Form 941 2011

What is the Form 941

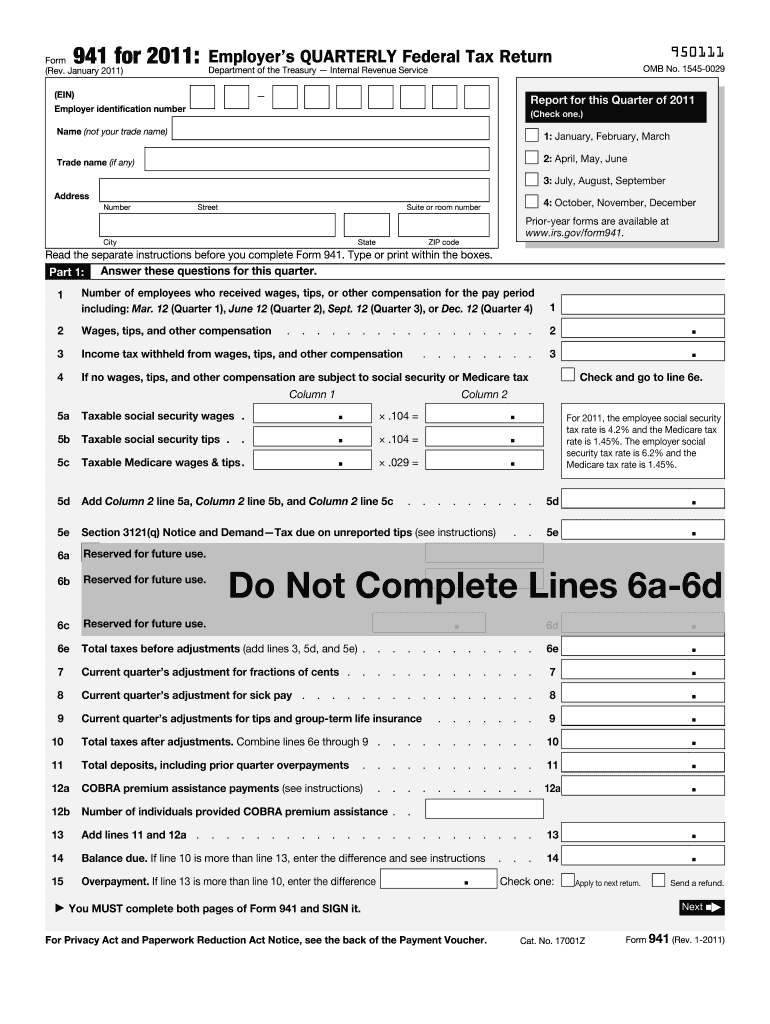

The Form 941, officially known as the Employer's Quarterly Federal Tax Return, is a crucial document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Employers must file this form quarterly, providing the IRS with essential information regarding their payroll tax obligations. The Form 941 also helps employers report the total taxable wages and the number of employees on their payroll, making it an essential tool for tax compliance.

How to use the Form 941

Using the Form 941 involves several steps to ensure accurate reporting of payroll taxes. Employers must first gather necessary information, including total wages paid, taxes withheld, and any adjustments for the quarter. The form requires details such as the employer's identification number (EIN), the number of employees, and the total tax liability for the quarter. After filling out the form, employers can submit it electronically or by mail, ensuring they meet the IRS filing deadlines.

Steps to complete the Form 941

Completing the Form 941 involves a series of methodical steps:

- Gather all necessary information, including your EIN, total wages, and taxes withheld.

- Fill out the form sections, including Part 1, which covers the number of employees and total taxes owed.

- Complete Part 2 for adjustments and credits, if applicable.

- Review the completed form for accuracy before submission.

- Submit the form electronically or by mail to the appropriate IRS address.

Legal use of the Form 941

The Form 941 is legally binding when filled out and submitted according to IRS regulations. Employers must ensure that all information provided is accurate and complete to avoid penalties. The form serves as an official record of payroll tax obligations and compliance with federal tax laws. Employers are required to retain copies of submitted forms for a minimum of four years, as they may be subject to audits by the IRS.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Form 941. The form is due on the last day of the month following the end of each quarter. The deadlines for the current tax year are:

- First quarter (January to March): April 30

- Second quarter (April to June): July 31

- Third quarter (July to September): October 31

- Fourth quarter (October to December): January 31 of the following year

Form Submission Methods

Employers have several options for submitting the Form 941. The most common methods include:

- Electronic filing through the IRS e-file system, which is secure and expedites processing.

- Mailing a paper copy of the form to the appropriate IRS address, depending on the employer's location.

- Using third-party payroll services that can file the form on behalf of the employer.

Quick guide on how to complete 2011 form 941

Effortlessly Prepare Form 941 on Any Device

The management of documents online has become increasingly popular among businesses and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed papers, as you can easily obtain the necessary form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Handle Form 941 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Modify and Electronically Sign Form 941 with Ease

- Find Form 941 and click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your edits.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns regarding lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 941 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form 941

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 941

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 941, and how can airSlate SignNow help with it?

Form 941 is the Employer's Quarterly Federal Tax Return that businesses must file to report income and payroll taxes. airSlate SignNow provides an easy-to-use platform that allows you to electronically sign and send Form 941 quickly, ensuring compliance and saving time in your filing process.

-

What features does airSlate SignNow offer for handling Form 941?

airSlate SignNow offers features like customizable templates, editable fields, and secure electronic signatures specifically for Form 941. These features streamline the completion and submission process, which reduces the risk of errors and enhances efficiency when managing tax documents.

-

Is airSlate SignNow a cost-effective solution for managing Form 941?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to manage Form 941. With flexible pricing plans, it allows companies of all sizes to save on printing, mailing costs, and administrative time associated with traditional paper forms.

-

Can I track the status of my Form 941 submissions with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Form 941 submissions in real-time. This means you can easily check if the document has been viewed, signed, or completed, providing peace of mind and better management of your tax documents.

-

Does airSlate SignNow integrate with other software to assist with Form 941?

Yes, airSlate SignNow offers integrations with popular accounting and payroll software, making it easy to manage Form 941 alongside your other financial operations. These integrations help streamline the workflow and reduce data entry errors by syncing information directly into your tax documents.

-

What are the security measures in place when signing Form 941 on airSlate SignNow?

Security is a top priority at airSlate SignNow. When signing Form 941, documents are protected with advanced encryption, ensuring that sensitive tax information remains confidential and secure throughout the signing process.

-

Can airSlate SignNow help with multiple Form 941 submissions for different employees?

Yes, airSlate SignNow simplifies the process of submitting multiple Form 941s for different employees. You can create reusable templates to expedite the completion and submission of forms for each employee, making your payroll tasks much more manageable.

Get more for Form 941

- Certificate of public convenience and necessity or nonemergency medical transportation service license certificate of public form

- Non profit organization information sheet

- Miami dade county public schools records management transcript request form student personal information name when attending

- Broward county platsite plan application platsite plan application form

- Broward county board of county commisioners form

- Building permitting ampamp inspections divisionfort myers fl form

- Plc reflection form

- Broward county veterinary report of deceased pet broward county veterinary report of deceased pet form

Find out other Form 941

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation