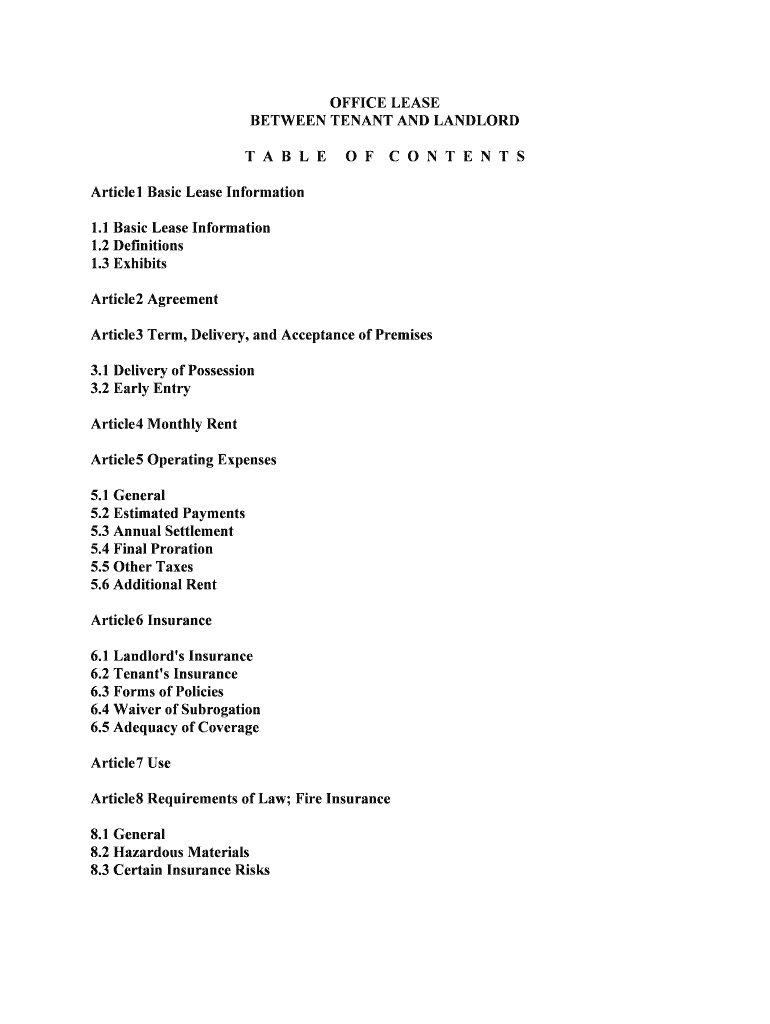

OFFICE LEASE BETWEEN TENANT AND LANDLORDT A B L E O F C O N T E N T S Article 1 Basic Lease Information1.1 Basic Lease Information1.2 Definitions1.3 ExhibitsArticle2 AgreementArticle3 Term, Delivery, and Acceptance of Premises3.1 Delivery of Possession3.2 Early EntryArticle 4 Monthly RentArticle5 Operating Expenses5.1 General5.2 Estimated Payments5.3 Annual Settlement5.4 Final Proration5.5 Other Taxes5.6 Additional RentArticle6 Insurance6.1 Landlord's Insurance6.2 Tenant's Insurance6.3 Forms of Policies6.4 Waiver of Subrogation6.5 Adequacy of CoverageArticle7 UseArticle8 Requirements of Law; Fire Insurance8.1 General8.2 Hazardous Materials8.3 Certain Insurance Risks

Article9 Assignment and Subletting9.1 General9.2 Submission of Information9.3 Payments to Landlord9.4 Prohibited Transfers9.5 Permitted Transfer9.6 RemediesArticle10 Rules and RegulationsArticle11 Common AreasArticle12 Landlord's Services12.1 Landlord's Repair and Maintenance12.2 Landlord's Other Services12.3 Tenant's Costs12.4 Limitation on LiabilityArticle13 Tenant's Care of the PremisesArticle14 Alterations14.1 General14.2 Free-Standing Partitions14.3 RemovalArticle15 Mechanics' LiensArticle16 End of TermArticle17 Eminent DomainArticle18 Damage and DestructionArticle19 Subordination19.1 General19.2 Attornment and NondisturbanceArticle20 Entry by LandlordArticle21 Indemnification, Waiver, and Release

21.1 Indemnification21.2 Waiver and ReleaseArticle22 Security DepositArticle23 Quiet EnjoymentArticle24 Effect of SaleArticle25 Default25.1 Events of Default25.2 Landlord's Remedies25.3 Certain Damages25.4 Continuing Liability After Termination25.5 Cumulative Remedies25.6 Waiver of RedemptionArticle26 ParkingArticle27 Miscellaneous27.1 No Offer27.2 Joint and Several Liability27.3 No Construction Against Drafting Party27.4 Time of the Essence27.5 No Recordation27.6 No Waiver27.7 Limitation on Recourse27.8 Estoppel Certificates27.9 Waiver of Jury Trial27.10 No Merger27.11 Holding Over27.12 Notices27.13 Severability27.14 Written Amendment Required27.15 Entire Agreement27.16 Captions27.17 Notice of Landlord's Default27.18 Authority27.19 Brokers27.20 Governing Law27.21 Late Payments27.22 No Easements for Air or Light27.23 Tax Credits27.24 Relocation of the Premises

27.25 Financial Reports27.26 Landlord's Fees27.27 Binding EffectExhibit A: The PremisesExhibit B: Legal Description of the LandExhibit C: WorkletterExhibit D: Rules and RegulationsExhibit E: Commencement Date Certificate

OFFICE LEASE THIS OFFICE LEASE is entered into by landlord and tenant as described in the following

basic lease information on the date that is set forth for reference only in the following basic lease

information. Landlord and tenant agree: ARTICLE 1 BASIC LEASE INFORMATION1.1 Basic Lease Information. In addition to the terms that are defined elsewhere in this lease, these

terms are used in this lease:(a) LEASE DATE: [date](b)LANDLORD: [name](c)LANDLORD'S ADDRESS: with a copy at the same time to: [address] __________________________________________ (d)TENANT: [name](e)TENANT'S ADDRESS: with a copy at the same time to: [address] ___________________________________________ (f)BUILDING ADDRESS: [address](g)PREMISES: The premises shown on Exhibit A to this lease, known as Suite

[number].(h)RENTABLE AREA OF THE PREMISES: [number] square feet.(i)RENTABLE AREA OF THE BUILDING: [number] square feet.(j)TERM: [number] months, beginning on the commencement date and expiring on the

expiration date.(k)COMMENCEMENT DATE: [date], or as extended pursuant to the work letter.(l)EXPIRATION DATE: [date], or as extended pursuant to the workletter.(m)SECURITY DEPOSIT: $[amount](n)MONTHLY RENT: $[amount] per month commencing [date] and ending [date];

$[amount] per month commencing [date] and ending [date]; and $[amount] per month

commencing [date] and ending [date]. The monthly rent includes the product of 1/12th of the

operating expenses base times the rentable area of the premises.

(o)OPERATING EXPENSES BASE: $[amount] per rentable square foot of the premises per

annum.(p)TENANT'S SHARE: [percent] % (determined by dividing the rentable area of the

premises by the rentable area of the building, multiplying the resulting quotient by 100, and

rounding to the 3rd decimal place).(q)PARKING SPACES: [number] spaces according to Article 26.(r)PARKING CHARGE: $[amount] per parking space per month, subject to adjustments

specified in Article 26.(s)BROKER: [name]1.2 Definitions:(a)ADDITIONAL RENT: Any amounts that this lease requires tenant to pay in addition to

monthly rent.(b)BUILDING: The building located on the land and of which the premises are a part.(c)LAND: The land on which the project is located and which is described on Exhibit B.(d)PRIME RATE: The rate of interest from time to time announced by

___________________________ _______________________ or any successor to it, as its prime

rate. If _______________________ or any successor to it ceases to announce its prime rate, the prime rate will be a comparable interest rate designated by landlord to replace the prime rate.(e)PROJECT: The development consisting of the land and all improvements built on the land,

including without limitation the building, parking lot, parking structure, if any, walkways,

driveways, fences, and landscaping.(f)RENT: The monthly rent and additional rent.(g)WORKLETTER: The workletter attached to this lease as Exhibit C (if any).If any other provision of this lease contradicts any definition of this Article, the other provision

will prevail.1.3 Exhibits. The following addendum and exhibits are attached to this lease and are made part of

this lease:ADDENDUM EXHIBIT A--The Premises

EXHIBIT B--Legal Description of the LandEXHIBIT C--WorkletterEXHIBIT D--Rules and RegulationsEXHIBIT E--Commencement Date CertificateARTICLE 2 AGREEMENTLandlord leases the premises to tenant, and tenant leases the premises from landlord, according to

this lease. The duration of this lease will be the term. The term will commence on the

commencement date and will expire on the expiration date.ARTICLE 3 DELIVERY OF PREMISES3.1 Delivery of Possession . Landlord will be deemed to have delivered possession of the premises

to tenant on the commencement date, as it may be adjusted pursuant to the workletter. Landlord

will construct or install in the premises the improvements to be constructed or installed by landlord

according to the workletter. If no workletter is attached to this lease, it will be deemed that landlord

delivered to tenant possession of the premises as is in its present condition on the commencement

date. Tenant acknowledges that neither landlord nor its agents or employees have made any

representations or warranties as to the suitability or fitness of the premises for the conduct of

tenant's business or for any other purpose, nor has landlord or its agents or employees agreed to

undertake any alterations or construct any tenant improvements to the premises except as

expressly provided in this lease and the workletter. If for any reason landlord cannot deliver

possession of the premises to tenant on the commencement date, this lease will not be void or

voidable, and landlord will not be liable to tenant for any resultant loss or damage. Tenant will

execute the commencement date certificate attached to this lease as Exhibit E within 15 days of

landlord's request.3.2 Early Entry. If tenant is permitted entry to the premises prior to the commencement date for the

purpose of installing fixtures or any other purpose permitted by landlord, the early entry will be at

tenant's sole risk and subject to all the terms and provisions of this lease as though the

commencement date had occurred, except for the payment of rent, which will commence on the

commencement date. Tenant, its agents, or employees will not interfere with or delay landlord's

completion of construction of the improvements. All rights of tenant under this Section 3.2 will be

subject to the requirements of all applicable building codes, zoning requirements, and federal,

state, and local laws, rules, and regulations, so as not to interfere with landlord's compliance with

all laws, including the obtaining of a certificate of occupancy for the premises. Landlord has the

right to impose additional conditions on tenant's early entry that landlord, in its reasonable

discretion, deems appropriate, including without limitation an indemnification of landlord and

proof of insurance, and will further have the right to require that tenant execute an early entry

agreement containing those conditions prior to tenant's early entry.ARTICLE 4 MONTHLY RENT

Throughout the term of this lease, tenant will pay monthly rent to landlord as rent for the premises.

Monthly rent will be paid in advance on or before the first day of each calendar month of the term.

If the term commences on a day other than the first day of a calendar month or ends on a day other

than the last day of a calendar month, then monthly rent will be appropriately prorated by landlord

based on the actual number of calendar days in such month. If the term commences on a day other

than the first day of a calendar month, then the prorated monthly rent for such month will be paid

on or before the first day of the term. Monthly rent will be paid to landlord, without written notice

or demand, and without deduction or offset, in lawful money of the United States of America at

landlord's address, or to such other address as landlord may from time to time designate in writing.ARTICLE 5 OPERATING EXPENSES5.1 General.(a) In addition to monthly rent, beginning on the commencement date tenant will pay tenant's

share of the amount by which the operating expenses paid, payable, or incurred by landlord in each

calendar year or partial calendar year during the term exceeds the product of the operating

expenses base times the rentable area of the building. If operating expenses are calculated for a

partial calendar year, the operating expenses base will be appropriately prorated.(b) As used in this lease, the term "operating expenses" means: (1)All reasonable costs of management, operation, and maintenance of the project,

including without limitation real and personal property taxes and assessments (and any tax levied

in whole or in part in lieu of or in addition to real property taxes); wages, salaries, and

compensation of employees; consulting, accounting, legal, janitorial, maintenance, guard, and

other services; management fees and costs (charged by landlord, any affiliate of landlord, or any

other entity managing the project and determined at a rate consistent with prevailing market rates

for comparable services and projects); reasonable reserves for operating expenses; that part of

office rent or rental value of space in the project used or furnished by landlord to enhance, manage,

operate, and maintain the project; power, water, waste disposal, and other utilities; materials and

supplies; maintenance and repairs; insurance obtained with respect to the project; depreciation on

personal property and equipment, except as set forth in (c) below or which is or should be

capitalized on the books of landlord; and any other costs, charges, and expenses that under

generally accepted accounting principles would be regarded as management, maintenance, and

operating expenses; and(2)The cost (amortized over such period as landlord will reasonably determine)

together with interest at the greater of the prime rate prevailing plus 2% or landlord's borrowing

rate for such capital improvements plus 2% on the unamortized balance of any capital improvements that are made to the project by landlord (i) for the purpose of reducing operating

expenses, or (ii) after the lease date and by requirement of any governmental law or regulation that

was not applicable to the project at the time it was constructed and not as a result of special

requirements for any tenant's use of the building.

(c)The operating expenses will not include: (1)depreciation on the project (other than depreciation on personal property,

equipment, window coverings on exterior windows provided by landlord and carpeting in public

corridors and common areas);(2) costs of alterations of space or other improvements made for tenants of the project;(3) finders' fees and real estate brokers' commissions;(4)ground lease payments, mortgage principal, or interest;(5)capital items other than those referred to in clause (b)(2) above;(6) costs of replacements to personal property and equipment for which depreciation

costs are included as an operating expense;(7) costs of excess or additional services provided to any tenant in the building that are

directly billed to such tenants;(8) the cost of repairs due to casualty or condemnation that are reimbursed by third

parties;(9)any cost due to landlord's breach of this lease;(10)any income, estate, inheritance, or other transfer tax and any excess profit,

franchise, or similar taxes on landlord's business;(11)all costs, including legal fees, relating to activities for the solicitation and execution

of leases of space in the building; and(12)any legal fees incurred by landlord in enforcing its rights under other leases for

premises in the building. (d)The operating expenses that vary with occupancy and that are attributable to any part of the

term in which less than 95% of the rentable area of the building is occupied by tenants will be

adjusted by landlord to the amount that landlord reasonably believes they would have been if 95%

of the rentable area of the building had been so occupied.(e)Tenant acknowledges that landlord has not made any representation or given tenant any

assurances that the operating expenses base will equal or approximate the actual operating expenses per square foot of rentable area of the premises for any calendar year during the term.5.2 Estimated Payments. During each calendar year or partial calendar year in the term, in addition

to monthly rent, tenant will pay to landlord on the first day of each month an amount equal to 1/12

of the product of tenant's share multiplied by the "estimated operating expenses" (defined below)

for such calendar year. "Estimated operating expenses" for any calendar year means landlord's

reasonable estimate of operating expenses for such calendar year, less the product of the operating

expenses base, multiplied by the rentable area of the building and will be subject to revision

according to the further provisions of this Section 5.2 and Section 5.3. During any partial calendar

year during the term, estimated operating expenses will be estimated on a full-year basis. During

each December during the term, or as soon after each December as practicable, landlord will give

tenant written notice of estimated operating expenses for the ensuing calendar year. On or before

the first day of each month during the ensuing calendar year (or each month of the term, if a partial

calendar year), tenant will pay to landlord 1/12 of the product of tenant's share multiplied by the

estimated operating expenses for such calendar year; however, if such written notice is not given in

December, tenant will continue to make monthly payments on the basis of the prior year's

estimated operating expenses until the month after such written notice is given, at which time

tenant will commence making monthly payments based upon the revised estimated operating

expenses. In the month tenant first makes a payment based upon the revised estimated operating

expenses, tenant will pay to landlord for each month which has elapsed since December the

difference between the amount payable based upon the revised estimated operating expenses and

the amount payable based upon the prior year's estimated operating expenses. If at any time or

times it reasonably appears to landlord that the actual operating expenses for any calendar year

will vary from the estimated operating expenses for such calendar year, landlord may, by written

notice to tenant, revise the estimated operating expenses for such calendar year, and subsequent

payments by tenant in such calendar year will be based upon such revised estimated operating

expenses.5.3 Annual Settlement. Within 120 days after the end of each calendar year or as soon after such

120-day period as practicable, landlord will deliver to tenant a statement of amounts payable under

Section 5.1 for such calendar year prepared and certified by landlord. Such certified statement will

be final and binding upon landlord and tenant unless tenant objects to it in writing to landlord

within 30 days after it is given to tenant. If such statement shows an amount owing by tenant that is

less than the estimated payments previously made by tenant for such calendar year, the excess will

be held by landlord and credited against the next payment of rent; however, if the term has ended

and tenant was not in default at its end, landlord will refund the excess to tenant. If such statement

shows an amount owing by tenant that is more than the estimated payments previously made by

tenant for such calendar year, tenant will pay the deficiency to landlord within 30 days after the

delivery of such statement. Tenant may review landlord's records of the operating expenses, at

tenant's sole cost and expense, at the place landlord normally maintains such records during

landlord's normal business hours upon reasonable advance written notice.5.4 Final Proration. If this lease ends on a day other than the last day of a calendar year, the

amount of increase (if any) in the operating expenses payable by tenant applicable to the calendar

year in which this lease ends will be calculated on the basis of the number of days of the term

falling within such calendar year, and tenant's obligation to pay any increase or landlord's

obligation to refund any overage will survive the expiration or other termination of this lease.5.5 Other Taxes.(a)Tenant will reimburse landlord upon demand for any and all taxes payable by landlord

(other than as set forth in subparagraph (b) below), whether or not now customary or within the

contemplation of landlord and tenant: (1) upon or measured by rent, including without limitation, any gross revenue tax,

excise tax, or value added tax levied by the federal government or any other governmental body

with respect to the receipt of rent; and(2)upon this transaction or any document to which tenant is a party creating or

transferring an interest or an estate in the premises. (b)Tenant will not be obligated to pay any inheritance tax, gift tax, transfer tax, franchise tax,

income tax (based on net income), profit tax, or capital levy imposed upon landlord.(c)Tenant will pay promptly when due all personal property taxes on tenant's personal

property in the premises and any other taxes payable by tenant that if not paid might give rise to a

lien on the premises or tenant's interest in the premises.5.6 Additional Rent. Amounts payable by tenant according to this Article 5 will be payable as rent,

without deduction or offset. If tenant fails to pay any amounts due according to this Article 5,

landlord will have all the rights and remedies available to it on account of tenant's failure to pay

rent.ARTICLE 6 INSURANCE6.1 Landlord's Insurance. At all times during the term, landlord will carry and maintain:(a)Fire and extended coverage insurance covering the project, its equipment, common area

furnishings, and leasehold improvements in the premises to the extent of the tenant finish

allowance (as that term is defined in the workletter);(b)Bodily injury and property damage insurance; and(c)Such other insurance as landlord reasonably determines from time to time.The insurance coverages and amounts in this Section 6.1 will be reasonably determined by

landlord, based on coverages carried by prudent owners of comparable buildings in the vicinity of

the project.6.2 Tenant's Insurance. At all times during the term, tenant will carry and maintain, at tenant's

expense, the following insurance, in the amounts specified below or such other amounts as

landlord may from time to time reasonably request, with insurance companies and on forms

satisfactory to landlord:(a)Bodily injury and property damage liability insurance, with a combined single occurrence

limit of not less than $3,000,000. All such insurance will be equivalent to coverage offered by a

commercial general liability form, including without limitation personal injury and contractual

liability coverage for the performance by tenant of the indemnity agreements set forth in Article 21

of this lease;(b)Insurance covering all of tenant's furniture and fixtures, machinery, equipment, stock, and

any other personal property owned and used in tenant's business and found in, on, or about the

project, and any leasehold improvements to the premises in excess of the allowance, if any,

provided pursuant to the workletter in an amount not less than the full replacement cost. Property

forms will provide coverage on a broad form basis insuring against "all risks of direct physical

loss." All policy proceeds will be used for the repair or replacement of the property damaged or

destroyed; however, if this lease ceases under the provisions of Article 18, tenant will be entitled to

any proceeds resulting from damage to tenant's furniture and fixtures, machinery, equipment,

stock, and any other personal property;(c)Worker's compensation insurance insuring against and satisfying tenant's obligations and

liabilities under the worker's compensation laws of the state in which the premises are located,

including employer's liability insurance in the limits required by the laws of the state in which the

project is located; and(d)If tenant operates owned, hired, or nonowned vehicles on the project, comprehensive

automobile liability at a limit of liability not less than $500,000 combined bodily injury and property damage.6.3 Forms of Policies. Certificates of insurance, together with copies of the endorsements, when

applicable, naming landlord and any others specified by landlord as additional insureds, will be

delivered to landlord prior to tenant's occupancy of the premises and from time to time at least 10

days prior to the expiration of the term of each such policy. All commercial general liability or

comparable policies maintained by tenant will name landlord and such other persons or firms as

landlord specifies from time to time as additional insureds, entitling them to recover under such

policies for any loss sustained by them, their agents, and employees as a result of the negligent acts

or omissions of tenant. All such policies maintained by tenant will provide that they may not be

terminated nor may coverage be reduced except after 30 days' prior written notice to landlord. All

commercial general liability and property policies maintained by tenant will be written as primary

policies, not contributing with and not supplemental to the coverage that landlord may carry.6.4 Waiver of Subrogation. Landlord and tenant each waive any and all rights to recover against

the other or against any other tenant or occupant of the project, or against the officers, directors,

shareholders, partners, joint venturers, employees, agents, customers, invitees, or business visitors

of such other party or of such other tenant or occupant of the project, for any loss or damage to

such waiving party arising from any cause covered by any property insurance required to be

carried by such party pursuant to this Article 6 or any other property insurance actually carried by

such party to the extent of the limits of such policy. Landlord and tenant from time to time will

cause their respective insurers to issue appropriate waiver of subrogation rights endorsements to

all property insurance policies carried in connection with the project or the premises or the

contents of the project or the premises. Tenant agrees to cause all other occupants of the premises

claiming by, under, or through tenant to execute and deliver to landlord such a waiver of claims

and to obtain such waiver of subrogation rights endorsements.

6.5 Adequacy of Coverage. Landlord, its agents, and employees make no representation that the

limits of liability specified to be carried by tenant pursuant to this Article 6 are adequate to protect

tenant. If tenant believes that any of such insurance coverage is inadequate, tenant will obtain such

additional insurance coverage as tenant deems adequate, at tenant's sole expense.ARTICLE 7 USEThe premises will be used only for general business office purposes and purposes incidental to that

use, and for no other purpose. Tenant will use the premises in a careful, safe, and proper manner.

Tenant will not use or permit the premises to be used or occupied for any purpose or in any manner

prohibited by any applicable laws. Tenant will not commit waste or suffer or permit waste to be

committed in, on, or about the premises. Tenant will conduct its business and control its

employees, agents, and invitees in such a manner as not to create any nuisance or interfere with,

annoy, or disturb any other tenant or occupant of the project or landlord in its operation of the

project.ARTICLE 8 REQUIREMENTS OF LAW; FIRE INSURANCE8.1 General. At its sole cost and expense, tenant will promptly comply with all laws, statutes,

ordinances, and governmental rules, regulations, or requirements now in force or in force after the

lease date, with the requirements of any board of fire underwriters or other similar body

constituted now or after the date, with any direction or occupancy certificate issued pursuant to any

law by any public officer or officers, as well as with the provisions of all recorded documents

affecting the premises, insofar as they relate to the condition, use, or occupancy of the premises,

excluding requirements of structural changes to the premises or the building, unless required by

the unique nature of tenant's use or occupancy of the premises.8.2 Hazardous Materials.(a)For purposes of this lease, "hazardous materials" means any explosives, radioactive

materials, hazardous wastes, or hazardous substances, including without limitation substances

defined as "hazardous substances" in the Comprehensive Environmental Response, Compensation

and Liability Act of 1980, as amended, 42 U.S.C. ## 9601-9657; the Hazardous Materials Transportation Act of 1975, 49 U.S.C. ## 1801-1812; the Resource Conservation and Recovery

Act of 1976, 42 U.S.C. ## 6901-6987; or any other federal, state, or local statute, law, ordinance,

code, rule, regulation, order, or decree regulating, relating to, or imposing liability or standards of

conduct concerning hazardous materials, waste, or substances now or at any time hereafter in

effect (collectively, "hazardous materials laws").(b)Tenant will not cause or permit the storage, use, generation, or disposition of any

hazardous materials in, on, or about the premises or the project by tenant, its agents, employees, or

contractors. Tenant will not permit the premises to be used or operated in a manner that may cause

the premises or the project to be contaminated by any hazardous materials in violation of any

hazardous materials laws. Tenant will immediately advise landlord in writing of (1) any and all

enforcement, cleanup, remedial, removal, or other governmental or regulatory actions instituted,

completed, or threatened pursuant to any hazardous materials laws relating to any hazardous materials affecting the premises; and (2) all claims made or threatened by any third party against

tenant, landlord, or the premises relating to damage, contribution, cost recovery, compensation,

loss, or injury resulting from any hazardous materials on or about the premises. Without landlord's

prior written consent, tenant will not take any remedial action or enter into any agreements or

settlements in response to the presence of any hazardous materials in, on, or about the premises.(c) Tenant will be solely responsible for and will defend, indemnify and hold landlord, its

agents, and employees harmless from and against all claims, costs, and liabilities, including

attorneys' fees and costs, arising out of or in connection with tenant's breach of its obligations in

this Article 8. Tenant will be solely responsible for and will defend, indemnify, and hold landlord,

its agents, and employees harmless from and against any and all claims, costs, and liabilities,

including attorneys' fees and costs, arising out of or in connection with the removal, cleanup, and

restoration work and materials necessary to return the premises and any other property of whatever

nature located on the project to their condition existing prior to the appearance of tenant's

hazardous materials on the premises. Tenant's obligations under this Article 8 will survive the

expiration or other termination of this lease.8.3 Certain Insurance Risks. Tenant will not do or permit to be done any act or thing upon the

premises or the project which would (a) jeopardize or be in conflict with fire insurance policies

covering the project and fixtures and property in the project; (b) increase the rate of fire insurance

applicable to the project to an amount higher than it otherwise would be for general office use of

the project; or (c) subject landlord to any liability or responsibility for injury to any person or

persons or to property by reason of any business or operation being carried on upon the premises.ARTICLE 9 ASSIGNMENT AND SUBLETTING9.1 General. Tenant, for itself, its heirs, distributees, executors, administrators, legal

representatives, successors, and assigns, covenants that it will not assign, mortgage, or encumber

this lease, nor sublease, nor permit the premises or any part of the premises to be used or occupied

by others, without the prior written consent of landlord in each instance, which consent will not be

unreasonably withheld or delayed. Any assignment or sublease in violation of this Article 9 will be

void. If this lease is assigned, or if the premises or any part of the premises are subleased or

occupied by anyone other than tenant, landlord may, after default by tenant, collect rent from the

assignee, subtenant, or occupant, and apply the net amount collected to rent. No assignment,

sublease, occupancy, or collection will be deemed (a) a waiver of the provisions of this Section

9.1; (b) the acceptance of the assignee, subtenant, or occupant as tenant; or (c) a release of tenant

from the further performance by tenant of covenants on the part of tenant contained in this lease.

The consent by landlord to an assignment or sublease will not be construed to relieve tenant from

obtaining landlord's prior written consent in writing to any further assignment or sublease. No

permitted subtenant may assign or encumber its sublease or further sublease all or any portion of its subleased space, or otherwise permit the subleased space or any part of its subleased space to be

used or occupied by others, without landlord's prior written consent in each instance.9.2 Submission of Information. If tenant requests landlord's consent to a specific assignment or

subletting, tenant will submit in writing to landlord (a) the name and address of the proposed

assignee or subtenant; (b) the business terms of the proposed assignment or sublease; (c)

reasonably satisfactory information as to the nature and character of the business of the proposed

assignee or subtenant, and as to the nature of its proposed use of the space; (d) banking, financial,

or other credit information reasonably sufficient to enable landlord to determine the financial

responsibility and character of the proposed assignee or subtenant; and (e) the proposed form of

assignment or sublease for landlord's reasonable approval.9.3 Payments to Landlord. If landlord consents to a proposed assignment or sublease, then

landlord will have the right to require tenant to pay to landlord a sum equal to (a) any rent or other

consideration paid to tenant by any proposed transferee that (after deducting the costs of tenant, if

any, in effecting the assignment or sublease, including reasonable alterations costs, commissions

and legal fees) is in excess of the rent allocable to the transferred space then being paid by tenant to

landlord pursuant to this lease; (b) any other profit or gain (after deducting any necessary expenses

incurred) realized by tenant from any such sublease or assignment; and (c) landlord's reasonable

attorneys' fees and costs incurred in connection with negotiation, review, and processing of the

transfer. All such sums payable will be payable to landlord at the time the next payment of monthly

rent is due.9.4 Prohibited Transfers. The transfer of a majority of the issued and outstanding capital stock of

any corporate tenant or subtenant of this lease, or a majority of the total interest in any partnership

tenant or subtenant, however accomplished, and whether in a single transaction or in a series of

related or unrelated transactions, will be deemed an assignment of this lease or of such sublease

requiring landlord's consent in each instance. For purposes of this Article 9, the transfer of

outstanding capital stock of any corporate tenant will not include any sale of such stock by persons

other than those deemed "insiders" within the meaning of the Securities Exchange Act of 1934, as

amended, effected through the "over-the-counter market" or through any recognized stock

exchange.9.5 Permitted Transfer. Landlord consents to an assignment of this lease or sublease of all or part

of the premises to a wholly-owned subsidiary of tenant or the parent of tenant or to any corporation

into or with which tenant may be merged or consolidated; provided that tenant promptly provides

landlord with a fully executed copy of such assignment or sublease and that tenant is not released

from liability under the lease.9.6 Remedies. If tenant believes that landlord has unreasonably withheld its consent pursuant to

this Article 9, tenant's sole remedy will be to seek a declaratory judgment that landlord has

unreasonably withheld its consent or an order of specific performance or mandatory injunction of

the landlord's agreement to give its consent; however, tenant may recover damages if a court of

competent jurisdiction determines that landlord has acted arbitrarily and capriciously in evaluating

the proposed assignee's or subtenant's creditworthiness, identity, and business character and the

proposed use and lawfulness of the use.ARTICLE 10 RULES AND REGULATIONSTenant and its employees, agents, licensees, and visitors will at all times observe faithfully, and

comply strictly with, the rules and regulations set forth in Exhibit D. Landlord may from time to

time reasonably amend, delete, or modify existing rules and regulations, or adopt reasonable new rules and regulations for the use, safety, cleanliness, and care of the premises, the building, and the

project, and the comfort, quiet, and convenience of occupants of the project. Modifications or

additions to the rules and regulations will be effective upon 30 days' prior written notice to tenant

from landlord. In the event of any breach of any rules or regulations or any amendments or

additions to such rules and regulations, landlord will have all remedies that this lease provides for

default by tenant, and will in addition have any remedies available at law or in equity, including

the right to enjoin any breach of such rules and regulations. Landlord will not be liable to tenant for

violation of such rules and regulations by any other tenant, its employees, agents, visitors, or

licensees or any other person. In the event of any conflict between the provisions of this lease and

the rules and regulations, the provisions of this lease will govern.ARTICLE 11 COMMON AREASAs used in this lease, the term "common areas" means, without limitation, the hallways,

entryways, stairs, elevators, driveways, walkways, terraces, docks, loading areas, restrooms, trash

facilities, and all other areas and facilities in the project that are provided and designated from time

to time by landlord for the general nonexclusive use and convenience of tenant with landlord and

other tenants of the project and their respective employees, invitees, licensees, or other visitors.

Landlord grants tenant, its employees, invitees, licensees, and other visitors a nonexclusive license

for the term to use the common areas in common with others entitled to use the common areas,

subject to the terms and conditions of this lease. Without advance written notice to tenant, except

with respect to matters covered by subsection (a) below, and without any liability to tenant in any

respect, provided landlord will take no action permitted under this Article 11 in such a manner as

to materially impair or adversely affect tenant's substantial benefit and enjoyment of the premises,

landlord will have the right to:(a) Close off any of the common areas to whatever extent required in the opinion of landlord

and its counsel to prevent a dedication of any of the common areas or the accrual of any rights by

any person or the public to the common areas;(b)Temporarily close any of the common areas for maintenance, alteration, or improvement

purposes; and(c)Change the size, use, shape, or nature of any such common areas, including erecting

additional buildings on the common areas, expanding the existing building or other buildings to

cover a portion of the common areas, converting common areas to a portion of the building or

other buildings, or converting any portion of the building (excluding the premises) or other

buildings to common areas. Upon erection of any additional buildings or change in common areas,

the portion of the project upon which buildings or structures have been erected will no longer be

deemed to be a part of the common areas. In the event of any such changes in the size or use of the

building or common areas of the building or project, landlord will make an appropriate adjustment

in the rentable area of the building or the building's pro rata share of exterior common areas of the

project, as appropriate, and a corresponding adjustment to tenant's share of the operating expenses

payable pursuant to Article 5 of this lease.ARTICLE 12 LANDLORD'S SERVICES12.1 Landlord's Repair and Maintenance. Landlord will maintain, repair and restore the common

areas of the project, including lobbies, stairs, elevators, corridors, and restrooms, the windows in

the building, the mechanical, plumbing and electrical equipment serving the building, and the

structure of the building in reasonably good order and condition.12.2 Landlord's Other Services.(a) Landlord will furnish the premises with those services customarily provided in comparable

office buildings in the vicinity of the project, including without limitation (1) electricity for

lighting and the operation of low-wattage office machines (such as desktop micro-computers,

desktop calculators, and typewriters) during business hours (as that term is defined below),

although landlord will not be obligated to furnish more power to the premises than is proportionally allocated to the premises under the building design; (2) heat and air conditioning

reasonably required for the comfortable occupation of the premises during business hours; (3)

access and elevator service; (4) lighting replacement during business hours (for building standard

lights, but not for any special tenant lights, which will be replaced at tenant's sole cost and

expense); (5) restroom supplies; (6) window washing with reasonable frequency, as determined by

landlord; and (7) daily cleaning service on weekdays. Landlord may provide, but will not be obligated to provide, any such services (except access and elevator service) on holidays or

weekends.(b)Tenant will have the right to purchase for use during business hours and non-business

hours the services described in clauses (a)(1) and (2) in excess of the amounts landlord has agreed

to furnish so long as (1) tenant gives landlord reasonable prior written notice of its desire to do so;

(2) the excess services are reasonably available to landlord and to the premises; and (3) tenant pays

as additional rent (at the time the next payment of monthly rent is due) the cost of such excess

service from time to time charged by landlord; subject to the procedures established by landlord

from time to time for providing such additional or excess services.(c) The term "business hours" means 7:00 a.m. to 6:00 p.m. on Monday through Friday, except

holidays (as that term is defined below), and 8:00 a.m. to 12:00 noon on Saturdays, except

holidays. The term "holidays" means New Year's Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, and Christmas Day.12.3 Tenant's Costs. Whenever equipment or lighting (other than building standard lights) is used

in the premises by tenant and such equipment or lighting affects the temperature otherwise

normally maintained by the design of the building's air conditioning system, landlord will have the

right, after prior written notice to tenant, to install supplementary air conditioning facilities in the

premises or otherwise modify the ventilating and air conditioning system serving the premises;

and the cost of such facilities, modifications, and additional service will be paid by tenant as

additional rent. If landlord reasonably believes that tenant is using more power than landlord

furnishes pursuant to Section 12.2, landlord may install separate meters of tenant's power usage,

and tenant will pay for the cost of such excess power as additional rent, together with the cost of

installing any risers, meters, or other facilities that may be necessary to furnish or measure such

excess power to the premises.12.4 Limitation on Liability. Landlord will not be in default under this lease or be liable to tenant or

any other person for direct or consequential damage, or otherwise, for any failure to supply any

heat, air conditioning, elevator, cleaning, lighting, security; for surges or interruptions of

electricity; or for other services landlord has agreed to supply during any period when landlord

uses reasonable diligence to supply such services. Landlord will use reasonable efforts to

diligently remedy any interruption in the furnishing of such services. Landlord reserves the right

temporarily to discontinue such services at such times as may be necessary by reason of accident;

repairs, alterations or improvements; strikes; lockouts; riots; acts of God; governmental

preemption in connection with a national or local emergency; any rule, order, or regulation of any

governmental agency; conditions of supply and demand that make any product unavailable;

landlord's compliance with any mandatory governmental energy conservation or environmental

protection program, or any voluntary governmental energy conservation program at the request of

or with consent or acquiescence of tenant; or any other happening beyond the control of landlord.

Landlord will not be liable to tenant or any other person or entity for direct or consequential

damages resulting from the admission to or exclusion from the building or project of any person. In the event of invasion, mob, riot, public excitement, strikes, lockouts, or other circumstances

rendering such action advisable in landlord's sole opinion, landlord will have the right to prevent

access to the building or project during the continuance of the same by such means as landlord, in

its sole discretion, may deem appropriate, including without limitation locking doors and closing

parking areas and other common areas. Landlord will not be liable for damages to person or

property or for injury to, or interruption of, business for any discontinuance permitted under this

Article 12, nor will such discontinuance in any way be construed as an eviction of tenant or cause

an abatement of rent or operate to release tenant from any of tenant's obligations under this lease.ARTICLE 13 TENANT'S CARE OF THE PREMISESTenant will maintain the premises (including tenant's equipment, personal property, and trade

fixtures located in the premises) in their condition at the time they were delivered to tenant,

reasonable wear and tear excluded. Tenant will immediately advise landlord of any damage to the

premises or the project. All damage or injury to the premises, the project, or the fixtures,

appurtenances, and equipment in the premises or the project that is caused by tenant, its agents,

employees, or invitees may be repaired, restored, or replaced by landlord, at the expense of tenant.

Such expense (plus 15% of such expense for landlord's overhead) will be collectible as additional

rent and will be paid by tenant within 10 days after delivery of a statement for such expense.ARTICLE 14 ALTERATIONS14.1 General.(a)During the term, tenant will not make or allow to be made any alterations, additions, or

improvements to or of the premises or any part of the premises, or attach any fixtures or equipment

to the premises, without first obtaining landlord's written consent. All such alterations, additions,

and improvements consented to by landlord, and capital improvements that are required to be

made to the project as a result of the nature of tenant's use of the premises: (1) Will be performed by contractors approved by landlord and subject to conditions

specified by landlord (which may include requiring the posting of a mechanic's or materialmen's lien bond); and(2)At landlord's option, will be made by landlord for tenant's account, and tenant will

reimburse landlord for their cost (including 15% for landlord's overhead) within 10 days after

receipt of a statement of such cost. (b) Subject to tenant's rights in Article 16, all alterations, additions, fixtures, and

improvements, whether temporary or permanent in character, made in or upon the premises either

by tenant or landlord, will immediately become landlord's property and at the end of the term will

remain on the premises without compensation to tenant, unless when consenting to such

alterations, additions, fixtures, or improvements, landlord has advised tenant in writing that such

alterations, additions, fixtures, or improvements must be removed at the expiration or other termination of this lease.14.2 Free-Standing Partitions. Tenant will have the right to install free-standing work station

partitions, without landlord's prior written consent, so long as no building or other governmental

permit is required for their installation or relocation; however, if a permit is required, landlord will

not unreasonably withhold its consent to such relocation or installation. The free-standing work

station partitions for which tenant pays will be part of tenant's trade fixtures for all purposes under

this lease. All other partitions installed in the premises are and will be landlord's property for all

purposes under this lease.14.3 Removal . If landlord has required tenant to remove any or all alterations, additions, fixtures,

and improvements that are made in or upon the premises pursuant to this Article 14 prior to the

expiration date, tenant will remove such alterations, additions, fixtures, and improvements at

tenant's sole cost and will restore the premises to the condition in which they were before such

alterations, additions, fixtures, improvements, and additions were made, reasonable wear and tear

excepted.ARTICLE 15 MECHANICS' LIENSTenant will pay or cause to be paid all costs and charges for work (a) done by tenant or caused to be

done by tenant, in or to the premises, and (b) for all materials furnished for or in connection with

such work. Tenant will indemnify landlord against and hold landlord, the premises, and the project

free, clear, and harmless of and from all mechanics' liens and claims of liens, and all other

liabilities, liens, claims, and demands on account of such work by or on behalf of tenant, other than

work performed by landlord pursuant to the workletter. If any such lien, at any time, is filed against

the premises or any part of the project, tenant will cause such lien to be discharged of record within

10 days after the filing of such lien, except that if tenant desires to contest such lien, it will furnish

landlord, within such 10-day period, security reasonably satisfactory to landlord of at least 150%

of the amount of the claim, plus estimated costs and interest, or comply with such statutory

procedures as may be available to release the lien. If a final judgment establishing the validity or

existence of a lien for any amount is entered, tenant will pay and satisfy the same at once. If tenant

fails to pay any charge for which a mechanics' lien has been filed, and has not given landlord

security as described above, or has not complied with such statutory procedures as may be

available to release the lien, landlord may, at its option, pay such charge and related costs and

interest, and the amount so paid, together with reasonable attorneys' fees incurred in connection

with such lien, will be immediately due from tenant to landlord as additional rent. Nothing

contained in this lease will be deemed the consent or agreement of landlord to subject landlord's

interest in the project to liability under any mechanics' or other lien law. If tenant receives written

notice that a lien has been or is about to be filed against the premises or the project, or that any

action affecting title to the project has been commenced on account of work done by or for or

materials furnished to or for tenant, it will immediately give landlord written notice of such notice.

At least 15 days prior to the commencement of any work (including but not limited to any

maintenance, repairs, alterations, additions, improvements, or installations) in or to the premises,

by or for tenant, tenant will give landlord written notice of the proposed work and the names and

addresses of the persons supplying labor and materials for the proposed work. Landlord will have

the right to post notices of nonresponsibility or similar written notices on the premises in order to

protect the premises against any such liens.ARTICLE 16 END OF TERM At the end of this lease, tenant will promptly quit and surrender the premises broom-clean,

in good order and repair, ordinary wear and tear excepted. If tenant is not then in default, tenant

may remove from the premises any trade fixtures, equipment, and movable furniture placed in the

premises by tenant, whether or not such trade fixtures or equipment are fastened to the building;

tenant will not remove any trade fixtures or equipment without landlord's prior written consent if

such fixtures or equipment are used in the operation of the building, or if the removal of such

fixtures or equipment will result in impairing the structural strength of the building. Whether or not

tenant is in default, tenant will remove such alterations, additions, improvements, trade fixtures,

equipment, and furniture as landlord has requested in accordance with Article 14. Tenant will fully

repair any damage occasioned by the removal of any trade fixtures, equipment, furniture,

alterations, additions, and improvements. All trade fixtures, equipment, furniture, inventory,

effects, alterations, additions, and improvements on the premises after the end of the term will be

deemed conclusively to have been abandoned and may be appropriated, sold, stored, destroyed, or

otherwise disposed of by landlord without written notice to tenant or any other person and without

obligation to account for them. Tenant will pay landlord for all expenses incurred in connection

with the removal of such property, including but not limited to the cost of repairing any damage to

the building or premises caused by the removal of such property. Tenant's obligation to observe

and perform this covenant will survive the expiration or other termination of this lease. ARTICLE 17 EMINENT DOMAINIf all of the premises are taken by exercise of the power of eminent domain (or conveyed by

landlord in lieu of such exercise) this lease will terminate on a date (the "termination date") which

is the earlier of the date upon which the condemning authority takes possession of the premises or

the date on which title to the premises is vested in the condemning authority. If more than 25% of

the rentable area of the premises is so taken, tenant will have the right to cancel this lease by

written notice to landlord given within 20 days after the termination date. If less than 25% of the

rentable area of the premises is so taken, or if the tenant does not cancel this lease according to the

preceding sentence, the monthly rent will be abated in the proportion of the rentable area of the

premises so taken to the rentable area of the premises immediately before such taking, and tenant's

share will be appropriately recalculated. If 25% or more of the building or the project is so taken,

landlord may cancel this lease by written notice to tenant given within 30 days after the termination date. In the event of any such taking, the entire award will be paid to landlord and

tenant will have no right or claim to any part of such award; however, tenant will have the right to

assert a claim against the condemning authority in a separate action, so long as landlord's award is

not otherwise reduced, for tenant's moving expenses and leasehold improvements owned by

tenant.ARTICLE 18 DAMAGE AND DESTRUCTION(a)If the premises or the building are damaged by fire or other insured casualty, landlord will

give tenant written notice of the time which will be needed to repair such damage, as determined

by landlord in its reasonable discretion, and the election (if any) which landlord has made

according to this Article 18. Such notice will be given before the 30th day (the "notice date") after

the fire or other insured casualty.(b)If the premises or the building are damaged by fire or other insured casualty to an extent

which may be repaired within 120 days after the notice date, as reasonably determined by landlord,

landlord will promptly begin to repair the damage after the notice date and will diligently pursue

the completion of such repair. In that event this lease will continue in full force and effect except

that monthly rent will be abated on a pro rata basis from the date of the damage until the date of the

completion of such repairs (the "repair period") based on the proportion of the rentable area of the

premises tenant is unable to use during the repair period.(c)If the premises or the building are damaged by fire or other insured casualty to an extent

that may not be repaired within 120 days after the notice date, as reasonably determined by

landlord, then (1) landlord may cancel this lease as of the date of such damage by written notice

given to tenant on or before the notice date or (2) tenant may cancel this lease as of the date of such

damage by written notice given to landlord within 10 days after landlord's delivery of a written

notice that the repairs cannot be made within such 120-day period. If neither landlord nor tenant so

elects to cancel this lease, landlord will diligently proceed to repair the building and premises and

monthly rent will be abated on a pro rata basis during the repair period based on the proportion of

the rentable area of the premises tenant is unable to use during the repair period.(d)Notwithstanding the provisions of subparagraphs (a), (b), and (c) above, if the premises or

the building are damaged by uninsured casualty, or if the proceeds of insurance are insufficient to

pay for the repair of any damage to the premises or the building, landlord will have the option to

repair such damage or cancel this lease as of the date of such casualty by written notice to tenant on

or before the notice date.

(e)If any such damage by fire or other casualty is the result of the willful conduct or

negligence or failure to act of tenant, its agents, contractors, employees, or invitees, there will be

no abatement of monthly rent as otherwise provided for in this Article 18. Tenant will have no

rights to terminate this lease on account of any damage to the premises, the building, or the project,

except as set forth in this lease.ARTICLE 19 SUBORDINATION19.1 General. This lease and tenant's rights under this lease are subject and subordinate to any

ground or underlying lease, mortgage, indenture, deed of trust, or other lien encumbrance (each a

"superior lien"), together with any renewals, extensions, modifications, consolidations, and

replacements of such superior lien, now or after the date affecting or placed, charged, or enforced

against the land, the building, or all or any portion of the project or any interest of landlord in them

or landlord's interest in this lease and the leasehold estate created by this lease (except to the extent

any such instrument expressly provides that this lease is superior to such instrument). This

provision will be self-operative and no further instrument of subordination will be required in

order to effect it. Notwithstanding the foregoing, tenant will execute, acknowledge, and deliver to

landlord, within 20 days after written demand by landlord, such documents as may be reasonably

requested by landlord or the holder of any superior lien to confirm or effect any such

subordination.19.2 Attornment and Nondisturbance . Tenant agrees that in the event that any holder of a superior

lien succeeds to landlord's interest in the premises, tenant will pay to such holder all rents

subsequently payable under this lease. Further, tenant agrees that in the event of the enforcement

by the holder of a superior lien of the remedies provided for by law or by such superior lien, tenant

will, upon request of any person or party succeeding to the interest of landlord as a result of such

enforcement, automatically become the tenant of and attorn to such successor in interest without

change in the terms or provisions of this lease. Such successor in interest will not be bound by:(a)Any payment of rent for more than one month in advance, except prepayments in the

nature of security for the performance by tenant of its obligations under this lease;(b)Any amendment or modification of this lease made without the written consent of such

successor in interest (if such consent was required under the terms of such superior lien);(c) Any claim against landlord arising prior to the date on which such successor in interest

succeeded to landlord's interest; or(d)Any claim or offset of rent against the landlord.Upon request by such successor in interest and without cost to landlord or such successor in

interest, tenant will, within 20 days after written demand, execute, acknowledge, and deliver an

instrument or instruments confirming the attornment, so long as such instrument provides that

such successor in interest will not disturb tenant in its use of the premises in accordance with this

lease.

ARTICLE 20 ENTRY BY LANDLORDLandlord, its agents, employees, and contractors may enter the premises at any time in response to

an emergency and at reasonable hours to:(a) Inspect the premises;(b)Exhibit the premises to prospective purchasers, lenders, or tenants;(c)Determine whether tenant is complying with all its obligations in this lease;(d)Supply cleaning service and any other service to be provided by landlord to tenant

according to this lease;(e)Post written notices of non-responsibility or similar notices; or(f)Make repairs required of landlord under the terms of this lease or make repairs to any

adjoining space or utility services or make repairs, alterations, or improvements to any other

portion of the building; however, all such work will be done as promptly as reasonably possible

and so as to cause as little interference to tenant as reasonably possible.Tenant, by this Article 20, waives any claim against landlord, its agents, employees, or contractors

for damages for any injury or inconvenience to or interference with tenant's business, any loss of

occupancy or quiet enjoyment of the premises, or any other loss occasioned by any entry in

accordance with this Article 20. Landlord will at all times have and retain a key with which to

unlock all of the doors in, on, or about the premises (excluding tenant's vaults, safes, and similar

areas designated in writing by tenant in advance). Landlord will have the right to use any and all

means landlord may deem proper to open doors in and to the premises in an emergency in order to

obtain entry to the premises, provided that landlord will promptly repair any damages caused by

any forced entry. Any entry to the premises by landlord in accordance with this Article 20 will not

be construed or deemed to be a forcible or unlawful entry into or a detainer of the premises or an

eviction, actual or constructive, of tenant from the premises or any portion of the premises, nor will

any such entry entitle tenant to damages or an abatement of monthly rent, additional rent, or other

charges that this lease requires tenant to pay.ARTICLE 21 INDEMNIFICATION, WAIVER, AND RELEASE21.1 Indemnification. Except for any injury or damage to persons or property on the premises that

is proximately caused by or results proximately from the negligence or deliberate act of landlord,

its employees, or agents, and subject to the provisions of Section 6.4, tenant will neither hold nor

attempt to hold landlord, its employees, or agents liable for, and tenant will indemnify and hold

harmless landlord, its employees, and agents from and against, any and all demands, claims,

causes of action, fines, penalties, damages (including consequential damages), liabilities,

judgments, and expenses (including without limitation reasonable attorneys' fees) incurred in

connection with or arising from:

(a)the use or occupancy or manner of use or occupancy of the premises by tenant or any

person claiming under tenant;(b) any activity, work, or thing done or permitted by tenant in or about the premises, the

building, or the project;(c)any breach by tenant or its employees, agents, contractors, or invitees of this lease; and(d)any injury or damage to the person, property, or business of tenant, its employees, agents,

contractors, or invitees entering upon the premises under the express or implied invitation of

tenant.If any action or proceeding is brought against landlord, its employees, or agents by reason of any

such claim for which tenant has indemnified landlord, tenant, upon written notice from landlord,

will defend the same at tenant's expense, with counsel reasonably satisfactory to landlord.21.2 Waiver and Release. Tenant, as a material part of t