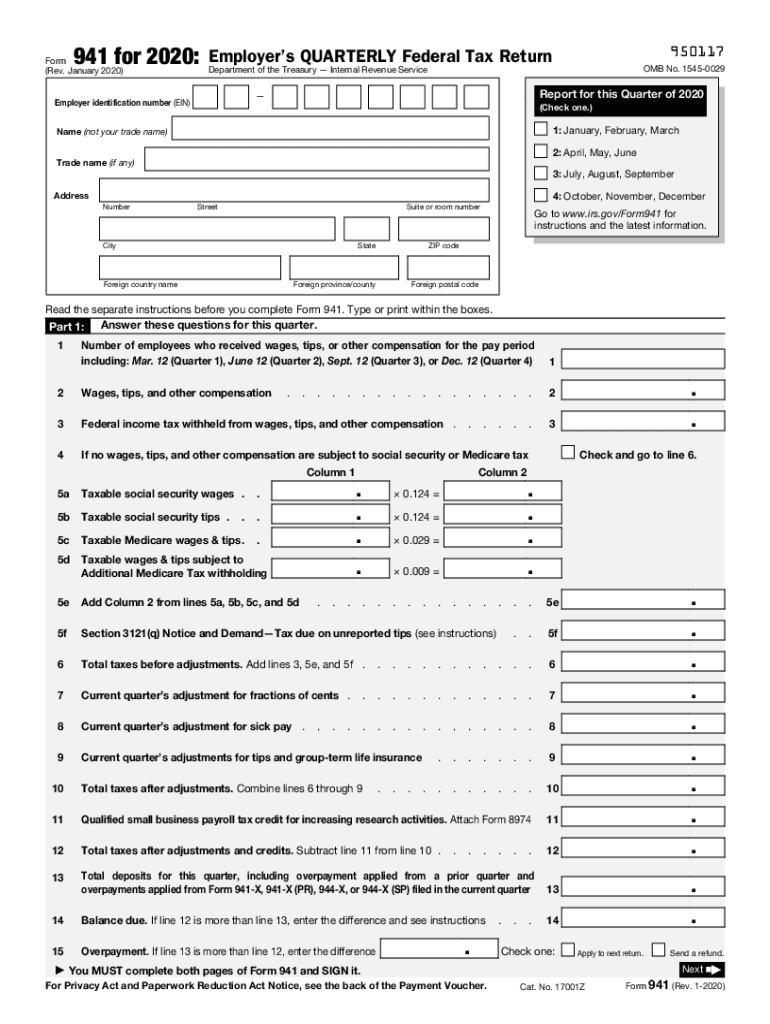

941 2020-2025 Form

What makes the form 941 for 2019 legally valid?

As the society takes a step away from office work, the completion of documents increasingly occurs electronically. The 2019 form 941 isn’t an exception. Dealing with it using digital means differs from doing this in the physical world.

An eDocument can be considered legally binding given that certain needs are satisfied. They are especially critical when it comes to signatures and stipulations related to them. Typing in your initials or full name alone will not guarantee that the institution requesting the form or a court would consider it accomplished. You need a trustworthy tool, like airSlate SignNow that provides a signer with a digital certificate. Furthermore, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - major legal frameworks for eSignatures.

How to protect your 941 form 2019 when completing it online?

Compliance with eSignature regulations is only a fraction of what airSlate SignNow can offer to make document execution legitimate and secure. In addition, it provides a lot of possibilities for smooth completion security smart. Let's rapidly go through them so that you can be assured that your form 941 remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: key privacy regulations in the USA and Europe.

- Two-factor authentication: provides an extra layer of security and validates other parties' identities via additional means, like a Text message or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the data safely to the servers.

Completing the 2010 941 tax with airSlate SignNow will give better confidence that the output form will be legally binding and safeguarded.

Quick guide on how to complete 2010 941 tax

Complete form 941 2019 effortlessly on any device

Online document management has gained popularity among enterprises and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage form 941 for 2019 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign 2019 form 941 without hassle

- Locate 941 form 2019 and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors requiring new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign form 941 and ensure optimal communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Video instructions and help with filling out and completing Form 941

Instructions and help about 2011 form 941 download

Find and fill out the correct 2013 form 941 fillable

Related searches to what is a federal 941 form 2019

Create this form in 5 minutes!

How to create an eSignature for the 2018 941

How to create an eSignature for the Form 941 Rev January 2020 Employers Quarterly Federal Tax Return in the online mode

How to create an eSignature for your Form 941 Rev January 2020 Employers Quarterly Federal Tax Return in Google Chrome

How to make an eSignature for signing the Form 941 Rev January 2020 Employers Quarterly Federal Tax Return in Gmail

How to make an electronic signature for the Form 941 Rev January 2020 Employers Quarterly Federal Tax Return from your mobile device

How to make an eSignature for the Form 941 Rev January 2020 Employers Quarterly Federal Tax Return on iOS devices

How to generate an eSignature for the Form 941 Rev January 2020 Employers Quarterly Federal Tax Return on Android devices

People also ask 2018 941 form

-

What is the 2014 form 941 and who needs to file it?

The 2014 form 941 is the Employer's Quarterly Federal Tax Return, which businesses must file to report income taxes, Social Security tax, and Medicare tax withheld from employees' wages. Every employer with employees that are subject to federal payroll taxes is required to file this form. It's crucial to understand your obligations to avoid penalties.

-

How can airSlate SignNow help with the 2014 form 941 filing process?

airSlate SignNow simplifies the filing process for the 2014 form 941 by allowing users to electronically sign and send documents securely. With an intuitive interface, you can easily prepare your forms, ensuring compliance and reducing the risk of errors. Moreover, it streamlines communication with your tax professional for seamless submission.

-

What features does airSlate SignNow offer for managing the 2014 form 941?

AirSlate SignNow offers robust features such as customizable templates, secure electronic signatures, and collaboration tools specifically designed for managing the 2014 form 941. These features ensure that your documents are not only compliant but are also organized and easily accessible when you need them. Additionally, you can track the status of your documents in real-time.

-

Is airSlate SignNow a cost-effective solution for filing the 2014 form 941?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to file the 2014 form 941. With various pricing plans to suit different business sizes and needs, you can enjoy signNow savings compared to traditional filing methods. By reducing paperwork and increasing efficiency, airSlate SignNow helps you save time and money.

-

Can I integrate airSlate SignNow with other software for filing the 2014 form 941?

Absolutely! AirSlate SignNow offers seamless integrations with various accounting software, enhancing your experience while managing the 2014 form 941. This means you can connect with platforms like QuickBooks or Xero to automatically import data, reduce manual entry, and ensure that your tax forms are accurate and complete.

-

What are the benefits of using airSlate SignNow for the 2014 form 941 signing process?

Using airSlate SignNow for the 2014 form 941 signing process provides numerous benefits, including faster turnaround times and enhanced security. The platform ensures that your documents are signed promptly, allowing for quick submission and compliance. Additionally, electronic signatures are legally binding, giving you peace of mind throughout the process.

-

What should businesses know about deadlines for the 2014 form 941?

It's important for businesses to be aware of the deadlines for filing the 2014 form 941. The form is typically due on the last day of the month following the end of each quarter. Failure to file on time can result in penalties, so utilizing airSlate SignNow can help ensure that your documents are prepared and sent out promptly.

Get more for 2018 941 tax form

- Instructions before completing this form read the privacy act and respondent burden on

- Northeast mississippi community college nemccedu form

- Va form 29 380 vba va

- Supplemental application for admission of students in elac form

- Hargrave military academy inquiry form

- Work release form 202344638

- Https business dmv virginia gov dmvnet extra securid form

- Request for internal transfer or promotion community college of form

Find out other 2018 federal 941

- eSignature New Jersey Mutual non-disclosure agreement Simple

- eSignature New Mexico Mutual non-disclosure agreement Computer

- Help Me With eSignature New Jersey Mutual non-disclosure agreement

- eSignature New Jersey Mutual non-disclosure agreement Easy

- eSignature New Jersey Mutual non-disclosure agreement Safe

- eSignature New Mexico Mutual non-disclosure agreement Mobile

- eSignature New Mexico Mutual non-disclosure agreement Now

- How Can I eSignature New Jersey Mutual non-disclosure agreement

- eSignature New York Mutual non-disclosure agreement Online

- eSignature New York Mutual non-disclosure agreement Computer

- eSignature New Mexico Mutual non-disclosure agreement Later

- eSignature New York Mutual non-disclosure agreement Mobile

- eSignature New York Mutual non-disclosure agreement Now

- eSignature New York Mutual non-disclosure agreement Later

- Can I eSignature New Jersey Mutual non-disclosure agreement

- eSignature New Mexico Mutual non-disclosure agreement Myself

- eSignature New York Mutual non-disclosure agreement Myself

- eSignature New York Mutual non-disclosure agreement Free

- eSignature New Mexico Mutual non-disclosure agreement Free

- eSignature New York Mutual non-disclosure agreement Secure