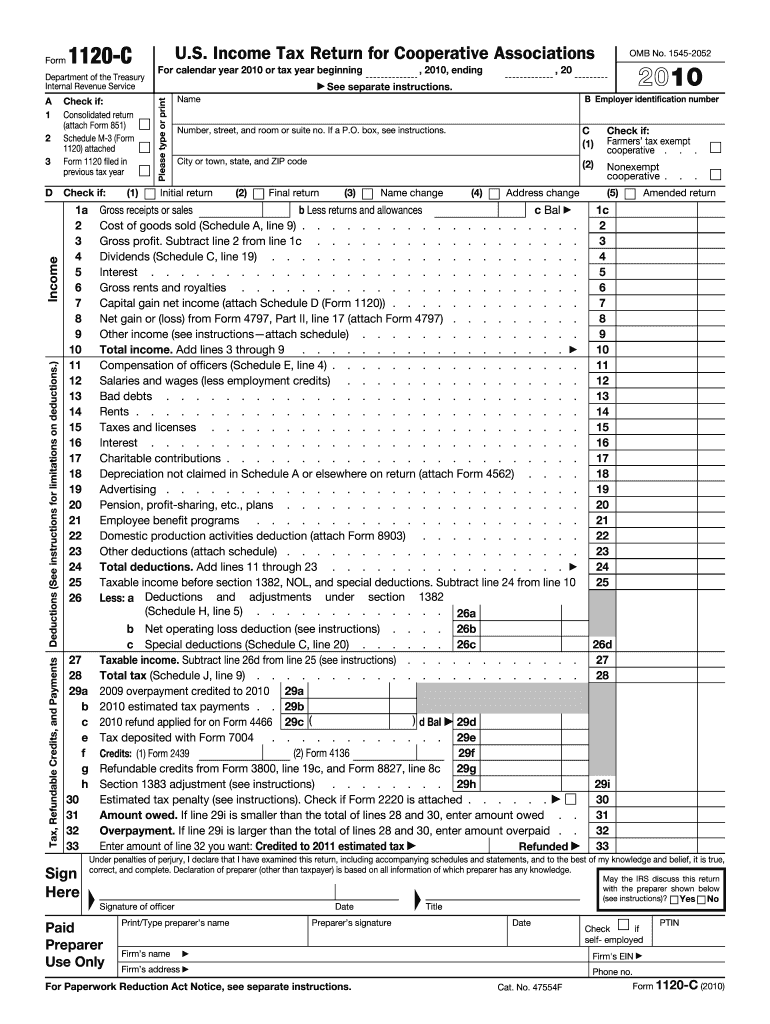

Fill and Sign the 2010 Form 1120 C Us Income Tax Return for Cooperative Associations

Useful Suggestions for Preparing Your ‘2010 Form 1120 C Us Income Tax Return For Cooperative Associations’ Online

Are you fed up with the nuisances of handling paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and businesses. Bid farewell to the lengthy routine of printing and scanning documents. With airSlate SignNow, you can easily complete and endorse paperwork online. Take advantage of the extensive features included in this intuitive and budget-friendly platform and transform your method of managing documents. Whether you need to approve forms or gather signatures, airSlate SignNow manages it all seamlessly, with just a few clicks.

Adhere to this guided procedure:

- Access your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘2010 Form 1120 C Us Income Tax Return For Cooperative Associations’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and allocate fillable fields for others (if necessary).

- Proceed with the Send Invite options to request electronic signatures from others.

- Download, print your copy, or convert it into a multi-use template.

No need to stress if you have to collaborate with your team on your 2010 Form 1120 C Us Income Tax Return For Cooperative Associations or send it for notarization—our platform has everything you require to accomplish such tasks. Create an account with airSlate SignNow today and enhance your document management to a greater level!

FAQs

-

What is the Form 1120 C U S Income Tax Return For Cooperative Associations?

The Form 1120 C U S Income Tax Return For Cooperative Associations is a tax form used by cooperative associations in the United States to report their income, deductions, and tax liability. This form is crucial for cooperative businesses to ensure compliance with federal tax regulations. By accurately filing the Form 1120 C U S Income Tax Return For Cooperative Associations, cooperatives can avoid penalties and maintain their tax-exempt status.

-

How can airSlate SignNow help with filing Form 1120 C U S Income Tax Return For Cooperative Associations?

airSlate SignNow offers a streamlined solution for preparing and eSigning the Form 1120 C U S Income Tax Return For Cooperative Associations. With our user-friendly platform, you can easily fill out your tax forms, gather necessary signatures, and submit them electronically. This reduces the time and effort involved in the filing process, ensuring your cooperative remains compliant.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow provides several features that facilitate efficient management of tax documents, including the ability to create templates for the Form 1120 C U S Income Tax Return For Cooperative Associations, real-time collaboration, and secure cloud storage. Our platform ensures that your documents are easily accessible and protected, allowing your team to work together seamlessly on tax preparation.

-

Is airSlate SignNow cost-effective for cooperative associations?

Yes, airSlate SignNow is a cost-effective solution for cooperative associations looking to manage their tax documents, including the Form 1120 C U S Income Tax Return For Cooperative Associations. We offer flexible pricing plans that cater to different needs and budgets, making it an affordable choice for cooperatives of all sizes. You can start with a free trial to see how it fits your requirements.

-

Can I integrate airSlate SignNow with my accounting software for tax filing?

Absolutely! airSlate SignNow integrates with various accounting software, allowing you to seamlessly pull data into your Form 1120 C U S Income Tax Return For Cooperative Associations. This integration simplifies the process of tax preparation and ensures accuracy by eliminating manual data entry, saving you time and reducing errors.

-

What benefits do I gain from using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including the Form 1120 C U S Income Tax Return For Cooperative Associations, offers numerous benefits. These include enhanced efficiency through electronic signatures, improved compliance with tax regulations, and secure document storage. Our platform also helps streamline communication among team members, making the tax filing process smoother.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes the security of your sensitive tax documents, including the Form 1120 C U S Income Tax Return For Cooperative Associations. We employ robust encryption methods and comply with industry standards to protect your data. This ensures that your cooperative's confidential information is secure throughout the entire document lifecycle.

Find out other 2010 form 1120 c us income tax return for cooperative associations

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles