941 Form 2006

What is the 941 Form

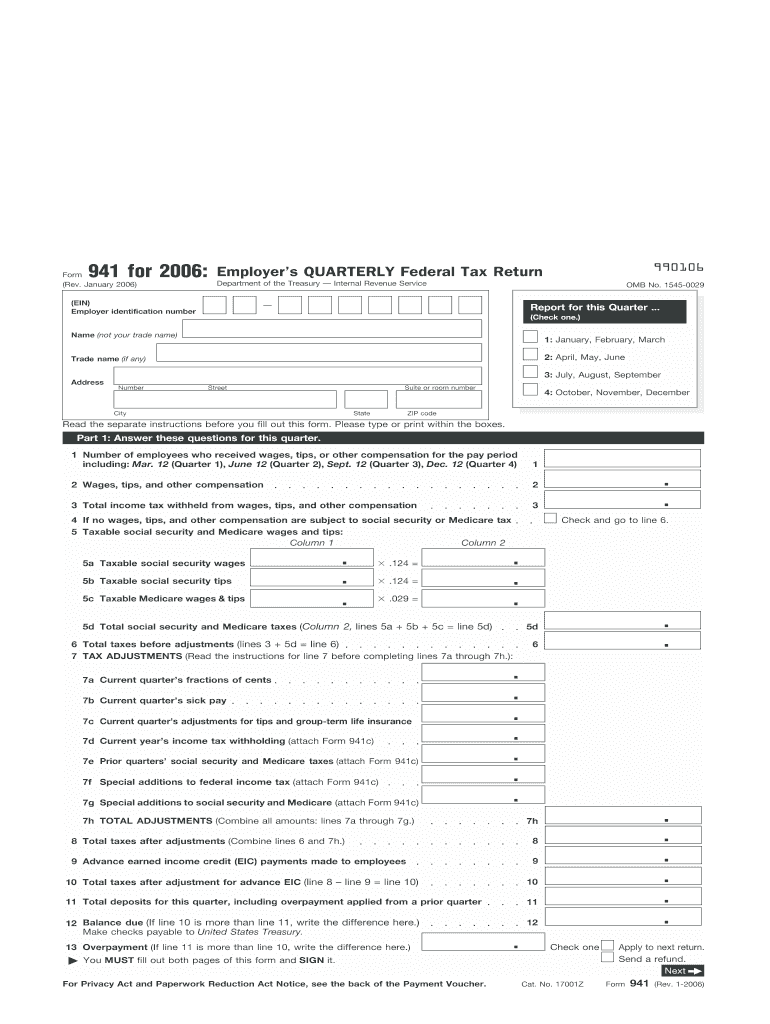

The 941 Form, officially known as the Employer's Quarterly Federal Tax Return, is a crucial document used by employers in the United States. It is filed quarterly to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. This form also includes the employer's share of Social Security and Medicare taxes. Understanding the 941 Form is essential for compliance with federal tax regulations and for maintaining accurate payroll records.

Steps to complete the 941 Form

Completing the 941 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll information, including total wages paid, tips received, and any adjustments for the quarter. Next, fill out the form by entering the appropriate figures in the designated boxes. It is important to calculate the total taxes owed accurately, including both withheld employee taxes and the employer's contributions. Finally, review the completed form for any errors before submission.

How to obtain the 941 Form

The 941 Form can be easily obtained through the Internal Revenue Service (IRS) website. It is available as a downloadable PDF, which can be printed and filled out manually. Alternatively, employers can access the form through various tax preparation software that offers electronic filing options. Ensuring that you have the most current version of the form is vital, as updates may occur periodically.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the 941 Form. The filing due dates are typically the last day of the month following the end of each quarter. For example, the deadlines for the 2023 tax year are April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 of the following year for the fourth quarter. Missing these deadlines may result in penalties and interest on unpaid taxes.

Legal use of the 941 Form

The 941 Form is legally binding when completed and submitted according to IRS guidelines. Employers must ensure that all information provided is accurate and truthful to avoid potential legal consequences. Additionally, electronic filing through compliant platforms can enhance security and streamline the submission process, ensuring that the form meets legal standards for electronic documents.

Key elements of the 941 Form

Several key elements must be included when filling out the 941 Form. These include the employer's identification information, total wages paid, taxes withheld, and any adjustments for the quarter. Employers must also report the number of employees and calculate the total tax liability. Each section of the form is designed to capture specific information necessary for accurate tax reporting.

Quick guide on how to complete 2006 941 form

Effortlessly Prepare 941 Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, enabling you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage 941 Form on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

The Easiest Way to Modify and eSign 941 Form Seamlessly

- Obtain 941 Form and click on Get Form to begin.

- Use the available tools to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about missing or misplaced documents, repetitive form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and eSign 941 Form and ensure outstanding communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2006 941 form

Create this form in 5 minutes!

How to create an eSignature for the 2006 941 form

How to generate an eSignature for a PDF in the online mode

How to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is the 941 Form and why is it important for businesses?

The 941 Form is a quarterly tax return that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Understanding the 941 Form is crucial for businesses to ensure compliance with IRS regulations and avoid penalties. Utilizing tools like airSlate SignNow can streamline the process of preparing and signing the 941 Form electronically.

-

How can airSlate SignNow help me manage my 941 Form submissions?

airSlate SignNow simplifies the management of your 941 Form submissions by allowing you to create, send, and eSign documents seamlessly. With its user-friendly interface, you can easily fill out your 941 Form and send it directly to your accountant or employees for signing. This not only saves time but also enhances the accuracy of your submissions.

-

Is there a cost associated with using airSlate SignNow for the 941 Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including features tailored for handling the 941 Form. Our plans include essential tools for document management and electronic signatures, which can signNowly reduce the time and cost associated with traditional paper-based processes. Explore our pricing page for detailed information on the costs.

-

What features does airSlate SignNow offer for completing the 941 Form?

airSlate SignNow provides several features that enhance your experience with the 941 Form, including customizable templates, secure eSigning, and tracking capabilities. You can create a digital version of your 941 Form, add necessary fields, and send it for signatures, all in one platform. This ensures that your forms are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other software to handle my 941 Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software, making it easy to manage your 941 Form alongside your other financial documents. This integration allows for automatic data entry and reduces the risk of errors, streamlining your entire workflow.

-

How secure is my information when using airSlate SignNow for the 941 Form?

Security is a top priority at airSlate SignNow. When handling your 941 Form and other sensitive documents, we utilize advanced encryption and secure cloud storage to protect your information. You can trust that your data is safe with us, ensuring compliance with privacy regulations.

-

Can I track the status of my 941 Form with airSlate SignNow?

Yes, airSlate SignNow offers comprehensive tracking features that allow you to monitor the status of your 941 Form throughout the signing process. You can see when the document has been sent, viewed, and signed, giving you complete visibility and peace of mind as you manage your tax submissions.

Get more for 941 Form

- Lansing individual income tax forms and instructions

- Kentucky tax registration application payoptions form

- Due date update wisconsin department of revenue form

- Dor property tax exemption forms wisconsin department

- 2020 form 512e oklahoma return of organization exempt from income tax

- 2020 511nr packet instructions oklahoma individual income form and instructions for nonresidents and part year residents

- Business tax registration wisconsin department of revenue form

- Free form m1 individual income tax return printable free

Find out other 941 Form

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer