One of the first instances of using an electronic signature in the United States dates back to the mid-nineteenth century. In 1869, the New Hampshire Supreme Court was the first to verify the enforceability of an eSignature submitted via telegraph. In the late 1980s and early 1990s, faxed signatures became legally enforceable in legal and administrative proceedings by state and federal agencies.

Starting from 1986, the Internal Revenue Service (IRS) offered an electronic filing option to the increasing number of taxpayers. A decade later, in 1997, approximately 15 million taxpayers filed their federal income tax returns in electronic form. In 1998, the IRS attempted to streamline the use of eSignatures for tax filing. Back then, the tax authority sent out postcards with an e-file customer number (ECN) to about 12 million taxpayers instead of the paper-based tax booklet.

The rise of electronic commerce in the mid-1990s accelerated the enactment of laws stipulating the use of eSignatures. All of this inevitably led to the adoption of the UETA (1999) and the ESIGN Act (2000). Today, both acts together with state laws and regulations, govern the use of eSignatures in the US.

Which laws govern the use of eSignatures for tax services in the US?

The Internal Revenue Code (IRC), previously the Internal Revenue Code of 1986, is the primary statutory basis of the federal tax law in the United States. It codifies multiple forms of federal tax laws, including income, payroll, estate, gift, excise, alcohol, tobacco, and employment taxes along with procedure and administration.

The Internal Revenue Service Restructuring and Reform Act (1998), also referred to as RRA, or the Taxpayers Bill of Rights III improved the organizational culture of the IRS and enhanced taxpayer rights and protections. The RRA contains provisions related to individuals and businesses, the structure and functioning of the IRS, taxpayer rights, and more.

Does the IRS allow the use of eSignatures?

Section 6061 of the Internal Revenue Code stipulates the use of electronic signatures for tax returns and other documents. Subparagraph 3 governs that taxpayers' eSignatures shall be accepted in relation to “any request for disclosure of a taxpayer's return or return information to a tax practitioner or any power of attorney (POA) granted by a taxpayer to a tax practitioner.” This means electronic signatures are viewed as legally valid for disclosure authorizations to tax practitioners.

The RRA includes multiple amendments to the Internal Revenue Code of 1986. The Act contains provisions covering the electronic filing of tax returns verified with eSignatures. Title II of the Act specifically indicates that:

- electronic filing is the preferred form of filing;

- 80% of all tax returns should be filed in electronic form by 2007;

- IRS should facilitate electronic filing through cooperation with the private sector.

Title II of the Act, Sec. 2003, addresses electronic signatures, internet availability of tax forms along with disclosure, and access to account information.

Which tax forms can be submitted with electronic signatures in the US?

Due to the COVID19 pandemic, the IRS introduced a temporary relaxation of rules regarding the use of digital and eSignatures for specific tax forms instead of hard signatures. The temporary deviation with the Memorandum for All Services and Enforcement Employees dated August 28, 2020, allows taxpayers and representatives to eSign the following forms that require a handwritten signature:

- Form 3115, Application for Change in Accounting Method;

- Form 8832, Entity Classification Election;

- Form 8802, Application for U.S. Residency Certification;

- Form 1066, U.S. Income Tax Return for Real Estate Mortgage Investment

Conduit;

- Form 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies;

- Form 1120-C, U.S. Income Tax Return for Cooperative Associations;

- Form 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts;

- Form 1120-L, U.S. Life Insurance Company Income Tax Return;

- Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return;

- Form 8453 series, Form 8878 series, and Form 8879 series regarding IRS e-file Signature Authorization Forms.

The above forms can be submitted with eSignatures if mailed from August 28, 2020, up until December 31, 2020.

In September, the IRS included six more forms to the list of electronically submitted forms:

- Form 706, U.S. Estate (and Generation-Skipping Transfer) Tax Return;

- Form 706-NA, U.S. Estate (and Generation-Skipping Transfer) Tax Return;

- Form 709, U.S. Gift (and Generation-Skipping Transfer) Tax Return;

- Form 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons;

- Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts;

- Form 3520-A, Annual Information Return of Foreign Trust With a U.S. Owner.

The federal agency continues to review the form submission process to reduce the burden for the tax community. At the same time, maintaining security and protection against identity theft stands among its main priorities.

What is a Form W9?

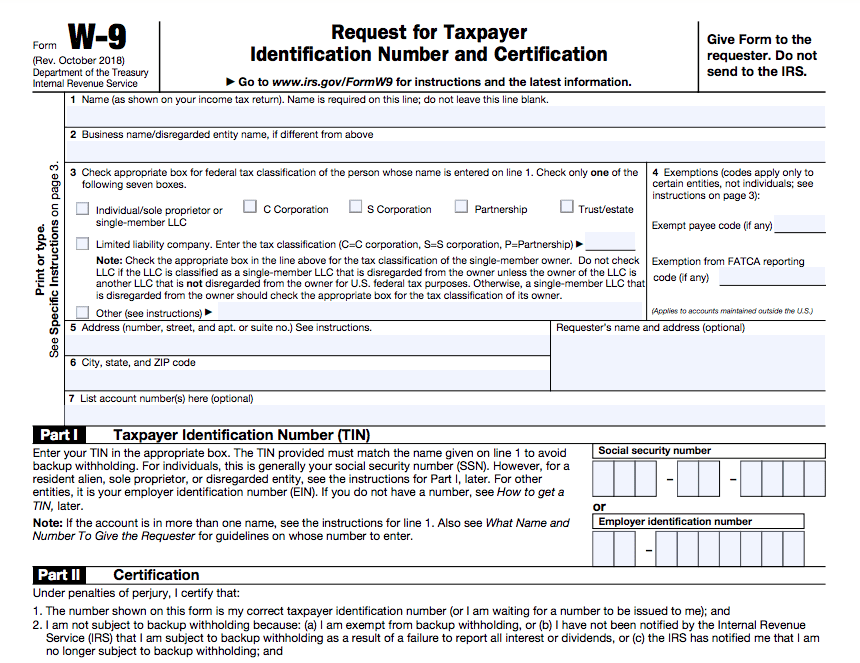

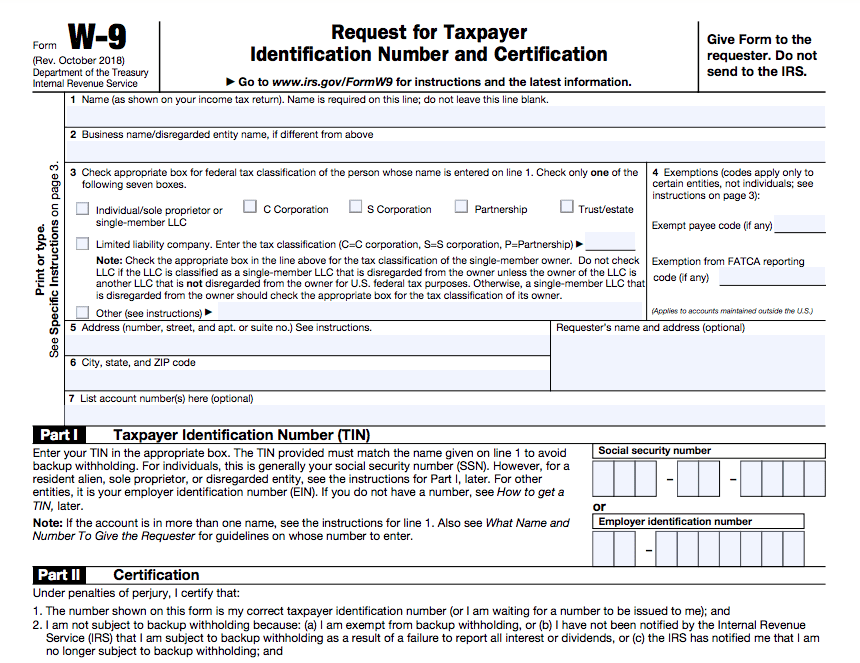

A Form W9 or the Request for Taxpayer Identification Number and Certification is an IRS form meant for independent contractors (freelancers, self-employed workers, consultants) and limited liability companies (LLCs). Employers use the W9 form to confirm a person's name, address, and taxpayer identification number (TIN) or social security number (SSN) for hiring purposes. Individuals defined as US citizens and resident aliens are subject to TIN/SSN confirmation.

Under the law, employers are responsible for withholding a portion of their full-time employees’ income taxes. However, no such obligation is in place regarding self-employed workers or independent contractors. The W9 form ensures that self-employed workers or independent contractors fulfill their responsibility in withholding taxes from their income.

Employers use the W9 form in the event they choose to compensate an independent contractor over $600 annually. However, the form may still be issued if the amount of compensation falls below the above threshold. An individual may be requested to fill out the W-9 Form in situations that do not concern the provision of services:

- real estate deals;

- mortgage interest payment;

- student loan interest payment;

- cancellation of debt;

- earning interest from a bank.

The difference between Forms W2 and W4

To many taxpayers, the difference between a W2, W4, and W9 isn’t so obvious. The purpose of each form needs clarification.

- Form W2 or the Wage and Tax Statement is an IRS form an employer is obligated to submit to each employee and the IRS at the end of the year. The W2 form is a statement of an employee's annual wages and taxes deducted from their paychecks.

- Form W4 or Employee's Withholding Allowance Certificate is an IRS form filled out by employees to provide direct employers with information about their tax situation. The W4 form indicates the amount of tax an employer has to deduct from an employee's paycheck based on their marital status, number of allowances and dependents, and other factors.

To sum up the similarities and differences between the W2, W4, and W9, see the comparison chart below:

| |

W2 |

W4 |

W9 |

| Who fills it out? |

Annually filled out by employers |

Filled out by employees in their first month of employment |

Filled out by self-employed workers and LLCs. |

| What is it for? |

Reports on the payments employers made to their employees throughout the year |

Helps employers calculate the amount of federal tax to be withheld from their employees’ paychecks |

Used by independent contractors to submit their TIN or SSN to other individuals, clients, and financial institutions. |

| Submission requirement |

One for each employee |

One for each employer |

One for each request |

| How often to submit? |

Annual submission |

One-time submission |

Upon request |

What is the purpose of an IRS Form W9?

In the event an employer pays a contractor over $600 during a tax year, these payments have to be reported to the IRS with an information return called Form 1099-MISC. It contains the income information indicated in the W9 form. This includes, but is not limited to, income paid to an individual as part of a contract, real estate operations, dividends paid against an investment, and other financial operations.

Employees are legally obligated to provide certain personal information to their employers. However, their privacy is protected by law. In the event an employer discloses an employee's personal information in any unsanctioned way, they can face civil and/or criminal prosecution.

Information Required on Form W9

A W9 requires:

- the individual name and business name of an independent contractor;

- type of a business entity (sole proprietorship, partnership, C corporation, S corporation, trust or estate, LLC, etc);

- tax identification number or social security number (for sole proprietors who don't have a tax ID number).

The individual filling out the W9 form has to prove they’re not subject to backup withholding. This doesn’t concern most taxpayers, but if it does, the company recruiting the independent contractor will need to deduct income tax from that contractor's paycheck at a rate of 24% and submit it to the IRS.

Given that the W9 form requires a TIN or SSN, both the individual filling it out and the company obtaining the filled-out form must protect it against identity theft during transmission and after receipt.

When is a W9 form not required?

- If you get a W9 from an unknown third party

In the event an independent contractor gets a W9 from someone other than their client, they are not obligated to fill it out. Disclosing a Social Security Number (SSN) and other personal information to a stranger could end up in identity theft. For instance, scammers occasionally send individuals W9 forms to obtain their SSNs.

If you doubt whether or not to fill out a W9 form a third party has sent you, request more information about the tax forms they plan to send you back after you complete it. Consult a tax professional to get clarification. The only reason why a third party could request a W9 from is to send you another IRS form.

- If your employer requests it from you

As we’ve already established, the appropriate form for employers is W4. What if your full-time employer requires you to fill out a W9 instead? That could mean you’ve been hired as an independent contractor, not an employee. If that’s the case, clarify your employment status to ensure you aren’t on a string for tax payments to the IRS.

How do I open a W9 in PDF format and sign it?

Unlike other legal forms used in the United States, Form W9 is relatively easy to complete. Download a blank W9 from the official IRS website or get it from an institution responsible for providing it. To complete a W9 form, fill out the required lines with accurate information.

Enter your full legal name that matches the name on your income tax return.

Fill out this line in the event you have a business name/disregarded entity name different from your legal name. Otherwise, you can leave it empty.

- Line 3: Federal Tax Classification

Check an appropriate box that indicates your tax status according to the IRS classification. Choose one of the six options:

- Individual/sole proprietor or individual-member LLC

- C corporation

- S corporation

- Partnership

- True/estate

- Limited liability company

Fill out this section if you are exempt from backup withholding and/or FATCA reporting. Enter the tax code that explains your exemption.

Provide your address, so that your employer could mail your returns. Enter your number, street, and apartment/suite number in line five. Enter your city, state, and ZIP code in line six.

Fill this line out or leave it empty, it’s optional. List any account numbers you have for your employer.

- Part I: Taxpayer Identification Number (TIN)

- Individuals and single-member LLCs have to provide their Social Security Number (SSN) instead of TIN.

- Corporations and partnerships have to provide the Employer Identification Number (EIN).

- A sole proprietor may provide both their SSN and EIN.

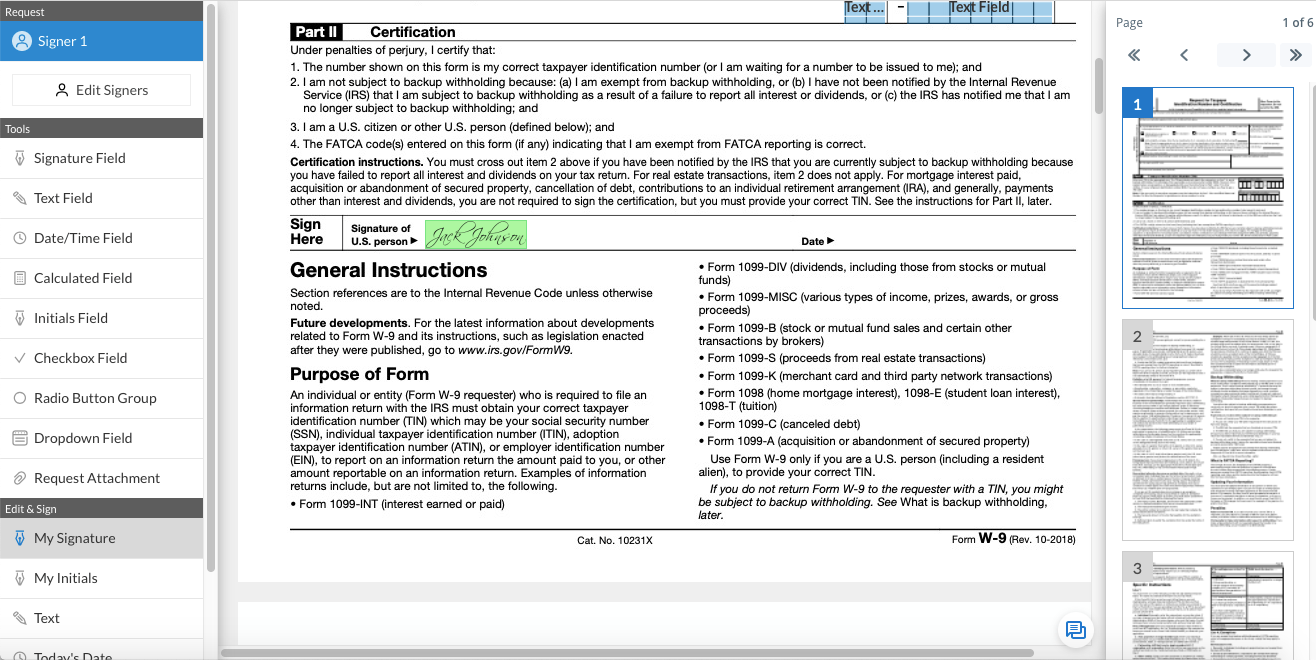

Use this section to validate the form with a signature (eSignature) and date. Before signing, check the information you’ve provided and confirm that it’s accurate.

Does the IRS allow you to eSign Form W9?

Before the worldwide pandemic, the IRS didn’t have a streamlined set of rules for recognizing the validity of eSignatures. As a result, each form has its own requirements, so tax professionals have to keep track of the ever-changing rules.

However, the IRS is actively endorsing eSignatures and the filing of electronic documentation. Practically every form has a method for valid eSigning.

- The IRS rules allow filers to eSign and submit the W9 and W4 forms electronically.

- The 1096/1099 e-filing process does not require a signature. However, certain companies may require you to prove the accuracy of the information submitted in the 1099 form.

- The recipients of the 1099 and W2 forms must consent to receive their forms electronically. The procedure does not require an eSignature but does require a record of consent.

To be valid, the W9 forms submitted with an eSignature must meet the Instructions for the Requester of Form W-9:

- Ensure the consistency of information. The information sent must correspond to the information received by the IRS.

- All instances of user access that result in the submission of sensitive information must be documented.

- The individual accessing the system to eSign and submit the W9 form must be the individual identified on the form or an authorized third-party.

- The taxpayer’s electronic signature must be required as the final entry to authenticate and verify the W9’s submission.

- The eSignature must be under penalties of perjury. The perjury statement must be in the same language as the paper W9 is in.

What is an electronic signature?

The ESIGN Act provides a clear definition of an electronic signature (eSignature). The term “electronic signature” refers to an electronic sound, symbol, or process, attached to or associated with a document used by an individual with the intent to sign the record. It has the same legal standing as a hardcopy signature as long as it conforms to the applicable legal framework.

How do electronic signatures work?

Very often, an eSignature implies a visual representation of a handwritten signature or a signer’s full name. When you eSign a PDF, the image of your signature is placed on its top layer. Anyone can embed an electronic signature into a PDF with the help of applicable eSignature apps and devices.

Here’s how to create an electronic signature:

- draw your signature on the screen of a mobile/tablet device;

- attach a photo of your hardcopy signature to a digital document;

- type your full name in a field of an eSignature app.

Individuals and companies can request an eSignature from contractors, business partners, or clients when sending them PDFs. An electronic signature denotes that both the sender and the recipient intend to sign the document and agree to conduct business in electronic form.

The use of electronic signatures is not limited to business only. They’re used for a majority of document-related transactions in different spheres of life. eSignature use cases range from medical history forms and loan agreements to teacher reports, policy declaration forms, etc.

Are electronic signatures secure?

Typically, to eSign a PDF or other document, a signer needs to upload an image of their signature from a device or draw it on a trackpad or touchscreen. This relatively simple procedure makes users believe eSignatures are not secure enough. Contrary to popular belief, it all depends on the eSignature app, usability, and security requirements of a particular business.

eSigning is associated with multiple security risks such as malware, hacking attacks, and identity theft. The IRS Electronic Signature (eSignature) Program lays out the security standards for the eSigning process. Section 10.10.1.1.5 (12-03-2019) suggests that Secure Access e-Authentication has multiple levels of online security and protection. The risk of each transaction is determined using several levels of assurance on a scale from 1-4. The type of identity proofing required depends on a given level.

- A (Level 1) denotes little or no confidence in asserted identity’s validity. As no taxpayer information is shared, identity proofing is not required.

- B (Level 2) denotes some confidence in the asserted identity’s validity. Single-factor identity proofing is required.

- C (Level 3) denotes high confidence in the asserted identity’s validity. This level requires several verification options:

- A multi-factor identity proofing

- An authentication request “Something you know” input

- An authentication request “Something you have” input

- D (Level 4) denotes very high confidence in the asserted identity’s validity. This level requires several verification options:

- An in-person identity proofing

- A multi-factor authentication request “Something you know” input

- A multi-factor authentication request “Something you have” input.

What makes an eSignature legally valid?

In a nutshell, the eSigning process is a single-factor authorization with a signer's identity being verified and a proof of signing. The legal validity and enforceability of eSignatures is stipulated by Section 101 of the ESIGN Act:

- All signatories must give consent to using an electronic signature.

- The process of creating an eSignature must be recorded with the software used for this purpose.

- Records of electronic signatures must be retained and available for accurate reproduction.

The absence of audit logs or weaknesses in authentication may result in eSigned records becoming inadmissible as court evidence, despite being legally valid. A major reason why any eSignature solution must meet a broader list of requirements:

- Unique eSignature that’s attributable to each user. Whenever an electronic document is sent for signature, the signer creates a one-of-a-kind eSignature attributed only to them.

- Choice of signer authentication options. A scope of authentication methods (an email address, IP address, and time of document access) can be used to verify a signer’s identity. The option of adding two-factor authentication to any document should also be made available.

- Cloud document retention. Electronic documents must be housed in secure cloud storage. Any individual involved in the signing process must be able to view and download a copy of the eSigned document.

- In-depth audit log. All parties involved in the signing process must be able to access a detailed document history within the eSignature app. An audit log must include the history of uploading, adding elements, viewing, and eSigning associated with each signer.

- Conformity with security standards. The eSignature solution must conform to the IRS security standards (PCI DSS 11.2) and guarantee the security of sensitive information.

How to eSign a W9 in airSlate SignNow

Individuals, small to medium-sized businesses, and enterprises use eSignature apps to electronically sign tax forms. With airSlate SignNow, users can eSign a W9 form in two clicks and prepare it for electronic filing to the IRS right from their accounts. As a part of the airSlate Business Cloud, airSlate SignNow provides access to an extensive database of legal documents and forms.

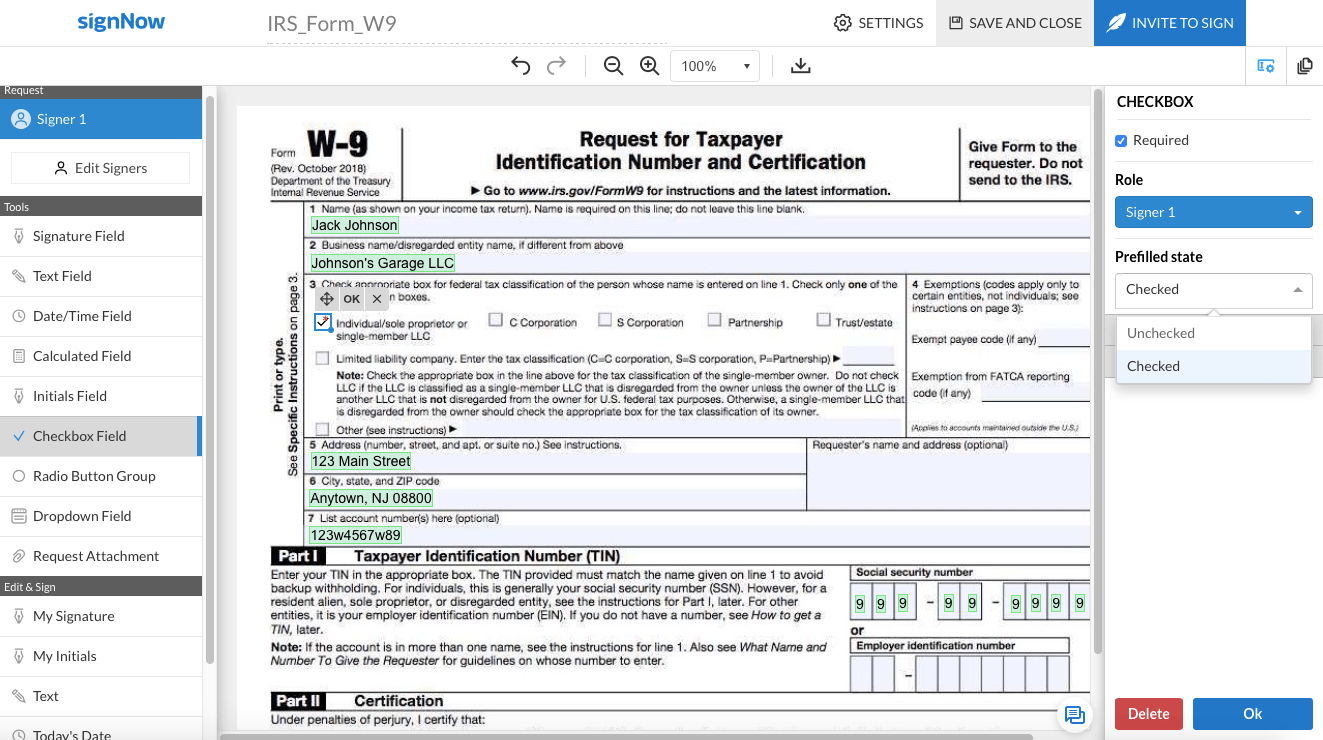

Follow the instructions below to eSign your Form W9 with airSlate SignNow:

- Download a W9 form in PDF format from the IRS website. Alternatively, you can get a blank W9 template right from your account. airSlate SignNow supports most in-demand document formats (PDF, DOCX, PPTX) and image file formats (JPG/JPEG, PNG).

- Log in to your airSlate SignNow account. From your Homepage, you can: choose an existing document or template from the airSlate SignNow Documents folder; import a file stored on your device to create a new document/template.

- Click the “Upload Documents” button in the top-left corner of the Homepage. Select the W9 PDF to upload it to airSlate SignNow from your device. After the form is uploaded, click on it to proceed.

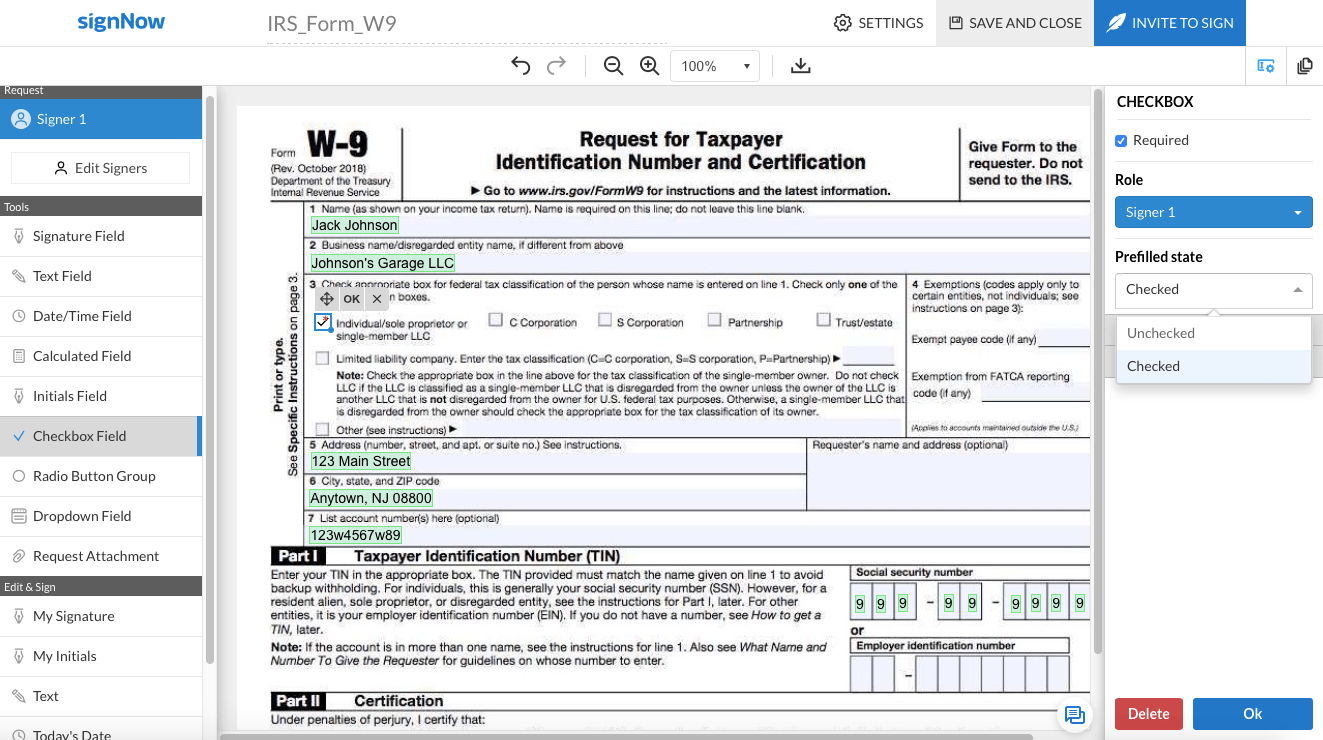

- Go to the Edit & Sign section on the right side of the screen and select Text to create a fillable text field. Repeat this step to create fillable text fields over lines 1, 2, 5, 6, 7, and Part I Taxpayer Identification Number (TIN). Fill in the requested information.

- In line 3, you need to create a checkbox and tick the appropriate box to mark the applicable tax classification. Go to the Tools section and click Checkbox Field. Put the cursor on the appropriate box and create a checkbox.

By default, the checkbox is unchecked. Go to the CHECKBOX panel on the right side of the screen. In the Prefilled state drop down menu, choose Checked. To save the changes, click OK at the bottom of the CHECKBOX panel.

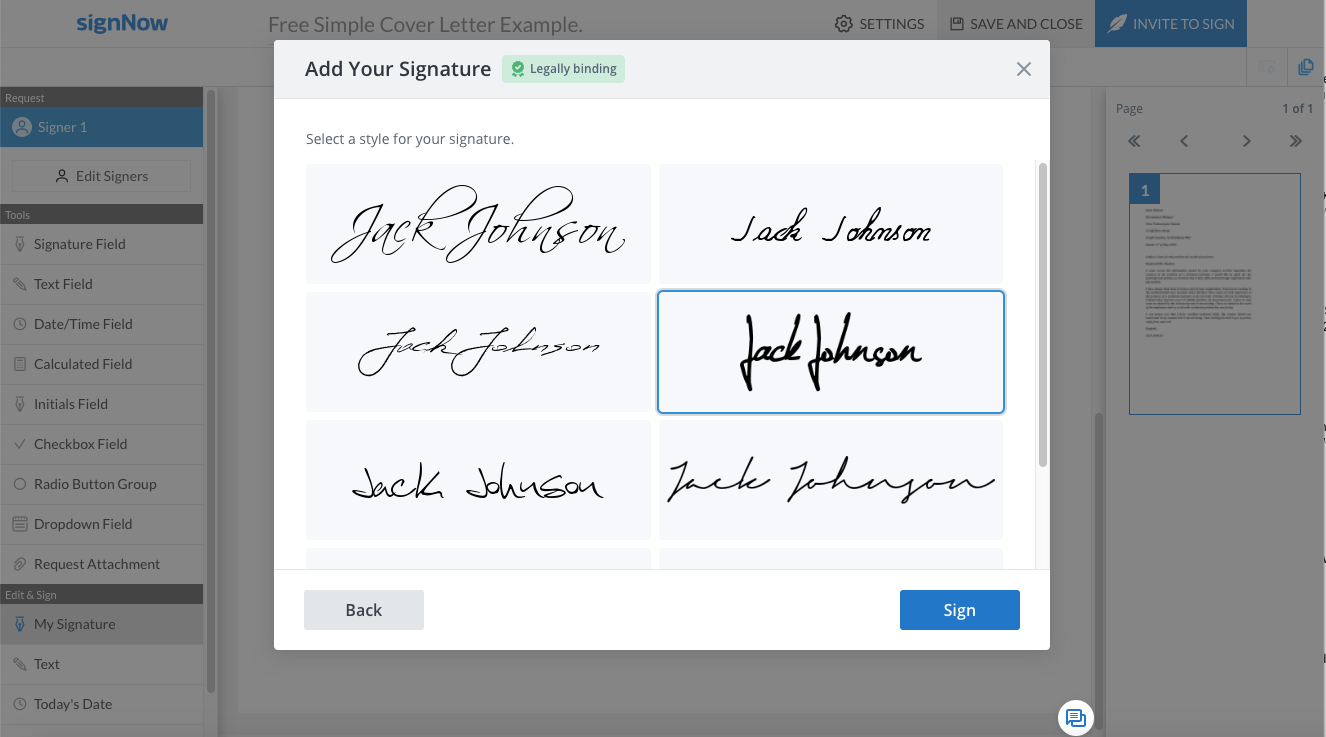

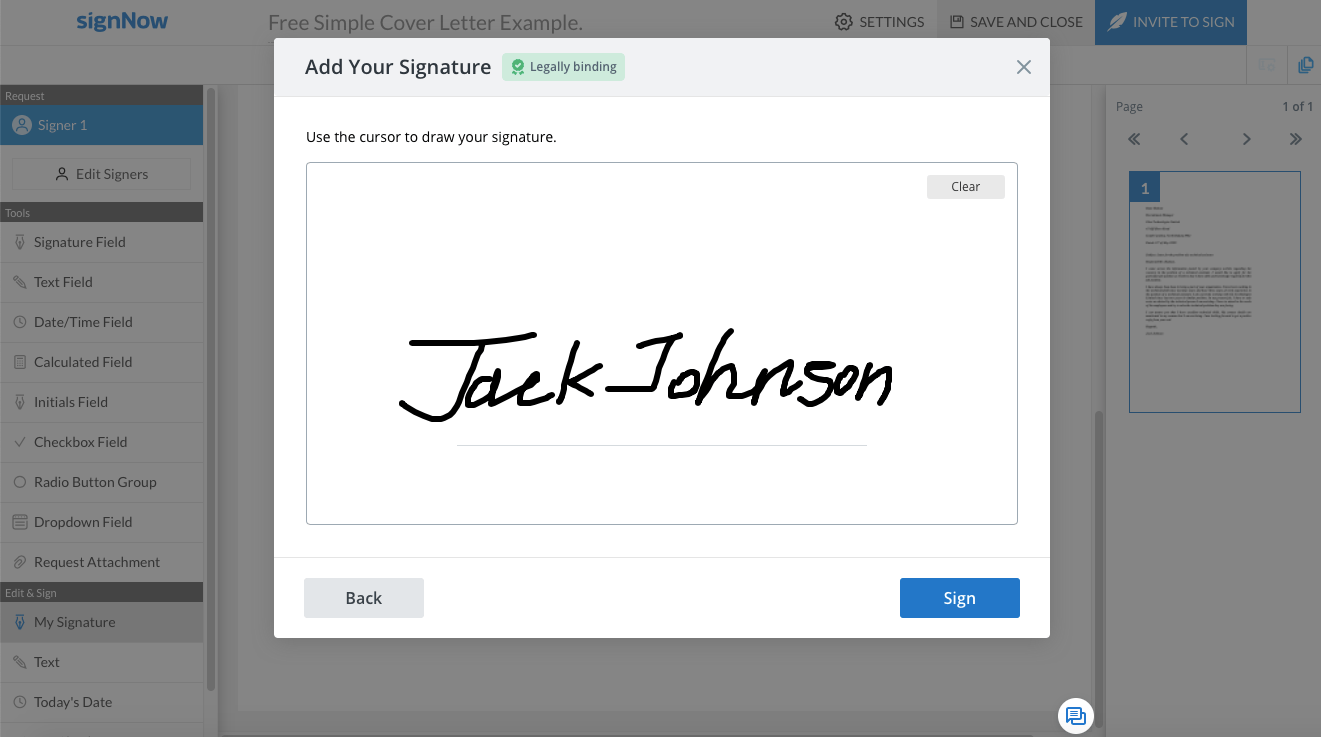

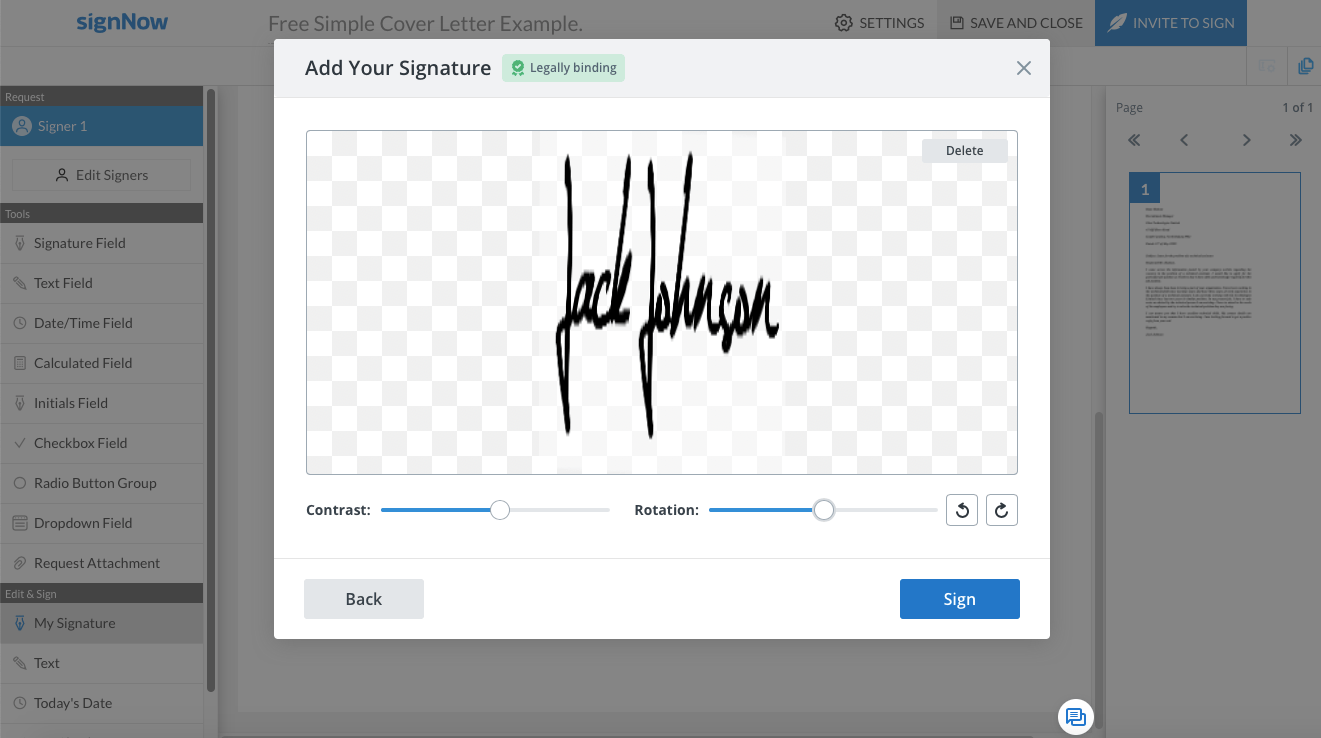

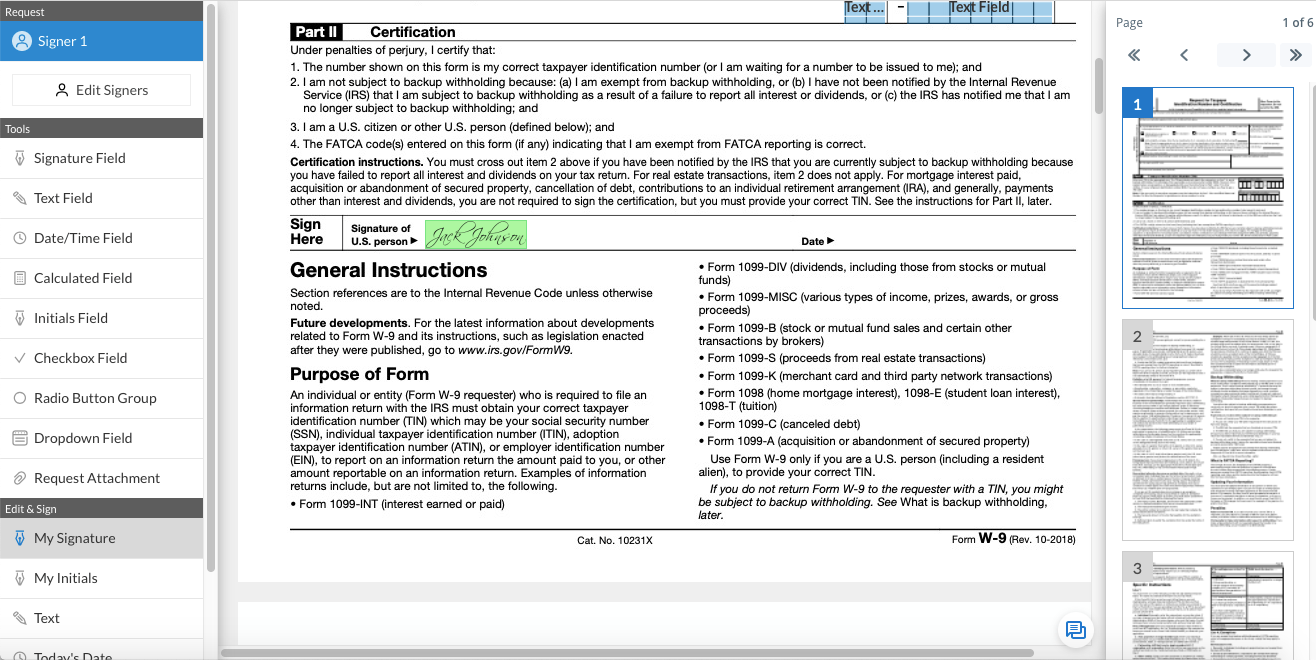

6. In the Part II Certification section of the W9, you need to apply your eSignature to verify the information you filled in. To eSign the W9 form, go to the Edit & Sign section, then click My Signature.

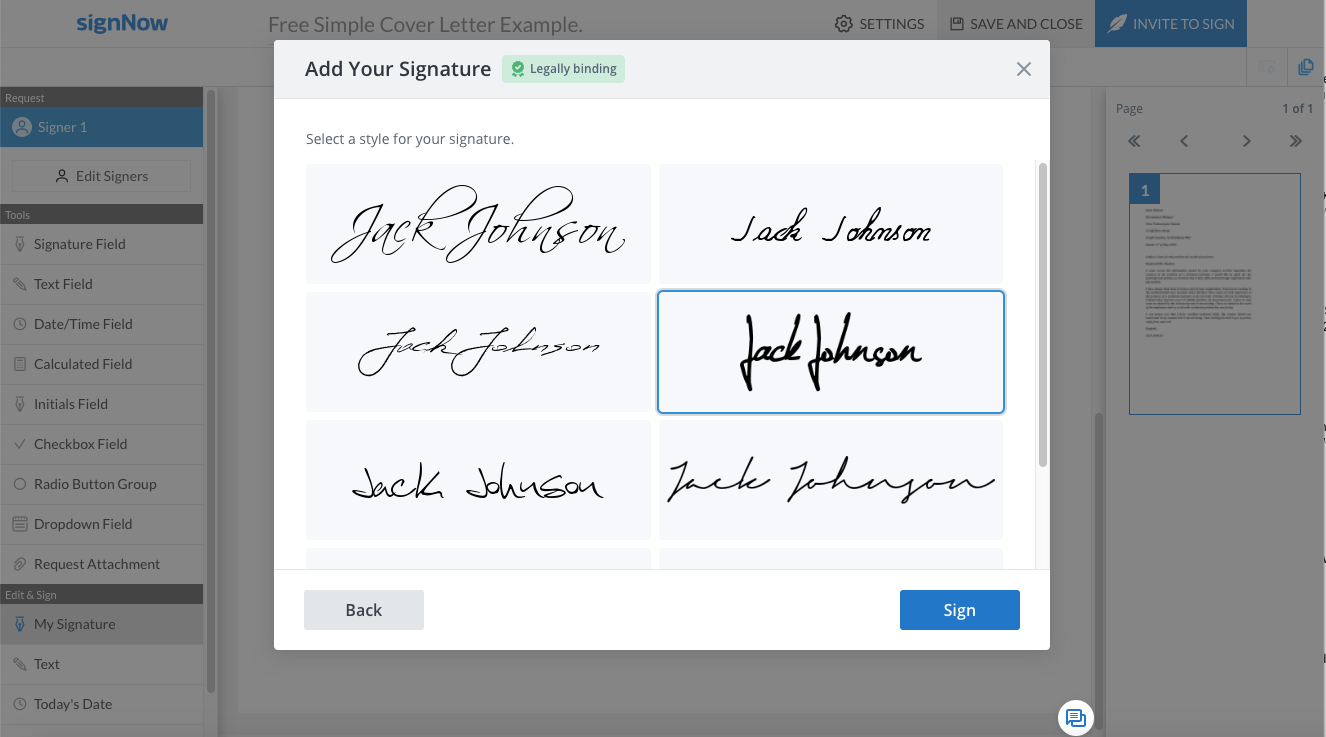

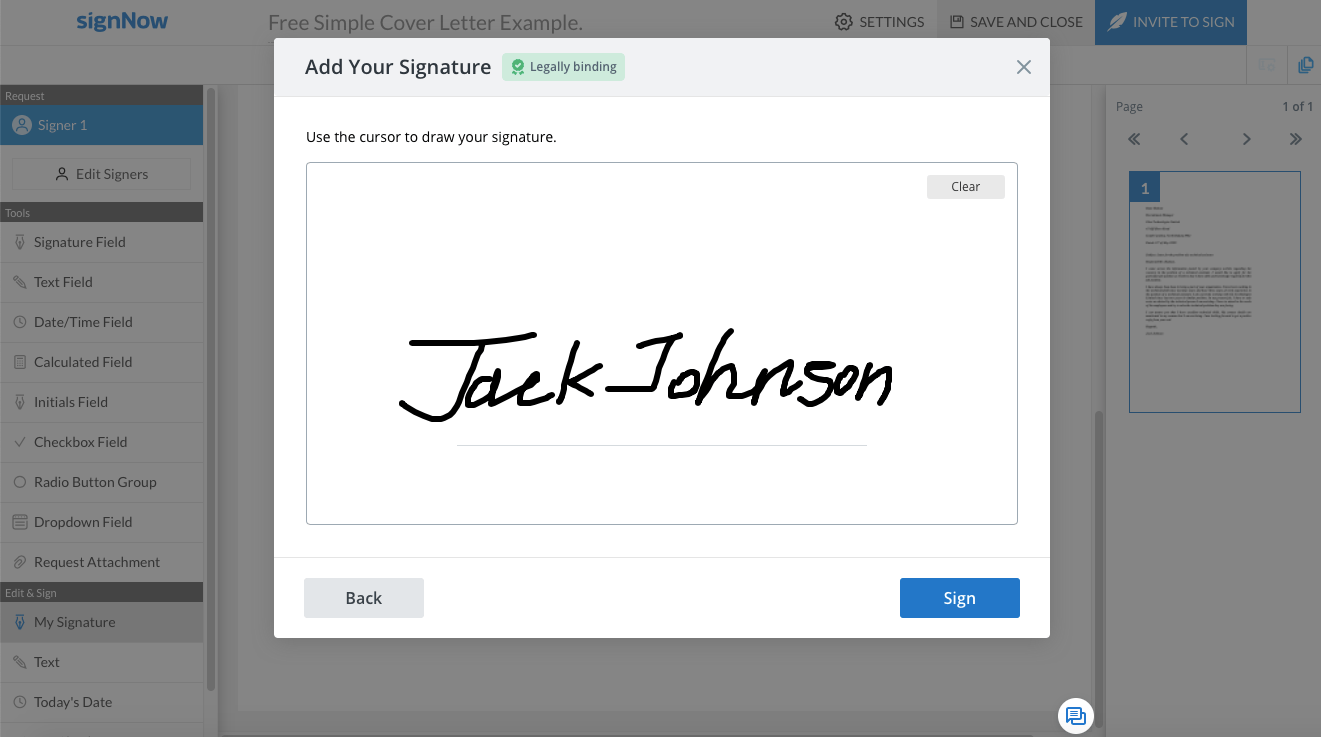

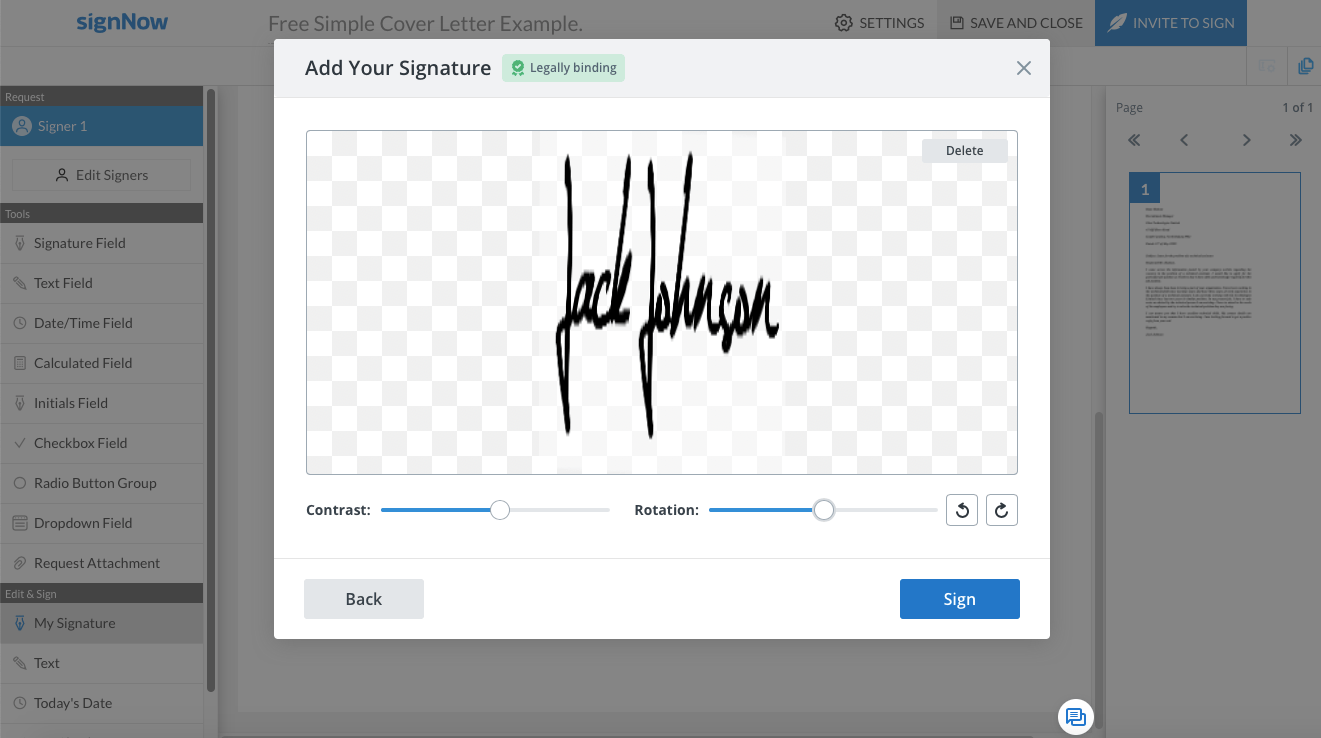

7. Click on the signature field to activate it and sign the document. Next, a pop-up window will show up where you can choose how you want to eSign your W9.

Pick one of the following three options:

● Type Your Signature. Enter your full name to create a new signature.

Feel free to alter the look and style of your eSignature using the Change Style option. Next, choose a different typeface for your electronic signature.

Draw Your Signature. Draw a signature by hand using a mouse or trackpad in the empty field.

Upload Your Signature. Drag and drop or upload an image of your signature in JPG, GIF, or PNG format from your device. Make sure the image size is under 4 Mb.

8. In the event, you’ve created several signatures, set one of them as a default. In the Select Your Signature pop-up, select the signature you like most and click “Set as My Default Signature”.

9. If everything looks fine, click the Sign button to complete the process. Click Save and Close to go back to the dashboard.

10. If you need to submit your eSigned W9 to the IRS via email, you can download the completed form on the airSlate SignNow Homepage. Just click the More (…) button on the far right to access the drop down menu. Next, click Download to obtain the completed form.

airSlate SignNow’s functionality is not limited to generating electronic signatures and editing PDFs. Users can make document templates, invite other users to eSign the document, view History with a detailed audit trail, and even download documents with History. Apart from that, users can merge, archive, move, rename, etc.

Tips for eSigning a Form W9

Even though a W9 is easy to complete, make sure you do everything correctly to avoid legal predicaments in the future. Here are several tips to streamline the process of filling out and eSigning a Form W9:

- Keep your information protected

Unfortunately, tax fraud happens frequently. Hence, your primary responsibility is protecting the sensitive information listed in the form to avoid identity theft and fraud. A completed W9 form contains your name, address, and SSN. To prevent fraudsters from accessing your personal information, never leave a completed W9 form in a public place or send it via unsecured methods. Use authorized eSignature apps and filing methods endorsed by the IRS. Send legal documents, like your W9 via secure methods: certified mail or encrypted email.

- Know who’s requesting a W9 from you

Before completing the W9 form, make sure to specify who’s requesting it, the reason behind the request, and how your information will be used.

- Watch out for any potential phishing scams via an email request.

- Always verify the request before filling anything out and sending anything back to avoid tax fraud.

- Address a tax consultant for advice if you doubt the legitimacy of a W9 form request.

- Never respond to an email requesting you to fill out a W9 form. Keep in mind that the IRS never requests sensitive taxpayers’ information via email.

In the event you receive an email from a federal agency requesting your information, most likely this is a phishing scam. Businesses requesting the W9 form would typically require you to fill out a paper copy. Alternatively, they would help you access the system they’re using to file the form electronically.

Note: an individual or enterprise can only request that you fill out a W9 form if they need to file an information return on you. You can decline if you suspect there’s no legal reason behind the request. Still, a legitimate employer is obligated to withhold taxes from your payment at a rate of 24%.

- Provide information accurately

Fill out your Form W9 thoroughly to avoid penalties for providing incorrect information. Mistakes on tax forms can be expensive. Make sure to verify your information before submitting the W9 form. Falsifying any information will most certainly result in prosecution and penalties. Run spell check to avoid typographical errors, specifically in your legal name or the name of your business and SSN. Check if you provided a correct address, otherwise, you won’t receive your information returns later on.

- Keep your Form W9 up to date

Update your W9 form every time you relocate to a new address, change your legal or business name, or undergo any significant personal or business-related changes.

How does airSlate SignNow improve tax processes?

1. airSlate SignNow uses powerful authentication to verify the signer

airSlate SignNow uses multi-factor authentication to verify the identity of each signer separately. Apart from login and password, airSlate SignNow requests a signer’s email address, full name, SMS code or voicemail verification, and fingerprint login verification. This powerful eSignature app complies with the IRS’s regulations, so you can be rest assured that the only one signing anything is the one who’s supposed to be signing.

2. airSlate SignNow retains the integrity of eSignatures

Once a tax form is eSigned with airSlate SignNow, it’s protected from further tampering. airSlate SignNow retains electronic documents with an index. Users can easily reproduce document copies for archiving purposes or electronic records.

3. airSlate SignNow provides an in-depth audit log

airSlate SignNow records all information related to the eSignature process. The detailed audit log contains the time and date of the eSigned document, the computer’s IP address, and identity verification. It’s viewable at any given time to track what’s happened, by who, and when.

Not only does airSlate SignNow establish a secure identification process for signers, but also prevents identity theft and any company fraud.

Streamline your tax process with airSlate SignNow and eSign your Form W9 today!