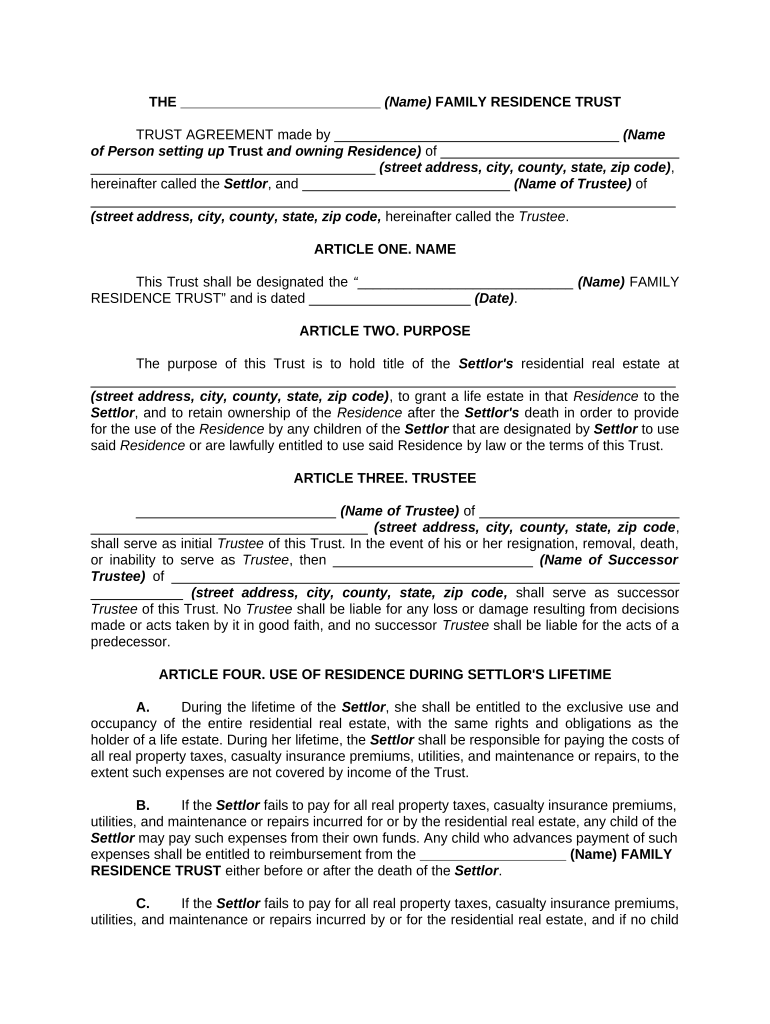

THE __________________________ (Name) FAMILY RESIDENCE TRUST

TRUST AGREEMENT made by _____________________________________ (Name

of Person setting up Trust and owning Residence) of _______________________________

_____________________________________ (street address, city, county, state, zip code) ,

hereinafter called the Settlor , and ___________________________ (Name of Trustee) of

____________________________________________________________________________

(street address, city, county, state, zip code , hereinafter called the Trustee .

ARTICLE ONE. NAME

This Trust shall be designated the “ ____________________________ (Name) FAMILY

RESIDENCE TRUST” and is dated _____________________ (Date) .

ARTICLE TWO. PURPOSE

The purpose of this Trust is to hold title of the Settlor's residential real estate at

____________________________________________________________________________

(street address, city, county, state, zip code) , to grant a life estate in that Residence to the

Settlor , and to retain ownership of the Residence after the Settlor's death in order to provide

for the use of the Residence by any children of the Settlor that are designated by Settlor to use

said Residence or are lawfully entitled to use said Residence by law or the terms of this Trust.

ARTICLE THREE. TRUSTEE

__________________________ (Name of Trustee) of __________________________

____________________________________ (street address, city, county, state, zip code ,

shall serve as initial Trustee of this Trust. In the event of his or her resignation, removal, death,

or inability to serve as Trustee , then __________________________ (Name of Successor

Trustee) of __________________________________________________________________

____________ (street address, city, county, state, zip code , shall serve as successor

Trustee of this Trust. No Trustee shall be liable for any loss or damage resulting from decisions

made or acts taken by it in good faith, and no successor Trustee shall be liable for the acts of a

predecessor.

ARTICLE FOUR. USE OF RESIDENCE DURING SETTLOR'S LIFETIME

A. During the lifetime of the Settlor , she shall be entitled to the exclusive use and

occupancy of the entire residential real estate, with the same rights and obligations as the

holder of a life estate. During her lifetime, the Settlor shall be responsible for paying the costs of

all real property taxes, casualty insurance premiums, utilities, and maintenance or repairs, to the

extent such expenses are not covered by income of the Trust.

B. If the Settlor fails to pay for all real property taxes, casualty insurance premiums,

utilities, and maintenance or repairs incurred for or by the residential real estate, any child of the

Settlor may pay such expenses from their own funds. Any child who advances payment of such

expenses shall be entitled to reimbursement from the ___________________ (Name) FAMILY

RESIDENCE TRUST either before or after the death of the Settlor .

C. If the Settlor fails to pay for all real property taxes, casualty insurance premiums,

utilities, and maintenance or repairs incurred by or for the residential real estate, and if no child

of the Settlor pays such expenses, then the Trustee shall sell the residential real estate at its

fair market value. In such event, the children of the Settlor shall have the option to purchase

described in Article Ten of this Trust agreement.

D. After any sale of the Residence under this Article, this Trust shall continue for the

remainder of the Settlor's lifetime, and the Settlor shall retain her interest as income

beneficiary of the Trust.

ARTICLE FIVE. USE OF RESIDENCE AFTER DEATH OF SETTLOR

After the death of the Settlor , the Trustee shall permit the use and occupancy of the

residential real estate in accordance with the following provisions:

_______________________ (Name of Person) of _____________________________

______________________________________ (street address, city, county, state, zip code ,

shall have the exclusive right to occupy the Residence on the Settlor's residential real estate,

for the entire lifetime of ____________________________ (Name of Person) . After the death

of ________________________ (Name of Person) or in the event he or she discontinues his

or her occupancy of the Residence , the Trustee may permit any other descendant of the Settlor

to occupy the main Residence for any period of time authorized by the Trustee .

ARTICLE SIX. PAYMENT OF EXPENSES AFTER DEATH OF SETTLOR

A. The Trustee shall pay from the income of the Trust, and if the income is

inadequate, then from any liquid assets of the Trust, all expenses related to the ownership and

use of the residential real estate of the Settlor , including property taxes, insurance,

maintenance, repairs, and utilities.

B. If the income and liquid assets of the Trust are insufficient to pay the expenses

related to the ownership and use of the residential real estate, then the Trustee shall provide for

payment of such expenses in the following manner:

The occupant of the Residence shall pay all expenses related to the main Residence ,

including the real property taxes, casualty insurance premiums, utilities, and maintenance or

repairs.

C. If the income and liquid assets of the Trust are insufficient for the payment of all

expenses related to the ownership and use of the Settlor's residential real estate, and if the

occupant of the Residence fails to pay such expenses, then the Trustee shall terminate the

occupancy rights of the beneficiary who fails to pay such expenses, and evict such beneficiary

from occupancy.

ARTICLE SEVEN. APPLICATION OF NET INCOME

A. During the lifetime of the Settlor , the Trustee shall distribute to the Settlor any

net income of the Trust remaining after paying all expenses related to the ownership and use of

the Residence and any other administrative expenses of the Trust.

B. After the death of the Settlor , any income of the Trust remaining after paying all

expenses related to the ownership and use of the Residence and any other administrative

expenses of the Trust shall be accumulated by the Trust and added to principal.

ARTICLE EIGHT. DISCLAIMER BY SETTLOR

In the event the Settlor files a written disclaimer with the Trustee of his or her life estate

and income interest in this Trust at any time, then the Trustee shall thereafter administer this

Trust as if the Settlor were deceased.

ARTICLE NINE. TERMINATION OF TRUST AFTER DEATH OF SETTLOR

A. Early Termination by Trustee. If the income and liquid assets of the Trust are

insufficient to pay all expenses related to the ownership and use of the residential real estate,

and if the beneficiaries of the Trust do not pay such expenses, then the Trustee may, in its sole

discretion, sell the residential real estate. Prior to the sale of the real estate by the Trustee , the

beneficiaries of the Trust shall have the option to purchase described in Article Ten . If no

beneficiary exercises the option to purchase, the Trustee shall sell the Residence at the best

price obtainable within a reasonable market period, considering real estate market conditions

prevailing at that time.

B. Early Termination by Beneficiaries. If at any time during the term of this Trust

(after the death of Settlor) all beneficiaries who have the present right to occupy the Residence

notify the Trustee in writing that they want the residential real estate sold and the Trust

terminated, the Trustee shall comply with such direction. Prior to the sale, the beneficiaries of

the Trust shall have the option to purchase the Residence described in Article Ten. If no

beneficiary exercises the option to purchase, the Trustee shall sell the real estate at the best

price obtainable within a reasonable market period, considering real estate market conditions

prevailing at that time.

C. Termination of Trust After Death of Settlor. After the death of the Settlor , the

Trustee shall sell the residential real estate and terminate this Trust. Prior to the sale of the real

estate by the Trustee , the beneficiaries of the Trust shall have the option to purchase described

in Article Ten . If no beneficiary exercises the option to purchase, the Trustee shall sell the real

estate with reasonable dispatch and at the best price obtainable, considering real estate market

conditions prevailing at that time.

D. Distribution of Sale Proceeds. In the event of the sale of the residential real

estate during the lifetime of the Settlor , the sale proceeds shall be reinvested and shall continue

to be held in this Trust for the benefit of the Settlor . In the event of the sale of the residential

real estate and after the death of the Settlor , the Trustee shall distribute the assets of the Trust

in equal shares among ________________ and ________________. If any of these remainder

beneficiaries predeceases this distribution, the share of such predeceased beneficiary shall be

distributed to his or her issue, by right of representation.

ARTICLE TEN. OPTION TO PURCHASE

A. In the event of any sale of the residential real estate held by this Trust, the

Trustee shall hire a certified real estate appraiser, at the expense of the Trust, to provide an

appraisal of the real estate. The Trustee shall deliver a copy of the appraisal to each surviving

child of the Settlor and to the issue of any deceased child of the Settlor .

B. __________________________ (Name of Person) shall have the first option to

purchase the real estate held by the Trust, and he or she shall have sixty (60) days from receipt

of the appraisal to notify the Trustee in writing of his or her exercise of the option to purchase

the real estate at its appraised value. If _________________________ (Name of Person) fails

to exercise his or her option to purchase, then ___________________________ (Name) or if

she is deceased , __________________________ (Name) of ___________________________

_________________________________________ address, city, county, state, zip code ,

shall have the next option to purchase the real estate. __________________________ (Name)

shall have thirty (30) days from the expiration or release of his or her option, but in no event less

than sixty (60) days from receipt of the appraisal, to give written notice to the Trustee of his or

her exercise of the option to purchase the real estate from the Trust at its appraised value.

C. If _______________________ (Name) and ______________________ (Name)

waive their options to purchase or fail to exercise their options to purchase, then the other

surviving children of the Settlor , or the issue of any deceased child of the Settlor , shall have

the next option to purchase the real estate owned by the Trust. All such beneficiaries shall have

thirty (30) days from the expiration or waiver of the option period held by __________________

(Name) and _____________________ (Name) , but in no event less than sixty (60) days from

receipt of the appraisal, to give written notice to the Trustee of the exercise of the option to

purchase. If more than one beneficiary exercises the option to purchase the Residence , they

shall purchase the Residence in proportion to their distributive shares under this Trust.

D. Any purchase of the real estate under this option shall be completed within forty-

five (45) days after the beneficiary gives written notice to the Trustee of the exercise of the

option. The purchase shall be in cash, but any beneficiary may receive credit towards the

purchase price equal to his or her distributive share of the Trust.

ARTICLE ELEVEN. TERMINATING DISTRIBUTION TO MINOR BENEFICIARY

If a distribution of any share of this Trust upon its termination is payable to a beneficiary

who is under the age of twenty-one (21), then the share of such beneficiary shall be transferred

to a custodian to be designated by the Trustee under the State’ Uniform Transfers to Minors

Act. The custodian shall hold the custodial property under the Act until the minor attains the age

of twenty-one (21) years.

ARTICLE TWELVE. SPENDTHRIFT PROVISION

The interests of the beneficiaries are created for their personal enjoyment, protection

and welfare and shall not be susceptible to assignment, anticipation, hypothecation or seizure

by legal process. If the Trustee believes that the interest of a beneficiary is threatened to be

diverted from the purpose for which it was created, the Trustee shall withhold any income and

principal which it is authorized to distribute to the beneficiary and shall apply it in such manner

as it considers advisable for the care, comfort, maintenance, education or general welfare of the

beneficiary. Such distributions to the beneficiary may be resumed when the Trustee considers

the diversion is no longer effective or threatened. This provision shall not be construed to extend

the term of any Trust.

ARTICLE THIRTEEN. BOND AND LIABILITY OF TRUSTEE

The Trustee shall not be liable for any loss or depreciation in the value of the Trust

estate occurring by reason of error in judgment in making any sale, investment, or reinvestment,

or in continuing to hold in Trust any property herewith or hereafter transferred to the Trustee , or

any investment or reinvestment hereafter made, unless the Trustee failed to act in good faith or

with reasonable care. No Trustee expressly named herein shall be required to furnish any bond

or security for the performance of its duties hereunder.

ARTICLE FOURTEEN. RESIGNATION OF TRUSTEE AND APPOINTMENT OF SUCCESSOR

A. Any Trustee may resign or decline to act by giving written notice to the current

adult income beneficiaries of this Trust. The Settlor shall have the right to remove and replace

any Trustee of this Trust during her lifetime. After the death of the Settlor , the children of the

Settlor then surviving shall have the power to remove the Trustee then acting by a written

notice of removal signed by all children of the Settlor other than any child who is then acting as

Trustee .

B. Upon the resignation, removal, or death of all Trustee s named in this Trust

agreement, the children of the Settlor then surviving shall unanimously appoint as Trustee any

corporation authorized to administer Trusts or any individual. However, in the event of the

removal of the acting Trustee , the consent or approval of the removed Trustee shall not be

required for appointment of the successor.

C. Each successor Trustee shall have the powers and discretions granted in this

agreement to its predecessor. No successor Trustee shall have a duty to audit or investigate the

administration accounts of a predecessor Trustee . No successor Trustee shall be liable for any

act, omission, or default of a predecessor Trustee .

D. If there is a corporate Trustee and it is merged with or transfers substantial all of

its assets to another corporation, or is in any other manner reorganized or reincorporated, then

the resulting corporation or transferee corporation shall be the Trustee .

ARTICLE FIFTEEN. POWERS OF TRUSTEE

The Trustee and any successor Trustee shall have the following powers, duties, and

discretion, in addition to those now or hereafter conferred by statute or case law in the State of

Arizona.

A. To retain any property as transferred to the Trustee by the Settlor , without

liability for any loss, even though the Trustee would not purchase the property as a Trust

investment and though to retain it might violate sound investment diversification

principles.

B. To sell at public or private sale, contract to sell, grant options to buy, convey,

transfer, exchange, partition, dedicate, lease or grant easements for a term within or

extending beyond the terms of the Trust, repair, improve, remodel, demolish or abandon,

any real or personal property of the Trust.

C. To borrow money, and mortgage or pledge Trust property.

D. To invest in bonds, common or preferred stocks, options, notes, real estate

mortgages, common Trust funds, shares of any investment company or Trust, or other

securities, and real or personal property.

E. To allot to any Trust an undivided interest in property, make joint investments for

two or more Trusts hereunder, distribute property in cash or in kind, or partly in each,

and to determine the value of any property so allotted or distributed.

F. To exercise in person or by proxy all voting and other rights, powers and

privileges, and take all steps to realize all benefits, with respect to stocks or other

securities.

G. To pay all expenses incurred in the administration of the Trust, including

reasonable compensation to the Trustee , and employ and pay reasonable compensation

to agents and counsel, including investment counsel.

H. To create out of income reasonable reserves for depreciation and depletion.

I. To accept additional property from any person and administer it as a part of the

Trust.

J. To deal with the fiduciary of any other estate or Trust, even though the fiduciary

is a Trustee hereunder.

K. To compromise or abandon any claim or demand in favor of or against the Trust.

L. To do all other acts necessary to accomplish the proper management,

investment and distribution of the Trust.

ARTICLE SIXTEEN. ACCOUNTING TO INCOME BENEFICIARIES

AND REMAINDER BENEFICIARIES

The Trustee shall render at least annually to the income beneficiaries under this Trust a

statement of account showing in detail all receipts, disbursements, and distributions of both

principal and income from the Trust since the last such statement. Unless the account is

objected to in writing within sixty (60) days from its rendition, the account shall be deemed

approved as stated. The approval of the account by the beneficiaries, and the guardians or legal

representatives of beneficiaries under legal disability, shall be final and binding on all persons

who are then or thereafter may become entitled to share any of the Trust principal or income.

ARTICLE SEVENTEEN. DEFINITION OF ISSUE

The words child , grandchild , and issue , and other terms indicative of descent, shall

exclude adopted persons and shall include only persons legitimately born, except for the

following instances:

1. A person adopted while he or she is under the age of eighteen (18) years shall

be considered legitimately born to the adopting parent or parents and shall not be

considered an adopted person;

2. A person born out of wedlock shall be considered legitimately born to the natural

mother unless a decree of adoption terminates her rights as parent during her life; and

3. A person born out of wedlock shall be considered legitimately born to the natural

father only if he:

a. Marries the child's natural mother;

b. Adopts the child at any time or carries out any legal procedure to confirm

the legitimate status of the child; or

c. Acknowledges in an irrevocable signed instrument delivered to the

Trustee while both the child and the natural father are living that the child is to be

considered legitimately born for purposes of this instrument.

ARTICLE EIGHTEEN. TESTAMENTARY POWER OF APPOINTMENT

The Settlor reserves the power to alter the distribution of the remainder interests in this

Trust among her descendants or such persons who at any time were married to a descendant

of the Settlor , in such proportions and subject to such Trusts, powers, and conditions as the

Settlor may provide and appoint in her Last Will and Testament duly admitted to probate,

specifically referring to and exercising this power.

ARTICLE NINETEEN. IRREVOCABLE TRUST

This Trust may not be amended or revoked by the Settlor .

Witness my signature this the __________________ (date) .

_______________________________________________

Name and signature of SETTLOR

State of Arizona

County of __________________

The foregoing instrument was acknowledged before me this _____ day of

_______________, 20______, by _________________________ (Name of Settlor) .

_________________________________

NOTARY PUBLIC

Print Name: ______________________

My Commission Expires:

____________________

ACCEPTANCE OF TRUSTEE

THE UNDERSIGNED, BEING THE TRUSTEE NAMED IN THIS INSTRUMENT, DOES

HEREBY AGREE TO ACT IN SUCH CAPACITY AND FURTHER AGREES TO ABIDE BY ALL

THE TERMS, CONDITIONS, AND PROVISIONS OF THIS TRUST AGREEMENT.

NAME OF TRUSTEE:

____________________________

_____________________________

Signature of Trustee

State of Arizona

County of _________________

The foregoing instrument was acknowledged before me this _____ day of

____________, 20______, by __________________________ (Name of Trustee) .

_________________________________

NOTARY PUBLIC

Print Name: ______________________

My Commission Expires:

____________________