B240A (Form B240A) (12/09)

UNITED STATES BANKRUPTCY COURT

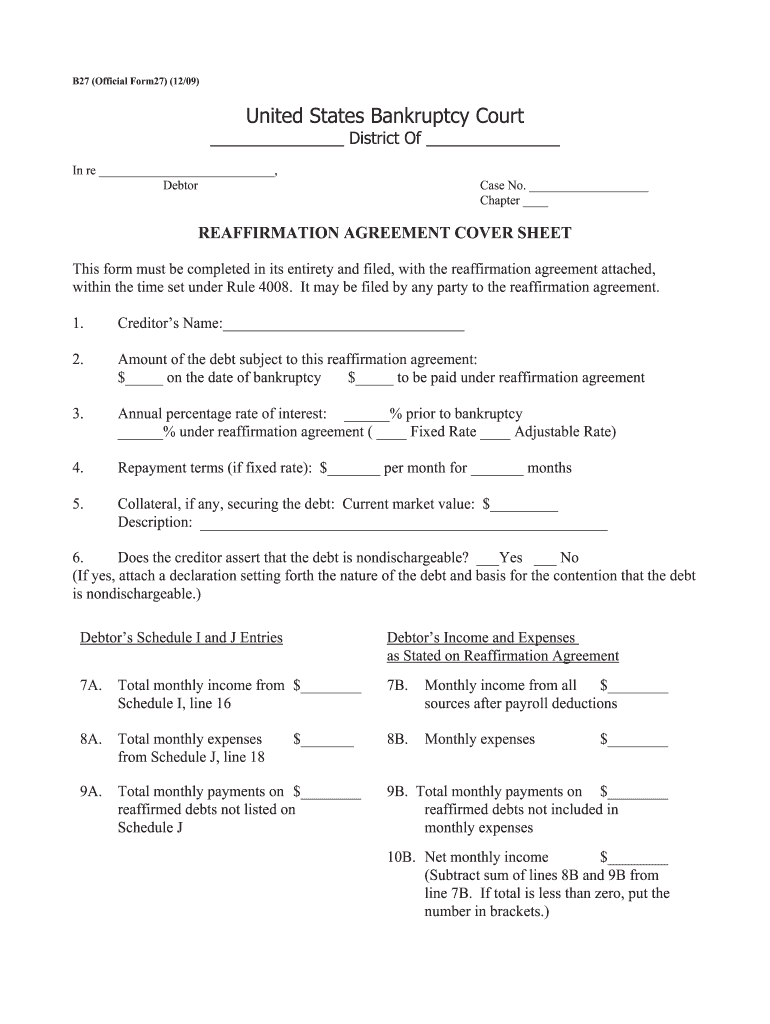

District of

In re , Case No.

Debtor Chapter

REAFFIRMATION DOCUMENTS

Name of Creditor: ______________________________________

G Check this box if Creditor is a Credit Union

I. REAFFIRMATION AGREEMENT

Reaffirming a debt is a serious financial decision. Before entering into this Reaffirmation

Agreement, you must review the important disclosures, instructions, and definitions found

in Part V of this Reaffirmation Documents packet.

1. Brief description of the original agreement being reaffirmed: _________________________

For example, auto loan

2. AMOUNT REAFFIRMED : $___________________________

The Amount Reaffirmed is the entire amount that you are agreeing to pay. This

may include unpaid principal, interest, and fees and costs (if any) arising on or

before the date you sign this Reaffirmation Agreement.

See the definition of “Amount Reaffirmed” in Part V.C below.

3. The ANNUAL PERCENTAGE RATE

applicable to the Amount Reaffirmed is _________%.

See definition of “Annual Percentage Rate” in Part V.C below.

This is a (check one) 9 Fixed rate9 Variable rate

If the loan has a variable rate, the future interest rate may increase or decrease from the Annual

Percentage Rate disclosed here.

Check one.

G Presumption of Undue Hardship

G No Presumption of Undue Hardship

See Debtor’s Statement in Support of

Reaffirmation, Part II below, to determine

which box to check.

Form B240A, Reaffirmation Documents Page 2

4. Reaffirmation Agreement Repayment Terms:

G If fixed term, $________ per month for ________ months starting on____________.

G If not fixed term, describe repayment terms: _______________________________.

5. Describe the collateral, if any, securing the debt:

Description: ____________________________

Current Market Value $_____________

6. Did the debt that is being reaffirming arise from the purchase of the collateral described

above?

G YesG No

If yes, what was the purchase price for the collateral? $____________

If no, what was the amount of the original loan? $____________

7. Detail the changes made by this Reaffirmation Agreement to the most recent credit terms on

the reaffirmed debt and any related agreement:

Terms as of the Terms After

Date of Bankruptcy Reaffirmation

Balance due (including

fees and costs) $_________ $________

Annual Percentage Rate ________% ________%

Monthly Payment $__________ $________

8. G Check this box if the creditor is agreeing to provide you with additional future credit in

connection with this Reaffirmation Agreement. Describe the credit limit, the Annual

Percentage Rate that applies to future credit and any other terms on future purchases and

advances using such credit: ________________________________________

_______________________________________________________________

II. DEBTOR’S STATEMENT IN SUPPORT

OF REAFFIRMATION AGREEMENT

1. Were you represented by an attorney during the course of negotiating this agreement?

Check one. Q Yes Q No

2. Is the creditor a credit union?

Check one. Q Yes Q No

Form B240A, Reaffirmation Documents Page 3

3. If your answer to EITHER question 1. or 2. above is “No” complete a. and b. below.

a.. My present monthly income and expenses are:

i. Monthly income from all sources after payroll deductions

(take-home pay plus any other income) $_________

ii. Monthly expenses (including all reaffirmed debts except

this one) $_________

iii. Amount available to pay this reaffirmed debt (subtract ii. from i.) $_________

iv. Amount of monthly payment required for this reaffirmed debt $_________

If the monthly payment on this reaffirmed debt (line iv.) is greater than the amount you have

available to pay this reaffirmed debt (line iii.), you must check the box at the top of page one that

says “Presumption of Undue Hardship.” Otherwise, you must check the box at the top of page

one that says “No Presumption of Undue Hardship.”

b. I believe this reaffirmation agreement will not impose an undue hardship on my dependents

or on me because:

Check one of the two statements below, if applicable:

G I can afford to make the payments on the reaffirmed debt because my monthly income

is greater than my monthly expenses even after I include in my expenses the monthly

payments on all debts I am reaffirming, including this one.

G I can afford to make the payments on the reaffirmed debt even though my monthly

income is less than my monthly expenses after I include in my expenses the monthly

payments on all debts I am reaffirming, including this one, because: _______________

______________________________________________________________________

Use an additional page if needed for a full explanation.

4. If your answers to BOTH questions 1. and 2. above were “Yes,” check the following

statement, if applicable:

G I believe this reaffirmation agreement is in my financial interest and I can afford to

make the payments on the reaffirmed debt.

Also, check the box at the top of page one that says “No Presumption of Undue Hardship.”

Form B240A, Reaffirmation Documents Page 4

III. CERTIFICATION BY DEBTOR(S) AND SIGNATURES OF PARTIES

I (We) hereby certify that:

i. I (We) agree to reaffirm the debt described above.

ii. Before signing this reaffirmation agreement, I (we) read the terms disclosed in this

Reaffirmation Agreement (Part I) and the Disclosure Statement, Instructions and

Definitions included in Part V below;

iii. The Debtor’s Statement in Support of Reaffirmation Agreement (Part II above) is

true and complete;

iv. I am (We are) entering into this agreement voluntarily and fully informed of my

(our) rights and responsibilities; and

v. I (We) have received a copy of this completed and signed Reaffirmation Documents

packet.

SIGNATURE(S):

Date _____________ Signature ________________________________________

Debtor

Date _____________ Signature ________________________________________

Joint Debtor, if any

If a joint reaffirmation agreement, both debtors must sign.

Reaffirmation Agreement Terms Accepted by Creditor:

Creditor

Print Name Address

Print Name of Representative Signature Date

IV. CERTIFICATION BY DEBTOR’S ATTORNEY (IF ANY)

To be filed only if the attorney represented the debtor during the course of negotiating this agreement .

I hereby certify that: (1) this agreement represents a fully informed and voluntary agreement

by the debtor; (2) this agreement does not impose an undue hardship on the debtor or any

dependent of the debtor; and (3) I have fully advised the debtor of the legal effect and

consequences of this agreement and any default under this agreement.

G A presumption of undue hardship has been established with respect to this agreement. In

my opinion, however, the debtor is able to make the required payment.

Check box, if the presumption of undue hardship box is checked on page 1 and the creditor is

not a Credit Union.

Date __________ Signature of Debtor’s Attorney_______________________________

Print Name of Debtor’s Attorney _____________________________

Form B240A, Reaffirmation Documents Page 5

V. DISCLOSURE STATEMENT AND INSTRUCTIONS TO DEBTOR(S)

Before agreeing to reaffirm a debt, review the terms disclosed in the Reaffirmation

Agreement (Part I) and these additional important disclosures and instructions.

Reaffirming a debt is a serious financial decision. The law requires you to take certain steps to

make sure the decision is in your best interest. If these steps, detailed in Part B below, are not

completed, the reaffirmation agreement is not effective, even though you have signed it.

A. DISCLOSURE STATEMENT

1.What are your obligations if you reaffirm a debt? A reaffirmed debt remains your

personal legal obligation. Your reaffirmed debt is not discharged in your bankruptcy

case. That means that if you default on your reaffirmed debt after your bankruptcy case is

over, your creditor may be able to take your property or your wages. Your obligations

will be determined by the reaffirmation agreement, which may have changed the terms of

the original agreement. If you are reaffirming an open end credit agreement, that

agreement or applicable law may permit the creditor to change the terms of that

agreement in the future under certain conditions.

2.Are you required to enter into a reaffirmation agreement by any law? No, you are

not required to reaffirm a debt by any law. Only agree to reaffirm a debt if it is in your

best interest. Be sure you can afford the payments that you agree to make.

3.What if your creditor has a security interest or lien? Your bankruptcy discharge does

not eliminate any lien on your property. A ‘‘lien’’ is often referred to as a security

interest, deed of trust, mortgage, or security deed. The property subject to a lien is often

referred to as collateral. Even if you do not reaffirm and your personal liability on the

debt is discharged, your creditor may still have a right under the lien to take the collateral

if you do not pay or default on the debt. If the collateral is personal property that is

exempt or that the trustee has abandoned, you may be able to redeem the item rather than

reaffirm the debt. To redeem, you make a single payment to the creditor equal to the

current value of the collateral, as the parties agree or the court determines.

4.How soon do you need to enter into and file a reaffirmation agreement? If you

decide to enter into a reaffirmation agreement, you must do so before you receive your

discharge. After you have entered into a reaffirmation agreement and all parts of this

Reaffirmation Documents packet requiring signature have been signed, either you or the

creditor should file it as soon as possible. The signed agreement must be filed with the

court no later than 60 days after the first date set for the meeting of creditors, so that the

court will have time to schedule a hearing to approve the agreement if approval is

required.

5.Can you cancel the agreement? You may rescind (cancel) your reaffirmation

agreement at any time before the bankruptcy court enters your discharge, or during the

60-day period that begins on the date your reaffirmation agreement is filed with the court,

whichever occurs later. To rescind (cancel) your reaffirmation agreement, you must

notify the creditor that your reaffirmation agreement is rescinded (or canceled).

Remember that you can rescind the agreement, even if the court approves it, as long as

you rescind within the time allowed.

Form B240A, Reaffirmation Documents Page 6

6.When will this reaffirmation agreement be effective?

a. If you were represented by an attorney during the negotiation of your reaffirmation

agreement

i. if the creditor is not a Credit Union , your reaffirmation agreement becomes

effective upon filing with the court unless the reaffirmation is presumed to be an

undue hardship in which case the agreement becomes effective only after the

court approves it;

ii. if the creditor is a Credit Union

, your reaffirmation agreement becomes

effective when it is filed with the court.

b. If you were not represented by an attorney during the negotiation of your

reaffirmation agreement , the reaffirmation agreement will not be effective unless the

court approves it. To have the court approve your agreement, you must file a motion.

See Instruction 5, below. The court will notify you and the creditor of the hearing on

your reaffirmation agreement. You must attend this hearing, at which time the judge will

review your reaffirmation agreement. If the judge decides that the reaffirmation

agreement is in your best interest, the agreement will be approved and will become

effective. However, if your reaffirmation agreement is for a consumer debt secured by a

mortgage, deed of trust, security deed, or other lien on your real property, like your

home, you do not need to file a motion or get court approval of your reaffirmation

agreement.

7.What if you have questions about what a creditor can do? If you have questions

about reaffirming a debt or what the law requires, consult with the attorney who helped

you negotiate this agreement. If you do not have an attorney helping you, you may ask

the judge to explain the effect of this agreement to you at the hearing to approve the

reaffirmation agreement. When this disclosure refers to what a creditor “may” do, it is

not giving any creditor permission to do anything. The word “may” is used to tell you

what might occur if the law permits the creditor to take the action.

B. INSTRUCTIONS

1. Review these Disclosures and carefully consider the decision to reaffirm. If you want to

reaffirm, review and complete the information contained in the Reaffirmation Agreement

(Part I above). If your case is a joint case, both spouses must sign the agreement if both

are reaffirming the debt.

2. Complete the Debtor’s Statement in Support of Reaffirmation Agreement (Part II above).

Be sure that you can afford to make the payments that you are agreeing to make and that

you have received a copy of the Disclosure Statement and a completed and signed

Reaffirmation Agreement.

3. If you were represented by an attorney during the negotiation of your Reaffirmation

Agreement, your attorney must sign and date the Certification By Debtor’s Attorney

section (Part IV above).

4. You or your creditor must file with the court the original of this Reaffirmation

Documents packet and a completed Reaffirmation Agreement Cover Sheet (Official

Bankruptcy Form 27).

5. If you are not represented by an attorney, you must also complete and file with the court

a separate document entitled “Motion for Court Approval of Reaffirmation Agreement

unless your reaffirmation agreement is for a consumer debt secured by a lien on your real

property, such as your home. You can use Form B240B to do this.

Form B240A, Reaffirmation Documents Page 7

C. DEFINITIONS

1.“Amount Reaffirmed” means the total amount of debt that you are agreeing to pay

(reaffirm) by entering into this agreement. The amount of debt includes any unpaid fees

and costs arising on or before the date you sign this agreement that you are agreeing to

pay. Your credit agreement may obligate you to pay additional amounts that arise after

the date you sign this agreement. You should consult your credit agreement to determine

whether you are obligated to pay additional amounts that may arise after the date of this

agreement.

2.“Annual Percentage Rate” means the interest rate on a loan expressed under the rules

required by federal law. The annual percentage Rate (as opposed to the “stated interest

rate”) tells you the full cost of your credit including many of the creditor’s fees and

charges. You will find the annual percentage rate for your original agreement on the

disclosure statement that was given to you when the loan papers were signed or on the

monthly statements sent to you for an open end credit account such as a credit card.

3. “Credit Union” means a financial institution as defined in 12 U.S.C. § 461(b)(1)(A)(iv).

It is owned and controlled by and provides financial services to its members and typically

uses words like “Credit Union” or initials like “C.U.” or “F.C.U.” in its name.

B240B (Form B240B) (12/09)

UNITED STATES BANKRUPTCY COURT

____________________District of___________________

In re ____________________________, Case No.__________________

Debtor Chapter________________

MOTION FOR APPROVAL OF REAFFIRMATION AGREEMENT

I (we), the debtor(s), affirm the following to be true and correct:

I am not represented by an attorney in connection with this reaffirmation agreement.

I believe this reaffirmation agreement is in my best interest based on the income and

expenses I have disclosed in my Statement in Support of Reaffirmation Agreement, and because

(provide any additional relevant reasons the court should consider):

Therefore, I ask the court for an order approving this reaffirmation agreement under the

following provisions (check all applicable boxes):

G 11 U.S.C. § 524(c)(6) (debtor is not represented by an attorney during the

course of the negotiation of the reaffirmation agreement)

G 11 U.S.C. § 524(m) (presumption of undue hardship has arisen because

monthly expenses exceed monthly income, as explained in Part II of Form

B240A, Reaffirmation Documents)

Signed:_______________________________

(Debtor)

_______________________________

(Joint Debtor, if any)

Date: __________________

B240C (Form B240C) (12/09)

United States Bankruptcy Court

____________________District of _____________________

In re _______________________________, Case No.________________

Debtor Chapter ________

ORDER ON REAFFIRMATION AGREEMENT

The debtor(s) _______________________ has (have) filed a motion for approval of the

reaffirmation agreement dated _____________________ made between the debtor(s) and

creditor ___________________________. The court held the hearing required by 11 U.S.C.

§ 524(d) on notice to the debtor(s) and the creditor on _____________________ (date).

COURT ORDER:G The court grants the debtor’s motion under 11 U.S.C. § 524(c)(6)(A)

and approves the reaffirmation agreement described above as not

imposing an undue hardship on the debtor(s) or a dependent of the

debtor(s) and as being in the best interest of the debtor(s).

G The court grants the debtor’s motion under 11 U.S.C. § 524(k)(8)

and approves the reaffirmation agreement described above.

G The court does not disapprove the reaffirmation agreement under

11 U.S.C. § 524(m).

G The court disapproves the reaffirmation agreement under

11 U.S.C. § 524(m).

G The court does not approve the reaffirmation agreement.

BY THE COURT

Date: __________________ _______________________________

United States Bankruptcy Judge

Valuable advice on setting up your ‘B27 Official Form27 1209’ online

Are you fed up with the burden of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for both individuals and organizations. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and sign paperwork online. Utilize the robust features bundled in this user-friendly and cost-effective platform to transform your method of document management. Whether you need to approve documents or gather electronic signatures, airSlate SignNow manages it all effortlessly, needing just a few clicks.

Follow this comprehensive guide:

- Log in to your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form repository.

- Open your ‘B27 Official Form27 1209’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and designate fillable fields for others (if needed).

- Continue with the Send Invite settings to request eSignatures from others.

- Download, print a copy for yourself, or convert it into a reusable template.

Don’t worry if you need to collaborate with others on your B27 Official Form27 1209 or send it for notarization—our solution provides everything you need to achieve these tasks. Register with airSlate SignNow today and elevate your document management to greater levels!