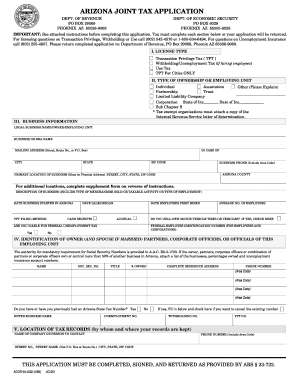

Fill and Sign the Az Joint Tax Application 100036943 Form

Valuable advice for finishing your ‘Az Joint Tax Application 100036943’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier eSignature solution for both individuals and businesses. Bid farewell to the monotonous routine of printing and scanning files. With airSlate SignNow, you can seamlessly complete and sign documents online. Utilize the powerful features bundled into this easy-to-use and affordable platform, transforming your method of handling paperwork. Whether you need to authorize forms or collect electronic signatures, airSlate SignNow simplifies everything with just a few clicks.

Adhere to this comprehensive tutorial:

- Access your account or register for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Edit your ‘Az Joint Tax Application 100036943’ in the editor.

- Select Me (Fill Out Now) to set up the form on your end.

- Include and designate fillable fields for other users (if required).

- Continue with the Send Invite settings to ask for eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you have to work alongside your colleagues on your Az Joint Tax Application 100036943 or send it for notarization—our platform provides everything you need to achieve such tasks. Sign up with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is the Az Joint Tax Application and how does it work?

The Az Joint Tax Application is a streamlined tool designed to simplify the process of filing joint tax returns in Arizona. It allows users to easily collaborate and eSign documents, ensuring that both partners can contribute to their tax filing seamlessly. With airSlate SignNow, the Az Joint Tax Application helps minimize errors and saves time during tax season.

-

What features does the Az Joint Tax Application offer?

The Az Joint Tax Application includes features such as document collaboration, eSigning, and secure cloud storage. Users can easily share their tax documents with their partner and complete the signing process electronically. Additionally, the application provides templates and reminders to help users stay organized and on track with their tax filings.

-

Is the Az Joint Tax Application cost-effective for couples filing taxes?

Yes, the Az Joint Tax Application is designed to be a cost-effective solution for couples filing their taxes together. With competitive pricing and a variety of subscription plans, users can choose the option that best fits their needs and budget. By utilizing airSlate SignNow, couples can save on potential tax preparation fees while ensuring a smooth filing process.

-

How does the Az Joint Tax Application enhance security for sensitive tax documents?

Security is a top priority for the Az Joint Tax Application. airSlate SignNow employs advanced encryption technology to protect all documents, ensuring that sensitive tax information remains confidential. Additionally, users can set up authentication measures, such as two-factor authentication, to further safeguard their accounts and documents.

-

Can the Az Joint Tax Application integrate with other accounting software?

Yes, the Az Joint Tax Application can integrate with various accounting and tax preparation software, enhancing its functionality. This allows users to easily import and export data, making the tax filing process even more efficient. By connecting with other tools, users can streamline their overall financial management.

-

What are the benefits of using the Az Joint Tax Application for filing taxes?

The Az Joint Tax Application offers numerous benefits, including time-saving features, easy collaboration, and enhanced accuracy in tax filing. It simplifies the process for couples by providing a user-friendly interface and automated reminders. By using airSlate SignNow, couples can ensure that their tax documents are completed and submitted on time, reducing stress during tax season.

-

How can I get started with the Az Joint Tax Application?

Getting started with the Az Joint Tax Application is easy! Simply visit the airSlate SignNow website, sign up for an account, and select the Az Joint Tax Application option. Once registered, you can begin uploading your tax documents, inviting your partner to collaborate, and eSigning your forms in just a few simple steps.

Find out other az joint tax application 100036943 form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles