Form 941 2020

What is the Form 941

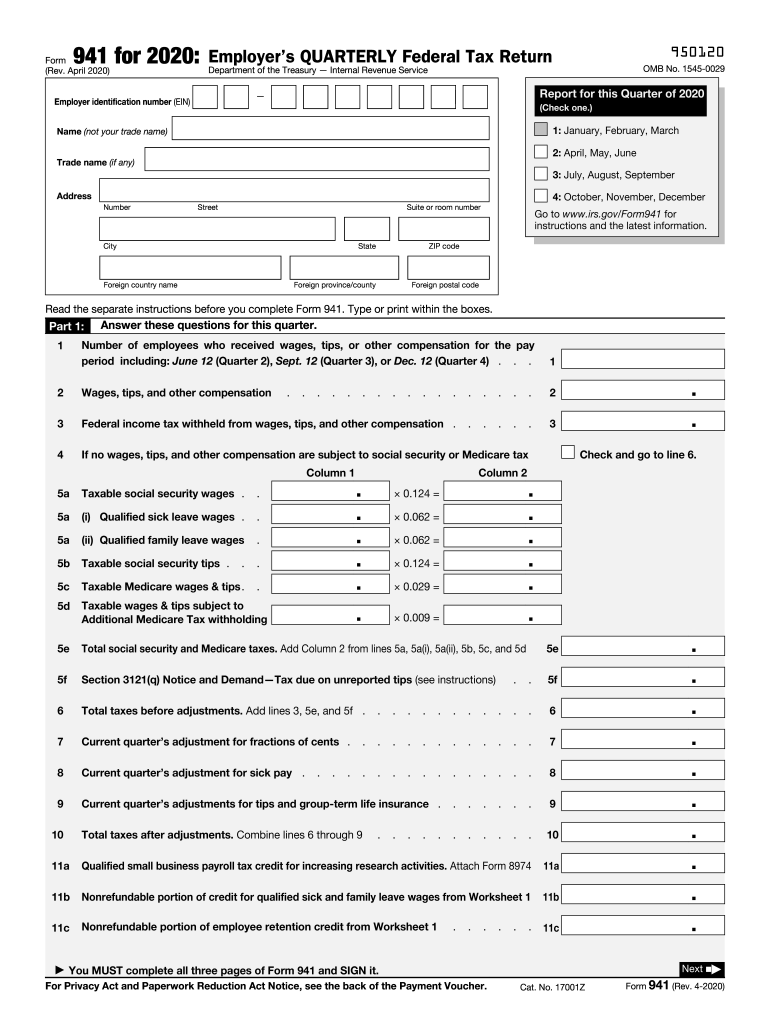

The 2014 Form 941 is a federal tax form used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. This form is essential for businesses to report their payroll tax liabilities and ensure compliance with federal tax regulations. The 941 form must be filed quarterly, providing a comprehensive overview of the taxes owed and the amounts already paid throughout the year.

How to use the Form 941

To effectively use the 2014 Form 941, employers should gather all necessary payroll information for the reporting period. This includes total wages paid, tips received, and the federal income tax withheld from employees. The form requires detailed calculations for Social Security and Medicare taxes, which are based on the wages reported. Employers must ensure accuracy in their calculations to avoid penalties and facilitate smooth processing by the IRS.

Steps to complete the Form 941

Completing the 2014 Form 941 involves several key steps:

- Gather payroll records for the reporting period.

- Calculate total wages and tips paid to employees.

- Determine the federal income tax withheld from employees' paychecks.

- Calculate the employer's share of Social Security and Medicare taxes.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors before submission.

Filing Deadlines / Important Dates

The 2014 Form 941 must be filed quarterly, with specific deadlines for each quarter:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

Employers should be aware of these deadlines to avoid late filing penalties and interest charges on unpaid taxes.

Legal use of the Form 941

The 2014 Form 941 is legally binding when filled out correctly and submitted on time. It serves as an official record of payroll taxes owed and paid, which can be audited by the IRS. Employers must ensure compliance with all federal tax laws when using this form, as inaccuracies can lead to serious penalties. Electronic filing is accepted and often recommended for faster processing and confirmation of submission.

Key elements of the Form 941

Key elements of the 2014 Form 941 include:

- Employer identification information, including name and EIN (Employer Identification Number).

- Total number of employees and total wages paid during the quarter.

- Federal income tax withheld.

- Calculations for Social Security and Medicare taxes.

- Any adjustments for prior quarters, if applicable.

Each of these elements must be accurately reported to ensure compliance and avoid penalties.

Quick guide on how to complete form 941

Complete Form 941 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow supplies you with all the resources necessary to create, modify, and eSign your files quickly without delays. Manage Form 941 on any platform using airSlate SignNow Android or iOS applications and enhance any document-centered operation today.

How to modify and eSign Form 941 without hassle

- Locate Form 941 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 941 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941

Create this form in 5 minutes!

How to create an eSignature for the form 941

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is the 2014 form 941 and why is it important?

The 2014 form 941 is the Employer's Quarterly Federal Tax Return used to report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. It's important for businesses to accurately file this form to avoid penalties and maintain compliance with IRS regulations.

-

How can airSlate SignNow assist in completing the 2014 form 941?

airSlate SignNow provides a seamless way to eSign and manage documents, including the 2014 form 941. With our easy-to-use interface, you can upload your completed form, obtain necessary eSignatures, and securely store your documents for future reference.

-

Is there a cost associated with using airSlate SignNow to manage the 2014 form 941?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs. Our cost-effective solution ensures that you can manage documents like the 2014 form 941 efficiently without breaking the bank.

-

What are the key features of airSlate SignNow for handling the 2014 form 941?

Key features of airSlate SignNow include high-level security, customizable templates, and real-time tracking for document status. These features ensure that your 2014 form 941 is processed quickly and securely with all required eSignatures.

-

Can I integrate airSlate SignNow with other software for managing the 2014 form 941?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software, making it easy to manage your 2014 form 941 alongside other critical business processes. This helps streamline your workflow and enhances productivity.

-

What benefits does using airSlate SignNow bring to the eSigning process of the 2014 form 941?

Using airSlate SignNow for the eSigning process of the 2014 form 941 offers benefits such as faster turnaround times, improved document security, and enhanced tracking capabilities. This allows you to complete your tax forms with confidence and ease.

-

How does airSlate SignNow ensure the security of my 2014 form 941?

airSlate SignNow employs industry-leading security measures, including SSL encryption and secure cloud storage to protect your 2014 form 941 and other sensitive documents. We prioritize your data privacy and ensure compliance with regulations.

Get more for Form 941

- Special power of attorney templatenet form

- Sample questionslandlord ampampamp tenant vakilno1com form

- In the matter of the estate of nccourtsgov form

- Free llc operating agreement templates pdfword form

- Prenuptial agreement imagestemplatenet form

- Sample land contract rurallawcenterorg form

- Agreement by unmarried individuals to purchase and hold form

- Form il 864lt

Find out other Form 941

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online