Fill and Sign the 2014 Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax under Section 6033e Irs

Useful Advice for Finalizing Your ‘2014 Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs’ Online

Are you fed up with the inconvenience of managing documents? Your solution is airSlate SignNow, the leading electronic signature platform for both individuals and businesses. Bid farewell to the lengthy routine of printing and scanning documents. With airSlate SignNow, you can easily fill out and sign documents online. Leverage the powerful features incorporated into this user-friendly and cost-effective platform and transform your document management approach. Whether you need to authorize forms or collect signatures, airSlate SignNow simplifies the process, requiring only a few clicks.

Adhere to these comprehensive instructions:

- Access your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form repository.

- Edit your ‘2014 Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs’ in the editor.

- Select Me (Fill Out Now) to finalize the form on your end.

- Add and assign fillable fields for others (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t worry if you need to collaborate with others on your 2014 Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs or send it for notarization—our platform provides everything necessary to accomplish such tasks. Sign up with airSlate SignNow today and enhance your document management experience!

FAQs

-

What is Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs?

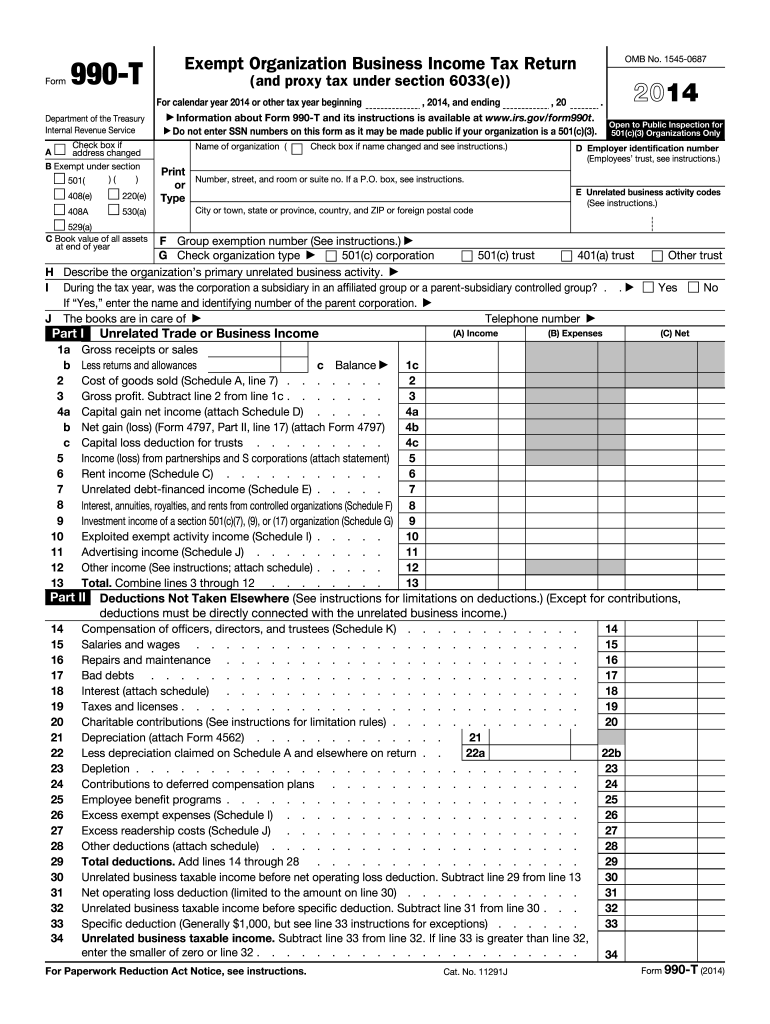

Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs is a tax form that exempt organizations must file to report unrelated business income. This form is crucial for maintaining compliance with IRS regulations, ensuring that tax-exempt entities accurately report their income and pay any required taxes.

-

How can airSlate SignNow help with Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs?

airSlate SignNow provides an efficient platform for managing and eSigning documents related to the Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs. Our solution ensures that all documents are securely stored and easily accessible, streamlining the process of tax compliance and reporting.

-

Is there a cost associated with using airSlate SignNow for Form 990 T compliance?

Yes, airSlate SignNow offers various pricing plans tailored to meet different organizational needs. Each plan provides features that facilitate the management of documents, such as the Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs, at an affordable rate, making it a cost-effective solution.

-

What features does airSlate SignNow offer for managing Form 990 T documents?

airSlate SignNow includes features like customizable templates, automated workflows, and secure eSigning capabilities for managing Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs. These features enhance efficiency and accuracy, allowing organizations to focus on compliance.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software, making it easier to manage the Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs along with other financial documents. This integration ensures a smooth workflow and reduces the chances of errors.

-

What benefits can organizations expect from using airSlate SignNow for Form 990 T filing?

Organizations can expect increased efficiency, improved compliance, and enhanced security when using airSlate SignNow for Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs. Our platform simplifies the document management process, allowing teams to focus on their core missions.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing industry-standard encryption and compliance measures to protect sensitive documents like the Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs. Your data is secure, and our platform is designed to keep your information confidential.

Find out other 2014 form 990 t exempt organization business income tax return and proxy tax under section 6033e irs

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles