941 Form 2010

What is the 941 Form

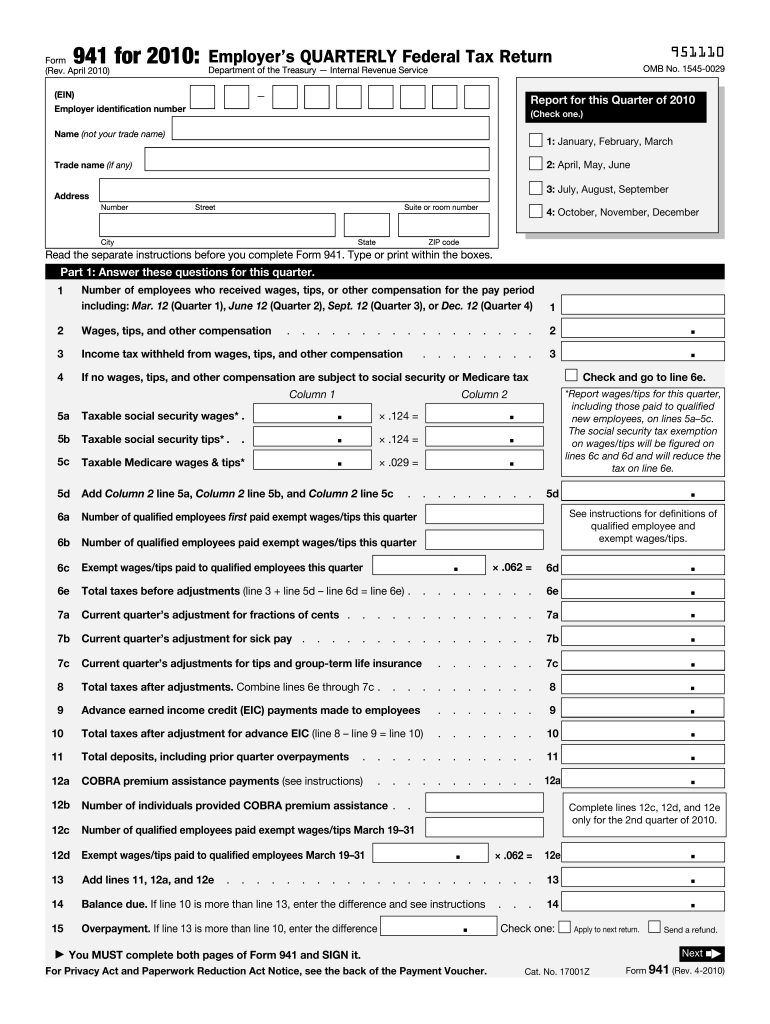

The 941 Form, officially known as the Employer's Quarterly Federal Tax Return, is a tax document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. This form is essential for businesses to accurately report their payroll taxes to the Internal Revenue Service (IRS) on a quarterly basis. Employers must file this form to ensure compliance with federal tax regulations and to avoid potential penalties.

How to use the 941 Form

To use the 941 Form, employers must gather all necessary payroll information for the quarter, including total wages paid, tips reported, and the amount of federal income tax withheld. The form requires detailed entries for each employee, including their Social Security numbers and wages. After completing the form, employers can submit it electronically or by mail, depending on their preference. Accurate completion is crucial to ensure that the correct amounts are reported and that the business remains compliant with tax laws.

Steps to complete the 941 Form

Completing the 941 Form involves several key steps:

- Gather payroll records for the quarter, including wages, tips, and tax withholdings.

- Fill out the employer identification information at the top of the form.

- Report the total number of employees and the total wages paid during the quarter.

- Calculate the amounts for federal income tax withheld, Social Security tax, and Medicare tax.

- Complete the section on any adjustments for the quarter, if applicable.

- Sign and date the form to certify accuracy before submission.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the 941 Form to avoid penalties. The form is due on the last day of the month following the end of each quarter. For instance:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

Legal use of the 941 Form

The 941 Form is legally binding when completed accurately and submitted on time. Employers must ensure that all reported information is truthful and complies with IRS regulations. Failure to file the form correctly can result in penalties, including fines and interest on unpaid taxes. It is crucial for businesses to maintain accurate records and consult legal or tax professionals if there are uncertainties regarding compliance.

Who Issues the Form

The 941 Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and updates regarding the form, including any changes in tax laws or filing procedures. Employers can access the form and related instructions directly from the IRS website or through authorized tax professionals.

Quick guide on how to complete 2010 941 form

Complete 941 Form effortlessly on any gadget

Web-based document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage 941 Form on any gadget using the airSlate SignNow Android or iOS applications, and simplify any document-related task today.

How to modify and eSign 941 Form without any hassle

- Obtain 941 Form and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just moments and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require you to print new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Edit and eSign 941 Form while ensuring excellent communication throughout your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 941 form

Create this form in 5 minutes!

How to create an eSignature for the 2010 941 form

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is a 941 Form and why do I need it?

The 941 Form is a quarterly tax return that businesses must file to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It's essential for ensuring compliance with IRS regulations and accurately calculating your tax liabilities.

-

How can airSlate SignNow help me with my 941 Form?

airSlate SignNow streamlines the process of completing and signing your 941 Form by providing easy-to-use electronic signature features. You can quickly send your 941 Form for signatures, ensuring you meet deadlines while maintaining compliance with tax regulations.

-

Is airSlate SignNow cost-effective for managing 941 Forms?

Yes, airSlate SignNow offers affordable pricing plans that cater to businesses of all sizes. By choosing our service, you can save time and resources when managing your 941 Form and other documentation.

-

What features does airSlate SignNow provide for 941 Form processing?

airSlate SignNow offers a range of features for 941 Form processing, including customizable templates, cloud storage, and automated reminders for signatures. These features enhance efficiency and help ensure that your form is submitted on time.

-

Can I integrate airSlate SignNow with my current accounting software for 941 Forms?

Absolutely! airSlate SignNow supports integrations with various accounting software platforms, allowing you to seamlessly manage your 941 Form alongside your financial documents. This integration enhances overall workflow efficiency.

-

What are the benefits of using eSignatures for my 941 Form?

Using eSignatures for your 941 Form provides faster turnaround times and reduces paper usage, leading to a more environmentally-friendly process. It also ensures that your documents are secure and accessible from anywhere.

-

How secure is the information I submit with my 941 Form via airSlate SignNow?

Security is a top priority for airSlate SignNow. We implement robust encryption and data protection measures to ensure that all information submitted with your 941 Form is secure and compliant with industry standards.

Get more for 941 Form

- Alternative coverage form

- Ma small group employer welcome kit tufts health plan form

- Mpc120915 2a nppcp papcp contracting application 419 request for taxpayer identification number and certification form

- For behavioral health professionals form

- Contracting applications provider central blue cross blue form

- What is tihttpsproviderbluecrossmacom form

- Idampampr and data collections handbook georgia department form

- Athlete medical form

Find out other 941 Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF