Federal Tax Return Schedule C Form 941 Instructions 2021

What is the Federal Tax Return Schedule C Form 941?

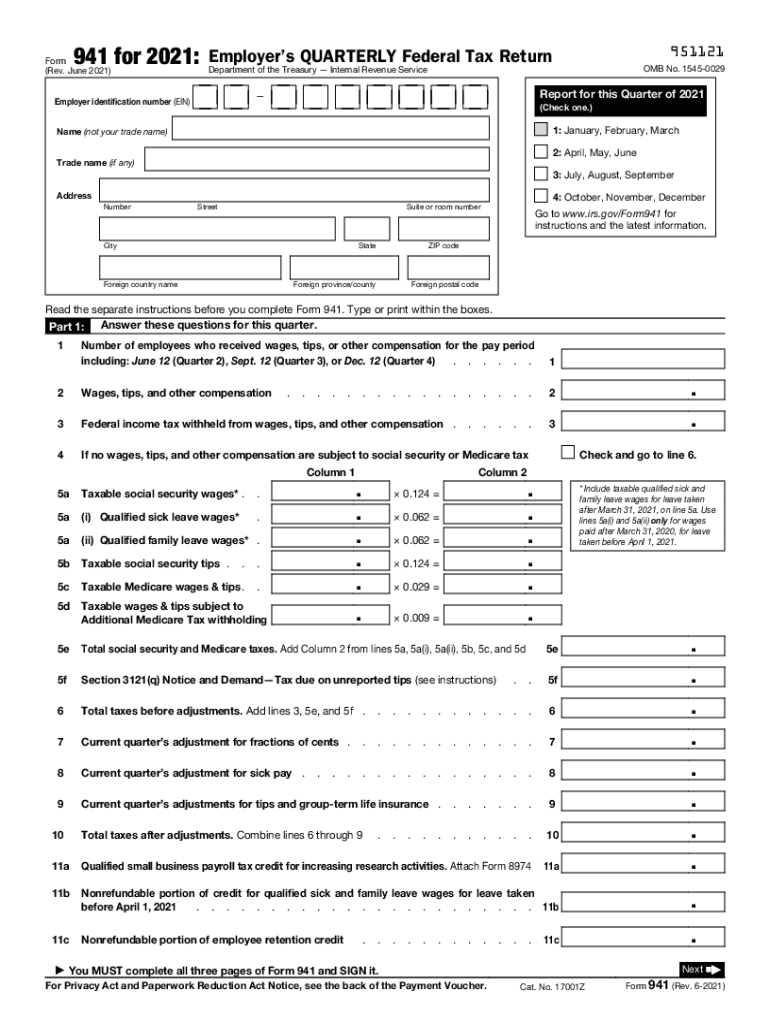

The Federal Tax Return Schedule C Form 941 is a crucial document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is typically filed quarterly and is essential for maintaining compliance with federal tax regulations. The 941 form provides the IRS with detailed information about the number of employees, wages paid, and taxes withheld, ensuring that businesses meet their tax obligations accurately and on time.

Steps to Complete the Federal Tax Return Schedule C Form 941

Completing the Federal Tax Return Schedule C Form 941 involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including total wages paid, taxes withheld, and the number of employees.

- Fill out the form with accurate figures, ensuring all calculations are correct.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate the information provided.

- Submit the completed form by the appropriate deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Federal Tax Return Schedule C Form 941 are critical for compliance. The form is due four times a year, with specific deadlines for each quarter:

- For the 1st quarter (January to March), the deadline is April 30.

- For the 2nd quarter (April to June), the deadline is July 31.

- For the 3rd quarter (July to September), the deadline is October 31.

- For the 4th quarter (October to December), the deadline is January 31 of the following year.

Legal Use of the Federal Tax Return Schedule C Form 941

The legal use of the Federal Tax Return Schedule C Form 941 is governed by IRS guidelines, which stipulate that employers must accurately report their payroll taxes. Failure to file or incorrect reporting can lead to significant penalties. The form serves as a legal document that verifies compliance with federal tax laws and ensures that the appropriate taxes are collected and remitted to the IRS.

Who Issues the Form?

The Federal Tax Return Schedule C Form 941 is issued by the Internal Revenue Service (IRS). The IRS is responsible for creating and updating the form, providing guidelines for its use, and ensuring that employers understand their obligations regarding payroll tax reporting. Employers can obtain the form directly from the IRS website or through authorized tax professionals.

Penalties for Non-Compliance

Non-compliance with the requirements of the Federal Tax Return Schedule C Form 941 can result in various penalties. These may include:

- Failure to file penalties, which can accumulate over time.

- Failure to pay penalties for taxes owed that are not paid by the deadline.

- Interest on unpaid taxes, which compounds until the balance is settled.

It is essential for employers to stay informed about their filing requirements to avoid these penalties.

Quick guide on how to complete federal tax return schedule c form 941 2019 instructions

Execute Federal Tax Return Schedule C Form 941 Instructions effortlessly on any gadget

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without hindrances. Handle Federal Tax Return Schedule C Form 941 Instructions on any system with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Federal Tax Return Schedule C Form 941 Instructions without any hassle

- Obtain Federal Tax Return Schedule C Form 941 Instructions and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Federal Tax Return Schedule C Form 941 Instructions and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal tax return schedule c form 941 2019 instructions

Create this form in 5 minutes!

How to create an eSignature for the federal tax return schedule c form 941 2019 instructions

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to irs com?

airSlate SignNow is a digital signature and document management solution that enables businesses to send and eSign documents efficiently. It offers features that can help streamline the process of submitting important documents to irs com. With airSlate SignNow, users can ensure their documents are sent quickly and securely, enhancing productivity.

-

How much does airSlate SignNow cost for businesses using it with irs com?

The pricing for airSlate SignNow is flexible, catering to businesses of all sizes with various plans. Many features, ideal for submitting documents to irs com, are included in these plans. It's designed to be a cost-effective solution without compromising on quality and functionality.

-

What features does airSlate SignNow offer for managing documents related to irs com?

airSlate SignNow provides robust features including eSigning, document templates, and real-time tracking. These features help users manage documents efficiently when dealing with irs com submissions. Additionally, the platform ensures compliance with relevant regulations, making it easier to handle sensitive financial documents.

-

Is airSlate SignNow secure for sending documents to irs com?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance certifications. When sending documents to irs com, users can trust that their sensitive information is protected. The platform adheres to industry standards to safeguard the integrity and confidentiality of your documents.

-

Can airSlate SignNow integrate with other software to help with irs com submissions?

Absolutely! airSlate SignNow boasts integrations with various business tools, enhancing its utility for tasks related to irs com. Whether it's CRM systems or cloud storage solutions, these integrations help create a seamless workflow for document handling and submissions.

-

What benefits does airSlate SignNow provide for small businesses filing with irs com?

For small businesses, airSlate SignNow offers a user-friendly interface and streamlined document processes, which can signNowly reduce the time spent on filings related to irs com. This allows them to focus more on core business activities while ensuring compliance. Additionally, its affordable pricing makes it accessible for smaller teams.

-

How does airSlate SignNow compare to other eSignature solutions for irs com documentation?

airSlate SignNow stands out among other eSignature solutions due to its combination of affordability, ease of use, and comprehensive features tailored for IRS-related workflows. It provides powerful tools specifically designed to handle documentation required by irs com, ensuring a more straightforward submission process. This makes it a preferred choice for many businesses.

Get more for Federal Tax Return Schedule C Form 941 Instructions

- Himp 1109 workersamp39 compensation board new york state wcb ny form

- New york state department of labor customer registration form

- Dwc ad form 1013353sjdb

- Notice of offer of modified or alternative work state of california dir ca form

- De9adj instructions form

- County of los angeles youthwork program form

- 2019 20 employer data sheetworksheet the local choice form

- Drug and alcohol testing employee handbook form

Find out other Federal Tax Return Schedule C Form 941 Instructions

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy