and related documents are protected from unauthorized access. You can confidently eSign and share sensitive documents knowing they are secure.

-

What support options are available for users managing the 941 Form with airSlate SignNow?

airSlate SignNow provides comprehensive customer support options, including live chat, email support, and a knowledge base filled with resources on managing the 941 Form. Our dedicated support team is available to help answer any questions you have, ensuring a smooth experience as you use our platform. We prioritize customer satisfaction and are here to assist you.

Get more for 941 Form

- How to full out a passport application form for stvincent and the grenadines guide

- Cna printable application form

- Social security application form

- Form adv part ii 253445

- Alabama form 40 2010

- Colorado state roads and highways historycolorado form

- Csairconditioninglicensestatetxus form

- Tdlr contractors license form

Find out other 941 Form

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile