Form 941 Rev March Employer's Quarterly Federal Tax Return 2022

What is the Form 941 Rev March Employer's Quarterly Federal Tax Return

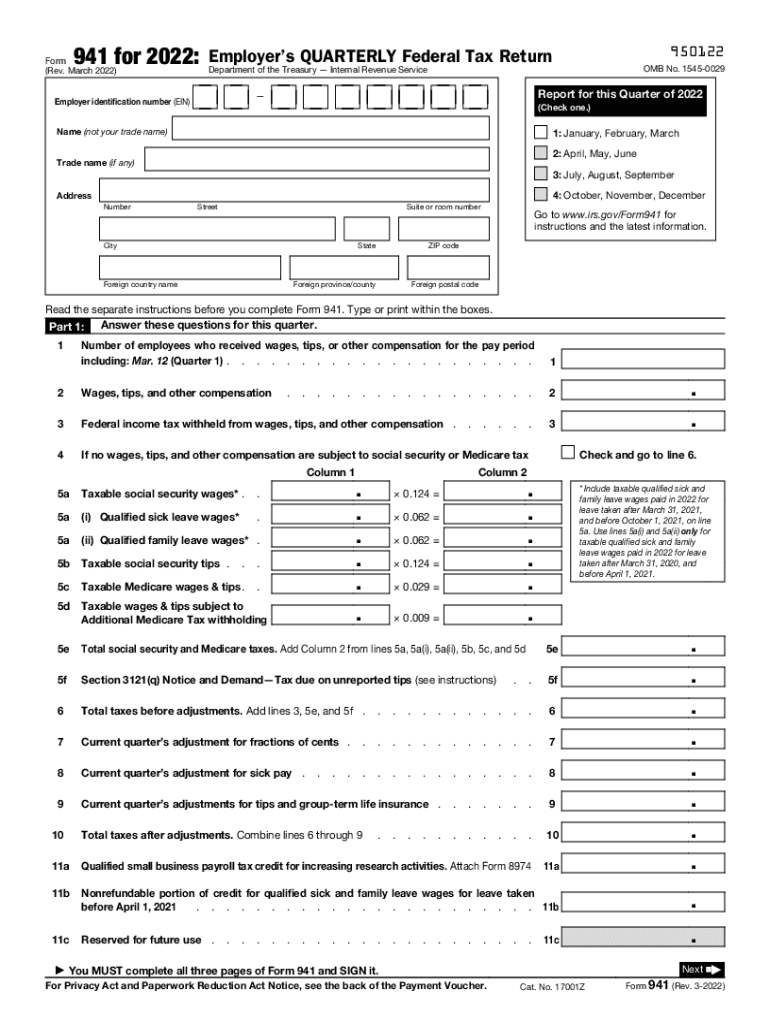

The Form 941 Rev March is a crucial document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This quarterly federal tax return is submitted to the Internal Revenue Service (IRS) and is essential for compliance with federal tax regulations. Employers must accurately complete this form to ensure proper reporting of their payroll tax obligations. The form captures various details such as total wages paid, taxable wages, and tax liabilities, which are vital for both the employer and the IRS.

Steps to complete the Form 941 Rev March Employer's Quarterly Federal Tax Return

Completing the Form 941 Rev March requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your Employer Identification Number (EIN), total wages paid, and taxes withheld for the quarter.

- Fill out the form, ensuring all sections are completed accurately, including the number of employees and total tax liability.

- Calculate the total taxes due, factoring in any adjustments or credits applicable to your situation.

- Review the completed form for accuracy, ensuring all figures are correct and all required fields are filled.

- Sign and date the form, confirming that the information provided is true and accurate.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when submitting the Form 941 Rev March. The due date for this quarterly tax return is typically the last day of the month following the end of the quarter. For example:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Form 941 Rev March. The methods include:

- Online: The form can be filed electronically through the IRS e-file system or approved tax software.

- Mail: Employers can print the completed form and send it to the appropriate IRS address based on their location.

- In-Person: Some employers may choose to deliver their forms in person at designated IRS offices, although this is less common.

Penalties for Non-Compliance

Failure to file the Form 941 Rev March on time or inaccuracies in reporting can lead to significant penalties. The IRS imposes penalties based on the length of the delay and the amount of tax owed. Common penalties include:

- Late Filing Penalty: Typically five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent.

- Accuracy-Related Penalty: May apply if the IRS determines there is a substantial understatement of tax.

Quick guide on how to complete form 941 rev march 2022 employers quarterly federal tax return

Effortlessly Prepare Form 941 Rev March Employer's Quarterly Federal Tax Return on Any Device

Digital document management has gained signNow traction among enterprises and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Form 941 Rev March Employer's Quarterly Federal Tax Return on any device utilizing the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The Simplest Way to Edit and Electronically Sign Form 941 Rev March Employer's Quarterly Federal Tax Return Without Stress

- Locate Form 941 Rev March Employer's Quarterly Federal Tax Return and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), or invite link, or download it to your computer.

No more concerns about lost or misplaced documents, frustrating form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from a device of your preference. Modify and electronically sign Form 941 Rev March Employer's Quarterly Federal Tax Return to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 rev march 2022 employers quarterly federal tax return

Create this form in 5 minutes!

How to create an eSignature for the form 941 rev march 2022 employers quarterly federal tax return

The way to generate an e-signature for your PDF file in the online mode

The way to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

How does airSlate SignNow ensure compliance with IRS gov regulations?

airSlate SignNow provides a secure platform that adheres to IRS gov standards for electronic signatures. Our system is designed to meet legal requirements, ensuring that your documents are valid and compliant. This helps businesses verify the authenticity and legality of their signed documents.

-

What pricing plans does airSlate SignNow offer for businesses concerned with IRS gov documents?

We offer various pricing plans tailored to meet the needs of different businesses dealing with IRS gov documents. Our pricing structures are transparent and offer flexibility, allowing you to choose a plan that fits your budget. Each plan includes essential features for efficient document management and eSigning.

-

What features make airSlate SignNow a top choice for managing IRS gov forms?

airSlate SignNow includes advanced features like templates, bulk sending, and robust security measures tailored for IRS gov forms. You can easily create, send, and track your documents in one seamless platform, which saves time and minimizes errors. Our user-friendly interface simplifies the signing process.

-

Can airSlate SignNow integrate with other software to facilitate IRS gov document workflows?

Yes, airSlate SignNow offers integrations with popular software to streamline your IRS gov document workflows. You can connect with tools like Google Drive, Salesforce, and others to create a comprehensive solution. This integration enhances efficiency and keeps everything organized in one place.

-

What benefits does airSlate SignNow provide for businesses filing IRS gov disclosures?

airSlate SignNow simplifies the process of filing IRS gov disclosures through efficient eSigning and document management. Our platform reduces the risk of errors and delays in your filing process. Businesses benefit from quicker turnaround times and better compliance with IRS requirements.

-

Is airSlate SignNow suitable for small businesses handling IRS gov documentation?

Absolutely! airSlate SignNow is an economical solution perfect for small businesses managing IRS gov documentation. Our platform is designed to be easy to use, even for those without extensive technical expertise, ensuring that everyone can navigate it effectively. The affordability and features support growth and efficiency.

-

How can I ensure my IRS gov documents are secure with airSlate SignNow?

Security is a top priority at airSlate SignNow, especially for sensitive IRS gov documents. We implement advanced encryption and authentication methods to protect your data throughout the signing process. Regular security audits ensure our platform remains compliant and safe for all users.

Get more for Form 941 Rev March Employer's Quarterly Federal Tax Return

- Small estate affidavit 497429174 form

- Nonintervention powers form

- Letters administration form application 497429176

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497429177 form

- Wa odometer disclosure statement form

- Wa odometer 497429179 form

- Promissory note in connection with sale of vehicle or automobile washington form

- Bill of sale for watercraft or boat washington form

Find out other Form 941 Rev March Employer's Quarterly Federal Tax Return

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free