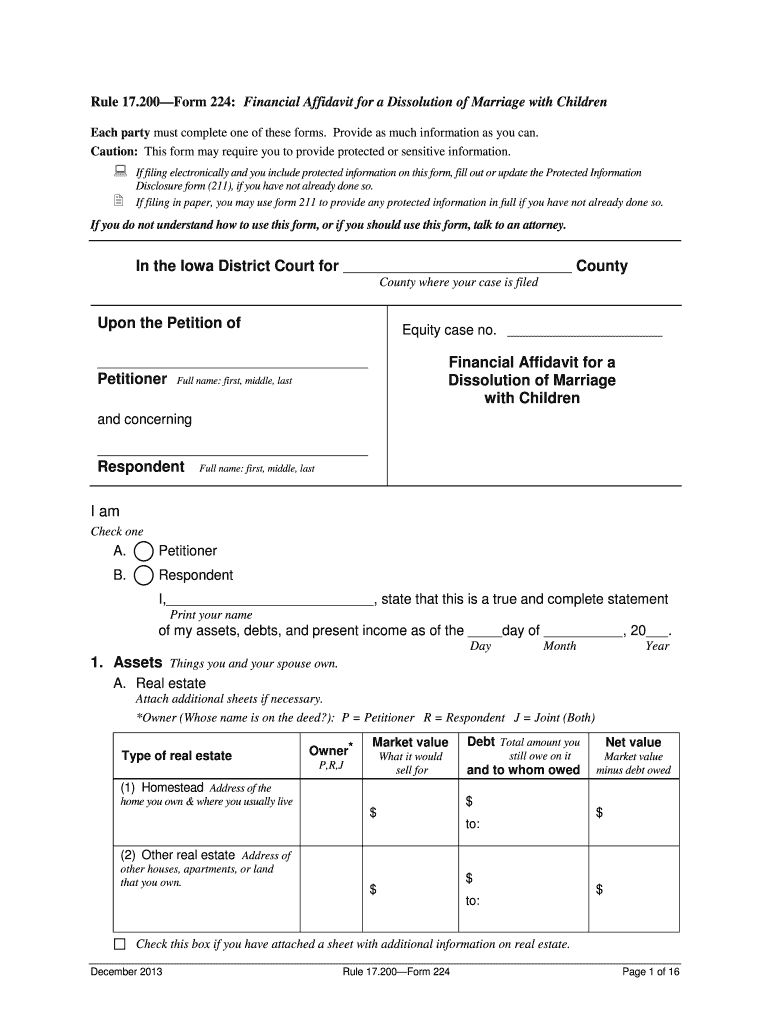

Rule 17.200—Form 224: Financial Affidavit for a Dissolution of Marriage with Children

Each party must complete one of these forms. Provide as much information as you can.

Caution: This form may require you to provide protected or sensitive information.

If filing electronically and you include protected information on this form, fill out or update the Protected Information

Disclosure form ( 211) , if you have not already done so.

If filing in paper, you may use form 2 11 to provide any protected information in full if you have not already done so.

If you do not understand how to use this form, or if you should use this form, talk to an attorney.

In the Iowa District Court for County

County where your case is filed

Upon the Petition of

Petitioner Full name: first, middle, las t

and concerning

Respondent Full name: first, middle, last

Equity case no.

Financial Affidavit for a

Dissolution of Marriage with Children

I am

Check one

A. Petitioner

B. Respondent

I, , state that this is a true and complete statement

Print your name

of my assets, debts, and present income as of the day of , 20 .

Day Month Year

1. Assets Things you and your spouse own.

A. Real estate

Attach additional sheets if ne cessary.

*Owner (Whose name is on the deed ?): P = Petitioner R = Respondent J = Joint (Both)

Type of real estate Owner

*

P,R,J

Market value

What it would

sell for

Debt Total amount you

still owe on it

and to whom owed

Net value

Market value

minus debt owed

(1) Homestead Address of the

home you own & where you usually live $ $

to:

$

(2) Other real estate Address of

other houses, apartments, or land

that you own.

$ $

to:

$

Check this box if you have attached a sheet with additional information on real estate .

December 2013 Rule 17.200—Form 224 Page 1 of 16

Rule 17.200—Form 224: Financial Affidavit for a Dissoluti on of Marriage with Children, continued

B. Vehicles

Includes cars, trucks, motorcycles , and other motorized vehicles.

*Owner (Whose name is on the car or vehicle title?): P = Petitioner R = Respondent J = Joint (Both)

Vehicles

Make (e.g. Ford)

Y ear

Owner*

P,R,J

Market value

What it would

sell for

Debt Total amount you

still owe on it

and to whom owed

Net Value

Market value

minus debt owed

(1)

$ $

to:

$

(2)

$ $

to:

$

(3)

$ $

to:

$

Check this box if you have attached a sheet with additional information on vehicles .

C. Securities , stocks, & bonds

*Owner (Whose name is on the securities, stocks, or bonds?):

P = Petitioner R = Respondent J = Joint (Both)

Securities, stocks , & bonds

Company name Owner*

P,R,J

Market value

What it would

sell for

Debt Total amount you

still owe on it

and to whom owed

Net value

Market value

minus debt owed

(1) $ $

to:

$

(2)

$ $

to:

$

(3)

$ $

to:

$

Check this box if you have attached a sheet with additional information on securities, stocks, and bonds.

D. Life insurance

*Owner (Whose name is on the policy ?): P = Petitioner R = Respondent J = Joint (Both)

Life insurance

Company name

Owner*

P,R,J

Cash value

Not death benefit

Loan from

cash value

Total amount still owed

on loan

Net value

Cash value

m inus loan

owed

(1) $ $ $

(2) $ $ $

(3) $ $ $

Check this box if you have attached a sheet with additional information on life insurance .

December 2013 Rule 17.200—Form 224 Page 2 of 16

Rule 17.200—Form 224: Financial Affidavit for a Dissoluti on of Marriage with Children, continued

E. Bank accounts

*Owner (Whose name is on the checking or savings account ?):

P = Petitioner R = Respondent J = Joint (Both)

Checking & savings

accounts

Bank or Credit Union name

If you do not use bank accounts,

write “Cash”

Owner*

P,R,J Cash value Personal loans or

overdraft accounts Total amount you still

owe on it

Net value

Cash value

minus loan /

overdraft owed

(1) $ $ $

(2) $ $ $

(3) $ $ $

Check this box if you have attached a sheet with additional information on checking and savings accounts.

F. Household contents

*Owner: P = Petitioner R = Respondent J = Joint (Both)

Household contents

Describe

Owner*

P,R,J

Market value

What it would

sell for

Debt Total amount you

still owe on it

and to whom owed

Net value

Market value

minus debt owed

(1) Furniture

a.

$ $

to:

$

b.

$ $

to:

$

c.

$ $

to:

$

d.

$ $

to:

$

(2) Appliances / Electronics

a.

$ $

to:

$

b.

$ $

to:

$

c.

$ $

to:

$

d.

$ $

to:

$

(3) Other contents

a.

$ $

to:

$

December

2013 Rule 17.200—Form 224 Page 3 of 16

Rule 17.200—Form 224: Financial Affidavit for a Dissoluti on of Marriage with Children, continued

b. $ $

to:

$

c.

$ $

to:

$

Check this box if you have attached a sheet with additional information on household assets .

G. Retirement assets

*Owner (Whose name is on the retirement account ?): P = Petitioner R = Respondent J = Joint (Both)

Retirement assets

Examples: Pensions, IRAs, 401(k)s,

annuities, etc. Owner*

P,R,J

Market value

What it would

sell for

Loan from

retirement account

Total amount you still owe on i t

and to whom owed

Net value

Market value

minu s loan

owed

(1) $ $

to:

$

(2)

$ $

to:

$

(3)

$ $

to:

$

Check this box if you have attached a sheet with additional information on retirement assets .

H. Other assets

Items not listed in the other boxes should be listed here. For example: jewelry, furs, guns, sporting goods,

farm animals.

*Owner: P = Petitioner R = Respondent J = Joint (Both)

Other assets

Describe

Owner*

P,R,J

Market value

What it would

sell for Debt Total amount you

still owe on it

and to whom owed

Net value

Market value

minus debt owed

(1) $ $

to:

$

(2)

$ $

to:

$

(3)

$ $

to:

$

Check this box if you have attached a sheet with additional information on other assets.

December 2013 Rule 17.200—Form 224 Page 4 of 16

Rule 17.200—Form 224: Financial Affidavit for a Dissoluti on of Marriage with Children, continued

I. Totals

(1) Total from attached sheets Listed in 1A -H. $

(2) Total net value of assets Listed in 1A -H. $

2. Other Debts

Debts may include things such as past due balances on utilitie s, money owed to a landlord for damages after

moving , credit card debt, and loans from friends, family, or banks.

Inclu de as “Other Debts” money you or your spouse owe that you did not include in the “Debt” or “Loan”

columns in 1A -H.

*Whose debt is it? P = Petitioner R = Respondent J = Joint (Both)

Other debts

List only those not included as “debt” or “loans” under “Assets” in part 1.

Whose

debt?*

P,R,J

Amount

owed

A. $

B. $

C. $

D. $

E. $

F. $

G. $

H. $

I. $

J. $

K. $

L. $

M. $

N. $

O. Totals from attached sheets , if any

Check this box if you have attached a sheet with addit ional information on other

debts and enter the total.

$

Total other debts

Including amounts shown on attached sheet s, if any. $

Continued on next page

December 2013 Rule 17.200—Form 224 Page 5 of 16

Rule 17.200—Form 224: Financial Affidavit for a Dissoluti on of Marriage with Children, continued

3. Income and Deductions

The deductions listed in section 3 are the deductions allowed by the Iowa Child Support G uidelines and are

subtracted when determining net income.

A. Petitioner

(1) Income and Deductions

If you are Respondent, give your best estimate for each amount.

*How often is income paid or deduction taken?

W = Weekly B = Bi-weekly (every other week) M = Monthly T = Two times a month

Current income and deductions

for Petitioner

Sources of income and deductions , not including Social

Security benefits

Income Deductions

How often paid?* W,B,M,T

Gross amount

Before deductions How often taken?* W,B,M,T

Amount of

deduction

a. Wages from employer

Employer name:

Job title:

$ $

b. Wages from employer

Employer name:

Job title:

$ $

c. Unemployment assistance $ $

d. Workers’ compensation $ $

e. Pension / Retirement $ $

f. Veteran’s benefits $ $

g. Other Identify : $ $

h. Other Identify :

$ $

i. Other Identify :

$ $

j. Mandatory pension contribution

List required contribution only (e.g. IPERS, TIAA/CREF).

Contributions above the required amount are optional and not

allowed as a deduction.

$

k. Union Dues $

**l. Prior court -ordered child support

Paid to: $

**m Prior court -ordered medical support

Paid to: $

**n. Prior court -ordered spousal support (alimony)

Paid to: $

o. Totals from attached sheets , if any

Check this box if you have attached a sheet with

additional information on Petitioner’s income and

deductions. $ $

Totals

Current income and deductions for Petitioner

$

Income total

$

Deductions

total

** Under “Amount of deduction,” list the amount of child support or spousal support actually paid under a prior court order

(an order filed before this action). If child support payments were not made through the Child Support Recovery Unit, attach

proof of payments for the past 12 months.

December 2013 Rule 17.200—Form 224 Page 6 of 16

Rule 17.200—Form 224: Financial Affidavit for a Dissoluti on of Marriage with Children, continued

(2) Petitioner’s other children with no court -orderd support, if any : If you are Respondent,

provide as much information as you can.

List the initials and birth year of each child for whom Petitioner is the legal parent.

Do not include any children involved in this case.

First, middle, & last

initials of each child Birth year

First, middle, & last

initials of each child Birth year

i. iv.

ii. v.

iii. vi.

Check this box if you have attached a sheet listing additional children for whom

Petitioner is the legal parent.

(3) Petitioner’s actual child care expenses due to employment, if any :

For custodial parent only . If you are not the custodial parent, skip to (4 ).

$ per

Amount Frequency

(4) Petitioner’s income from Social Security benefits , if any:

a. Supplemental Security Income (SSI), if any :

i. Supplemental Security Income (SSI) paid to Petitioner for disability: $ per month

ii. Supplemental Security Income (SSI) paid to children for their disability: $ per month

iii. List the children in Petitioner’s home who receive SSI benefits Use initials only :

First, middle, & last

initials of each child Birth year

First, middle, & last

initials of each child Birth year

(a) (d)

(b) (e)

(c) (f)

Check this box if you have attached a sheet listing additional children who receive

Supplemental Security Income (SSI).

b. Social Security Disability (SSD) or Social Security Retirement (SSR) , if any :

i. Benefit paid for Petitioner $ per month

ii. Benefit paid for each child in Petitioner’s home $ per month

iii. Number of children receiving benefits children

c. Social Security Disability (SSD) , if any:

i. Paid to children for their disability: $ per month

ii. List the children in Petitioner’s home who receive SSD benefits Use initials only :

December 2013 Rule 17.200—Form 224 Page 7 of 16

Rule 17.200—Form 224: Financial Affidavit for a Dissolution of Marriage with Children, continued

First, middle, & last

initials of each child Birth year

First, middle, & last

initials of each child Birth year

(a) (d)

(b) (e)

(c) (f)

Check this box if you have attached a sheet listing additional children who receive

S ocial Security Disability (SS D).

B. Respondent

(1) Income and Deductions

If you are Petitioner, give your best estimate for each amount.

* How often is income paid or deduction taken?

W = Weekly B = Bi-weekly (every other week) M = Monthly T = Two times a month

Current income and deductions

for Respondent

Sources of income and deductions, not including Social

Security benefits

Income Deductions

How often paid?* W,B,M,T

Gross amount

Before deductions How often taken?* W,B,M,T

Amount of

deduction

a. Wages from employer

Employer name:

Job title:

$ $

b. Wages from employer

Employer name:

Job title:

$ $

c. Unemployment assistance $ $

d. Workers’ compensation $ $

e. Pension / Retirement $ $

f. Veteran’s benefits $ $

g. Other Identify : $ $

h. Other Identify : $ $

i. Other Identify : $ $

j. Mandatory pension contribution

List required contribution only (e.g. IPERS, TIAA/CREF).

Contributions above the required amount are optional and not

allowed as a deduction.

$

k. Union Dues $

**l. Prior court -ordered child support

Paid to: $

**m. Prior court-ordered medical support

Paid to: $

**n. Prior court -ordered spousal support (alimony)

Paid to: $

December 2013 Rule 17.200—Form 224 Page 8 of 16

Rule 17.200—Form 224: Financial Affidavit for a Dissoluti on of Marriage with Children, continued

o. Totals from attached sheets , if any

Check this box if you have attached a sheet with

additional information on Respondent’s income and

deductions. $ $

Totals

Current income and deductions for Respondent

$

Income total

$

Deductions

total

** Under “Amount of deduction,” list the amount of child support or spousal support actually paid under a prior court order

(an order filed before this action). If child support payments were not made through the Child Support Recovery Unit, attach

proof of payments for the past 12 months.

(2) Respondent’s other children with no court-orderd support, if any : If you are Petitioner,

provide as much information as you can.

List the initials and birth year of each child for whom Respondent is the legal parent.

Do not include any children involved in this case.

First, middle, & last

initials of each child Birth year

First, middle, & last

initials of each child Birth year

i. iv.

ii. v.

iii. vi.

Check this box if you have attached a sheet listing additional children for whom

Respondent is the legal parent.

(3) Respondent’s actual child care expenses due to employment, if any :

For custodial parent only . If you are not the custodial parent, skip to (4) .

$ per

Amount Frequency

(4) Respondent’s income from Social Security benefits, if any:

a. Supplemental Security Income (SSI), if any :

i. Supplemental Security Income (SSI) paid to Respondent for disability: $ per month

ii. Supplemental Security Income (SSI) paid to children for their disability: $ per month

iii. List the children in Respondent’s home who receive SSI benefits Use initials only :

First, middle, & last

initials of each child Birth year

First, middle, & last

initials of each child Birth year

(a) (d)

(b) (e)

(c) (f)

Check this box if you have attached a sheet listing additional children who receive

Supplemental Security Income (SSI).

December 2013 Rule 17.200—Form 224 Page 9 of 16

Rule 17.200—Form 224: Financial Affidavit for a Dissoluti on of Marriage with Children, continued

b. Social Security Disability (SSD) or Social Security Retirement (SSR) , if any :

i. Benefit paid for Respondent $ per month

ii. Benefit paid for each child in Respondent’s home $ per month

iii. Number of children receiving benefits children

c. Social Security Disability (SSD) , if any:

i. Paid to children for their disability: $ per month

ii. List the children in Respondent’s home who receive SSD benefits Use initials only :

First, middle, & last

initials of each child Birth year

First, middle, & last

initials of each child Birth year

(a) (d)

(b) (e)

(c) (f)

Check this box if you have attached a sheet listing additional children who receive

Supplemental Security Disability (SS D).

4. Costs for Health Insurance, Medical Support, and Dental Care

A. Costs for Petitioner If you are Respondent , give your best estimate for each amount.

(1) Petitioner has health insurance available through employer .

a. True

b. False

If you check a, list the frequency and cost of health insurance paid.

If you check b, continue to (2) .

*How often paid? W = Weekly B = Bi-weekly (every other week) M = Monthly

T = Two times a month

Type of employer health insurance How often paid?*

W,B,M,T Cost

Single health insurance $

Family health insurance $

(2) Petitioner has health insurance through a source other than employer.

a. True

b. False

If you check a, list the frequency and cost of health insurance paid.

If you check b, continue to (3) .

*How often paid? W = Weekly B = Bi-weekly (every other week) M = Monthly

T = Two times a month

December 2013 Rule 17.200—Form 224 Page 10 of 16

Rule 17.200—Form 224: Financial Affidavit for a Dissoluti on of Marriage with Children, continued

Type of other health insurance

How often paid?*

W,B,M,T Cost

Single health insurance $

Family health insurance $

(3) Petitioner pays medical support for the child or children as required by court order.

a. True

b. False

If you check a, list the frequency and cost of medical support paid.

If you check b, continue to (4) .

*How often paid? W = Weekly B = Bi-weekly (every other week) M = Monthly

T = Two times a month

Medical support paid to How often paid?*

W,B,M,T Cost

$

$

$

(4) Petitioner has dental insurance available through employer .

a. True

b. False

If you check a, list the frequency and cost of dental insurance paid.

If you check b, continue to (5) .

*How often paid? W = Weekly B = Bi-weekly (every other week) M = Monthly

T = Two times a month

Type of employer dental insurance How often paid?*

W,B,M,T Cost

Single dental insurance $

Family dental insurance $

(5) Petitioner has dental insurance through a source other than employer.

a. True

b. False

If you check a, list the frequency of other dental insurance paid.

If you check b, continue to (6) .

*How often paid? W = Weekly B = Bi-weekly (every other week) M = Monthly

T = Two times a month

December 2013 Rule 17.200—Form 224 Page 11 of 16

Rule 17.200—Form 224: Financial Affidavit for a Dissoluti on of Marriage with Children, continued

Type of other dental insurance

How often paid?*

W,B,M,T Cost

Single dental insurance $

Family dental insurance $

(6) Petitioner pays other medical expenses not covered by insurance.

a. True

b. False

If you check a, list the cost and frequency of other medical expenses paid that are not covered by

insurance. Include all medical, dental, vision, etc. expenses as one lump sum.

If you check (6) b, continue to 4B, Costs for Respondent .

*How often paid? W = Weekly B = Bi-weekly (every other week) M = Monthly

T = Two times a month

How often paid?*

W,B,M,T Cost

$

$

B. Costs for Respondent If you are Petitioner , give your best estimate for each amount.

(1) Respondent has health insurance available through employer .

a. True

b. False

If you check a, list the frequency and cost of health insurance paid.

If you check b, continue to (2) .

*How often paid? W = Weekly B = Bi-weekly (every other week) M = Monthly

T = Two times a month

Type of employer health insurance How often paid?*

W,B,M,T Cost

Single health insurance $

Family health insurance $

(2) Respondent has health insurance through a source other than employer .

a. True

b. False

If you check a, list the frequency and cost of health insurance paid.

If you check b, continue to (3) .

*How often paid? W = Weekly B = Bi-weekly (every other week) M = Monthly

T = Two times a month

December 2013 Rule 17.200—Form 224 Page 12 of 16

Rule 17.200—Form 224: Financial Affidavit for a Dissoluti on of Marriage with Children, continued

Type of other health insurance

How often paid?*

W,B,M,T Cost

Single health insurance $

Family health insurance $

(3) Respondent pays medical support for the child or children as required by court

order.

a. True

b. False

If you check a, list the frequency and cost of medical support paid.

If you check b, continue to (4) .

*How often paid? W = Weekly B = Bi-weekly (every other week) M = Monthly

T = Two times a month

Medical support paid to How often paid?*

W,B,M,T Cost

$

$

$

(4) Respondent has dental insurance available through employer .

a. True

b. False

If you check a, list the frequency and cost of dental insurance paid.

If you check b, continue to (5) .

*How often paid? W = Weekly B = Bi-weekly (every other week) M = Monthly

T = Two times a month

Type of employer dental insurance How often paid?*

W,B,M,T Cost

Single dental insurance $

Family dental insurance $

(5) Respondent has dental insurance through a source other than employer .

a. True

b. False

If you check a, list the frequency of other dental insurance paid.

If you check (5) b, continue to (6).

*How often paid? W = Weekly B = Bi-weekly (every other week) M = Monthly

T = Two times a month

December 2013 Rule 17.200—Form 224 Page 13 of 16

Rule 17.200—Form 224: Financial Affidavit for a Dissoluti on of Marriage with Children, continued

Type of other dental insurance

How often paid?*

W,B,M,T Cost

Single dental insurance $

Family dental insurance $

(6) Respondent pays other medical expenses not covered by insurance.

a. True

b. False

If you check a, list the cost and frequency of other medical expenses paid that are not covered by

insurance. Include all medical, dental, vision, etc. expenses as one lump sum.

If you check (6) b, continue to 5, Expenses .

*How often paid? W = Weekly B = Bi-weekly (every other week) M = Monthly

T = Two times a month

How often paid?*

W,B,M,T Cost

$

$

5. Expenses

A. Living arrangements

Check one

(1) My spouse and I live in the same home.

(2) My spouse and I do not live in the same home.

B. My expenses

Note: You must complete this section if you or your spouse want spousal support ( alimony).

*How often paid?: W = Weekly B = Bi-weekly (every other week) M = Monthly

T = Two times a month A = Annually

Type of expense Paid to

How often

paid?*

W,B,M,T,A

Monthly

payment

(1) House payment or rent $

(2) Food

At home & restaurants

$

(3) Transportation (gas, bus fare)

Not car loan payments – see (12).

$

(4) Clothing $

(5) Medical, dental

Not health insurance payments –

see (10) .

$

December 2013 Rule 17.200—Form 224 Page 14 of 16

Rule 17.200—Form 224: Financial Affidavit for a Dissoluti on of Marriage with Children, continued

(6) Utilities (gas, electric)

$

(7) Phone

$

(8) Cable / satellite television /

internet $

(9) Car insurance payment $

(10) Health insurance payment $

(11) Credit card payments $

(12) Car loan payments $

(13) Other loan payments $

(14) Other expense

Identify:

$

(15) Other expense

Identify:

$

(16) Other expense

Identify:

$

(17) Totals from attached sheets, if any

Check this box if you have attached a sheet with

additional information on your expenses .

$

Total expenses $

Continued on next page

December 2013 Rule 17.200—Form 224 Page 15 of 16

Rule 17.200—Form 224: Financial Affidavit for a Dissoluti on of Marriage with Children, continued

6. Attorney Help

Check one

A. An attorney did not help me prepare or fill in this paper.

B. An attorney helped me prepare or fill in this paper.

If you check B, you must fill in the following information :

Name of attorney or organization, if any Attorney’s P.I.N. # – Ask the attorney

Business address of attorney or organization City State ZIP code

( ) ( )

Attorney’s phone number Attorney’s f ax number – optional Attorney’s email address – optional

7. Certification of Service by Mailing or Delivery

Section 8 to be completed only if filing in paper or if the other party is exempt from electronic filing.

This document, if filed electronically, will automatically be served on registered parties.

I, , certify that on , 20

Print your name Month Day Year

I mailed or gave a copy of this Financial Affidavit to the other party or the other party’s

attorney at this address:

Name of person to whom I delivered or mailed it

Party’s or attorney’s mailing address City State ZIP code

8. Oath and Signature

I, , certify under penalty of perjury and pursuant to the

Print your name

laws of the State of Iowa that I have read this Financial Affidavit and that the information I have

provided in this Financial Affidavit is true and correct.

, 20

Signed on: Month Day Year Your signature*

Mailing address City State ZIP code

( )

Phone number Email address Additional email address – if available

* Whether filing electronic ally or in paper, you must handwrite your signature on this form. If you are filing electronically,

scan the form after signing it and then file electronically.

December 2013 Rule 17.200—Form 224 Page 16 of 16