Form 941 Rev January Irs 2022

What is the Form 941?

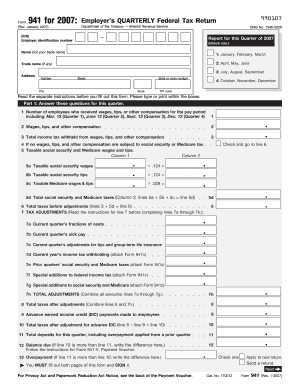

The Form 941, officially known as the Employer's Quarterly Federal Tax Return, is a crucial document used by employers in the United States to report income taxes, social security tax, and Medicare tax withheld from employee wages. This form is filed quarterly and is essential for ensuring compliance with federal tax regulations. The IRS requires employers to report the total wages paid, the amount of taxes withheld, and any adjustments for the quarter.

How to use the Form 941

Using the Form 941 involves several steps to ensure accurate reporting. Employers must first gather necessary information, including total wages paid to employees, the amount of federal income tax withheld, and the employer's share of social security and Medicare taxes. The form can be filled out electronically or by hand. Employers should ensure that they complete all sections accurately to avoid penalties. After filling out the form, it must be submitted to the IRS by the designated deadline.

Steps to complete the Form 941

Completing the Form 941 requires attention to detail. Follow these steps:

- Gather all relevant payroll records for the quarter.

- Fill in the employer identification information, including the name and address.

- Report total wages, tips, and other compensation in the appropriate sections.

- Calculate the total taxes withheld and the employer's share of social security and Medicare taxes.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

Form 941 must be filed quarterly, and the deadlines are critical for compliance. The due dates for filing are:

- For the first quarter (January to March): April 30

- For the second quarter (April to June): July 31

- For the third quarter (July to September): October 31

- For the fourth quarter (October to December): January 31 of the following year

Penalties for Non-Compliance

Failing to file the Form 941 on time can result in significant penalties. The IRS imposes a penalty based on the amount of tax owed. If the form is filed late, the penalty can be as high as five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, interest accrues on any unpaid taxes, adding to the overall cost of non-compliance.

Digital vs. Paper Version

Employers have the option to file the Form 941 either digitally or on paper. The digital version is often more efficient, allowing for quicker processing and confirmation of receipt. Electronic filing also reduces the risk of errors associated with paper forms. However, some employers may prefer the traditional paper method. Regardless of the method chosen, ensuring accuracy is essential for compliance with IRS regulations.

Quick guide on how to complete form 941 rev january 2007 irs

Complete Form 941 Rev January Irs effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious substitute to conventional printed and signed papers, as you can access the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form 941 Rev January Irs on any device with airSlate SignNow's Android or iOS applications and streamline any document-based workflow today.

How to modify and electronically sign Form 941 Rev January Irs effortlessly

- Locate Form 941 Rev January Irs and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your method of delivering your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 941 Rev January Irs and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 rev january 2007 irs

Create this form in 5 minutes!

How to create an eSignature for the form 941 rev january 2007 irs

How to make an e-signature for your PDF online

How to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

How does airSlate SignNow comply with irs gov regulations?

airSlate SignNow is designed to meet the stringent standards set by irs gov for electronic signatures. Our platform ensures that all eSignatures are legally binding and compliant with IRS requirements, providing you peace of mind during tax season.

-

What pricing options does airSlate SignNow offer for IRS-related documents?

airSlate SignNow provides flexible pricing plans suitable for individuals and businesses dealing with irs gov paperwork. Our competitive plans are designed to cater to users who frequently handle IRS documents while ensuring affordability and value.

-

Can I integrate airSlate SignNow with other tools for IRS forms?

Yes, airSlate SignNow integrates seamlessly with various tools and software essential for managing IRS forms. This feature allows you to streamline your workflow, quickly send documents to irs gov, and keep all your records organized in one place.

-

What are the key benefits of using airSlate SignNow for IRS submissions?

Using airSlate SignNow for IRS submissions offers signNow time savings and document security. You can easily eSign and send necessary documents to irs gov without the hassle of printing or mailing, ensuring your submissions are faster and safer.

-

Is airSlate SignNow secure for sending IRS documents?

Absolutely, airSlate SignNow prioritizes the security of your documents, including IRS submissions. Our platform employs robust encryption and follows best practices to ensure that all data shared with irs gov and other entities remains confidential and secure.

-

How can airSlate SignNow help streamline my IRS e-filing process?

airSlate SignNow simplifies the IRS e-filing process by allowing users to sign and send documents electronically. This feature helps you reduce paperwork and eliminate delays associated with physical forms for submissions to irs gov.

-

Does airSlate SignNow provide support for tax professionals dealing with irs gov?

Yes, airSlate SignNow offers specialized support for tax professionals who frequently interact with irs gov. Our customer care team is knowledgeable about tax regulations and can assist you in navigating the software effectively.

Get more for Form 941 Rev January Irs

- 2021 michigan direct deposit of refund 3174 2021 michigan direct deposit of refund 3174 form

- 2021 i 804 form 804 claim for decedents wisconsin income tax refund fillable

- 2021 michigan adjustments of capital gains and losses mi 1041d form

- Instructions for form rp 458 a application for alternative veterans exemption from real property taxation revised

- Michigan form 4891 cit annual return taxformfinder

- 2022 i 119 instructions for wisconsin schedule t wisconsin schedule t instructions form

- 4582 michigan business tax penalty and interest computatino for underpaid estimated tax 4582 michigan business tax penalty and form

- Electronic filing requirement for tax return preparers form

Find out other Form 941 Rev January Irs

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast