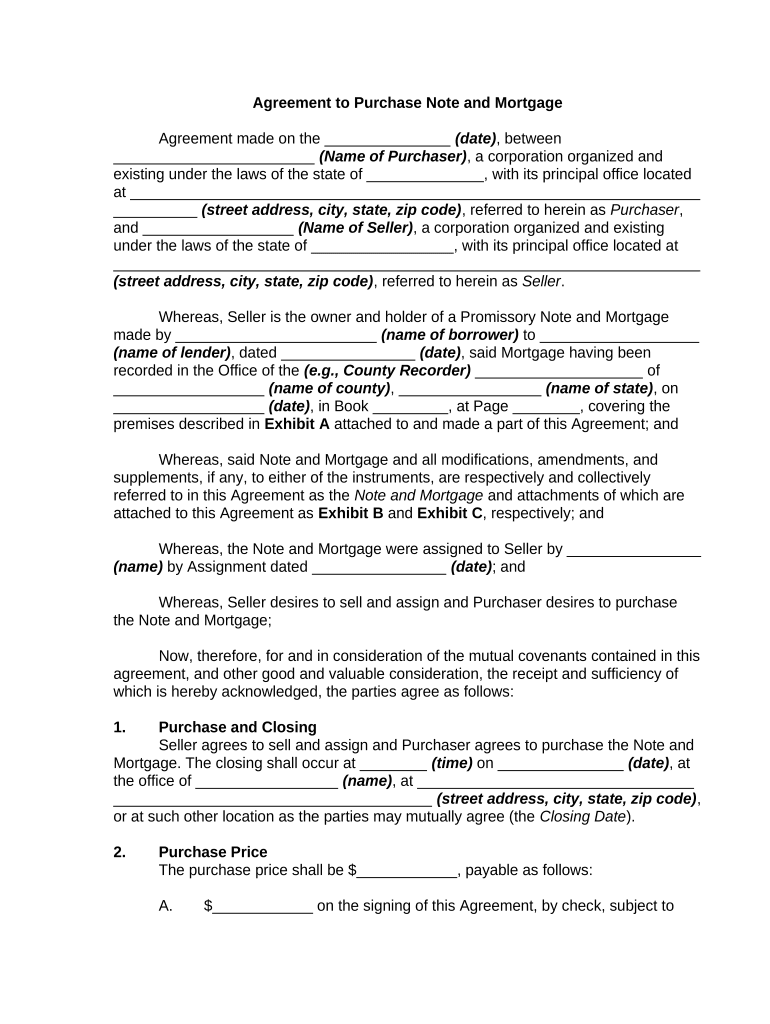

Agreement to Purchase Note and Mortgage

Agreement made on the _______________ (date) , between

________________________ (Name of Purchaser) , a corporation organized and

existing under the laws of the state of ______________, with its principal office located

at ____________________________________________________________________

__________ (street address, city, state, zip code) , referred to herein as Purchaser ,

and __________________ (Name of Seller) , a corporation organized and existing

under the laws of the state of _________________, with its principal office located at

______________________________________________________________________

(street address, city, state, zip code) , referred to herein as Seller .

Whereas, Seller is the owner and holder of a Promissory Note and Mortgage

made by ________________________ (name of borrower) to ___________________

(name of lender) , dated ________________ (date) , said Mortgage having been

recorded in the Office of the (e.g., County Recorder) ____________________ of

__________________ (name of county) , _________________ (name of state) , on

__________________ (date) , in Book _________, at Page ________, covering the

premises described in Exhibit A attached to and made a part of this Agreement; and

Whereas, said Note and Mortgage and all modifications, amendments, and

supplements, if any, to either of the instruments, are respectively and collectively

referred to in this Agreement as the Note and Mortgage and attachments of which are

attached to this Agreement as Exhibit B and Exhibit C , respectively; and

Whereas, the Note and Mortgage were assigned to Seller by ________________

(name) by Assignment dated ________________ (date) ; and

Whereas, Seller desires to sell and assign and Purchaser desires to purchase

the Note and Mortgage;

Now, therefore, for and in consideration of the mutual covenants contained in this

agreement, and other good and valuable consideration, the receipt and sufficiency of

which is hereby acknowledged, the parties agree as follows:

1. Purchase and Closing

Seller agrees to sell and assign and Purchaser agrees to purchase the Note and

Mortgage. The closing shall occur at ________ (time) on _______________ (date) , at

the office of _________________ (name) , at _________________________________

______________________________________ (street address, city, state, zip code) ,

or at such other location as the parties may mutually agree (the Closing Date ).

2. Purchase Price

The purchase price shall be $____________, payable as follows:

A. $____________ on the signing of this Agreement, by check, subject to

collection, the receipt of which is acknowledged, to be held in escrow pursuant to

Section 15 of this Agreement; and

B. $____________, constituting the balance of the purchase price, by good,

certified check of Purchaser or official bank check payable to the order of Seller.

3. No Representations and Warranties

The Note and Mortgage are to be sold and assigned "as is" and without

recourse, as the same may be construed or determined on the basis of Exhibit B and

Exhibit C attached to this Agreement, without any limitation, any moratoriums of

interest or deferment of any date for payment of principal or the maturity date of the

Note, Mortgage, or otherwise. Other than representing that Seller is the present holder

of the Note and Mortgage, it is agreed that there are no other representations or

warranties, express or implied, relating to the Note or Mortgage or the sale and

assignment of them, nor are there any inducements, express or implied, to Purchaser

made to induce Purchaser to enter into this Agreement, or the closing of it, not set forth

in this Agreement. There are no conditions for closing and payment under this

Agreement except as specifically provided for in this Agreement. Purchaser waives any

and all rights in and to any and all such claims whether by way of defense, set-off,

counterclaim, or otherwise.

4. Broker’s Representations

Seller shall not be liable or bound by any verbal or written statements,

representations, real estate or mortgage broker's "set ups" or information pertaining to

the Note and Mortgage furnished by any real estate or mortgage broker, agent,

employee, servant, or any other person unless the same are specifically set forth in this

Agreement or in any supplemental written agreement between the parties.

5. No Broker

The parties represent to each other and agree that there is no broker who was

instrumental in bringing about the sale contemplated in this Agreement. The Purchaser

represents and warrants to Seller that no broker brought about the sale contemplated in

this Agreement and if any claim is made for a broker's commission as a result of acts or

actions of Purchaser with respect to this transaction, Purchaser shall hold Seller, its

successors, and assigns harmless and shall indemnify Seller from and against any and

all liabilities arising out of such claims, including, but not limited to, reasonable

attorneys' fees. This Section shall survive the closing.

6. Default; Liquidated Damages

In the event of default by Purchaser in the performance of any of the terms of this

Agreement and in the event of default by Purchaser under any supplemental Agreement

which may constitute a default under this Agreement, then at Seller's option all monies

previously paid on account of this Agreement shall be retained as liquidated damages

under this Agreement and this Agreement shall become null and void and neither party

shall have any further rights against the other.

7. Seller’s Failure to Perform

If for any reason, other than the matters excepted and set forth in this

Agreement, Seller shall be unable to assign the Note and Mortgage in accordance with

this Agreement, or if Seller cannot or does not comply with this Agreement for any

reason, then the sole obligation of Seller shall be to refund the monies paid by

Purchaser to Seller on account of this Agreement. Upon the payment of such refund,

this Agreement shall terminate and neither party shall have a claim against the other.

Purchaser, however, may nevertheless accept such assignment of the Note and

Mortgage as Seller may be able to assign, without reduction of the purchase price for

any credit or allowance against the same and without any other liability on the part of

the Seller. The acceptance of such assignment by Purchaser shall be deemed to be full

performance by and a discharge of every covenant and obligation to be performed on

the part of Seller pursuant to the provisions of this Agreement except those, if any,

which in this Agreement are specifically stated to survive the closing date.

8. Notice

Any notice or demand that under the provisions of this Agreement or otherwise

must or may be given or made by any party to this Agreement shall be in writing and

may be given or made by mailing the same by certified or registered mail, return receipt

requested, addressed to the respective party at the address set forth at the top of this

Agreement. Either party may designate by notice in writing a new or other address by

which such notice or demand subsequently shall be given, made or mailed. Any notice

given under this Agreement by mail shall be deemed delivered when deposited in a

United States general or branch post office, enclosed in a registered or certified prepaid

wrapper, addressed as provided in this Section.

9. Assignment

This Agreement may not be assigned by Purchaser in whole or in part without

Seller's prior written consent in every instance.

10. Title Insurance

The Seller shall give and the Purchaser shall accept an assignment of the Note

and Mortgage containing such signatures and as any title company that is a member of

the _______________________________ (board of title underwriters) designated by

Seller will accept as sufficient to assign Seller's interest in the Note and Mortgage.

Seller shall assign to Purchaser its title insurance policy with _____________________

(name of title insurance company) , bearing Policy Number ____________, which

insures the Mortgage.

11. Delivery of Documents

At the closing Seller shall deliver to Purchaser an assignment of the Note and

Mortgage duly executed and acknowledged so as to assign the Note and Mortgage to

the Purchaser, without recourse to Seller/assignor and in accordance with this

Agreement, together with the original Note and Mortgage and a letter to the Note Payer

instructing it to make future payments to the Purchaser.

12. Estoppel Letter

At the closing Seller shall also deliver an estoppel letter from the holder of the

Mortgage dated _______________ (date) , between __________________ (name) , as

Mortgagor, and __________________ (name) , as Mortgagee, securing an

indebtedness in the original principal amount of $ __________ (the First Mortgage ). The

First Mortgage wraps around and is inclusive of a Mortgage dated ________________

(date) , between _________________ (name) , as Mortgagor, and _________________

(name) , as Mortgagee, securing an indebtedness in the original principal amount of

$____________, which has been reduced to $____________. The estoppel letter shall

be deemed satisfactory if it includes the following information:

A. The date of original Note;

B. The interest rate of the first Mortgage;

C. The principal balance outstanding; and

D. The date that the next payment is due.

13. Fees, Taxes and Charges

Any recording fees, taxes, title charges, or other charges or impositions which

may be imposed with respect to this transaction shall be paid by Purchaser; the

purchase price set forth in this Agreement shall be net to Seller.

14. No Filing or Recording

Neither this Agreement nor any memorandum of it shall be filed or recorded by

Purchaser in any public office in _______________ (state) .

15. Escrow

The down payment of $____________ shall be held in escrow by

_________________ (name) (the Escrow Agent ) in an interest-bearing account and

shall be remitted with interest to the Seller upon the closing of title or if Purchaser

defaults under this Agreement. The Escrow Agent shall remit the down payment with

interest, if any, to the Purchaser if: (1) Seller defaults and Purchaser is not then in

default; or (2) the Purchaser becomes otherwise entitled to the return of the same by

the terms of this Agreement. It is agreed that the Escrow Agent's sole duties under this

Agreement are as indicated in this Section and that the Escrow Agent in the

performance of its duties under this Agreement shall incur no liability except for willful

malfeasance and shall not be liable or responsible for anything done or omitted to be

done in good faith as provided in this Agreement. If a dispute shall arise as to the

disposition of all or any portion of the down payment held by the escrow agent, the

Escrow Agent shall either: (a) deposit the same with a court of competent jurisdiction,

pending the decision of any such court with respect to the disposition of the down

payment; or (b) hold the same pending receipt of joint instructions from the Seller and

the Purchaser and shall be entitled to rely upon such joint instructions with respect to

the disposition of the down payment. The Seller and Purchaser promise and agree to

indemnify and save the Escrow Agent harmless, except for its willful malfeasance, from

any claims, liabilities, judgments, attorney's fees, and other expenses of every kind and

nature, which may be incurred by the Escrow Agent by reason of its acceptance of, and

its performance under, this Agreement.

16. Severability

The invalidity of any portion of this Agreement will not and shall not be deemed to

affect the validity of any other provision. If any provision of this Agreement is held to be

invalid, the parties agree that the remaining provisions shall be deemed to be in full

force and effect as if they had been executed by both parties subsequent to the

expungement of the invalid provision.

17. No Waiver

The failure of either party to this Agreement to insist upon the performance of any

of the terms and conditions of this Agreement, or the waiver of any breach of any of the

terms and conditions of this Agreement, shall not be construed as subsequently waiving

any such terms and conditions, but the same shall continue and remain in full force and

effect as if no such forbearance or waiver had occurred.

18. Governing Law

This Agreement shall be governed by, construed, and enforced in accordance

with the laws of the State of _____________.

19. Attorney’s Fees

In the event that any lawsuit is filed in relation to this Agreement, the

unsuccessful party in the action shall pay to the successful party, in addition to all the

sums that either party may be called on to pay, a reasonable sum for the successful

party's attorney fees.

20. Mandatory Arbitration

Any dispute under this Agreement shall be required to be resolved by binding

arbitration of the parties hereto. If the parties cannot agree on an arbitrator, each party

shall select one arbitrator and both arbitrators shall then select a third. The third

arbitrator so selected shall arbitrate said dispute. The arbitration shall be governed by

the rules of the American Arbitration Association then in force and effect.

21. Entire Agreement

This Agreement shall constitute the entire agreement between the parties and

any prior understanding or representation of any kind preceding the date of this

Agreement shall not be binding upon either party except to the extent incorporated in

this Agreement.

22. Modification of Agreement

Any modification of this Agreement or additional obligation assumed by either

party in connection with this Agreement shall be binding only if placed in writing and

signed by each party or an authorized representative of each party.

23. Counterparts

This Agreement may be executed in any number of counterparts, each of which

shall be deemed to be an original, but all of which together shall constitute but one and

the same instrument.

24. In this Agreement, any reference to a party includes that party's heirs, executors,

administrators, successors and assigns, singular includes plural and masculine includes

feminine.

WITNESS our signatures as of the day and date first above stated.

_________________________ ________________________

(Name of Seller) (Name of Purchaser)

By:___________________________ By:___________________________

_________________________ _________________________

(P rinted Name & Office in Corporation) (P rinted Name & Office in Corporation)

_________________________ _________________________

(Signature of Officer) (Signature of Officer)

(Attach Exhibits)

(Acknowledgment form may vary by state)

STATE OF ________________

COUNTY OF _______________

Personally appeared before me, the undersigned authority in and for the said

county and state, on this _____ day of ________________, 20_____, within my

jurisdiction, the within named _____________________ (Name of Officer) , who

acknowledged that he is ____________________ (Name of Office) of

___________________________ (Name of Corporation) , a __________________

(name of state) corporation, and that for and on behalf of the said corporation, and as

its act and deed he executed the above and foregoing instrument, after first having been

duly authorized by said corporation so to do.

________________________________

NOTARY PUBLIC

My Commission Expires:

____________________

STATE OF _____________

COUNTY OF ____________

Personally appeared before me, the undersigned authority in and for the said

county and state, on this ______ day of ______________, 20______, within my

jurisdiction, the within named _____________________ (Name of Officer) , who

acknowledged that he is ____________________ (Name of Office) of

_________________________ (Name of Corporation) , a _____________________

(name of state) corporation, and that for and on behalf of the said corporation, and as

its act and deed he executed the above and foregoing instrument, after first having been

duly authorized by said corporation so to do.

________________________________

NOTARY PUBLIC

My Commission Expires:

____________________