Form 941 2009

What is the Form 941

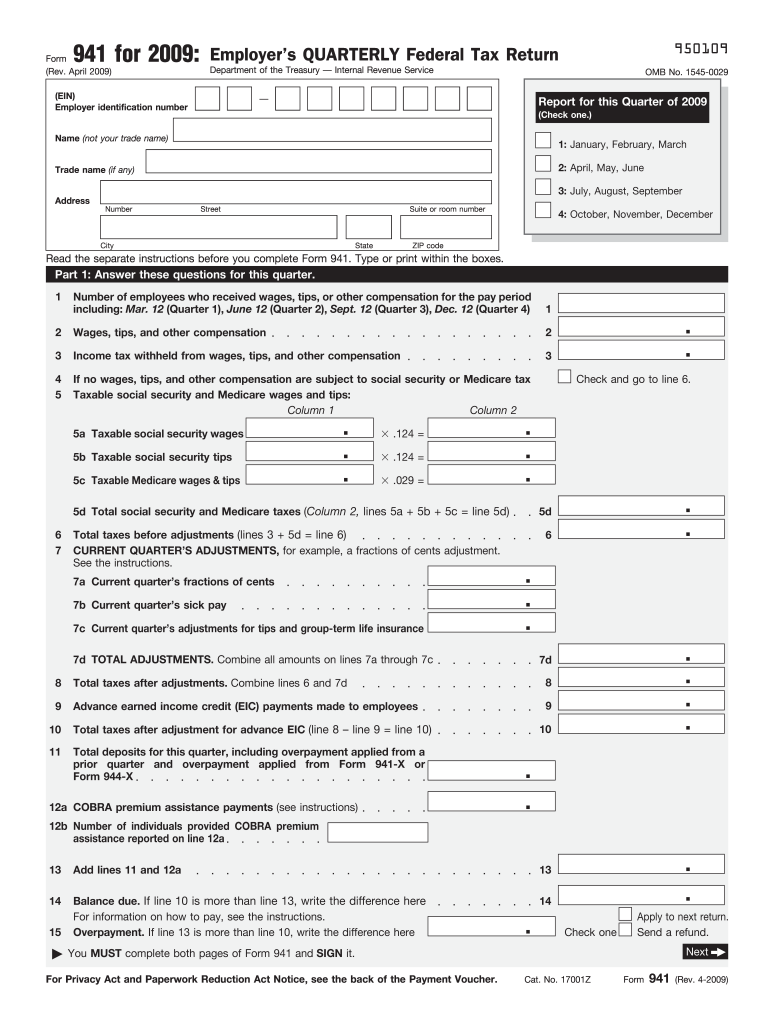

The 2009 Form 941 is a quarterly tax form used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for businesses to ensure compliance with federal tax obligations. It provides the IRS with information about the employer's tax liabilities and helps in tracking the employment taxes owed for each quarter.

How to use the Form 941

To use the 2009 Form 941, employers must accurately fill out the required sections, including details about wages paid, taxes withheld, and any adjustments. Employers should gather all necessary payroll records for the quarter to ensure accurate reporting. After completing the form, it must be submitted to the IRS by the specified deadlines to avoid penalties.

Steps to complete the Form 941

Completing the 2009 Form 941 involves several key steps:

- Gather payroll records for the quarter.

- Fill in the business information, including the employer identification number (EIN).

- Report total wages paid and the corresponding federal income tax withheld.

- Calculate Social Security and Medicare taxes based on the wages reported.

- Include any adjustments for prior quarters if applicable.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the 2009 Form 941. The form is due on the last day of the month following the end of each quarter. For example, the deadlines for 2009 are as follows:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31 of the following year

Legal use of the Form 941

The 2009 Form 941 is legally binding when completed accurately and submitted on time. It serves as a formal declaration of employment taxes owed by the employer. Compliance with IRS guidelines is crucial to avoid penalties and ensure that the form is accepted as a valid tax document.

Who Issues the Form

The 2009 Form 941 is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. Employers must use the form as part of their tax reporting obligations to the IRS.

Quick guide on how to complete 2009 form 941

Complete Form 941 effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Form 941 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form 941 with ease

- Locate Form 941 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of delivery for your form, whether by email, SMS, an invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Form 941 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 form 941

Create this form in 5 minutes!

How to create an eSignature for the 2009 form 941

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the 2009 form 941 and why is it important?

The 2009 form 941 is a quarterly tax return that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Filing the 2009 form 941 accurately is crucial for staying compliant with IRS regulations and avoiding penalties. Businesses must ensure timely submission of this form to maintain their good standing with the tax authorities.

-

How can airSlate SignNow help with the 2009 form 941?

airSlate SignNow streamlines the signing process for the 2009 form 941 by allowing users to send, sign, and store documents electronically. This efficiency minimizes paperwork and enhances collaboration among team members. With our user-friendly platform, businesses can ensure the 2009 form 941 is completed and submitted correctly.

-

What are the pricing options for using airSlate SignNow for the 2009 form 941?

airSlate SignNow offers various pricing plans to fit different business needs, starting with a free trial for new users. Our affordable subscription options allow users to efficiently manage the signing process for documents like the 2009 form 941 without breaking the bank. Explore our website for detailed pricing information tailored to your specific requirements.

-

Can airSlate SignNow integrate with other software to manage the 2009 form 941?

Yes, airSlate SignNow provides seamless integrations with popular accounting and payroll software, making it easier to manage the 2009 form 941 alongside your financial operations. This integration helps keep all your important tax documents organized and accessible. Utilizing these tools can simplify your filing process substantially.

-

What features does airSlate SignNow offer for managing tax documents like the 2009 form 941?

Key features of airSlate SignNow include customizable templates, secure cloud storage, and real-time tracking of document status. These features are designed to simplify the process of preparing and signing the 2009 form 941, ensuring that all necessary fields are accurately completed. Users can also set reminders to ensure timely submission of the form.

-

Is airSlate SignNow secure for submitting the 2009 form 941?

Absolutely! airSlate SignNow prioritizes data security and compliance. Our platform uses advanced encryption methods to protect sensitive information when submitting documents like the 2009 form 941. With secure access controls and audit trails, you can be confident that your tax documents are safe.

-

How does airSlate SignNow benefit businesses in handling the 2009 form 941?

Using airSlate SignNow helps businesses save time and reduce errors when handling the 2009 form 941. Our cost-effective solution ensures that documents are sent, completed, and stored efficiently in a digital format. This minimizes the hassle of paperwork and allows teams to focus on their core business activities.

Get more for Form 941

- How to fill sbrdtd 1235 yearmis 2010 form

- 2010 form 1120 l us life insurance company income tax return

- 2010 form 1120 c us income tax return for cooperative associations

- Form 1099 sa 2010

- 2010 form 1099 q payments from qualified education programs under sections 529 and 530

- 1099 oid 2010 forms

- 2010 form 1099 div

- 1098 int form editable 2010

Find out other Form 941

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors