Form 941 Rev March Employer's Quarterly Federal Tax Return 2023

What is the Form 941 Rev March Employer's Quarterly Federal Tax Return

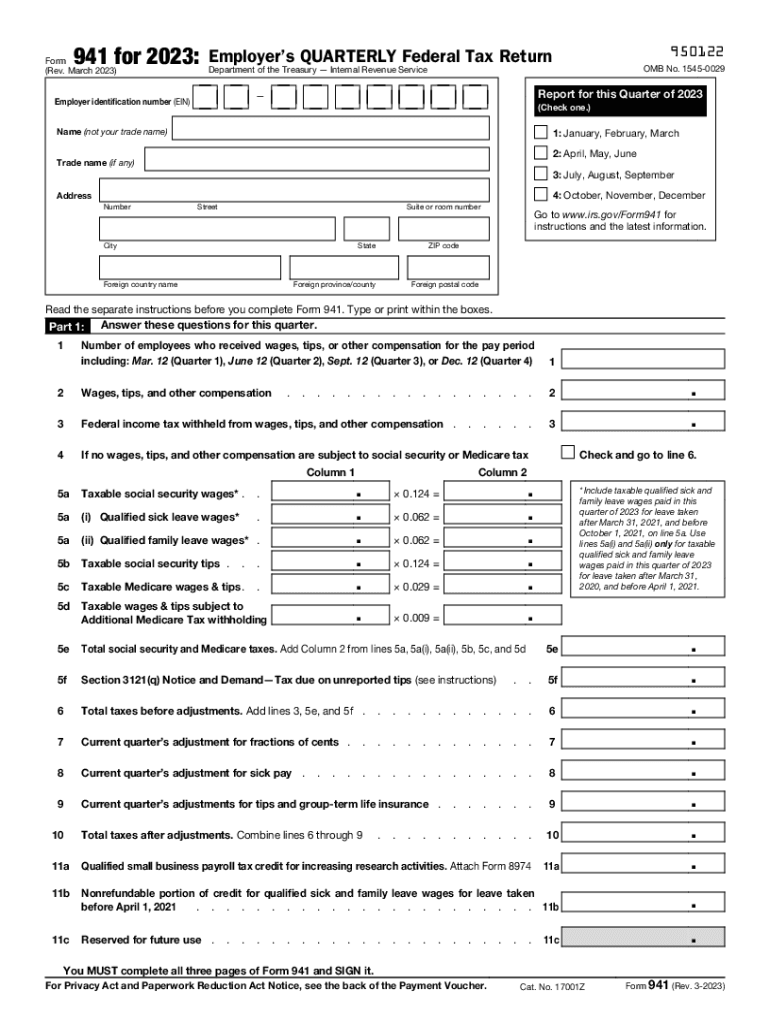

The Form 941, also known as the Employer's Quarterly Federal Tax Return, is a crucial document that employers in the United States are required to file with the Internal Revenue Service (IRS). This form is used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It also reports the employer’s portion of Social Security and Medicare taxes. The 941 form is essential for businesses to ensure compliance with federal tax obligations and to maintain accurate records of payroll taxes.

Steps to complete the Form 941 Rev March Employer's Quarterly Federal Tax Return

Completing the Form 941 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including total wages paid, tips, and other compensation. Next, calculate the total taxes withheld for the quarter, including federal income tax, Social Security tax, and Medicare tax. After filling in the required fields, review the form for accuracy. Finally, sign and date the form before submitting it to the IRS. It's important to keep a copy for your records.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when submitting Form 941 to avoid penalties. The form is due on the last day of the month following the end of each quarter. For instance, the deadlines for 2020 were April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 of the following year for the fourth quarter. Staying aware of these dates is crucial for maintaining compliance with IRS regulations.

Legal use of the Form 941 Rev March Employer's Quarterly Federal Tax Return

The legal use of Form 941 is vital for employers to fulfill their tax obligations. This form must be filed accurately and on time to avoid penalties and interest charges. The IRS considers the information reported on Form 941 as legally binding, making it essential for employers to ensure that all figures are correct and that the form is signed by an authorized individual. Compliance with IRS regulations regarding Form 941 helps protect businesses from audits and potential legal issues.

How to obtain the Form 941 Rev March Employer's Quarterly Federal Tax Return

Employers can obtain the Form 941 through the IRS website, where it is available as a downloadable PDF. Additionally, tax software programs often include the form as part of their features, making it easier for businesses to fill it out electronically. For those who prefer paper forms, they can be requested directly from the IRS or obtained from tax professionals. It is important to ensure that you are using the most current version of the form to comply with IRS requirements.

Form Submission Methods (Online / Mail / In-Person)

Employers have multiple options for submitting Form 941 to the IRS. The form can be filed electronically through the IRS e-file system, which is a convenient and efficient method. Alternatively, businesses can mail the completed form to the appropriate IRS address based on their location. In-person submission is generally not available for Form 941, as the IRS encourages electronic filing for faster processing. Each method has its own guidelines, so it's important to follow the instructions provided by the IRS.

Quick guide on how to complete form 941 rev march employers quarterly federal tax return

Complete Form 941 Rev March Employer's Quarterly Federal Tax Return effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can access the appropriate template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle Form 941 Rev March Employer's Quarterly Federal Tax Return on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to alter and eSign Form 941 Rev March Employer's Quarterly Federal Tax Return with ease

- Find Form 941 Rev March Employer's Quarterly Federal Tax Return and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, frustrating form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in several clicks from any device you prefer. Modify and eSign Form 941 Rev March Employer's Quarterly Federal Tax Return and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 rev march employers quarterly federal tax return

Create this form in 5 minutes!

How to create an eSignature for the form 941 rev march employers quarterly federal tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 941 form 2020 pdf?

The 941 form 2020 pdf is a quarterly tax form used by employers to report income taxes, social security tax, and Medicare tax withheld from employee wages. It is essential for accurate payroll reporting and tax compliance. Submitting the form in its PDF format streamlines the filing process and ensures that the information is easily accessible.

-

How can airSlate SignNow help with the 941 form 2020 pdf?

airSlate SignNow simplifies the process of signing and managing the 941 form 2020 pdf. Our platform allows users to quickly upload, eSign, and share the form securely with relevant parties. This enhances productivity and reduces delays associated with traditional paper document handling.

-

Is airSlate SignNow a cost-effective solution for handling the 941 form 2020 pdf?

Yes, airSlate SignNow offers competitive pricing that makes it a cost-effective solution for managing the 941 form 2020 pdf and other documents. Our subscription plans cater to businesses of all sizes, ensuring that everyone can benefit from our easy-to-use electronic signature capabilities without breaking the bank.

-

What features does airSlate SignNow include for the 941 form 2020 pdf?

airSlate SignNow comes equipped with features like real-time collaboration, secure eSigning, document tracking, and templates, all of which facilitate the management of the 941 form 2020 pdf. These features ensure that users can complete their forms accurately and efficiently while also maintaining security and compliance.

-

Can I integrate airSlate SignNow with other software for processing the 941 form 2020 pdf?

Absolutely! airSlate SignNow easily integrates with various third-party applications to enhance your workflow related to the 941 form 2020 pdf. This means you can link it to your payroll systems and other business tools, making document management streamlined across your organization.

-

What are the benefits of using airSlate SignNow for the 941 form 2020 pdf?

Using airSlate SignNow for the 941 form 2020 pdf offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced document security. Our cloud-based platform allows you to access your forms anywhere, ensuring that you can manage your tax responsibilities seamlessly, no matter where you are.

-

Is it easy to eSign the 941 form 2020 pdf with airSlate SignNow?

Yes, eSigning the 941 form 2020 pdf with airSlate SignNow is incredibly easy. Users can customize their signing experience and complete the process in just a few clicks, signNowly speeding up the turnaround time for document approval and submission.

Get more for Form 941 Rev March Employer's Quarterly Federal Tax Return

Find out other Form 941 Rev March Employer's Quarterly Federal Tax Return

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now