1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

Session of 2002

HOUSE BILL No. 2748

By Committee on Insurance

1-31

AN ACT amending the health care provider insurance availability act;

concerning coverage documentation and surcharge payment due date;

providing for payment of interest; amending K.S.A. 40-3402 and

K.S.A. 2001 Supp. 40-3404 and repealing the existing sections.

Be it enacted by the Legislature of the State of Kansas:

Section 1. K.S.A. 40-3402 is hereby amended to read as follows: 403402. (a) A policy of professional liability insurance approved by the commissioner and issued by an insurer duly authorized to transact business

in this state in which the limit of the insurer’s liability is not less than

$200,000 per claim, subject to not less than a $600,000 annual aggregate

for all claims made during the policy period, shall be maintained in effect

by each resident health care provider as a condition to rendering professional service as a health care provider in this state, unless such health

care provider is a self-insurer. This provision shall not apply to optometrists and pharmacists on or after July 1, 1991 nor to physical therapists

on and after July 1, 1995 nor to health maintenance organizations on or

after July 1, 1997. Such policy shall provide as a minimum coverage for

claims made during the term of the policy which were incurred during

the term of such policy or during the prior term of a similar policy. Any

insurer offering such policy of professional liability insurance to any health

care provider may offer to such health care provider a policy as prescribed

in this section with deductible options. Such deductible shall be within

such policy limits.

(1) Each insurer providing basic coverage shall, within 30 60 days

after the premium for the basic coverage is received by the insurer or

within 30 days from the effective date of this act, whichever is later date

the basic coverage becomes effective, shall notify the board of governors

that such coverage is or will be in effect. Such notification shall be on a

form approved by the board of governors and shall include information

identifying the professional liability policy issued or to be issued, the name

and address of all health care providers covered by the policy, the amount

of the annual premium, the inception and expiration dates of the coverage

and, such other information as the board of governors shall require and

shall be accompanied by the surcharge payment required by subsection

�HB 2748

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

2

(b) of K.S.A. 40-3404, and amendments thereto. A copy of the notice

required by this subsection shall be furnished the named insured.

(2) In the event of termination of basic coverage by cancellation, nonrenewal, expiration or otherwise by either the insurer or named insured,

notice of such termination shall be furnished by the insurer to the board

of governors, the state agency which licenses, registers or certifies the

named insured and the named insured. Such notice shall be provided no

less than 30 days prior to the effective date of any termination initiated

by the insurer or within 10 days after the date coverage is terminated at

the request of the named insured and shall include the name and address

of the health care provider or providers for whom basic coverage is terminated and the date basic coverage will cease to be in effect. No basic

coverage shall be terminated by cancellation or failure to renew by the

insurer unless such insurer provides a notice of termination as required

by this subsection.

(3) Any professional liability insurance policy issued, delivered or in

effect in this state on and after July 1, 1976, shall contain or be endorsed

to provide basic coverage as required by subsection (a) of this section.

Notwithstanding any omitted or inconsistent language, any contract of

professional liability insurance shall be construed to obligate the insurer

to meet all the mandatory requirements and obligations of this act. The

liability of an insurer for claims made prior to July 1, 1984, shall not

exceed those limits of insurance provided by such policy prior to July 1,

1984.

(b) Unless a nonresident health care provider is a self-insurer, such

health care provider shall not render professional service as a health care

provider in this state unless such health care provider maintains coverage

in effect as prescribed by subsection (a), except such coverage may be

provided by a nonadmitted insurer who has filed the form required by

subsection (b)(1). This provision shall not apply to optometrists and pharmacists on or after July 1, 1991 nor to physical therapists on and after

July 1, 1995.

(1) Every insurance company authorized to transact business in this

state, that is authorized to issue professional liability insurance in any

jurisdiction, shall file with the commissioner, as a condition of its continued transaction of business within this state, a form prescribed by the

commissioner declaring that its professional liability insurance policies,

wherever issued, shall be deemed to provide at least the insurance required by this subsection when the insured is rendering professional services as a nonresident health care provider in this state. Any nonadmitted

insurer may file such a form.

(2) Every nonresident health care provider who is required to maintain basic coverage pursuant to this subsection shall pay the surcharge

�HB 2748

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

3

levied by the board of governors pursuant to subsection (a) of K.S.A. 403404, and amendments thereto, directly to the board of governors and

shall furnish to the board of governors the information required in subsection (a)(1).

(c) Every health care provider that is a self-insurer, the university of

Kansas medical center for persons engaged in residency training, as described in subsection (r)(1) of K.S.A. 40-3401, and amendments thereto,

the employers of persons engaged in residency training, as described in

subsection (r)(2) of K.S.A. 40-3401, and amendments thereto, the private

practice corporations or foundations and their full-time physician faculty

employed by the university of Kansas medical center or a medical care

facility or mental health center for self-insurers under subsection (e) of

K.S.A. 40-3414, and amendments thereto, shall pay the surcharge levied

by the board of governors pursuant to subsection (a) of K.S.A. 40-3404,

and amendments thereto, directly to the board of governors and shall

furnish to the board of governors the information required in subsection

(a)(1) and (a)(2).

(d) In lieu of a claims made policy otherwise required under this

section, a person engaged in residency training who is providing services

as a health care provider but while providing such services is not covered

by the self-insurance provisions of subsection (d) of K.S.A. 40-3414, and

amendments thereto, may obtain basic coverage under an occurrence

form policy if such policy provides professional liability insurance coverage and limits which are substantially the same as the professional liability

insurance coverage and limits required by subsection (a) of K.S.A. 403402, and amendments thereto. Where such occurrence form policy is in

effect, the provisions of the health care provider insurance availability act

referring to claims made policies shall be construed to mean occurrence

form policies.

Sec. 2. K.S.A. 2001 Supp. 40-3404 is hereby amended to read as

follows: 40-3404. (a) Except for any health care provider whose participation in the fund has been terminated pursuant to subsection (i) of

K.S.A. 40-3403, and amendments thereto, the board of governors shall

levy an annual premium surcharge on each health care provider who has

obtained basic coverage and upon each self-insurer for each fiscal year.

This provision shall not apply to optometrists and pharmacists on or after

July 1, 1991 nor to physical therapists on or after July 1, 1995, nor to

health maintenance organizations on and after July 1, 1997. Such premium surcharge shall be an amount based upon a rating classification

system established by the board of governors which is reasonable, adequate and not unfairly discriminating. The annual premium surcharge

upon the university of Kansas medical center for persons engaged in

residency training, as described in paragraph (1) of subsection (r) of

�HB 2748

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

4

K.S.A. 40-3401, and amendments thereto, shall be based on an assumed

aggregate premium of $600,000. The annual premium surcharge upon

the employers of persons engaged in residency training, as described in

paragraph (2) of subsection (r) of K.S.A. 40-3401, and amendments

thereto, shall be based on an assumed aggregate premium of $400,000.

The surcharge on such $400,000 amount shall be apportioned among the

employers of persons engaged in residency training, as described in paragraph (2) of subsection (r) of K.S.A. 40-3401, and amendments thereto,

based on the number of residents employed as of July 1 of each year. The

annual premium surcharge upon any nonprofit corporation organized to

administer the graduate medical education programs of community hospitals or medical care facilities affiliated with the university of Kansas

school of medicine shall be based upon an assumed aggregate premium

of $10,000. The surcharge on such assumed aggregate premium shall be

apportioned among all such nonprofit corporations.

(b) (1) In the case of a resident health care provider who is not a

self-insurer, the premium surcharge shall be collected in addition to the

annual premium for the basic coverage by the insurer and shall not be

subject to the provisions of K.S.A. 40-252, 40-955 and 40-2801 et seq.,

and amendments thereto. The amount of the premium surcharge shall

be shown separately on the policy or an endorsement thereto and shall

be specifically identified as such. Such premium surcharge shall be due

and payable by the insurer to the board of governors within 30 60 days

after the annual premium for the basic coverage is received by the insurer,

but in the event basic coverage is in effect at the time this act becomes

effective, such surcharge shall be based upon the unearned premium until

policy expiration and annually thereafter. Within 15 days immediately

following the effective date of this act, date basic coverage becomes effective. Premium surcharge payments submitted beyond the 60-day period shall include accrued interest beginning with the effective date of the

basic coverage to the postmarked date of the premium surcharge payment

submission. The interest accrued shall be calculated based on double the

interest rate provided for in subsection (e)(1) of K.S.A. 40-204, and

amendments thereto. Interest amounts shall be payable by the basic coverage insurer and shall not be the responsibility of the health care provider. Premium surcharge payments shall be submitted with the notification form required by subsection (a)(1) of K.S.A. 40-3402, and

amendments thereto. The board of governors shall send to each insurer

information necessary for their compliance with this subsection.

(2) The certificate of authority of any insurer who fails to comply with

the provisions of paragraph (1) of this subsection, shall be suspended

pursuant to K.S.A. 40-222, and amendments thereto, until such insurer

shall pay the annual premium surcharge due and payable to the board of

�HB 2748

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

5

governors, including any accrued interest amount due under paragraph

(1).

(3) Nonresident compliance documents and surcharge payments must

be submitted to the board of governors within 60 days of the effective

date of the coverage period being requested by the nonresident health

care provider. In the case of a nonresident health care provider or a selfinsurer, the premium surcharge shall be collected in the manner prescribed in K.S.A. 40-3402, and amendments thereto.

(c) In setting the amount of such surcharge, the board of governors

may require any health care provider who has paid a surcharge for less

than 24 months to pay a higher surcharge than other health care

providers.

Sec. 3. K.S.A. 40-3402 and K.S.A. 2001 Supp. 40-3404 are hereby

repealed.

Sec. 4. This act shall take effect and be in force from and after its

publication in the statute book.

�

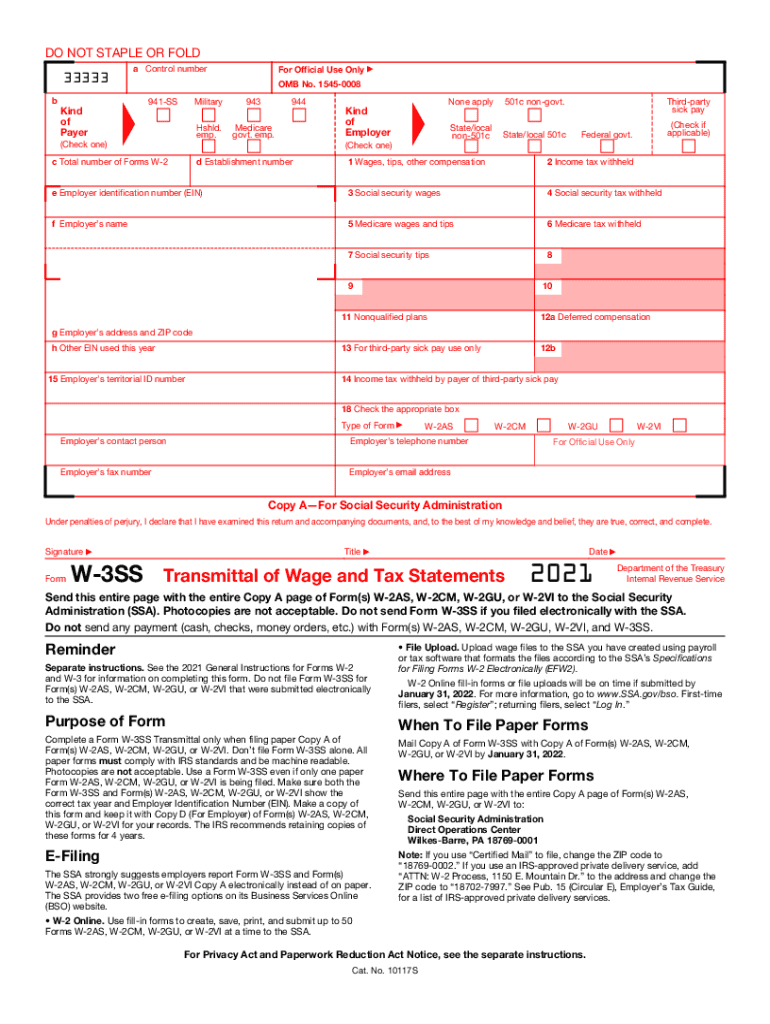

Useful suggestions for preparing your ‘2021 Form W 3ss Transmittal Of Wage And Tax Statements’ online

Feeling burdened by the stress of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature tool for both individuals and organizations. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can conveniently complete and endorse documents online. Take advantage of the extensive features included in this user-friendly and affordable platform and transform your method of document management. Whether you need to approve forms or gather signatures, airSlate SignNow manages everything smoothly with just a few clicks.

Adhere to this comprehensive guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form collection.

- Access your ‘2021 Form W 3ss Transmittal Of Wage And Tax Statements’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your end.

- Add and designate fillable fields for other participants (if required).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with others on your 2021 Form W 3ss Transmittal Of Wage And Tax Statements or send it for notarization—our solution provides all the necessary tools to accomplish such tasks. Sign up with airSlate SignNow today and take your document management to the next level!