Irs Form 941 2008

What is the Irs Form 941

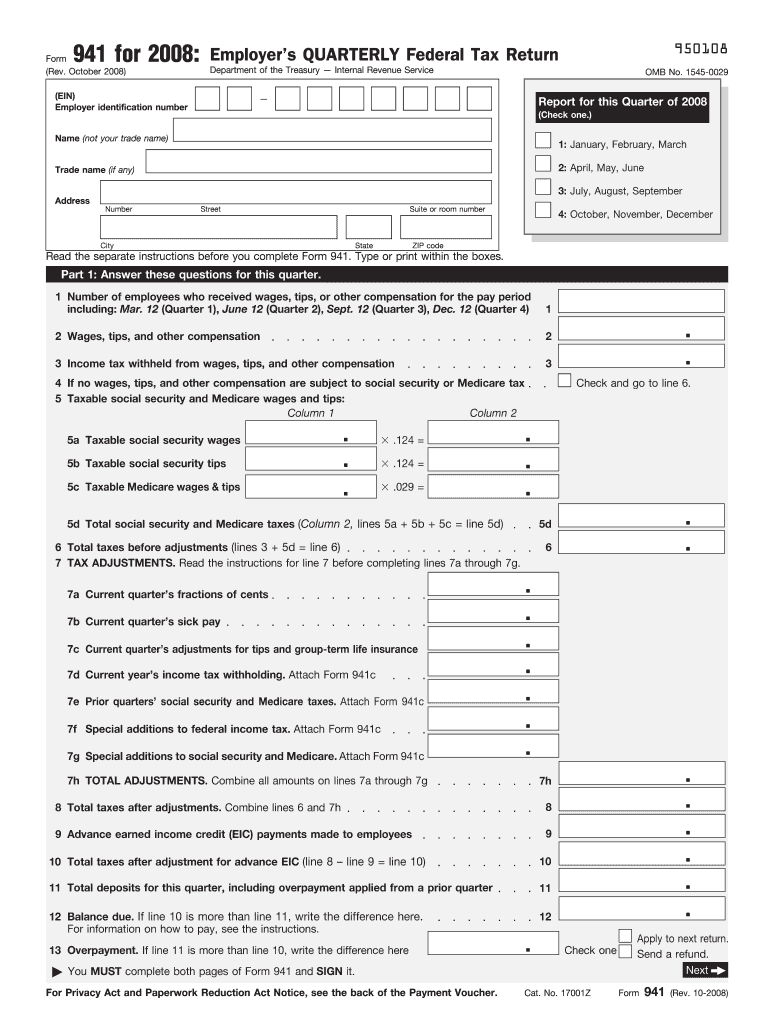

The Irs Form 941, also known as the Employer's Quarterly Federal Tax Return, is a crucial document for employers in the United States. This form is used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It also includes the employer's portion of Social Security and Medicare taxes. Businesses must file this form quarterly to ensure compliance with federal tax regulations.

How to use the Irs Form 941

To effectively use the Irs Form 941, employers need to gather all relevant payroll information for the reporting period. This includes total wages paid, tips, and other compensation, as well as the total amount of federal income tax withheld. Employers must accurately complete the form, ensuring all calculations are correct. Once completed, the form must be submitted to the IRS, either electronically or by mail, depending on the employer's preference and compliance requirements.

Steps to complete the Irs Form 941

Completing the Irs Form 941 involves several key steps:

- Gather necessary payroll records for the quarter, including wages and tax withholdings.

- Fill out the form by providing accurate data in each section, including employer identification information.

- Calculate total taxes owed, ensuring to include both employee and employer contributions.

- Review the form for accuracy before submission, checking for any errors in calculations or missing information.

- Submit the completed form to the IRS by the designated deadline, either electronically or via mail.

Legal use of the Irs Form 941

The legal use of the Irs Form 941 is essential for maintaining compliance with federal tax laws. Employers are required to file this form quarterly to report taxes withheld from employee wages. Failure to file or inaccuracies in reporting can lead to penalties and interest charges. It is important for employers to understand their obligations under the law and ensure that the form is completed accurately and submitted on time.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Form 941 are crucial for employers to avoid penalties. The form must be filed quarterly, with specific deadlines for each quarter:

- First quarter (January to March): Due by April 30.

- Second quarter (April to June): Due by July 31.

- Third quarter (July to September): Due by October 31.

- Fourth quarter (October to December): Due by January 31 of the following year.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Irs Form 941. The form can be filed electronically through the IRS e-file system, which is often the preferred method due to its speed and efficiency. Alternatively, employers may choose to mail the completed form to the appropriate IRS address based on their location. In-person submission is generally not an option for this form, as the IRS encourages electronic filing for quicker processing.

Quick guide on how to complete 2008 irs form 941

Complete Irs Form 941 effortlessly on any device

Digital document management has gained traction among enterprises and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and safely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Irs Form 941 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to alter and electronically sign Irs Form 941 without hassle

- Locate Irs Form 941 and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just moments and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Irs Form 941 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2008 irs form 941

Create this form in 5 minutes!

How to create an eSignature for the 2008 irs form 941

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is IRS Form 941 and why is it important?

IRS Form 941 is a quarterly tax return used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It is crucial for compliance with federal tax regulations, ensuring that employers fulfill their tax obligations accurately and on time. Understanding how to correctly fill out IRS Form 941 can help businesses avoid penalties and maintain good standing with the IRS.

-

How can airSlate SignNow assist with IRS Form 941?

airSlate SignNow streamlines the process of completing and eSigning IRS Form 941 by providing an intuitive platform for document management. With features like templates and electronic signatures, businesses can easily prepare, sign, and share their IRS Form 941 with relevant parties. This reduces the time spent on paperwork and enhances efficiency in tax reporting.

-

What features does airSlate SignNow offer for managing IRS Form 941?

airSlate SignNow offers a variety of features tailored for managing IRS Form 941, including document templates, secure eSigning, and real-time collaboration. These tools allow users to customize their forms, gather signatures quickly, and keep track of submissions, ensuring that your IRS Form 941 is handled efficiently and securely. Additionally, the platform provides reminders to help you stay on top of deadlines.

-

Is airSlate SignNow cost-effective for small businesses filing IRS Form 941?

Yes, airSlate SignNow provides a cost-effective solution for small businesses needing to file IRS Form 941. With competitive pricing plans, businesses can choose the option that best fits their needs without sacrificing crucial features. Investing in airSlate SignNow can save time and reduce errors, ultimately leading to cost savings during tax season.

-

Can I integrate airSlate SignNow with other accounting software for IRS Form 941?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and payroll software, making it easier to manage your IRS Form 941 alongside your financial records. This integration ensures that all your data is synchronized, allowing for a more streamlined filing process and minimizing the risk of discrepancies.

-

What are the benefits of using airSlate SignNow for IRS Form 941 submissions?

Using airSlate SignNow for IRS Form 941 submissions offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform simplifies the eSignature process, ensuring that all necessary signatures are obtained quickly. Additionally, users can access their documents anytime, anywhere, which is essential for meeting IRS deadlines.

-

Is electronic filing of IRS Form 941 allowed with airSlate SignNow?

While airSlate SignNow simplifies the signing and management of IRS Form 941, the actual submission of the form must be done through the IRS e-File system. However, airSlate SignNow ensures that your documents are properly prepared and signed before you file electronically, making the entire process more efficient.

Get more for Irs Form 941

Find out other Irs Form 941

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage